Agriculture

Need for New Agriculture Export-Import Policy

- 27 May 2024

- 14 min read

For Prelims: Agricultural Exports Trends, Cereals, Sugar, Onions, Agricultural Export Policy (AEP), Market Access Agreements, Agricultural Export Policy 2018, Edible Oils, and Pulses

For Mains: Reasons for Agricultural Exports Decline, Agricultural Export Policy (AEP), Export Subsidies, Tariff Reductions, Quality Standards, Market Access Agreements, Agricultural Export Policy 2018, Monitoring Framework, Consumer Food security and infrastructure development.

Why in News?

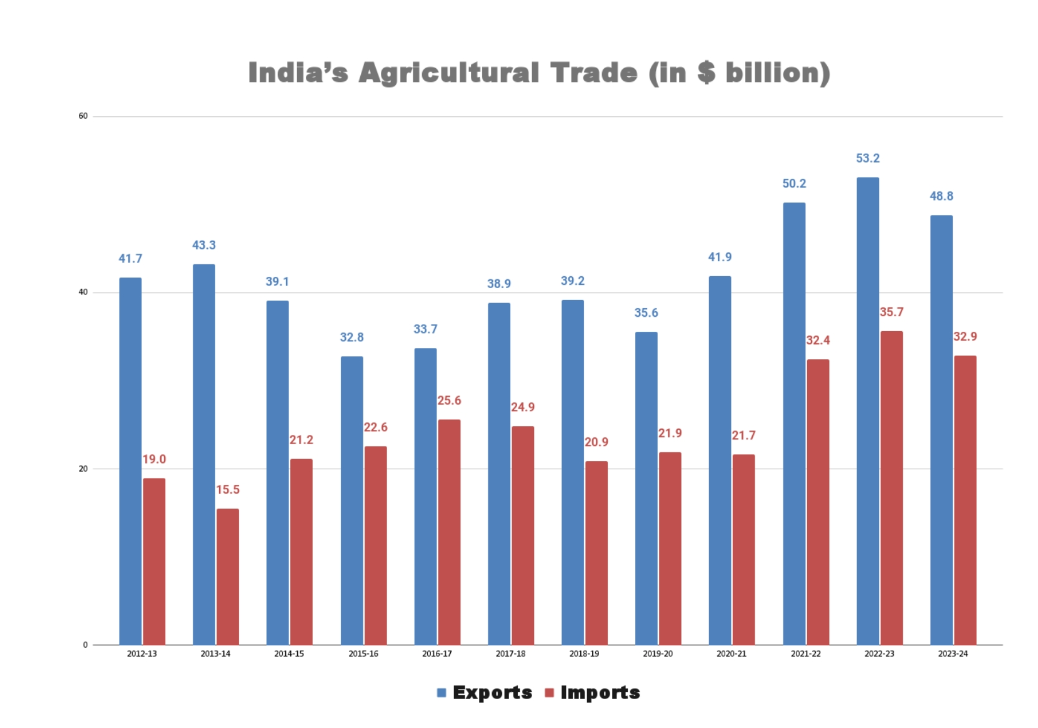

Recently, Department of Commerce data revealed that India's agricultural exports declined by 8.2% in 2023-24, primarily due to government curbs on various commodities. Meanwhile, agricultural imports dropped by 7.9% due to lower edible oil prices.

- These trends underscore the need for a balanced agriculture export-import policy to stabilise the agricultural sector and ensure both domestic availability and market growth.

What is the Current State of Indian Agricultural Exports and Imports?

- Agricultural Exports:

- India's agricultural exports witnessed a substantial decline of 8.2% in the fiscal year 2023-24, totalling USD 48.82 billion.

- This drop comes after a record-breaking performance of USD 53.15 billion in the previous fiscal year 2022-23.

- Declined Commodities:

- Sugar Exports: No sugar exports were allowed from October 2023, reducing exports to USD 2.82 billion in 2023-24 from USD 5.77 billion in the previous year.

- Non-Basmati Rice Exports: Concerns over domestic availability and food inflation triggered a ban on all white non-basmati rice exports from July 2023.

- Currently, only parboiled grain shipments are permitted within the non-basmati segment, attracting a 20% duty.

- These restrictions have pulled down overall non-basmati exports from a record USD 6.36 billion in 2022-23 to USD 4.57 billion in 2023-24.

- Wheat Exports: Exports stopped in May 2022, plummeting to USD 56.74 million in 2023-24 from USD 2.12 billion in 2021-22.

- Onion Exports: In May 2024, the Centre lifted a ban on onion exports. Simultaneously, a floor price of USD 550 per tonne (below which no exports can take place) and a 40% duty were imposed.

- Official data reveals onion exports at only 17.08 lakh tonnes (lt), worth USD 467.83 million, during April-February 2023-24, as against 25.25 lt (USD 561.38 million) for the whole of 2022-23.

- Growth in Other Commodities:

- Basmati rice and spices exports saw growth, with basmati rice reaching USD 5.84 billion and spices crossing the USD 4 billion mark for the first time.

- Exports of marine products, castor oil, and other cereals (mainly maize) also posted growth, contributing to the overall export basket.

- India's agricultural exports witnessed a substantial decline of 8.2% in the fiscal year 2023-24, totalling USD 48.82 billion.

- Agricultural Imports:

- India's agricultural imports witnessed a 7.9% dip during the fiscal year 2023-24, reflecting the impact of global market conditions and domestic demand.

- Reduced Edible Oil Imports:

- The significant decline in overall agricultural imports was largely due to a single commodity: edible oils.

- India's imports of vegetable fats topped USD 20 billion in 2022-23, a year immediately after the Russia-Ukraine war when global prices for vegetable oils were at their peak.

- However, in 2023-24, the average FAO vegetable oil sub-index eased to 123.4 points, indicating lower global prices.

- As a result, the vegetable oil import bill fell below USD 15 billion during the last fiscal year.

- Surge in Pulse Imports:

- Imports of pulses almost doubled to USD 3.75 billion in 2023-24, the highest since the USD 3.90 billion and USD 4.24 billion levels of 2015-16 and 2016-17, respectively.

- The surge in pulse imports highlights the continued dependence on

foreign sources to meet domestic demand for this essential commodity.

What are the Key Factors Influencing India's Agricultural Exports and Imports?

- Export Restrictions: The government has imposed curbs on the export of commodities like rice, wheat, sugar, and onions due to concerns over domestic availability and food inflation.

- These restrictions have led to a significant decline in the exports of these commodities.

- Global Price Movements: The UN Food and Agriculture Organization's (FAO) food price index (base: 2014-16=100) is used as a reference to track global agri-commodity prices.

- The FAO food price index dipped from an average of 119.1 points in 2013-14 to 96.5 points between 2013-14 and 2019-20, reflecting a crash in global agri-commodity prices.

- This crash in global prices reduced the cost competitiveness of India's agricultural exports.

- However, the global price recovery following the Covid-19 pandemic and the Russia-Ukraine war led to the FAO index soaring to 140.8 points in 2022-23.

- This spike in global prices resulted in India's farm exports and imports zooming to all-time highs in 2022-23, before dropping in the fiscal year 2023-24.

- In 2023-24, the average FAO index eased to 121.6 points, while the vegetable oil sub-index fell to 123.4 points, leading to a decline in India's edible oil import bill.

- Government Policies: The government's decision to maintain low or zero import duties on pulses and edible oils contradicts its goal of boosting domestic production.

- This policy favours imports over domestic cultivation, potentially discouraging farmers from diversifying crops. Ultimately, it undermines long-term agricultural development and self-sufficiency.

What is Agricultural Export Policy?

- About: An agricultural export policy consists of a collection of government rules, actions, and encouragements aimed at regulating and boosting the export of agricultural goods from a specific nation.

- The policy encompasses export subsidies, tariff reductions, quality standards, market access agreements, financial incentives, and trade promotion initiatives to boost agricultural producers' and exporters' access to international markets and enhance their competitiveness.

- India’s Agriculture Export Policy, 2018: In December 2018, the government implemented a comprehensive agriculture export policy aimed at leveraging India's agricultural export potential using appropriate policy measures to establish India as a leading force in global agriculture and increase the income of farmers.

- Objective: It aimed at doubling agricultural exports from USD 30+ billion to over USD 60 billion by 2022.

- It was expected that farmers would get the benefit of export opportunities in the overseas market.

- It would promote ethnic, organic, traditional, and non-traditional Agri products exports.

- To establish a monitoring framework to oversee the implementation of the Agricultural Exports Policy.

- Elements:

- Strategic: Policy measures, infrastructure, and logistics; supporting a holistic approach to boost exports; greater involvement of state governments in agricultural exports.

- Operational: Focus on clusters, promoting value-added exports, marketing and promotion of "Brand India," attracting private investments into production and processing, establishing a strong quality regime, and research & development.

- Objective: It aimed at doubling agricultural exports from USD 30+ billion to over USD 60 billion by 2022.

What are the Challenges to the Agri-Export Policy of India?

- Policy Instability and Double Standards: Frequent changes in export policies, often aimed at protecting domestic consumers from price hikes, can adversely affect farmers and traders. Sudden bans and restrictions, such as those on wheat and onions, disrupt market stability and long-term trade relationships.

- Conflicting Goals: The government's reduced import duties on pulses and low tariffs on edible oils aim to ensure consumer affordability but conflict with promoting domestic crop diversification to less water-intensive and import-substituting crops.

- Subsidy Centric Schemes: Populist measures during election seasons, like increased consumer food and farmer fertilizer subsidies, loan waivers, and free power, though politically popular, undermine fiscal discipline and the agricultural sector's financial health.

- Inadequate R&D Investment: India's investment in agricultural R&D is around 0.5% of agricultural GDP, insufficient for substantial growth, and needs to be doubled or tripled to enhance production and exports.

- Quality and Standards: Ensuring consistent quality and compliance with international sanitary and phytosanitary (SPS) standards is a significant challenge for Indian agricultural exports due to pests and diseases.

- Competitiveness: India faces competition in pricing and quality in its agricultural exports, whereas exchange rate fluctuations also influence competitiveness.

Government Schemes to Promote Agri-Export in India

What are the Steps Ahead for a Stable Agri-Export Policy in India?

- Balancing Interests and Long-Term Goals: Economists suggest more predictable and rules-based policies, like temporary tariffs, to manage exports without sudden shocks.

- Strategic Buffer Stocks and Market Intervention: The government should maintain buffer stocks of essential commodities to mitigate price volatility and ensure market stability. This approach allows for more controlled and less disruptive market interventions, preventing sudden policy shifts that can destabilise the agricultural sector.

- Farmer’s Welfare: Prioritise the welfare of farmers and ensure that they receive fair prices for their produce. The success of agricultural exports should directly benefit the farming community.

- Support for Domestic Consumers: To ensure food security, policy support is needed for domestic consumers, and it should be through a domestic income policy targeted specifically at vulnerable sections of society.

- Productivity Enhancement: Increasing agricultural productivity while ensuring quality is essential for competitiveness. It will require investments in R&D, seeds, irrigation, fertilisers, and better farming practices.

- Diversify Export Basket: Diversify the basket of agricultural exports, emphasise value-added products, lessen reliance on a select few commodities, and target a wide array of international markets.

- Infrastructure Development: Invest in modern infrastructure, including cold storage, processing facilities, transportation, and logistics, to reduce post-harvest losses and enhance export competitiveness.

- International Best Practices: Strengthen diplomatic efforts to negotiate favourable trade agreements and reduce trade barriers to gain better access to international markets. Learn from successful agricultural export policies and best practices in other countries such as:

- The Netherlands: A global leader in horticulture exports, the Netherlands emphasises innovation, efficient logistics, and strong producer organisations.

- The United States: The U.S. Department of Agriculture offers a range of programs to support agricultural exports, including market development initiatives and technical assistance.

|

Drishti Mains Question: Q. Discuss the steps needed to improve India's export-import policy to enhance international trade competitiveness. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to the circumstances in Indian agriculture, the concept of “Conservation Agriculture” assumes significance. Which of the following fall under the Conservation Agriculture? (2018)

1. Avoiding the monoculture practices

2. Adopting minimum tillage.

3. Avoiding the cultivation of plantation crops

4. Using crop residues to cover soil surface

5. Adopting spatial and temporal crop sequencing/crop rotations

Select the correct answer using the code given below:

(a) 1, 3 and 4

(b) 2, 3, 4 and 5

(c) 2, 4 and 5

(d) 1, 2, 3 and 5

Ans: (c)

Mains

Q. What are the present challenges before crop diversification? How do emerging technologies provide an opportunity for crop diversification?(2021)

Q. What are the main constraints in transport and marketing of agricultural produce in India? (2020)