Indian Economy

Counterproductive High Tariffs on Electronic Components

- 20 Jan 2022

- 7 min read

For Prelims: Electronic Sector, Related Initiatives, Growth in the Electronic sector, Indian Cellular and Electronics Association.

For mains: India’s Electronic sector and issues related to it, Related Initiatives, India’s electronic sector vs other countries.

Why in News

Recently, a report by the Indian Cellular and Electronics Association (ICEA) has said that India’s policy of adopting high tariffs on the import of electronics components may prove to be counterproductive.

- ICEA is the apex industry body of the mobile and electronics industry comprising manufacturers.

Key Points

- High Tariffs:

- India has adopted high tariffs on the import of electronics components to reduce risks from global competition and save domestic companies.

- However, it may prove to be counterproductive to its schemes aimed at increasing domestic production of electronic products.

- India has adopted high tariffs on the import of electronics components to reduce risks from global competition and save domestic companies.

- India vs Other Nations: All the countries have tried to encourage the domestic production of electronic goods in their geographies by adopting almost similar strategies such as attracting Foreign Direct Investment (FDI), improving domestic capabilities and competitiveness, increasing exports and then linking their markets with global value chains.

- China: Since 1980 China has improved its ranking in terms of office and telecom equipment export from 35 to 1, while Vietnam, which did not export any such electronic products up until 1990s has climbed the ladder to become the eight largest export in just 20 years.

- Mexico: Similarly, Mexico, which was 37th in terms of electronics product export in the 1980s has steadily risen through the ranks to gain 11th place, a position it has maintained over the last two decades.

- Thailand: It ranked 45 in 1980, has also consolidated its position in the top 15 electronic product exporters, according to the report.

- India: On the other hand, India, which started at 40th position in the 1980s has gained and lost positions to reach 28th position by 2019.

- High Tariffs and India’s Loss:

- Though all the countries followed nearly the same policy to boost domestic electronics manufacturing, one major difference between India and the rest of the countries was heavy reliance on tariffs.

- It is due to such high tariffs that investors and electronic component makers from global markets shy away from India as a market since the participation of the country in global value chains has remained low.

- Further, despite the size of the Indian economy, its participation in exports and international trade has remained low.

- Even for the domestic markets, the assumption that it will be beneficial to most companies since it is large and growing is wrong.

- For example, in the case of mobile phones, where one of the largest PLI schemes is currently operational, the size of the domestic market is expected to increase to USD 55 billion by 2025-26, whereas the global market is expected to reach USD 625 billion by the same time.

- Thus, at present, the Indian domestic market is about 6.5% of the global market, with a possibility of growing to 8.8%, if the growth forecasts are reasonably robust.

- At present, India’s market share is not attractive enough for FDI to choose India as a location primarily on the basis of its domestic market per se, especially if India’s policies result in cost inefficiencies which create obstacles to accessing a much larger global market.

- Counterproductivity of PLI Scheme:

- One of the major reasons why the report concluded that a high tariff on the import of electronic components may end up undoing the gains of Production Linked Incentive (PLI) schemes is that companies which have extensive global value chains are reluctant to enter India when tariffs for components are high.

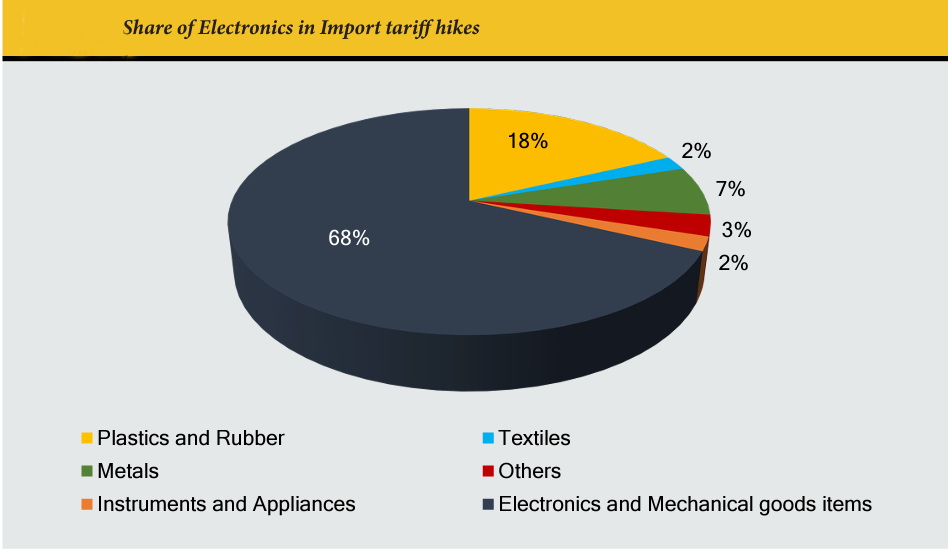

- While the large electronics markets of India may look attractive, they are very small in global terms. Moreover, India does not produce about 50% of the components on which tariff has been increased. Hence the impact of tariffs is likely to be adverse on India’s competitiveness.

- Although globally companies such as the US are increasing tariffs on the import of electronic components, India must keep its tariff at a bare minimum to ensure it remains competitive among its peers in the Asian neighbourhood.

- Related Initiatives:

India’s Electronic Sector

- The Indian electronics sector is tremendously growing with the demand expected to cross USD 400 billion by 2023-24.

- Domestic production has grown from USD 29 billion in 2014-15 to nearly USD 70 billion in 2019-20 (Compounded Annual Growth Rate of 25%).

- Most of this production takes place in the final assembly units (last-mile industries) located in India and focussing on them would help develop deep backward linkages, thus inducing industrialisation.

- This was an idea propounded by economist Albert O Hirschman in his theory of ‘Unbalanced Growth’.

- The Economic Survey 2019-20 also promoted this idea and suggested “assembly in India for the world”, especially in “networked products”, in a bid to create four crore well-paid jobs by 2025 and eight crore jobs by 2030.