Aspirational Goals of RBI | 11 Jun 2024

For Prelims: RBI, Capital Account, INR Internationalisation, Capital Account Convertibility, Non-resident Deposits, Indian MNCs and Global Brands, Digital Payment System, UPI, RTGS, NEFT, Central Bank Digital Currency (e-Rupee), Globalisation, GIFT City, Monetary Policy Framework, Climate Change Initiatives, Rupee Masala Bonds

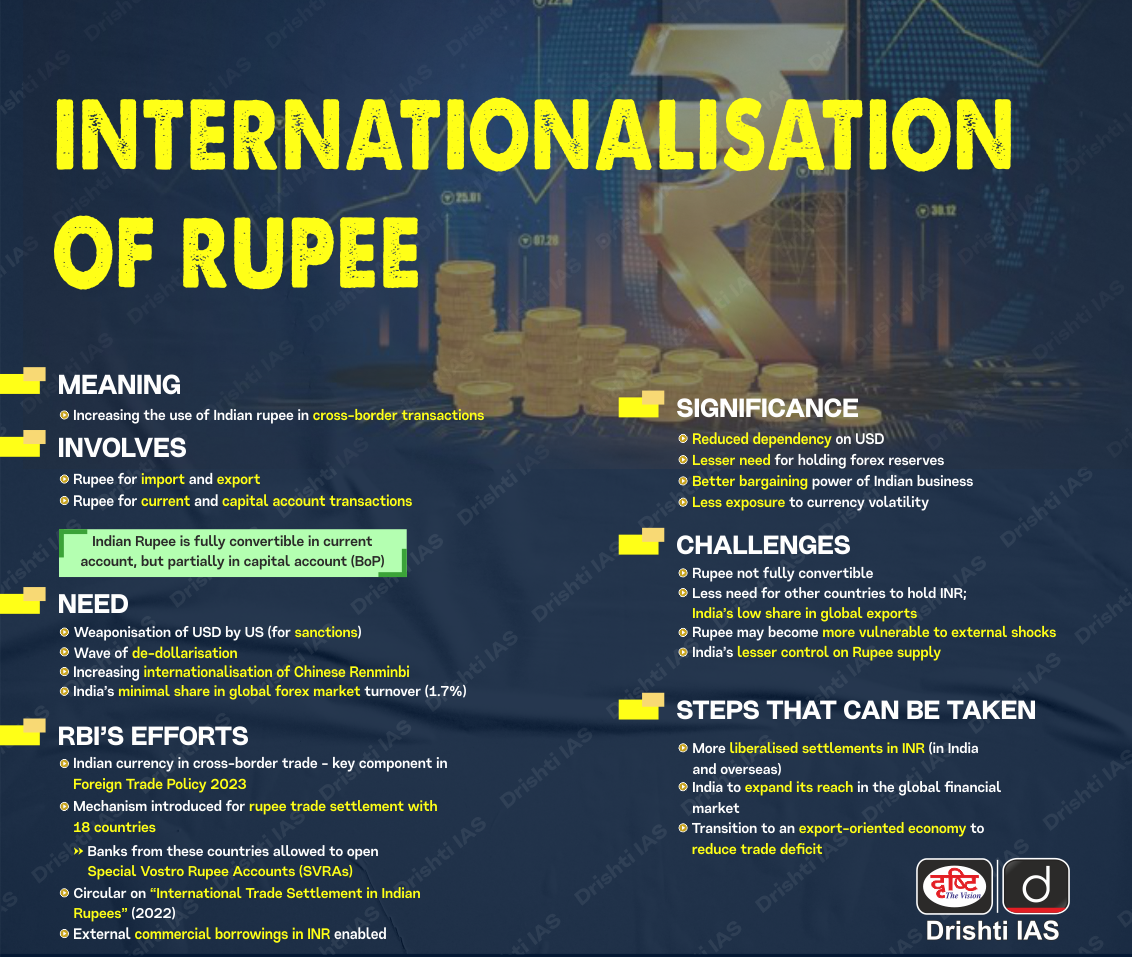

For Mains: Challenges in Capital Account Liberalisation and INR Internationalisation

Why in News?

Recently, the Reserve Bank of India (RBI) has outlined several aspirational goals in preparation for India's fast-growing economy, aiming to be "future-ready" by the time it reaches its centenary year, RBI@100.

What are the Aspirational Goals of RBI?

- Capital Account Liberalisation and INR Internationalisation:

- Capital Account Convertibility: Proposed full capital account convertibility, allowing free conversion between the rupee and foreign currencies for capital transactions.

- Internationalisation of the Rupee: Enabling non-residents to use the rupee for cross-border transactions and enhancing rupee account accessibility for persons outside India.

- Calibrated Interest-Bearing Non-Resident Deposits: Adopting a careful approach toward interest-bearing deposits for non-residents.

- Promotion of Indian MNCs and Global Brands: Supporting overseas investments by Indian multinational corporations.

- Digital Payment System Universalisation:

- Domestic and Global Expansion: Expanding the use of India's digital payment systems (UPI, RTGS, NEFT) domestically and internationally, and linking payment systems with other countries.

- The starting point can be integrating Indian payment systems with those of other countries.

- Central Bank Digital Currency (e-Rupee): Phased implementation of the e-Rupee.

- Domestic and Global Expansion: Expanding the use of India's digital payment systems (UPI, RTGS, NEFT) domestically and internationally, and linking payment systems with other countries.

- Globalisation of India’s Financial Sector:

- Domestic Banking Expansion: Aligning banking sector growth with national economic growth.

- Top Global Banks: Aiming to position 3-5 Indian banks among the top 100 global banks in terms of size and operations and positioning the Reserve Bank as a model central bank of the global south.

- Support for GIFT City: Assisting the International Financial Services Centres Authority (IFSCA) in making GIFT City a leading international financial hub.

- Monetary Policy Framework Review:

- Balancing Act: Addressing the balance between price stability and economic growth from an Emerging Market Economy perspective.

- Policy Communication: Refining monetary policy communication and addressing spillovers from debt overhang in important economies.

- Climate Change Initiatives: Providing guidance for stress testing asset portfolios, strengthening payment systems against climate risks, and proposing disclosure norms and a government taxonomy for climate risks.

-

Short and Medium-Term Measures:

- Trade Arrangements: Standardizing approaches for bilateral and multilateral trade invoicing, settlement, and payment in rupee and local currencies.

- Financial Market Strengthening: Fostering a global rupee market and recalibrating the foreign portfolio investor regime.

- Rupee Masala Bonds: Reviewing taxes on rupee masala bonds.

- Global Bond Indices: Including Indian Government Bonds in global bond indices.

Steps Towards Internationalisation of Rupees

- Developments in the GIFT City

- Asian Clearing Union (ACU), a regional payment arrangement facilitates the settlement of trade transactions among its member countries on a multilateral basis. The ACU currently has 13 member countries. India is a member of ACU.

- In March 2023, the RBI put in place the mechanism for rupee trade settlement with as many as 18 countries.

- Banks from these countries have been allowed to open Special Vostro Rupee Accounts (SVRAs) for settling payments in Indian Rupees.

- In July 2022, the RBI issued a circular on “International Trade Settlement in Indian Rupees”.

- RBI enabled external commercial borrowings in Rupees as per the (especially Masala Bonds).

Narasimham Committee

- Dr Manmohan Singh set up Narasimham Committee in 1991 to analyse India’s banking sector and recommend reforms. It was followed by the 1998 Committee which is known as the Narasimham Committee II.

- Narasimham Committee- I Recommendations:

- A 4-tier hierarchy for the Indian banking system with 3 or 4 major public sector banks at the top and rural development banks for agricultural activities at the bottom.

- A quasi-autonomous body under RBI for supervising banks and financial institutions.

- Reduction in statutory liquidity ratio

- Reaching of 8% capital adequacy ratio

- Setting up Asset Reconstruction fund

- Narasimham Committee- II Recommendations:

- Stronger banking system: The Committee recommended the merger of major public sector banks to boost international trade. However, the Committee warned against merging stronger banks with weaker banks.

- Reform in the role of RBI: The Committee also recommended reforms in the role of the RBI in the banking sector. The Committee felt that RBI being the regulator, it should not have ownership in any bank.

- NPAs: The Committee wanted the banks to reduce their NPAs to 3% by 2002. It also recommended the formation of Asset Reconstruction Funds or Asset Reconstruction Companies.

- Foreign banks: It also proposed to raise the minimum start-up capital to USD 25 million for foreign banks from USD 10 million.

Tarapore Committee

- The RBI had appointed the Tarapore committee in 1997. The committee was formed with the objective of progressive liberalisation of capital account transactions.

- It suggested that full convertibility should be achieved in three phases and the process should be subject to fulfilment of certain crucial preconditions and signposts.

- Prior RBI approval dispensed with for foreign direct and portfolio investment and disinvestments

- Banks and FIs allowed to play in local and overseas gold markets

- FIIs, NRIs, non resident banks allowed into the forward exchange markets

- Financial institutions allowed to be full fledged authorised dealers.

What are the Challenges in Achieving the Aspirational Goals of RBI?

- Triffin Dilemma: It describes the conflict between a country's domestic monetary policy goals and its role as an international reserve currency issuer.

- The Triffin dilemma could manifest as a conflict between maintaining stability in India's domestic economy and meeting the global demand for the Rupee.

- Exchange Rate Volatility: Opening up the currency to international markets can increase volatility in its exchange rate, especially in the initial stages. Fluctuations can impact trade and investments, affecting economic stability.

- Impact on Export: The Rupee’s internationalisation will leads to increased demand for the currency in global markets, which may make Indian exports costly.

- Limited International Demand: The daily average share for the rupee in the global forex market is only around 1.6%, while India’s share of global goods trade is ~2%. The challenge lies in increasing share of Indian products in the competitive global market.

- Convertibility Concern: The absence of full convertibility of INR for capital transactions will restrict its widespread use in international trade and finance.

- Cybersecurity Threats: Digital payment systems are vulnerable to cyberattacks, which can lead to fraud and loss of money. Building trust requires robust security measures to protect user data and ensure the safety of transactions.

- High Non-Performing Assets (NPAs): Indian banks, particularly public sector ones, struggle with a high percentage of non-performing assets (loans unlikely to be repaid) making them less likely to absorb shock in case of global financial crisis.

What are the Steps Needed to Reach the Aspirational Goals?

- Convertible of Rupee: As per the recommendation of Tarapore committee, the goal should be of full convertibility by 2060, letting financial investments move freely between India and abroad.

- This would allow foreign investors to easily buy and sell the rupee, enhancing its liquidity and making it more attractive. Tobin Tax can be used as a safeguard measure by RBI against currency speculation.

- Reforms Suggested by Tarapore Committee:

- It had listed several preconditions such as fiscal consolidation, inflation control, low level of non-performing assets, low current account deficit and strengthening of financial markets for achieving capital account liberalisation.

- Strong Fiscal Management: Such as reducing fiscal deficits lower than 3.5%, reducing gross Inflation rate to 3%-5%, and reducing gross banking non-performing assets to less than 5%.

- Liberalised Scheme for Personal Remittance: The introduction of a more liberal scheme for personal remittances to facilitate easier transactions for individuals dealing with foreign exchange.

- Pursue a Deeper Bond Market: Enabling foreign investors and Indian trade partners to have more investment options in rupees, enabling its international use apart from developing the corporate bond market in India.

- Increase Rupee in International Trade: Optimising the trade settlement formalities for rupee import/export transactions would go a long way. For example rupee swap agreements with various countries, payment of Russian oil in Indian rupee etc.

- Globalisation of India’s Financial Sector: Encourage domestic banking expansion through licensing reforms and incentivise branch network expansion. Support Indian banks in enhancing their global presence through strategic partnerships and acquisitions.

- For example, similar to the support provided to Khanij Bidesh India Ltd support could be provided to banks for acquisition, merger and collaboration with foreign banking institutions.

- Monetary Policy Framework Review: Conduct a comprehensive review of the monetary policy framework to ensure it aligns with the goals of price stability and economic growth.

- Enhance transparency and clarity in monetary policy communication to manage market expectations effectively. For example releasing of meeting minutes.

- Climate Change Initiatives: Issue guidelines for stress testing of asset portfolios to assess climate change risks. Work with financial institutions to develop resilience measures against climate-related risks in payment systems. Propose disclosure norms for climate risk reporting and contribute to the development of a standardised government taxonomy.

|

Drishti Mains Question: Q. Discuss the key challenges faced by the Reserve Bank of India in its efforts to internationalise the Indian rupee. What measures can be taken to overcome these challenges? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Convertibility of rupee implies (2015)

(a) being able to convert rupee notes into gold

(b) allowing the value of rupee to be fixed by market forces

(c) freely permitting the conversion of rupee to other currencies and vice versa

(d) developing an international market for currencies in India

Ans: (c)

Q. With reference to Balance of Payments, which of the following constitutes/constitute the Current Account? (2014)

- Balance of trade

- Foreign assets

- Balance of invisibles

- Special Drawing Rights

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3

(c) 1 and 3

(d) 1, 2 and 4

Ans: (c)

Mains:

Q. Implementation of Information and Communication Technology (ICT) based Projects/ Programmes usually suffers in terms of certain vital factors. Identify these factors, and suggest measures for their effective implementation. (2019)