165th Anniversary of Income Tax Day | 28 Aug 2024

Why in News?

Recently, the Union Finance Minister presided over the 165th Anniversary of Income Tax Day observed by the Central Board of Direct Taxes (CBDT) in New Delhi, highlighting the Income Tax Department's significant achievements.

What is Income Tax Day?

- About: Income Tax Day (or Aaykar Divas), celebrated on 24th July, marks a significant milestone in India's fiscal history. This day commemorates the introduction of income tax in India by Sir James Wilson, a British economist in 1860 to meet the losses from the 1857 Military Mutiny.

- Income Tax Day not only honours the historical development of tax administration in India but also highlights the continuous advancements and modernization efforts aimed at creating a more efficient and taxpayer-friendly system.

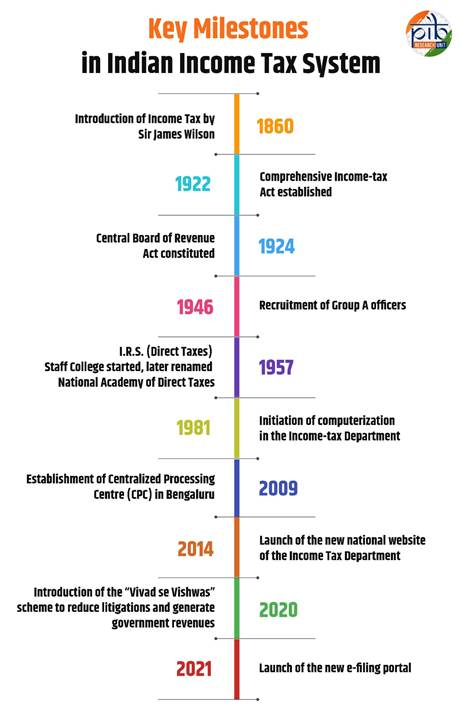

- Evolution of Income Tax in India:

- Income-tax Act of 1922: It established a structured tax system in India by formalising various income tax authorities and laying the foundation for a systematic administration framework.

- Central Board of Revenue Act (1924): Created the Central Board of Revenue, a statutory body responsible for administering income tax.

- Recruitment of Group A Officers (1946): Enhanced professional development with training in Bombay and Calcutta.

- Establishment of the National Academy of Direct Taxes (1957): Strengthened professional training and development.

- Income Tax Act of 1961: Several amendments were made over the years, leading to the Income Tax Act of 1961, which has been in force since April 1962 and applies to the whole of India.

- Bifurcation of Central Board of Revenue in 1964: Initially the Board was in charge of both direct and indirect taxes.

- However, when the administration of taxes became too burdensome for a single board, it was divided into two separate entities: the Central Board of Direct Taxes and the Central Board of Excise and Customs, under the Central Boards of Revenue Act, 1963.

- Technological Advancements: The introduction of computerisation in 1981 focused on processing challans electronically. In 2009, the Centralized Processing Centre (CPC) was set up in Bengaluru to handle the bulk processing of e-filed and paper returns, operating efficiently in a jurisdiction-free manner.

- The E-Verification Scheme enables authorities to collect information to accurately determine a taxpayer's income and reduce tax evasion, while providing taxpayers with relevant financial data from various sources.

- Vivad se Vishwas scheme: It is a settlement program in India that aims to end pending direct tax disputes between taxpayers and the government.

- The scheme helps litigants settle their disputes and allow the government to collect revenue that's tied up in litigation.

What is Income Tax?

- Definition: It is a government levy on the income earned by individuals and businesses during a financial year.

- "Income" encompasses various sources, defined broadly under Section 2(24) of the Income Tax Act, 196.

- Income Sources:

- Salary: Includes all payments from an employer to an employee, such as basic pay, allowances, commissions, and retirement benefits.

- House Property: Rental income from residential or commercial properties is taxable.

- Business/Profession: Profits from business or professional activities are taxable after deducting expenses.

- Capital Gains: Profits from selling capital assets like property or jewellery are taxable. These gains can be long-term or short-term.

- Other Sources: Includes income not covered by the other categories, such as savings interest, family pension, gifts, lottery winnings, and investment returns.

- Importance: It is crucial for nation-building, providing essential revenue for security, services, and economic development.

- It balances wealth redistribution and state power, shaping social structure and establishing a social contract.

- Tax reforms enhance governance, expand state capacity, and boost legitimacy, making income tax vital for a self-sustaining state and societal welfare.

- Current Landscape: The landscape of personal income tax (PIT) in India has seen significant growth, reflecting the country's expanding economy and improved tax compliance.

- Gross PIT, including the Securities Transaction Tax (STT), increased from Rs 5.75 lakh crore in 2020-21 to Rs 9.67 lakh crore in 2022-23. By 2023-24, the personal income tax collections, including STT, had surged to an impressive Rs 12.01 lakh crore (provisional, as of April 2024).

- For the assessment year (AY) 2024-25, there were 58.57 lakh first-time Income Tax Returns (ITRs) filers (Total ITRs filed for AY 2024-25 is 7.28 crore), showcasing India's economy becoming more formalised as more people voluntarily pay taxes.

- ITR is a form that individuals in India must submit to the Income Tax Department, containing information about their income and taxes for the financial year from 1st April to 31st March of the following year.

- The Income Tax Department has made significant progress since its inception, with revenue growing from Rs. 30 lakh to Rs. 20 lakh crore, doubling the tax base, and increasing the tax-to-GDP ratio, through initiatives like the rationalisation of corporate tax and the new tax regime.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (2018)

- It is introduced as a part of the Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)