Carbon Markets in India: A Catalyst for Green Growth

This editorial is based on the Article STRIKING A GREEN BALANCE which was published in The Indian Express on 15/09/2023. It talks about the development of carbon markets in India and their role in addressing the challenges posed by climate change and carbon emissions.

For Prelims: Carbon markets, Kyoto Protocol, Bureau of Energy Efficiency, Indian Carbon Market (ICM), Paris Agreement, Greenwashing, NDCs, GHG emissions, Carbon credits trading scheme

For Mains: Carbon Markets: Indian Carbon Market, Benefits, Challenges and Way Forward

As India develops its economy to meet the growing needs of its people, the country will confront serious challenges due to climate change consequences and the allied necessity to curb carbon emissions.

With the impact of global warming becoming more severe, there is immense urgency to embrace practices that mitigate greenhouse gas (GHG) emissions.

A vibrant carbon trading network is among the numerous solutions that are being adopted or considered to tackle the emergency.

What are Carbon Markets?

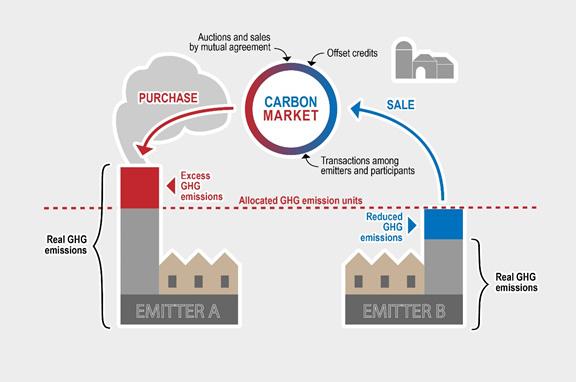

- About: Carbon markets are essentially a tool for putting a price on carbon emissions— they establish trading systems where carbon credits or allowances can be bought and sold.

- A carbon credit is a kind of tradable permit that, per United Nations standards, equals one tonne of carbon dioxide removed, reduced, or sequestered from the atmosphere.

- Carbon allowances or caps, meanwhile, are determined by countries or governments according to their emission reduction targets.

- Carbon trading started formally in 1997 under the United Nations' Kyoto Protocol.

- Types: There are broadly two types of carbon markets that exist today, viz:

- Voluntary Markets: Those markets in which emitters buy carbon credits to offset the emission of one tonne of CO2 or equivalent greenhouse gasses.

- Such carbon credits are created by activities which reduce CO2 from the air, such as afforestation.

- In a voluntary market, a corporation looking to compensate for its unavoidable GHG emissions purchases carbon credits from an entity engaged in projects that reduce, remove, capture, or avoid emissions.

- For Instance, in the aviation sector, airlines may purchase carbon credits to offset the carbon footprints of the flights they operate.

- In voluntary markets, credits are verified by private firms as per popular standards.

- Compliance Markets: They are set up by policies at the national, regional, and/or international level and are officially regulated.

- Today, compliance markets mostly operate under a principle called “cap-and-trade”, most popular in the European Union (EU).

- Voluntary Markets: Those markets in which emitters buy carbon credits to offset the emission of one tonne of CO2 or equivalent greenhouse gasses.

What is the Status of the Carbon Market in India?

- In India, the Centre is planning to set up the Indian Carbon Market (ICM) by establishing a national framework that will help in decarbonising the domestic economy.

- The draft framework for the Indian Carbon Credit Scheme 2023 was recently notified by the Union government.

- The Bureau of Energy Efficiency functioning under the Ministry of Power has been tasked to develop the Carbon Trading Scheme in tandem with the Ministry of Environment, Forest & Climate Change.

- The ICM will have following benefits:

- It will help India lower the emissions intensity of its GDP by 45% by 2030 compared to the 2005 levels, thereby meeting its NDC target related to its global climate commitments.

- ICM would help in decarbonising the commercial and industrial segments (in line with India’s net zero by 2070).

- It will give a fillip to energy transition due to its greater scope for covering the country’s potential energy segments.

- GHG emissions intensity targets and benchmarks would then be developed in sync with the domestic emissions trajectory, according to the climate goals.

- Although the ICM would be regulated, it will offer flexibility to companies in hard-to-abate segments to augment their GHG emission efforts through carbon market credits. It will also create more awareness, change and innovation across hard-to-abate industries.

- It could help attract finance and technology for sustainable projects that can generate carbon credits.

- It will help India lower the emissions intensity of its GDP by 45% by 2030 compared to the 2005 levels, thereby meeting its NDC target related to its global climate commitments.

What are the Benefits of Carbon Markets?

- Financial Incentives: Carbon markets establish a financial incentive system where entities are allotted emission limits and can trade emission permits. This encourages companies to reduce emissions below their limits and penalizes excess emissions.

- Cost-Effective Reductions: Carbon markets prioritize cost-effective emission reductions. Companies that can reduce emissions more easily and at a lower cost are incentivized to do so, leading to overall emission reductions at a lower economic cost.

- Business Flexibility: Carbon markets provide businesses with flexibility in choosing how to reduce emissions. They can invest in cleaner technologies, improve energy efficiency, or purchase carbon credits from emission reduction projects elsewhere, allowing for a diverse range of strategies.

- Clean Tech Promotion: These markets stimulate the development and adoption of cleaner technologies and practices. Companies are motivated to innovate and invest in technologies that reduce emissions to lower their compliance costs in the carbon market.

- Support for Sustainability: Carbon markets generate funds for sustainable projects that reduce emissions, such as renewable energy, afforestation, reforestation, and energy efficiency projects. These projects earn carbon credits that can be sold in the market, attracting investments.

- Climate Goal Alignment: Carbon markets can be tailored to align with a country's climate goals and international commitments, helping nations meet their emission reduction targets, such as those set in the Paris Agreement, by creating a mechanism for tracking and reducing emissions.

- Transparency & Accountability: Participation in carbon markets requires accurate measurement and reporting of emissions. This leads to greater transparency and accountability in tracking and reducing greenhouse gas emissions.

- Revenue Generation: Governments can generate revenue through carbon markets by auctioning emission permits or imposing carbon taxes. This revenue can be reinvested in sustainability initiatives or used for other public purposes. Additionally, companies can earn revenue by selling carbon credits.

- For instance, Tesla, the electric car maker, sold carbon credits to legacy car manufacturers to the tune of USD 518 million in just the first quarter of 2021.

What are the Challenges Before Carbon Markets?

- Double Counting of Emissions Reductions: This occurs when the same emission reduction is claimed by more than one entity or under more than one system. This can undermine the environmental integrity and credibility of carbon markets.

- Quality and Authenticity of Climate Projects: Ensuring the credibility and genuineness of climate projects poses the challenge of determining their level of additionality, measurability, verifiability, permanence, and the prevention of emissions shifting.

- Poor Market Transparency: This relates to the ambiguity about the availability and accessibility of information on the supply and demand of carbon credits or offsets, as well as their prices, transactions, and impacts.

- Greenwashing: This is the practice of using carbon credits or offsets to create a false or misleading impression of environmental responsibility, without actually reducing emissions or changing business practices. This can erode public trust and divert resources from more effective climate actions.

- Regulatory Uncertainty: This involves the lack of clarity or stability of the policies and regulations that govern carbon markets, both at the national and international levels. This can create risks and barriers for market participants and investors.

- For instance, in India, there is a question of whether the Ministry of Power is the appropriate Ministry to regulate the carbon credits trading scheme or whether it should be the Ministry of Environment.

What Steps can be taken to Overcome the Challenges of Carbon Markets?

- Developing a common taxonomy and terminology for carbon credits and offsets, as well as a consistent accounting framework to avoid double counting of emissions reductions.

- Establishing clear and credible quality criteria and verification mechanisms for climate projects that generate carbon credits or offsets, based on principles such as additionality, measurability, permanence and avoidance of leakage.

- Enhancing market transparency and disclosure by providing reliable and timely data and reporting on the supply and demand of carbon credits or offsets, as well as their prices, transactions and impacts.

- Preventing and penalizing Greenwashing by setting clear and enforceable rules and guidelines for making claims and communicating about carbon credits or offsets, as well as ensuring public awareness and scrutiny.

- Harmonizing and integrating different carbon market systems at the national, regional and international levels, as well as creating linkages and synergies with other policy instruments and initiatives.

Conclusion

- As the country moves steadily towards a net-zero world, decarbonising industrial activity will be critical. It is here that industry leaders in carbon management solutions and clean energy transition can play a pivotal role in facilitating the transition towards a net-zero future by helping the nation switch from fossil fuel or legacy technologies to clean energy systems.

- As India tries to strike a delicate balance between economic needs and environmental concerns, a vibrant carbon trading mechanism can be crucial in creating a more sustainable future.

|

Drishti Mains Question: The Indian government is in the process of establishing the Indian Carbon Market (ICM) as a key component of its climate action strategy. In this context, discuss the benefits and challenges associated with carbon markets. How can the ICM contribute to India's climate goals? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements (2023)

Statement—I Carbon markets are likely to be one of the most widespread tools in the fight against climate change.

Statement—II Carbon markets transfer resources from the private sector to the State.

Which one of the following is correct in respect of the above statements?

(a) Both Statement—I and Statement—II are correct and Statement—II is the correct explanation for Statement—I

(b) Both Statement—I and Statement—II are correct and Statement—II is not the correct explanation for Statement—I

(c) Statement—I is correct but Statement—II is incorrect

(d) Statement—I is incorrect but Statement—II is correct

Ans: B

Q. The concept of carbon credit originated from which one of the following? (2009)

(a) Earth Summit, Rio de Janeiro

(b) Kyoto Protocol

(c) Montreal Protocol

(d) G-8 Summit, Heiligendamm

Ans: B