Indian Economy

Concerns in Asset Reconstruction Companies (ARCs)

- 09 Sep 2024

- 10 min read

For Prelims: Asset Reconstruction Companies (ARCs), Non Performing Asset (NPAs), Assets Under Management (AUM), Retail NPAs, National Asset Reconstruction Company Ltd (NARCL), Insolvency and Bankruptcy Code (IBC), SARFAESI Act, 2002, Maidavolu Narasimham, Qualified Buyers.

For Mains: Challenges in Functioning of Asset Reconstruction Companies (ARCs) and Remedial Measures.

Why in News?

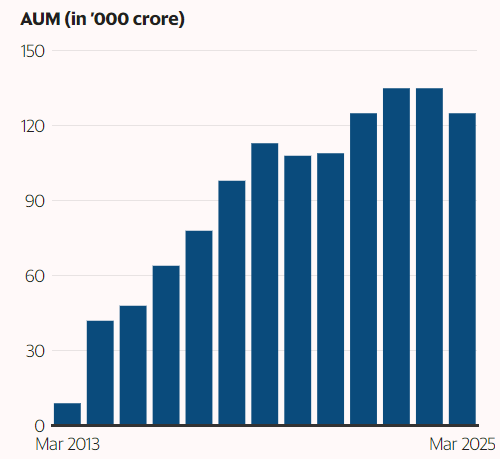

Recently, Asset Reconstruction Companies (ARCs) have experienced a slowdown in growth due to Non Performing Asset (NPAs) reaching a 12-year low of 2.8% in March 2024.

- Ratings agency Crisil projects that assets under management (AUM) by ARCs will contract by 7-10% in 2024-25 after remaining unchanged in 2023-24.

What are the Concerns of Asset Reconstruction Companies (ARCs)?

- Low Business Potential: The decrease in new non-performing corporate assets has driven ARCs to focus on smaller, less profitable retail loans.

- Despite this shift, there has not been a notable increase in retail NPAs, which further restricts opportunities for ARCs.

- Increased Investment Mandate: In October 2022, the Reserve Bank of India (RBI), directed ARCs to invest at least 15% of bank investments in security receipts or 2.5% of the total security receipts issued, whichever is higher.

- Net Owned Funds Requirements: In October 2022, the RBI raised the minimum net owned funds requirement for ARCs from Rs 100 crore to Rs 300 crore to ensure that ARCs have robust balance sheets.

- This decision imposed additional constraints on ARCs' capital usage, with many struggling to meet the ₹300 crore requirement, leading to potential mergers or exits.

- Net-owned funds are similar to net worth and are defined as the difference between what a company owns and owes.

- This decision imposed additional constraints on ARCs' capital usage, with many struggling to meet the ₹300 crore requirement, leading to potential mergers or exits.

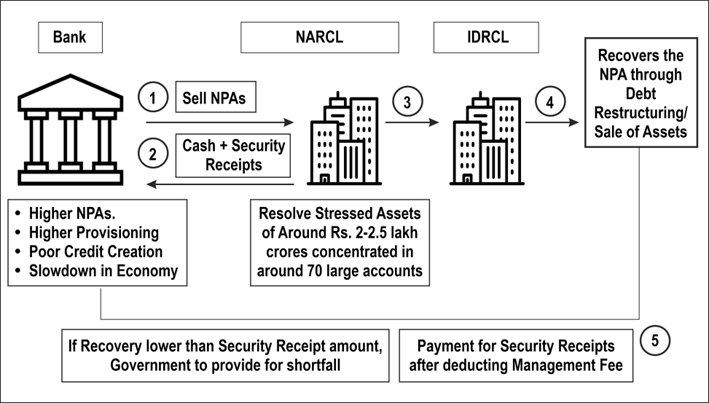

- Competition from NARCL: The establishment of the state-owned National Asset Reconstruction Company Ltd (NARCL) represents a significant challenge as NARCL offers security receipts that are guaranteed by the government which are more lucrative to financial institutions.

- Regulatory Challenges: The RBI also mandated that ARCs must obtain approval from an independent advisory committee for all settlement proposals.

- This measure has led to delays in the approval of settlements, especially in retail loans, as advisory committees are cautious to avoid future scrutiny.

- Increased RBI scrutiny has hit major ARCs, with Edelweiss ARC banned from new loans for bypassing regulations through related group loans.

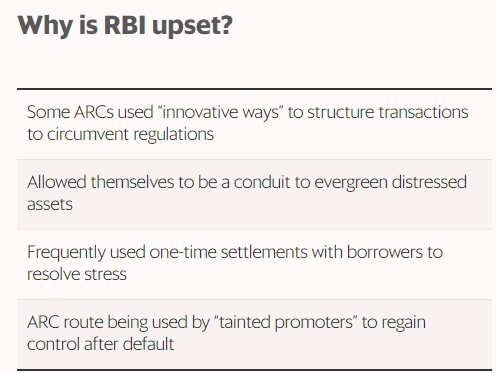

- Trust Deficit: A trust deficit seems to have emerged between the regulator (RBI) and ARCs.

- The RBI has expressed concerns that some transactions may be helping defaulting promoters to regain control of their assets which amounts to circumventing the provisions of Section 29A of the Insolvency and Bankruptcy Code (IBC).

- Section 29A of IBC bars defaulting promoters from bidding for their insolvent firms.

- The RBI has expressed concerns that some transactions may be helping defaulting promoters to regain control of their assets which amounts to circumventing the provisions of Section 29A of the Insolvency and Bankruptcy Code (IBC).

What are ARCs?

- About: An asset reconstruction company (ARC) is a special type of financial institution that buys the debts of the bank at a mutually agreed value and attempts to recover the debts or associated securities by itself.

- Background of ARCs: The concept of ARCs was introduced by the Narsimham Committee – II (1998), leading to the establishment of ARCs under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act, 2002).

- Presently, 27 ARCs are registered with the RBI, including notable ones like NARCL, Edelweiss ARC, and Arcil.

- Registration and Regulation of ARCs: ARC is registered under the Companies Act, 2013 and must also be registered with the RBI under section 3 of the SARFAESI Act.

- They function as per the SARFAESI Act and guidelines issued by the Reserve Bank of India.

- Funding for ARCs: The required funds to purchase such debts (NPAs) can be raised from Qualified Buyers (QBs). QBs are the sole entities from whom an ARC can raise funds.

- QBs include insurance companies, banks, state financial and industrial development corporations, trustees or ARCs registered under SARFAESI, and asset management companies registered with SEBI.

- Working of the ARCs:

- Asset Reconstruction: It involves acquiring a bank's or financial institution's rights in loans, advances, debentures, bonds, guarantees, or other credit facilities for recovery purposes, collectively referred to as 'financial assistance'.

- ARCs buy distressed loans at a discount for cash or a combination of cash and security receipts, which can be redeemed within eight years.

- Securitisation: It involves acquiring financial assets by issuing security receipts to Qualified Buyers.

- Asset Reconstruction: It involves acquiring a bank's or financial institution's rights in loans, advances, debentures, bonds, guarantees, or other credit facilities for recovery purposes, collectively referred to as 'financial assistance'.

Non-Performing Asset (NPA)

- About: A loan is classified as an NPA when the loan payments have not been made for a minimum period of 90 days.

- For agriculture, a loan is classified as an NPA if the principal or interest is not paid for two cropping seasons.

- Types of NPAs: Banks classify NPAs into three categories based on how long the asset has been non-performing and the likelihood of recovering the dues.

- Sub-standard Assets: A substandard asset is an asset classified as an NPA for a period less than or equal to 12 months.

- Doubtful Assets: A doubtful asset is an asset that has been non-performing for a period exceeding 12 months.

- Loss Assets: Assets that are uncollectible and where there is little, or no hope of recovery and that need to be fully written off.

Recent Changes in ARCs Regulations by RBI

- Strengthening Governance Structure: RBI mandated that the chair of the board and at least half the directors in a board meeting must be independent directors to enhance corporate governance at ARCs.

- Enhancing Transparency: ARCs must disclose their track record of returns generated for security receipt investors and collaborate with rating agencies for schemes launched over the past eight years to increase transparency.

- Revised Investment Requirements: ARCs must invest in security receipts (SRs) at least 15% of the transferors' investment or 2.5% of the total receipts issued, whichever is higher, replacing the previous requirement of 15% of all receipts.

What Measures Can Be Taken to Address the Challenges Faced by ARCs?

- Diversification of Asset Portfolios: ARCs should diversify their asset portfolios by exploring opportunities beyond traditional corporate and retail loans.

- This could include sectors like infrastructure, MSMEs, and stressed sectors that still have potential for recovery.

- Improving Regulatory Transparency and Collaboration: ARCs should work closely with the RBI and other regulatory bodies to ensure transparent operations and compliance with all guidelines.

- Establishing a standard code of conduct could also help improve trust and accountability.

- Enhancing Efficiency in Settlements: To counter delays caused by the mandatory approval from independent advisory committees ARCs can employ technology such as AI-driven analytics which could help in faster evaluation, thus minimising delays while maintaining compliance.

- Adopting Strategic Competition with NARCL: Private ARCs should focus on differentiating their services by offering specialised solutions tailored to niche markets or by focusing on faster recovery mechanisms.

|

Drishti Mains Question: Q. Discuss the challenges faced by Asset Reconstruction Companies (ARCs) and suggest measures to enhance their effectiveness. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news?(2017)

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented by the Government.

Ans: (b)

-min.jpg)