Important Facts For Prelims

10th Anniversary of Pradhan Mantri Mudra Yojana

- 09 Apr 2025

- 4 min read

Why in News?

On 8th April 2025, the Pradhan Mantri Mudra Yojana (PMMY) completed 10 years since its launch in 2015. It has been pivotal in providing collateral-free financial support to micro and small enterprises (MSEs) across India.

What are the Key Achievements of PMMY?

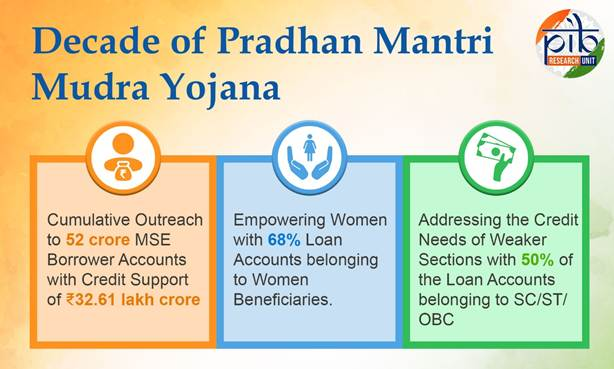

- Credit Outreach: Since 2015, over Rs 32.61 lakh crore has been disbursed through 52 crore loans, including 100+ million first-time borrowers.

- MSME lending rose from Rs 8.5 lakh crore (FY14) to Rs 27.25 lakh crore (FY24), with its share in bank credit growing from 15.8% to nearly 20%.

- Inclusive Financial Access: Women constitute 68% of PMMY beneficiaries. From FY16 to FY25, per woman loan disbursement rose at a CAGR of 13% and deposits at 14%.

- Half of the PMMY accounts are held by SC, ST, and OBC entrepreneurs, and 11% by minorities, as per SBI.

- Pandemic Support: A 2% interest-subvention on Shishu loans under Atma Nirbhar Bharat helped prevent defaults and protect livelihoods during Covid-19.

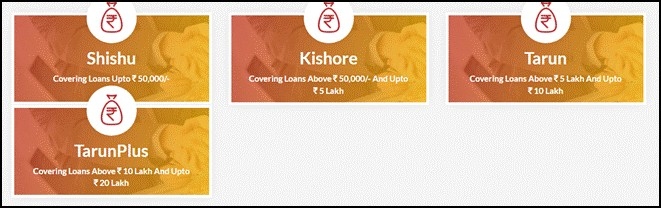

- Maturing Credit Demand: More borrowers are moving from small Shishu loans (declined from 92% to 63%) to higher Kishor (rose from 5.9% to 44.7%) and Tarun categories.

- Regional Reach: Tamil Nadu, UP, and Karnataka lead in total PMMY disbursals, Tripura, Odisha, and Tamil Nadu top in per capita loans.

- J&K leads UTs in loan disbursal, while Bihar and West Bengal reflect untapped potential.

What is Pradhan Mantri Mudra Yojana (PMMY)?

- About: MUDRA (Micro Units Development and Refinance Agency) is a flagship scheme of the Government of India, launched in 2015 to provide affordable, collateral-free institutional credit through Member Lending Institutions (MLIs).

- Key Features:

- Type: Central Sector Scheme

- Funding Provision: Loans are extended through Member Lending Institutions (MLIs) such as Scheduled Commercial Banks, RRBs, NBFCs, and MFIs.

- Refinancing: Managed by MUDRA Ltd. (Micro Units Development & Refinance Agency), which refinances MLIs but does not lend directly to borrowers.

- Credit Guarantee: Provided via the Credit Guarantee Fund for Micro Units (CGFMU), set up in 2015.

- Other Benefits:

- No processing fees, no collateral, easy access to credit, and flexible repayment terms.

- MUDRA Card, a debit card issued against the loan account to meet working capital needs.

- Loan Categories:

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Pradhan Mantri MUDRA Yojana is aimed at (2016)

(a) bringing the small entrepreneurs into formal financial system

(b) providing loans to poor farmers for cultivating particular crops

(c) providing pensions to old and destitute persons

(d) funding the voluntary organizations involved in the promotion of skill development and employment generation

Ans: (a)