Governance

Cyber Crime

For Prelims: Cyber Crime, Seventh Schedule of the Constitution, Internet of Things, Crypto-Currency, Massive Open Online Courses.

For Mains: Cyber Crime, Related Challenges and Measures to Deal with it.

Why in News?

The Indian government has taken significant steps to strengthen the mechanism for dealing with Cybercrimes in a comprehensive and coordinated manner.

What is Cyber Crime?

- About:

- Cybercrime is defined as a crime where a computer is the object of the crime or is used as a tool to commit an offense.

- Cybercrimes fall under State subjects as per the Seventh Schedule of the Constitution of India.

- It involves illegal or unauthorized activities that exploit technology to commit various forms of crimes.

- Cybercrime covers a wide range of offenses and can affect individuals, organizations, and even governments.

- Cybercrime is defined as a crime where a computer is the object of the crime or is used as a tool to commit an offense.

- Types:

- Distributed Denial-of-Service (DDoS) Attacks: These are used to make an online service unavailable and take the network down by overwhelming the site with traffic from a variety of sources.

- Botnets: Botnets are networks from compromised computers that are controlled externally by remote hackers. The remote hackers then send spam or attack other computers through these botnets.

- Identity Theft: This cybercrime occurs when a criminal gains access to a user’s personal information or confidential information and then tries to tarnish reputation or seek a ransom.

- Cyberstalking: This kind of cybercrime involves online harassment where the user is subjected to a plethora of online messages and emails. Typically, cyberstalks use social media, websites, and search engines to intimidate a user and instill fear.

- Phishing: It is a type of social engineering attack often used to steal user data, including login credentials and credit card numbers. It occurs when an attacker, masquerading as a trusted entity, dupes a victim into opening an email, instant message, or text message.

What are the Challenges Related to Cyber Security in India?

- Profit-Friendly Infrastructure Mindset:

- Post liberalisation, the Information Technology (IT), electricity and telecom sector have witnessed large investments by the private sector.

- Operators are not investing in protective infrastructure, rather they are focused on the profitable infrastructure only, because they think investment on cyber-attack preparedness may not generate good profits.

- All operators are focused on profits, and do not want to invest in infrastructure that will not generate profits (i.e. protective infrastructure).

- Absence of Separate Procedural Code:

- There is no separate procedural code for the investigation of cyber or computer-related offences.

- Trans-National Nature of Cyber Attacks:

- Most cybercrimes are trans-national in nature. The collection of evidence from foreign territories is not only a difficult but also a tardy process.

- Expanding Digital Ecosystem:

- In the last couple of years, India has traversed on the path of digitalizing its various economic factors and has carved a niche for itself successfully.

- The latest technologies like 5G and Internet of Things (IoT) will increase the coverage of the internet-connected ecosystem.

- With the advent of digitalisation, paramount consumer and citizen data will be stored in digital format and transactions are likely to be carried out online which makes India a breeding ground for potential hackers and cyber-criminals.

- Limited Expertise and Authority:

- Offenses related to crypto-currency remain under-reported as the capacity to solve such crimes remains limited.

- Although most State cyber labs are capable of analysing hard disks and mobile phones, they are yet to be recognized as 'Examiners of Electronic Evidence' (by the central government). Until then, they cannot provide expert opinions on electronic data.

What Measures Can be Taken to Tackle Cyber Crimes in India?

- Cybersecurity Awareness Campaign:

- The governments at various levels need to conduct massive cybersecurity awareness campaigns, regarding Cyber frauds, use strong, unique passwords, being careful using public wi-fi, etc.

- Cyber Insurance:

- Develop cyber insurance policies that are tailored to the specific needs of different businesses and industries. Customized policies will help ensure that organizations have coverage for the most relevant cyber risks they face.

- Cyber insurance provides financial coverage against losses resulting from cyber incidents and by mitigating the financial impact of these incidents, organizations can recover more quickly and continue their operations.

- Develop cyber insurance policies that are tailored to the specific needs of different businesses and industries. Customized policies will help ensure that organizations have coverage for the most relevant cyber risks they face.

- Data Protection Law:

- Data is referred to as the new currency, thus is a requirement for a stringent data protection regime in India.

- In this context, the European Union's General Data Protection Regulation and India’s Personal Data Protection Bill, 2019 are steps in the right direction.

- Data is referred to as the new currency, thus is a requirement for a stringent data protection regime in India.

- Collaborative Trigger Mechanism:

- For a country like India where the citizenry is more vulnerable to cybercrime, there is an urgent need for a collaborative trigger mechanism.

- This mechanism would bind all parties and enable law enforcers to act quickly and safeguard citizens and businesses from a fast-growing menace.

- In this context, the Indian Cyber Crime Coordination Centre will assist in centralizing cybersecurity investigations, prioritize the development of response tools and bring together private companies to contain the menace.

- For a country like India where the citizenry is more vulnerable to cybercrime, there is an urgent need for a collaborative trigger mechanism.

What are the Government Initiatives to Cope with Cyber Crimes in India?

- Indian Cyber Crime Coordination Centre (I4C): This center coordinates efforts to tackle all types of cyber-crimes across the country.

- National Cyber Forensic Laboratory: It provides early-stage cyber forensic assistance to Investigating Officers of all State/UT Police through both online and offline modes.

- CyTrain Portal: A Massive Open Online Courses (MOOC) platform for capacity building of police officers, judicial officers, and prosecutors through online courses on critical aspects of cyber-crime investigation, forensics, and prosecution.

- National Cyber Crime Reporting Portal: A platform where the public can report incidents of cyber-crimes, with a special focus on crimes against women and children.

- Citizen Financial Cyber Fraud Reporting and Management System: It is a system for immediate reporting of financial frauds and assistance in lodging online cyber complaints through a toll-free helpline.

- Cybercrime Prevention against Women and Children (CCPWC) Scheme: Financial assistance provided to States/UTs for developing capabilities of Law Enforcement Agencies in investigating cyber-crimes.

- Joint Cyber Coordination Teams: Constituted to enhance coordination among Law Enforcement Agencies of States/UTs, particularly in areas with multi-jurisdictional issues related to cyber-crimes.

- Central Assistance for Modernization of Police: Providing financial support to States/UTs for acquiring modern weaponry, advanced communication/forensic equipment, and cyber policing equipment.

Conclusion

- It is of critical importance to ensure global cooperation through information sharing and strengthening joint efforts in cybersecurity research and development as most cyberattacks originate from beyond the borders.

- It is important for the corporates or the respective government departments to find the gaps in their organisations and address those gaps and create a layered security system, wherein security threat intelligence sharing is happening between different layers.

Indian Polity

Suspension of MPs from Parliament

For Prelims: Suspension of MPs from Parliament, Lok Sabha, Rajya Sabha, Member of Parliament, Presiding Officer, Speaker.

For Mains: Suspension of MPs from Parliament.

Why in News?

Recently, one of the MPs (Member of Parliament) of the Rajya Sabha has been suspended for “violating” the directives of the chair.

- The Rajya Sabha has been witnessing protests from the opposition over the Manipur Issue. They are demanding the Prime Minister's response to the matter, and as a result, one of the involved MPs was suspended.

What is the Process of Suspension of MPs?

- General Principle:

- The general principle is that it is the role and duty of the Presiding Officer — Speaker of Lok Sabha and Chairman of Rajya Sabha — to maintain order so that the House can function smoothly.

- To ensure that proceedings are conducted in the proper manner, the Speaker/ Chairman is empowered to force a member to withdraw from the House.

- Rules of Procedure and Conduct:

| Lok Sabha | Rajya Sabha |

|

Rule 373:

|

Rule 255:

|

|

Rule 374:

|

Rule 256:

|

|

Rule 374A:

|

- Terms of Suspension:

- The maximum period of suspension is for the remainder of the session.

- Suspended members cannot enter the chamber or attend the meetings of the committees.

- He will not be eligible to give notice for discussion or submission.

- He loses the right to get a reply to his questions.

What are Interventions by the Court?

- Article 122 of the Constitution says parliamentary proceedings cannot be questioned before a court.

- Although courts have intervened in the procedural functioning of the legislature like,

- Maharashtra Legislative Assembly passed a resolution in its 2021 Monsoon Session suspending 12 BJP MLAs for a year.

- The matter came before the Supreme Court, which held that the resolution was ineffective in law beyond the remainder of the Monsoon Session.

Way Forward

- It is difficult to deal with planned parliamentary offenses and deliberate disturbances for publicity or political reasons.

- So, opposition members should play a constructive role in Parliament and they should be allowed to put forward their views and express themselves in a dignified manner.

- There is a need to strike a balance between deliberate disruption and raising the important issue.

International Relations

8th India-Australia Defence Policy Talks

For Prelims: 8th India-Australia Defence Policy Talks, Comprehensive Strategic Partnership, Nuclear Non-Proliferation Treaty, 2+2 Ministerial Dialogue, Mutual Logistics Support Agreement, QUAD.

For Mains: India-Australia Relations, challenges and Way Forward.

Why in News?

The 8th India-Australia Defence Policy Talks (DPT) was held at Canberra, Australia.

What are the Key Highlights of the Talks?

- Both India and Australia reviewed the bilateral defence cooperation and explored new initiatives to further strengthen bilateral defence engagements.

- Both sides reaffirmed their commitment to fully implement the Comprehensive Strategic Partnership based on mutual trust and understanding, common interests and shared values.

- India highlighted the potential of the Indian defence industry with capacity and capability to cooperate with Australian Armed forces in its shipbuilding and maintenance plans.

- Both sides agreed for early finalization of hydrography agreement.

How have been the India- Australia Relations so far?

- Historical Perspective:

- Australia and India for the first time established diplomatic relations in the pre-Independence period, when the Consulate General of India was first opened as a Trade Office in Sydney in 1941.

- In 2014, Australia signed a Uranium supply deal with India, the first of its kind with a country that is a non-signatory to the Nuclear Non-Proliferation Treaty, in recognition of India’s “impeccable” non-proliferation record.

- Strategic Ties:

- In 2020, Prime ministers of both the countries elevated bilateral relationship from Strategic Partnership to Comprehensive strategic Partnershipduring India-Australia Leaders’ Virtual Summit.

- In 2022, there were a series of high-level engagements and exchange of ministerial visits in 2022 and in 2023 including India-Australia virtual summit and Foreign Ministers meet. Several key announcements were made during 2nd India-Australia Virtual Summit including:

- A Letter of Intent on Migration and Mobility Partnership Arrangement to foster the exchange of skills.

- Defence Cooperation:

- The First India-Australia 2+2 Ministerial Dialogue took place in September 2021 in New Delhi.

- The Mutual Logistics Support Agreement (MLSA) was signed during the Virtual Summit in June 2020 to enhance defence cooperation.

- Joint military exercises:

- Bilateral:

- Naval Exercise Kakadu

- Ausindex (Navy)

- Ex AUSTRA HIND (Army)

- Multilateral Exercise:

- Malabar: Australia will host the "Malabar" exercises in August 2023, with participation from India, Japan, and the US.

- Exercise Pitch Black 22.

- Bilateral:

- China Factor:

- Australia-China ties became strained due to several reasons including Australia banning Huawei from the 5G network, call for enquiry into the origins of Covid-19 and Slamming china’s human rights violations in Xinjiang and Hongkong.

- China responded by imposing trade barriers on Australian exports, and by cutting off all ministerial contact.

- India is facing Chinese aggression along the border which has been highlighted by incidents such as the Galwan valley clash.

- Both Australia and India support a rules-based international order and they are seeking to forge regional institutions in the Indo-Pacific which are inclusive, promote further economic integration.

- The countries’ participation in Quad (India, Australia, US, Japan) is an example of their convergence of interests, based on shared concerns.

- Multilateral Cooperation:

- Both are members of the Quad, Commonwealth, Indian Ocean Rim Association (IORA), ASEAN Regional Forum, Asia Pacific Partnership on Climate and Clean Development, Indo-Pacific Economic Forum (IPEF) and have participated in the East Asia Summits.

- Both countries have also been cooperating as members of the Five Interested Parties (FIP) in the World Trade Organization context.

- Australia is an important player in Asia Pacific Economic Cooperation (APEC) and supports India's membership of the organisation.

- Economic Cooperation:

- Economic Cooperation Trade Agreement (ECTA):

- It is the first free trade agreement signed by India with a developed country in a decade which entered into force in December 2022.

- Supply Chain Resilience Initiative (SCRI):

- India and Australia are partners in the trilateral arrangement along with Japan which seeks to enhance the resilience of supply chains in the Indo-Pacific Region.

- Bilateral trade:

- Australia is currently India's 17th largest trading partner, and India is Australia's 9th largest trading partner.

- The bilateral trade between India and Australia (April – November 2022) stood at USD 18,903 million.

- Australia occupies the 29th position in FDI equity inflows into India with a cumulative FDI amount of USD 1,060.27 million from April 2000 – September 2022.

- Economic Cooperation Trade Agreement (ECTA):

- Cooperation in Education Sector:

- The Mechanism for Mutual Recognition of Educational Qualifications (MREQ) was signed in March 2023. This will facilitate mobility of students between India and Australia.

- Deakin University and University of Wollongong are planning to open campuses in India.

- More than 1 lakh Indian students are pursuing higher education degrees in Australian universities, making Indian students the second largest cohort of foreign students in Australia.

- Cooperation on Clean Energy:

- In 2022, both countries signed a Letter of Intent on New and Renewable Energy for cooperation to reduce the cost of renewable energy technologies, including ultra low-cost solar and clean hydrogen.

- India announced Australian Dollars (AUD) 10 million for Pacific Island Countries under the International Solar Alliance (ISA).

- Both the countries committed to USD 5.8 million to the three-year India-Australia Critical Minerals Investment Partnership.

Way Forward

- The India-Australia relations have strengthened in recent years due to shared values, interests, geography, and objectives.

- Both countries envision a free, open, inclusive, and rules-based Indo-Pacific region, unilateral or coercive actions are not preferred and are to be avoided in resolving any disagreements or conflicts.

- Renewed relationship between India- Australia through initiatives such as India Australia bilateral Summits give an opportunity to further strengthen the ties between the two countries to play an active role in ensuring rule-based order in the Indo-Pacific.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q.1 Consider the following countries: (2018)

- Australia

- Canada

- China

- India

- Japan

- USA

Which of the above are among the ‘free-trade partners’ of ASEAN?

(a) 1, 2, 4 and 5

(b) 3, 4, 5 and 6

(c) 1, 3, 4 and 5

(d) 2, 3, 4 and 6

Ans: (c)

- The Association of Southeast Asian Nations (ASEAN) has free trade agreements with six partners, namely the People’s Republic of China, Republic of Korea, Japan, India as well as Australia and New Zealand.

Indian Economy

Full-Reserve Banking V/s Fractional-Reserve Banking

For Prelims: Full-Reserve Banking, Fractional-Reserve Banking, Bank run, Deposit Insurance and Credit Guarantee Corporation

For Mains: Issues Related to Banking Sector in India

Why in News?

Economists are engaged in a debate regarding Full-Reserve Banking (100% reserve banking) versus Fractional-Reserve Banking.

- While both systems have their proponents and critics, understanding the key differences between them is crucial in assessing their potential impact on economic growth and financial stability.

What is Full-Reserve Banking V/s Fractional-Reserve Banking?

- Full-Reserve Banking: Safeguarding Deposits

- Under full-reserve banking, banks are strictly prohibited from lending out demand deposits received from customers reducing the risk of bank runs.

- Instead, they must always hold 100% of these deposits in their vaults, acting merely as custodians.

- Banks serve as safekeepers of depositors' money, charging fees for this service.

- Banks can only lend money received as time deposits.

- Fractional-Reserve Banking: Expanding Credit and Risk

- Fractional-reserve banking system, currently in practice, allows banks to lend more money than the cash they hold in their vaults.

- This system relies heavily on electronic money for lending.

- Bank runs are a potential risk if many depositors simultaneously demand cash.

- However, central banks can provide emergency cash to avert immediate crises.

- Fractional-reserve banking system, currently in practice, allows banks to lend more money than the cash they hold in their vaults.

- Differing Perspectives:

- Supporters of fractional-reserve banking argue that it spurs investment and economic growth by freeing the economy from relying solely on real savings from depositors.

- On the other hand, advocates of full-reserve banking argue that it prevents crises inherent in the fractional-reserve system and leads to a more stable economy.

- Supporters of fractional-reserve banking argue that it spurs investment and economic growth by freeing the economy from relying solely on real savings from depositors.

What is the Difference Between Demand Deposits and Time Deposits?

- Demand Deposits:

- Demand deposits refer to funds held in a bank account that can be withdrawn at any time without any notice or penalty.

- These are also known as "current accounts."

- It provides high liquidity and flexibility for everyday transactions and payments.

- Since customers can withdraw funds on demand, banks typically pay little to no interest on these accounts.

- Demand deposits refer to funds held in a bank account that can be withdrawn at any time without any notice or penalty.

- Time Deposits:

- Time deposits are funds held in a bank account for a fixed period, commonly known as a "term" or "tenure."

- The account holder agrees not to withdraw the funds until the term expires.

- In return for locking in their money, the bank rewards the account holder with a higher interest rate compared to demand deposits

- However, withdrawing the funds before the maturity date typically incurs a penalty.

- Time deposits are funds held in a bank account for a fixed period, commonly known as a "term" or "tenure."

What is Bank Run?

- About:

- A bank run refers to a situation where a large number of depositors simultaneously withdraw their funds from a bank, often due to concerns about the bank's solvency or stability.

- Impact:

- Liquidity Crisis: A sudden and massive withdrawal of funds can lead to a liquidity crisis for the bank.

- The bank may not have enough cash reserves to meet all the withdrawal requests, which can further fuel panic among depositors.

- Contagion Effect: A bank run on one bank can create a ripple effect, spreading fear and panic to other banks in the system.

- This contagion effect can lead to a broader financial crisis if it isn't contained promptly.

- Loss of Confidence: A bank run can erode public confidence in the entire banking system, leading to a loss of trust in financial institutions.

- This can result in a long-term decrease in deposits, making it harder for banks to lend and support economic growth.

- It can also lead to increased informalisation of economy.

- Liquidity Crisis: A sudden and massive withdrawal of funds can lead to a liquidity crisis for the bank.

Note:

In India, the Deposit Insurance and Credit Guarantee Corporation (DICGC) provides deposit insurance for bank deposits up to a certain limit (currently ₹5 lakh per depositor per bank). However, in the event of a bank failure, depositors with funds exceeding this limit may face losses.

Social Justice

Global Education Monitoring Report 2023: UNESCO

For Prelims: Global Education Monitoring Report 2023, United Nations Educational, Scientific and Cultural Organization, Covid-19 Pandemic, SDG (Sustainable Development Goals) 4.

For Mains: Global Education Monitoring Report 2023.

Why in News?

Recently, the UNESCO (United Nations Educational, Scientific and Cultural Organization) has released the Global Education Monitoring Report 2023, titled ‘Technology in Education: A Tool on Whose Terms’ endorsed ban on smartphones in schools where technology integration does not improve learning.

What are the Key Highlights of the Report?

- Rationale for Restricting Smartphone Usage:

- The report highlighted that “mere proximity to a mobile device was found to distract students and to have a negative impact on learning in 14 countries, yet less than one in four have banned smartphone use in schools.

- It cited a study of young people between the age 2 and 17 years which showed that higher screen time was associated with poorer well-being; less curiosity, self-control and emotional stability; higher anxiety; and depression diagnoses.

- Inequity in Access:

- During the Covid-19 Pandemic, the rapid shift to online learning left out at least half a billion students worldwide, disproportionately affecting the poorest and those in rural areas.

- Limited Adaptation of Digital Technology:

- The fast pace of technological change puts strain on education systems to adapt.

- Digital literacy and critical thinking skills are crucial, especially with the growth of generative AI.

- However, adaptation efforts are still in progress, with only a limited number of countries having defined skills and curricula for AI.

- Data Privacy:

- Children’s data are being exposed, yet only 16% of countries explicitly guarantee data privacy in education by law.

- One analysis found that 89% of 163 education technology products recommended during the pandemic could survey children.

- Further, 39 of 42 governments providing online education during the pandemic fostered uses that risked or infringed on children’s rights.

- Children’s data are being exposed, yet only 16% of countries explicitly guarantee data privacy in education by law.

- Consideration of Costs:

- Many countries ignore the long-term financial implications of technology purchases, and the EdTech market continues to expand while basic education needs remain unmet.

- Technology is often brought to plug a gap, with no view to the long-term costs for national budgets.

- The cost of moving to basic digital learning in low-income countries and connecting all schools to the internet in lower-middle-income countries would add 50% to their current financing gap for achieving national SDG (Sustainable Development Goals) 4 targets.

What are the Recommendations?

- There is a need for rigorous and impartial evidence of technology's effectiveness in learning. Policymakers need to have reliable evidence to make informed decisions about technology integration in education.

- Technology should enhance learning experiences and support the well-being of students and teachers rather than replace in-person, teacher-led instruction.

- The right to education is increasingly tied to meaningful connectivity, and it calls for setting benchmarks to connect all schools to the internet by 2030, with a focus on reaching marginalized communities.

- While technology offers potential benefits in education, it is essential to consider the long-term costs.

What is UNESCO?

- UNESCO is a specialized agency of the United Nations (UN). It seeks to build peace through international cooperation in Education, the Sciences and Culture.

- It is also a member of the United Nations Sustainable Development Group (UNSDG), a coalition of UN agencies and organizations aimed at fulfilling the SDGs.

- UNESCO’s Headquarters are located in Paris and the Organization has more than 50 field offices around the world.

- It has 194 Members and 12 Associate Members and is governed by the General Conference and the Executive Board.

- Three UNESCO member states are not UN members: Cook Islands, Niue, and Palestine.

- While two UN member states (Israel, Liechtenstein) are not UNESCO members.

Important Facts For Prelims

White Label ATMs

Why in News?

The Reserve Bank of India (RBI) has taken significant steps to promote ATM penetration, especially in Tier III to VI centres, by permitting non-bank companies to set up, own and operate White Label ATMs (WLAs).

- These WLAs provide various banking services to customers based on cards issued by banks, and the RBI has implemented measures to improve their viability and functioning.

- As of now, four authorised non-bank entities are operating White Label ATMs in the country.

What are White Label ATMs (WLAs)?

- About:

- ATMs set up, owned and operated by non-banks are called WLAs.

- Non-bank ATM operators are authorised under the Payment & Settlement Systems Act, 2007 by the RBI.

- They provide banking services to customers using debit/credit/prepaid cards issued by banks.

- Besides dispensing cash, WLAs offer services like account information, cash deposit, bill payment, mini statements, PIN change, and cheque book requests.

- Steps to Enhance WLA Presence and Viability:

- Cash Sourcing Flexibility:

- WLAs are allowed to source cash from retail outlets to address cash sourcing constraints.

- Following the demonetization (Rs 500 & Rs 1000 Bank Notes), as WLAs are having difficulties in sourcing cash from their sponsor bank(s).

- WLA operators can buy wholesale cash directly from the Reserve Bank and currency chests.

- They can also source cash from any scheduled bank, including Cooperative Banks and Regional Rural Banks.

- WLAs are allowed to source cash from retail outlets to address cash sourcing constraints.

- Expanded Services and Partnerships:

- WLAs are permitted to offer bill payment and interoperable cash deposit services.

- They can display advertisements for non-financial products/services, enhancing revenue streams.

- Banks can issue co-branded ATM cards in partnership with authorized WLA operators.

- This allows WLAs to facilitate 'on-us' transactions, increasing their attractiveness to customers.

- On-Tap Authorization:

- RBI introduced on-tap authorization for WLAs to encourage more non-bank players to enter the ATM industry.

- This streamlined approval process simplifies WLA establishment and fosters greater competition.

- Driving ATM Penetration:

- The focus is on expanding ATM penetration in Tier III to VI centres to improve banking accessibility in underserved areas.

- WLAs play a crucial role in achieving this objective, offering convenient banking services to a broader customer base.

- Facilitating Consumer Complaints and Protection:

- The Consumer Education and Protection Department of RBI addresses complaints against WLAs.

- From April 2022 to June 2023, 98 complaints were received and handled by the Consumer Education and Protection Cells (CEPCs) of RBI.

- RBI has undertaken various steps to promote education and financial literacy, with one of the initiatives being the National Strategy for Financial Education (NSFE) 2020-2025.

- The Consumer Education and Protection Department of RBI addresses complaints against WLAs.

- Cash Sourcing Flexibility:

What are the Different types of ATMs?

| Type of ATM | Description |

|

|

|

|

|

|

|

|

|

They are mainly used by farmers and rural customers for various banking needs. |

Important Facts For Prelims

Fame India Phase-II

Why in News?

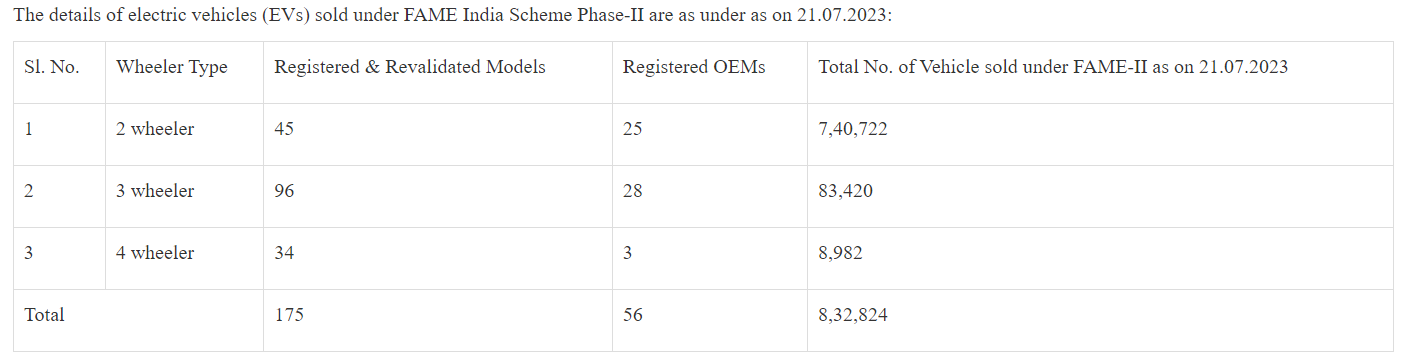

Recently, the Ministry of State for Heavy Industries highlighted the developments of Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme Phase-II in a written reply to the Lok Sabha.

- The FAME India Scheme, aimed at promoting electric vehicles (EVs) in the country, has taken significant strides to incentivize the adoption of EVs and expand the electric mobility infrastructure.

What is FAME India Phase-II?

- Background:

- FAME India is a part of the National Electric Mobility Mission Plan. Main thrust of FAME is to encourage electric vehicles by providing subsidies.

- Two phases of the scheme:

- Phase I: started in 2015 and was completed on 31st March 2019.

- The scheme covers Hybrid & Electric technologies like Mild Hybrid, Strong Hybrid, Plug in Hybrid & Battery Electric Vehicles.

- FAME India Phase-II:

- Duration: Five years from April 1, 2019.

- Budgetary support: Rs. 10,000 crores.

- Target: Encouraging the adoption of 7,090 eBuses, 5 lakh e-3 Wheelers, 55,000 e-4 Wheeler Passenger Cars, and 10 lakh e-2 Wheelers.

- Focus: Electrification of public and shared transportation.

- Duration: Five years from April 1, 2019.

- Steps Taken to Promote Electric Vehicles:

- Expanding EV Charging Network:

- Under Phase-I: 520 charging stations/infrastructure sanctioned.

- Phase-II: Sanctioning of 2,877 Electric Vehicle Charging Stations in 68 cities across 25 States/UTs and 1,576 charging stations across 9 Expressways and 16 Highways.

- Capital Subsidy for OMCs: Rs. 800 crore sanctioned for the establishment of 7,432 electric vehicle public charging stations.

- Government Incentives and Subsidies for Electric Vehicles:

- FAME India Scheme Phase-II:

- Upfront reduction in the purchase price of EVs for buyers.

- Production Linked Incentive (PLI) Scheme for Automotive Sector:

- Budgetary outlay of Rs. 25,938 crores to support domestic manufacturing of vehicles, including electric vehicles.

- PLI Scheme for Advanced Chemistry Cell (ACC):

- Budgetary outlay of Rs. 18,100 crore to establish a competitive ACC battery manufacturing setup in the country.

- FAME India Scheme Phase-II:

- Reduced GST and Exemptions:

- GST on EVs reduced from 12% to 5%.

- GST on chargers/charging stations for EVs reduced from 18% to 5%.

- Exemptions and Waivers:

- Battery-operated vehicles are exempt from permit requirements and given green license plates.

- Ministry of Road Transport and Highways (MoRTH) advised states to waive road tax on EVs to reduce initial cost.

- Awareness Initiatives Promoting E-Mobility:

- Various initiatives to create awareness about EVs in colleges/universities and institutions across India.

- Collaboration with International Centre for Automotive Technology (ICAT) for EV awareness programs.

- Expanding EV Charging Network:

Rapid Fire

Rapid Fire Current Affairs

Resource Efficiency Circular Economy Industry Coalition

Recently, the Union Minister for Environment, Forest and Climate Change launched the Resource Efficiency Circular Economy Industry Coalition (RECEIC) during the 4th G-20 Environment and Climate Sustainability Working Group (ECSWG) meeting in Chennai.

- The ECSWG aims to enhance cooperation among the G20 nations for a sustainable future.

- RECEIC, with 39 multinational corporations, aims to adopt resource efficiency and circular economy principles to address environmental challenges from waste.

- It focuses on tackling waste-related issues like plastics, microplastics, e-waste, and chemical waste.

- India's efforts in mitigating plastic waste burdens through Extended Producers’ Responsibility (EPR) guidelines are emphasized.

- 41 lakh tonnes of plastic waste generated in India in 2021-22, with 30 lakh tonnes allocated to registered recyclers and plastic waste processors.

- 2.6 million tonnes worth of EPR certificates generated by plastic waste processors, with around 1.51 million tonnes purchased by PIBOs against 2022-23 obligations.

Read more: India's Circular Revolution

Impact of Pollen Diversity on Honeybee Diets

Researchers from Texas A&M AgriLife Research seek insights into the impact of pollen diversity on honeybee diets and their regulation of pollen collection and consumption.

- Honeybees balance their protein-lipid intake, ensuring they do not overconsume either nutrient beyond what is required.

- Inadequate nutrition and landscape transformations are two significant contributors to the decline of over 40% of managed honeybees in the United States annually.

- Nutritional deficits can have adverse negative impacts on bees and colonies.

- The researchers' primary hypothesis is that honeybees tightly control their multiple nutrient intakes using a two-level process.

- First, foragers judiciously gather pollen based on its nutritional content.

- Next, nurse bees selectively feed on accumulated pollen, or bee bread, to balance their nutrient intake.

- The findings of the research will equip beekeepers with valuable insights, enabling them to provide essential dietary supplements and improve the health of their colonies.

India Hosts Asian Youth & Junior Weightlifting Championships 2023

Recently, the Asian Youth and Junior Weightlifting Championships 2023 was inaugurated at Gautam Buddha University, Greater Noida.

- It is the first time India is hosting this event. The championship sees the participation of 15+ nations from Asia.

- India's weightlifters recently won a record-breaking 61 medals at the Weightlifting Commonwealth Championships.

Read more: Role of Sport in Aspirational India

FDA Approves Over-the-Counter Birth Control Pill Opill

The U.S. FDA recently approved Opill, the first over-the-counter birth control pill.

- Opill is a progestin-only pill that uses a synthetic hormone called norgestrel to prevent pregnancy by thickening cervical mucus and thinning the uterus lining.

- Opill is advised for breastfeeding mothers, those intolerant to estrogen, and individuals with certain health conditions.

- It is not recommended to use Opill with other hormonal birth controls or as an emergency contraceptive.

Read more: Medical Termination of Pregnancy (MTP) Amendment Act, 2021