Europe’s Digital Euro | 16 Nov 2024

The European Central Bank (ECB) has introduced the digital euro as a new central bank digital currency (CBDC), designed to modernise the payment landscape in Europe.

- The digital euro aims to facilitate direct payments without intermediary banks or gateways, functioning as a digital version of cash that enables peer-to-peer transactions, even offline, while maintaining a level of anonymity similar to cash.

- Issued directly by the ECB, this CBDC is designed to lower transaction costs, including for micro-payments which are currently expensive with traditional banks.

- The ECB envisions the digital euro as a counterbalance to non-European payment providers and a tool to strengthen Europe’s digital sovereignty against global competitors, especially US companies.

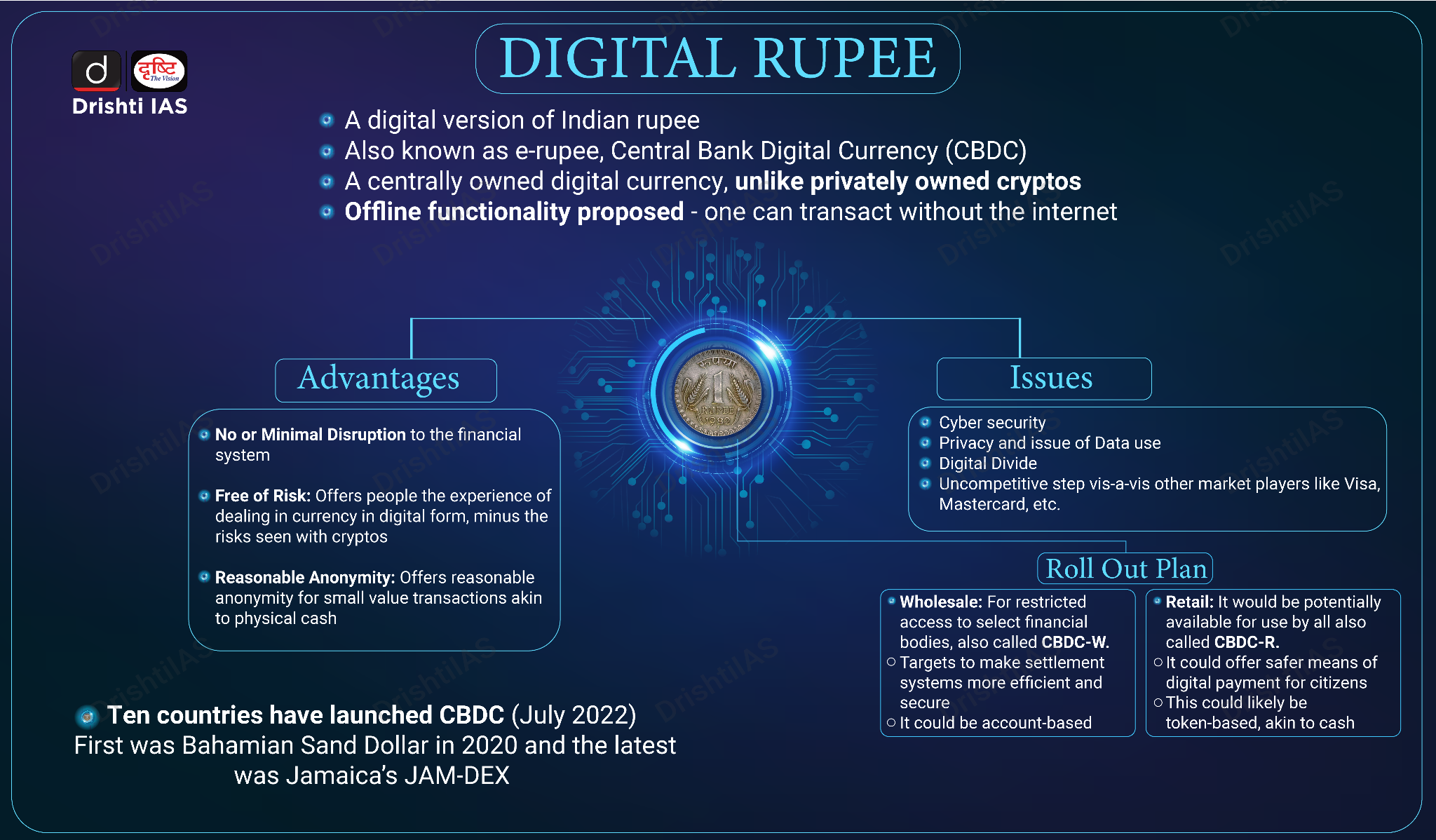

- The Reserve Bank of India (RBI) launched the Digital Rupee (e₹) in 2022, as a CBDC.

- CBDCs are a digital form of a paper currency and unlike cryptocurrencies that operate in a regulatory vacuum, these are legal tenders issued and backed by a central bank.

Read more: Central Bank Digital Currency