Rapid Fire

Decline in FDI Equity Inflows in FY 2024

- 01 Jun 2024

- 1 min read

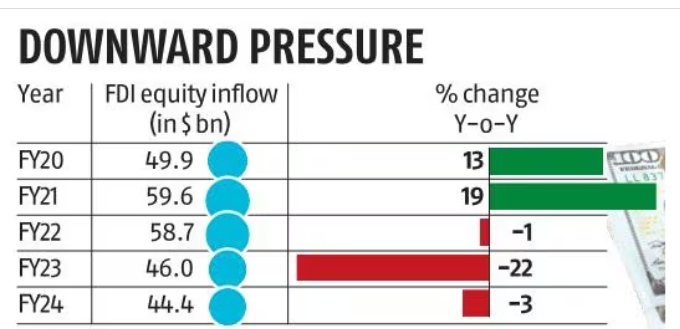

The Foreign direct investment (FDI) equity inflows in India fell to a five-year low of USD 44.42 billion in the financial year ended 31st March 2024 (FY24), marking a 3.5% year-on-year (Y-o-Y) contraction.

- The decline in FDI equity inflows can be attributed to external factors such as high interest rates in advanced economies and a limited absorptive capacity in various sectors in India.

- Total FDI, including equity capital, reinvested earnings, and other capital, contracted by 1% Y-o-Y to USD 70.95 billion during FY24 as per Department for Promotion of Industry and Internal Trade (DPIIT).

- Singapore remained the top investor with USD 11.77 billion in FDI, followed by Mauritius, the United States, Netherlands, and Japan.

- Maharashtra continued to be the most favoured destination for investors, receiving USD 15.11 billion worth of investments, although inflows declined by 2%, followed by Karnataka.

- Computer software and hardware, services sector, and trading were the top recipients of FDI, but all three sectors saw a decline in inflows.

Read more: India's Foreign Direct Investment Trends