Important Facts For Prelims

Factors Shaping Global Gold Prices

- 16 May 2024

- 9 min read

Why in News?

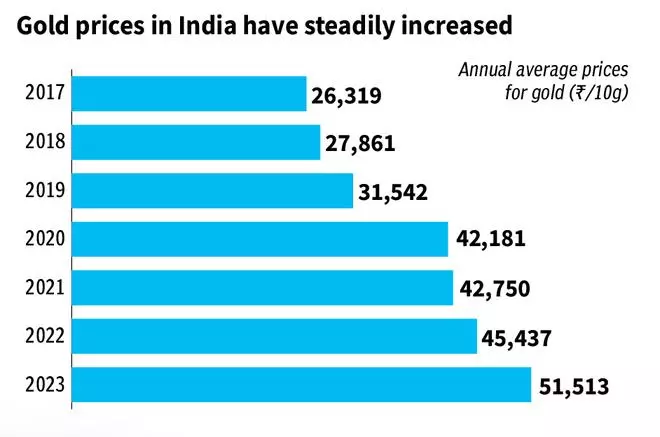

A recent econometric study has found that there is a direct relationship between crude oil prices and gold prices, and an inverse relationship between the value of the U.S. dollar and gold prices.

What are the Major Findings of the Study?

- Findings: There is a positive correlation between global Crude Oil price and the international price of gold and a negative correlation between the external value of the U.S. Dollar and the International price of Gold .

- In other words, when crude oil prices shoot up, prices of gold increase, and when value of the US Dollar increases, the price of gold decreases.

- Reasons: Rise in international crude oil prices lead to global Inflation, which leads to an increase in the demand for gold as a Hedge against Inflation, as gold is a real asset and not subject to loss of value.

- Assuming other conditions are the same, when the U.S. dollar is strong, gold prices tend to remain low and steady.

- However, if the dollar weakens, demand for gold rises, leading to an increase in its price.

- This shift occurs because a strong dollar boosts confidence in its value, reducing the need for gold investment, while a weaker dollar prompts concerns about value loss, driving people towards gold as a safer asset.

- Assuming other conditions are the same, when the U.S. dollar is strong, gold prices tend to remain low and steady.

What are the Factors that Affect Gold Prices Worldwide?

- Gold Production: On the supply side, the gold prices depend on its production and mining cost.

- Since most of the available gold has already been mined, new production will involve digging deeper into the earth, which is expensive.

- So when the prices of crude oil and natural gas rise, it contributes to the rise in the price of gold.

- Top 5 gold producing countries are: China, Australia, Russia, Canada and the US.

- Since most of the available gold has already been mined, new production will involve digging deeper into the earth, which is expensive.

- Demand by Central Banks: Institutional demand, particularly from central banks, drives gold prices to record levels.

- They purchase gold to strengthen reserve assets, given its value retention.

- With rising crude oil prices and geopolitical tensions, central banks globally are increasing their gold reserves to mitigate risks associated with foreign currency reserves.

- As of March 2024, the Reserve Bank of India held a total of 822 metric tonnes of gold, with 408 metric tonnes held within the country.

- Investor Demand: Whenever stock markets, real estate and bonds fall across the world, investors turn to gold to park their funds.

- It is considered as a safe haven for investors during periods of uncertainties because gold is highly liquid and carries no default risk.

- Also individual and institutional investors like to invest in physical gold or their financial derivatives and exchange traded funds (ETFs) as a component of their investment portfolio with the aim of diversification of risk and safety of investment.

- Financial Derivatives are a financial instrument which derives its value/price from the underlying assets.

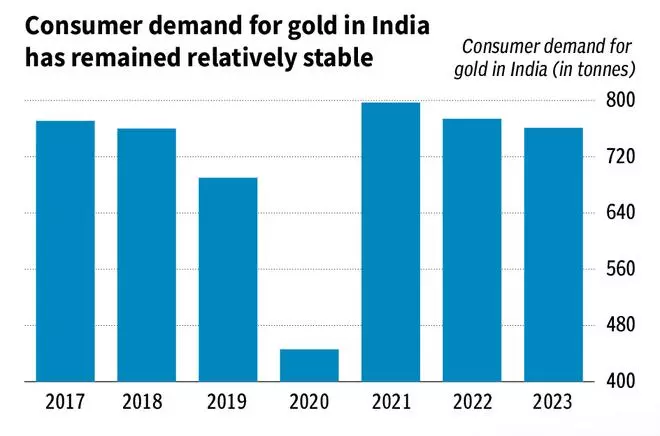

- Consumer Demand: It arises from individuals as well as jewellers.

- In both China and India, the largest consumers and importers of gold, it is bought as a traditional store of wealth and as ornaments for special occasions.

- However, consumer demand is mostly seasonal.

- Industrial Demand: Industrial demand is influenced by technology. Gold as a metal is preferred by industry for its intrinsic properties like malleability and conductivity.

- It is used in various industries such as:

- In the electronics industry for its excellent conductivity and corrosion resistance. It's commonly found in connectors, circuit boards, and various electronic components.

- In dentistry for making crowns, bridges, and other dental prosthetics due to their biocompatibility and durability.

- In aerospace applications, such as coating spacecraft components and satellites, due to its reflective properties and resistance to corrosion in harsh environments.

- In medical devices, such as implants and diagnostic equipment, due to its biocompatibility and inertness within the human body.

- It is used in various industries such as:

What is the Status of the Gold Industry in India?

- Gold Reserves in India: As per National Mineral Inventory, total reserves/resources of gold ore in India estimated at 501.83 million tonnes as of 2015.

- Largest resources of gold ore located in Bihar (44%), followed by Rajasthan (25%), Karnataka (21%), West Bengal (3%), Andhra Pradesh (3%), Jharkhand (2%)

- Karnataka commands around 80% of the nation's total gold output. The Kolar Gold Fields (KGF) in the Kolar district is one of the world's oldеst and deepest gold minеs.

- India Gold Import: India is the world's second-largest gold consumer. India's gold imports increased by 30% in 2023-24, reaching USD 45.54 billion.

- However, there was a significant decline of 53.56% in gold imports observed in March 2024.

- Sovereign Gold Bond Scheme: It was introduced by the Government in November 2015 as part of the Gold Monetisation Scheme.

- The objective was to decrease the demand for physical gold and encourage a portion of domestic savings, typically used for buying gold, to be invested in financial savings instead.

What is the Gold Standard?

- The Gold Standard (GS) is a voluntary carbon offset program focused on progressing the United Nations Sustainable Development Goals (SDGs) and ensuring that project’s benefit their neighbouring communities.

- It was developed under the leadership of the World Wildlife Fund (WWF), HELIO International, and SouthSouthNorth, with a focus on offset projects that provide lasting social, economic, and environmental benefits.

Read More: Increase in Gold Prices

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. What is/are the purpose/purposes of Government’s ‘Sovereign Gold Bond Scheme’ and ‘Gold Monetization Scheme’? (2016)

- To bring the idle gold lying with Indian households into the economy.

- To promote FDI in the gold and jewellery sector.

- To reduce India’s dependence on gold imports.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans:(c)

Q. Which one of the following groups of items is included in India’s foreign-exchange reserves? (2013)

(a) Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries

(b) Foreign-currency assets, gold holdings of the RBI and SDRs

(c) Foreign-currency assets, loans from the World Bank and SDRs

(d) Foreign-currency assets, gold holdings of the RBI and loans from the World Bank

Ans: (b)

Q. Indian Government Bond Yields are influenced by which of the following? (2021)

- Actions of the United States Federal Reserve

- Actions of the Reserve Bank of India

- Inflation and short-term interest rates

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)