EU's Carbon Border Tax: Impact on India's Exports

This editorial is based on “India must strategise against EU carbon tax” which was published in The Hindu Business Line on 22/10/2023. It talks about the implications of the European Union’s proposed Carbon Border Adjustment Mechanism (CBAM) for India’s exports and climate policy.

For Prelims: EU, Carbon Trade, Carbon Emission, EU Emissions Trading System (ETS), Green Energy, Decarbonization. FTA (Free Trade Agreement), common but differentiated responsibility,

For Mains: Carbon Border Adjustment Mechanism and its Implications on India.

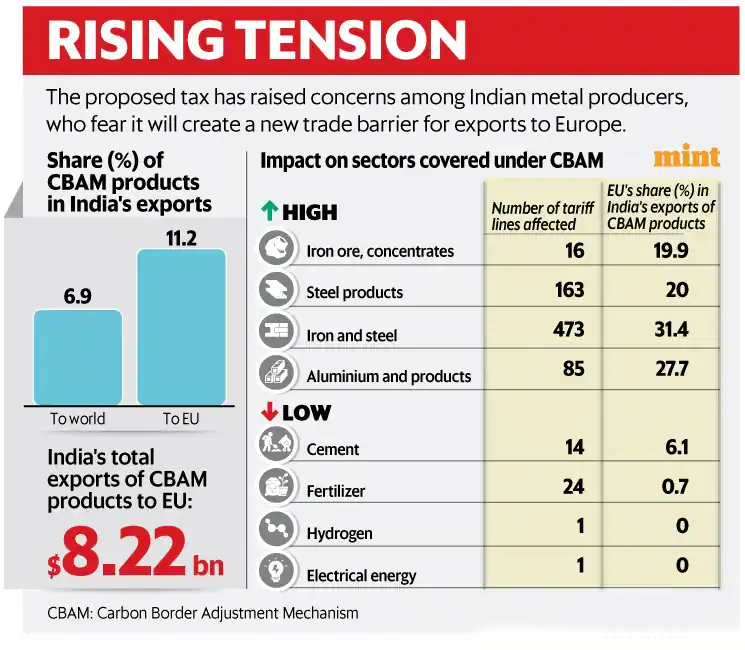

The EU’s plan to collect a carbon border tax with effect from January 1, 2026, could raise the cost of India’s exports, according to experts seized on the matter. Beginning October, 2023, Indian exporters are supposed to submit documents on their processes roughly every two months. The EU will soon have 'verifiers' to check submissions from Indian exporters on their processes. Currently, this applies to steel, aluminum, cement, fertilizer, hydrogen and electricity, but it will be expanded to all imports into the EU in the future.

What is the EU's Carbon Border Tax?

- The EU’s Carbon Border Tax (Carbon Border Adjustment Mechanism (CBAM)) is a policy measure that aims to put a fair price on the carbon emissions generated during the production of certain goods imported into the EU.

- It is part of the “Fit for 55 in 2030 package", which is the EU’s plan to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels in line with the European Climate Law.

- The CBAM will apply to imports of cement, iron and steel, aluminium, fertilizers, electricity and hydrogen from countries that have less stringent climate policies than the EU.

- Importers of these goods will have to buy carbon certificates that reflect the amount of carbon emissions embedded in their products.

- The price of these certificates will be equivalent to the price of carbon in the EU Emissions Trading System (ETS), which is a market-based system that regulates the emissions of industries within the EU.

- It is intended to encourage cleaner industrial production in non-EU countries and prevent carbon leakage, which is the relocation of carbon-intensive activities to countries with lower environmental standards.

What are India's Concerns regarding CBAM?

- Increased Costs and Reduced Competitiveness: The CBAM could increase the costs and reduce the competitiveness of Indian exports to the EU, especially in sectors like steel and aluminum, which account for a large share of India’s trade with the EU.

- According to a report, the CBAM will translate into a 20-35% tax on select imports into the EU starting January 1, 2026.

- India's 26.6% of exports of iron ore pellets, iron, steel, and aluminum products go to the EU.

- These products will be hit by CBAM. India exports these goods worth around USD8 billion annually to the EU.

- According to a report, the CBAM will translate into a 20-35% tax on select imports into the EU starting January 1, 2026.

- Compliance Issues: The CBAM is also a huge compliance headache. It could also create administrative and technical challenges for Indian producers and importers, who will have to monitor, calculate, report and verify their emissions according to the EU standards.

- India’s smaller firms will lose out, as they did when the EU imposed a strict regime in 2006 (EU REACH) to regulate chemical imports.

- Against FTA Norms: CBAM is criticized as a non-tariff barrier that undermines zero duty FTAs. India pays the levy while allowing duty-free entry for supposedly 'green' products, which is seen as contradictory.

- Contradicts EU and Developed Nations' Commitment to Green Transition: The imposition of a carbon tax on imports, determined by documented carbon emissions, contradicts the commitment of the EU and developed nations to support the green transition of other countries. Instead, it will result in a flow of funds in the opposite direction.

How should India respond to the EU's CBAM?

- Resisting CBAM in Multilateral Forums: India should oppose the CBAM in international forums as this mechanism undermines the principle of 'common but differentiated responsibility' by restricting the developing world's ability to industrialize.

- Working Around CBAM: India is considering collecting a similar tax on their exports to the EU. While this might result in the same tax burden for producers, the funds collected could be reinvested to make production processes more environmentally friendly, potentially reducing future taxes.

- However, there are uncertainties about whether the EU would accept such a move and whether it could be implemented without raising legal questions domestically and internationally.

- Diversify Export Markets: India should reduce dependence on the EU market by exploring new opportunities in regions like Asia, Africa, and Latin America is a strategic response. This diversification can help the country reduce its vulnerability to the impacts of the CBAM and other economic changes.

- Incentivizing Greener Production:

- India can begin preparations and in fact, seize the opportunity to make production greener and sustainable by incentivizing cleaner production which will benefit India in both remaining competitive in a more carbon-conscious future.

- International economic system and achieving its 2070 Net Zero Targets without compromising on its developmental goals and economic aspirations.

Conclusion

The EU's Carbon Border Tax (CBAM) presents challenges for India's exports, especially in sectors like steel and aluminum. India needs a multifaceted approach: engaging in international forums to oppose CBAM, seeking bilateral agreements, diversifying export markets, and promoting greener production. Balancing environmental responsibility and economic prosperity is essential for India's position in a carbon-conscious global market.

|

Drishti Mains Question: Analyze the implications of EU's Carbon Border Tax on India, and discuss the strategic responses that India can undertake to address these challenges. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q1. Which of the following adopted a law on data protection and privacy for its citizens known as ‘General Data Protection Regulation’ in April, 2016 and started implementation of it from 25th May, 2018? (2019)

(a) Australia

(b) Canada

(c) The European Union

(d) The United States of America

Ans: (c)

Q2. ‘Broad-based Trade and Investment Agreement (BTIA)’ is sometimes seen in the news in the context of negotiations held between India and (2017)

(a) European Union

(b) Gulf Cooperation Council

(c) Organization for Economic Cooperation and Development

(d) Shanghai Cooperation Organization

Ans: (a)