Important Facts For Prelims

Decline in 10-Year Bond Yield

- 06 Dec 2024

- 5 min read

Why in News?

Recently, Indian government bond yields witnessed a significant decline, with the 10-year benchmark yield dropping to its lowest level since 2021.

- This shift is attributed to rising optimism about the Reserve Bank of India (RBI) potentially easing interest rates in its upcoming monetary policy review.

What Factors Have Contributed to the Decline in the Bond Yields?

- Economic Growth Slowdown: India's GDP growth slowed to 5.4% in the September 2024 quarter, marking the lowest growth in 7 quarters.

- The economic slowdown has raised concerns, driving expectations of RBI monetary easing, through rate cuts or liquidity measures leading to increased demand for bonds and a consequent decline in yields.

- Measures Taken by RBI: Anticipations of liquidity infusion through Open Market Operations (OMO) or a cut in the Cash Reserve Ratio (CRR) of around 50 basis points by the RBI could release approximately Rs 1.1 lakh crore into the banking system.

- This move would likely reduce shorter-term bond yields and boost liquidity.

- Foreign Investments: Increased foreign investments in Indian bonds, including Rs 7,700 crore in net purchases in a short period and Rs 20,200 crore by foreign lenders, have boosted demand, contributing to declining yields and signaling investor confidence in the economy.

What is Bonds and Bond Yield?

- Bonds: A bond is an instrument to borrow money. It is like an IOU (I owe you).

- A bond could be floated/issued by a country's government or by a company to raise funds.

- Since Government Bonds (referred to as G-secs in India, Treasury in the US, and Gilts in the UK) come with the sovereign’s guarantee, they are considered one of the safest investments.

- Bond Yield:

- Bond yield represents the return an investor can expect from a bond, expressed as a percentage.

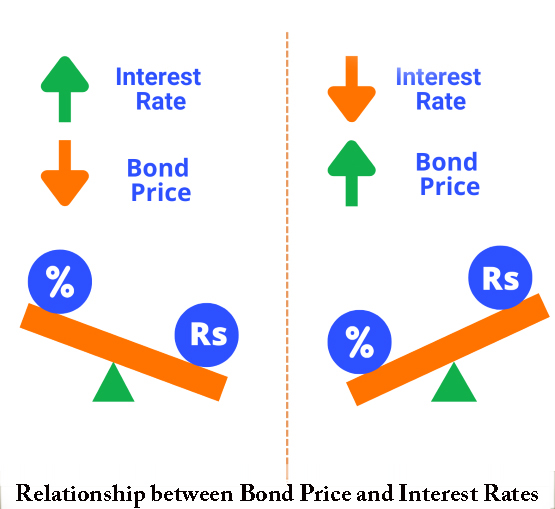

- However, this return is not fixed and varies with changes in the bond's market price. It is inversely related to bond prices i.e. when bond prices rise, yields fall, and vice versa.

- Every bond has:

- Face Value: The nominal value of the bond, typically repaid at maturity.

- Coupon Payment: The fixed annual payment made to the bondholder.

- Coupon Rate: The annual interest rate expressed as a percentage of the bond's face value.

- For example, a 10-year government security (G-sec) with a face value of Rs. 100, a coupon payment of Rs. 5, and a coupon rate of 5% offers a 5% yield. The investor receives Rs. 5 annually for 10 years and the Rs. 100 face value at maturity, representing the return for lending Rs. 100 today.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q.1 In the context of the Indian economy, non-financial debt includes which of the following? (2020)

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Q.2 Consider the following statements: (2018)

- The Reserve Bank of India manages and services Government of India Securities but not any State Government Securities.

- Treasury bills are issued by the Government of India and there are no treasury bills issued by the State Governments.

- Treasury bills offer are issued at a discount from the par value.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (c)

Q.3 In the context of Indian economy, ‘Open Market Operations’ refers to (2013)

(a) borrowing by scheduled banks from the RBI

(b) lending by commercial banks to industry and trade

(c) purchase and sale of government securities by the RBI

(d) None of the above

Ans: (c)