FDI Inflow Touches $82 Bn in FY21 | 25 May 2021

Why in News

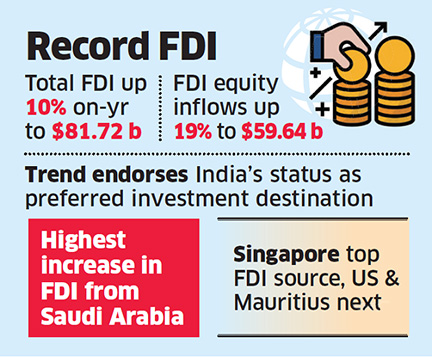

In the Financial Year 2020-21, India sees growth of 10% (to $82 bn) in Foreign Direct Investment (FDI). FDI equity investments rise 19% to $60 billion.

- In 2019-20, India had received $74.39 billion in FDI, with almost $50 billion coming in the form of equity investments.

Key Points

- Top Investors:

- Singapore emerged as the top investor with almost a third of all investments, followed by the US which accounted for 23% of FDI and Mauritius from where 9% of the foreign capital flows originated.

- Sharpest Growth from Saudi Arabia:

- The sharpest growth among the top 10 FDI-origin countries was recorded from Saudi Arabia.

- Investments jumped from $90 million in 2019-20 to $2.8 billion in 2020-21.

- FDI Equity:

- FDI equity flows from the US more than doubled during the year compared with 2019-20, while investments from the UK surged 44%.

- Top FDI Destinations;

- Gujarat was the top FDI destination in 2020-21, accounting for 37% of the foreign equity inflows, followed by Maharashtra (2nd) which got 27% of the equity inflows.

- Karnataka (3rd) accounted for another 13% of the equity investments.

- Top Sectors:

- Computer software and hardware has emerged as the top sector during 2020-21 with about 44% share of the total FDI equity inflow.

- These are followed by construction (infrastructure) activities (13%) and services sector (8%), respectively.

Foreign Direct Investment

- Definition: FDI is the process whereby residents of one country (the home country) acquire ownership of assets for the purpose of controlling the production, distribution and other activities of a firm in another country (the host country).

- It is different from Foreign Portfolio Investment where the foreign entity merely buys stocks and bonds of a company. FPI does not provide the investor with control over the business.

- Three Components:

- Equity capital is the foreign direct investor’s purchase of shares of an enterprise in a country other than its own.

- Reinvested earnings comprise the direct investors’ share of earnings not distributed as dividends by affiliates, or earnings not remitted to the direct investor. Such retained profits by affiliates are reinvested.

- Intra-company loans or intra-company debt transactions refer to short- or long-term borrowing and lending of funds between direct investors (or enterprises) and affiliate enterprises.

- Routes through which India gets FDI:

- Automatic Route: In this, the foreign entity does not require the prior approval of the government or the RBI.

- Government Route: In this, the foreign entity has to take the approval of the government.

- The Foreign Investment Facilitation Portal (FIFP) facilitates the single window clearance of applications which are through approval route.

- It is administered by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry.

- Government Measures to Promote FDI:

- In 2020, factors such as a swift response in combating the Covid crisis, favourable demographics, impressive mobile and internet penetration, massive consumption and technology uptake, played an important role in attracting the investments.

- Launch of Schemes attracting investments, such as, National technical Textile Mission, Production Linked Incentive Scheme, Pradhan Mantri Kisan SAMPADA Yojana, etc.

- The government has elaborated upon the initiatives under the Atmanirbhar Bharat to encourage investments in different sectors.

- As a part of its Make in India initiative to promote domestic manufacturing, India deregulated FDI rules for several sectors over the last few years.