Enhancing India's Agri-Exports | 05 Mar 2025

For Prelims: Food Inflation, Pulses, Sanitary and Phytosanitary (SPS), Technical Barriers to Trade (TBT), MSP, WTO, Development Box, FTAs, Agricultural Export Policy (AEP), 2018.

For Mains: Trends in India’s agricultural exports, associated challenges and way forward.

Why in News?

India’s agricultural exports grew by 6.5% to USD 37.5 billion (Apr-Dec 2024), while imports rose by 18.7% to USD 29.3 billion that has reduced the agricultural trade surplus.

What are the Trends in India’s Agricultural Exports?

- Shift in Cotton Trade: India is now a net importer of cotton, reversing its earlier status as an exporter.

- Once the 2nd-largest exporter after the US, India’s cotton exports fell from USD 4.3 billion in 2011-12 to USD 1.1 billion in 2023-24.

- Shrinking Agricultural Trade Surplus: India’s agricultural trade surplus peaked at USD 27.7 billion in 2013-14, fell to USD 16 billion in 2023-24.

- Impact of Global Commodity Prices: Between 2013-14 and 2019-20, falling global food prices reduced India’s agri-export competitiveness.

- Post Covid-19 and the Russia-Ukraine war, prices surged, boosting exports to USD 53.2 billion in 2022-23.

- Major Export Commodities:

- Marine Products: Export of marine products, India's leading agri-export, declined in 2023-24, with the downward trend continuing in 2024-25.

- Sugar & Wheat: Sugar and wheat exports fell in 2023-24 due to government restrictions aimed at controlling domestic food inflation.

- Rice: Rice exports, especially non-basmati, remained strong despite a ban on white rice and export duty on parboiled rice.

- Basmati rice, spices, coffee, and tobacco exports are set to reach record highs in 2024-25.

- Cash Crops: Coffee and tobacco exports surged due to adverse weather affecting key producers like Brazil, Vietnam, and Zimbabwe.

- Others: India has also consolidated its position as the world’s leading exporter of chilli, mint products, cumin, turmeric, coriander, fennel, etc.

- Major Import Commodities:

- Edible Oil: Edible oil imports in 2024-25 are projected to be the highest mainly due to price hikes caused by the Russia-Ukraine war.

- Pulses imports averaged USD 1.7 billion (2018-23) due to higher domestic pulses production but are expected to surpass USD 5 billion ( 2024-25) due to low production in 2023-24.

- Key Destinations:

- Exports:

- Asia: In 2023, India exported USD 48 billion in agri-products, with the Global South (75%) and Asia (58%) as key markets.

- China and the UAE each imported USD 3 billion each in Indian agri-products, while Vietnam imported USD 2.6 billion.

- Africa: Africa accounted for 15% of India’s total agri exports.

- US: US accounts for 13.4% of Indian agri exports primarily consisting of rice (Basmati & Non-Basmati), sesame seeds, and fresh fruits.

- Europe: Europe accounts for 12.6% of Indian agri exports primarily consisting of tobacco, fresh fruits and ornamental plants.

- Asia: In 2023, India exported USD 48 billion in agri-products, with the Global South (75%) and Asia (58%) as key markets.

- Imports:

- Global South: The Global South supplies 48% of India’s agri-imports, led by Brazil, China, Mexico, Argentina and Indonesia.

- Developed Economies: Top three suppliers are the US, the Netherlands, and Germany.

- Exports:

- Agricultural Start-ups:

| Click Here to Read: What is Agricultural Export Policy? |

What are Challenges in India's Agricultural Exports?

- Non-Tariff Barriers (NTBs): Developed countries impose stringent Sanitary and Phytosanitary (SPS) and Technical Barriers to Trade (TBT) creating trade barriers for Indian agricultural exports. E.g.,

- India's basmati rice and tea exports have faced European bans over pesticide contamination.

- Japan has banned imports of cut flowers from India over zero-tolerance pest rules in floricultural products, although such pests are found in Japan.

- Unfair Level Playing Field: Developed nations’ heavy farm subsidies to their farmers and high tariffs on Indian agri exports create a disadvantage for Indian farmers.

- The US provides USD 61,286 per farmer annually, while India gives only USD 282, lowering global prices and hurting Indian farmers.

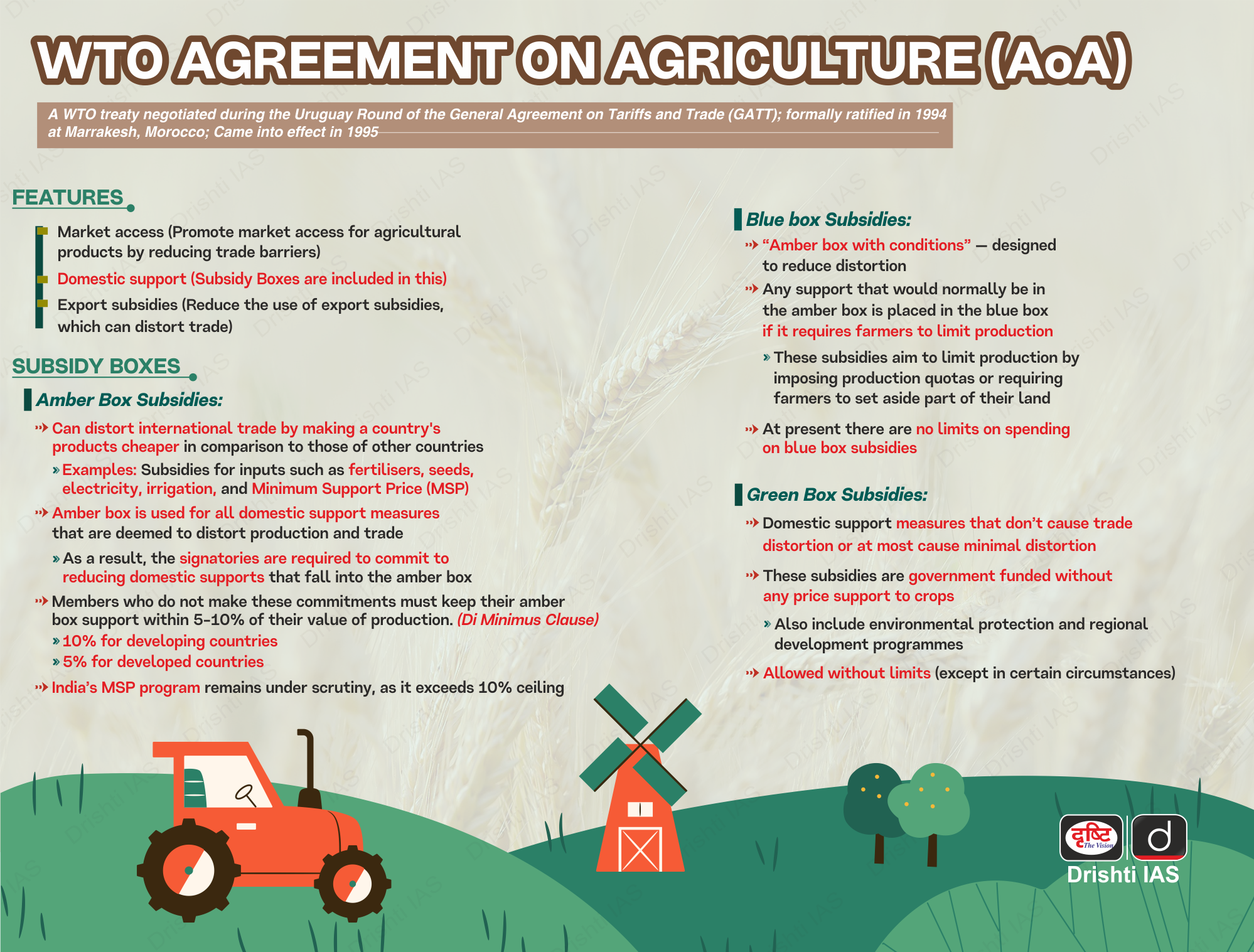

- Challenges to India's MSP Policy: Developed countries like the US, Canada, and Australia challenge India’s MSP at the WTO, claiming it exceeds the 10% limit (Amber box) under the AoA, risking dispute proceedings.

- India can provide uncapped input subsidies under the AoA’s ‘Development Box’ for developing nations, but developed countries seek limits that can threaten small farmers' livelihoods.

- Challenges from FTAs: India's FTAs with countries like Singapore, ASEAN, and Japan lower tariffs on imported agri-products, hinders farmers' adoption of new technologies and investment in infrastructure, reducing global competitiveness.

- Frequent Export Restrictions: India’s export restrictions to control price shocks deter foreign importers and domestic investment in post-harvest management and food processing.

- Frequent onion bans disrupt supply chains and reduce India’s reliability in the global market, prompting import partners to seek alternatives.

What are Government Initiatives to Boost Agriculture Exports?

Way Forward

- Establish Market Intelligence Units: The government should set up external market intelligence units to provide real-time data on international export demand, helping farmers and exporters meet global market needs.

- Support Agri-Tech Startups: India’s vast agriculture sector provides startups opportunities to scale, expand, and innovate to maximize trade potential.

- Diversify Export Markets: India should explore new products and markets, prioritizing dairy, poultry, vegetables, and fruits in Africa, Southeast Asia, and the Middle East.

- With rising post-pandemic demand for superfoods (e.g., millets) and herbal products, India should promote their cultivation and processing.

- Compliance with SPS Measures: India should educate agri-value chain participants (both upstream and downstream) on SPS compliance and develop processing infrastructure to boost quality and global competitiveness.

- Cooperatives and FPOs educate farmers on SPS regulations, food safety, and best practices through workshops on pest control, residue management, and hygiene.

- Develop Agro-Climatic Clusters: Identifying suitable agro-climatic zones for cultivating export-oriented crops will optimize productivity and quality.

- Microsoft’s Project Farm Vibes (PFV) can boost crop yields by 40% while reducing resource consumption.

- Establish a Credible Trade Policy: India needs to streamline its agricultural trade policy to minimize the frequent imposition of export restrictions.

|

Drishti Mains Question: What steps should India take to increase its share in global agricultural trade? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the circumstances in Indian agriculture, the concept of “Conservation Agriculture” assumes significance. Which of the following fall under the Conservation Agriculture?

- Avoiding the monoculture practices

- Adopting minimum tillage.

- Avoiding the cultivation of plantation crops

- Using crop residues to cover soil surface

- Adopting spatial and temporal crop sequencing/crop rotations

Select the correct answer using the code given below:

(a) 1, 3 and 4

(b) 2, 3, 4 and 5

(c) 2, 4 and 5

(d) 1, 2, 3 and 5

Ans: (c)

Mains

Q. What are the present challenges before crop diversification? How do emerging technologies provide an opportunity for crop diversification?(2021)

Q. What are the main constraints in transport and marketing of agricultural produce in India? (2020)