Indian Economy

Gross Fixed Capital Formation

For Prelims: Capital expenditure, Gross Fixed Capital Formation, Gross Domestic Product, 8th Pay Commission, Sovereign Green Bonds

For Mains: Declining private capex and its impact on GDP, Role of Gross Fixed Capital Formation in economic growth

Why in News?

The share of private capital expenditure (capex) in India’s Gross Fixed Capital Formation (GFCF) has declined to a decade-low of 33% in FY24.

What is Gross Fixed Capital Formation?

- GFCF: Also known as "investment," GFCF refers to the net increase in an economy's fixed capital assets (investment minus disposals) over a specific period.

- It includes investments in infrastructure, machinery, equipment, and other durable assets that contribute to long-term economic growth.

- It is a key part of Gross Capital Formation (GCF), which also includes Change in Stocks (Inventories) and Net Acquisition of Valuables (items like gold, gems, and precious stones etc,).

- Significance: It constitutes around 30% of India’s nominal Gross Domestic Product (GDP), making it the second-largest component after private final consumption expenditure.

- GFCF is crucial for economic growth as it directly boosts GDP, enhances productivity, and improves living standards.

- It promotes self-reliance by creating capital assets and supporting innovation.

- GFCF as an indicator of business confidence, especially in the private sector, reflects future economic potential and overall output capacity.

- GFCF Trends: From FY15 to FY24, GFCF grew at a compounded annual growth rate (CAGR) of 10%.

- However, growth has been slowing since FY23, with GFCF growth moderating to 9% in FY24 from 20% in FY23.

- GFCF is crucial for economic growth as it directly boosts GDP, enhances productivity, and improves living standards.

- Reasons for Declining GFCF: In FY24, private capex share in GFCF fell to 33% as unlisted entities witnessed a contraction, leading to an overall decline in GFCF.

- A global slowdown and weak export demand for Indian products have reduced investment in production capacity, while the influx of cheap Chinese imports in certain sectors like textile have discouraged domestic expansion.

- In FY24, the cash flow from operations to capex ratio rose to 1.6x (from 1.3x in FY14–20).

- However, instead of investing in new assets, firms prioritized debt repayment leading to a decline in capex and GFCF.

- Implications of Decline in GFCF: A decline in GFCF hampers long-term economic growth by limiting productive capacity and job creation.

- It delays infrastructure development, reduces private sector participation, and signals weak investor confidence potentially discouraging foreign direct investment (FDI).

- Decline in GFC leads to over-reliance on public spending which is unsustainable and may hinder innovation, competitiveness, and inclusive growth.

What Can Be Done to Revive Private Capex and GFCF?

- Boost Domestic Consumption: Fast-track the 8th Pay Commission and increase MNREGA wages, as recommended by the Parliamentary Standing Committee on Rural Development, to boost rural spending and overall demand.

- Higher disposable income will encourage businesses to invest in production capacity, leading to increased Capex and GFCF.

- Strengthen Exports and Imports: Finalize Free Trade Agreements (FTAs) with the UK and the EU to integrate Indian businesses into global supply chains, boosting capital formation and investment.

- To counter Chinese imports revive traditional industries (e.g., textiles, toys) by integrating them with e-commerce platforms to expand market reach. Impose anti-dumping duties on Chinese steel to protect domestic manufacturers and support the MSME ecosystem.

- Private Sector R&D and Innovation: Operationalize the Rs 1 lakh crore innovation corpus (Budget 2024-25) to incentivize private investment in R&D to enhance global competitiveness and long-term economic growth.

- Industrial Infrastructure: Provide infrastructure status to the hospitality sector to attract private investments.

- Sustainable Growth: Scale up green finance through sovereign green bonds to fund climate adaptation projects and attract private investments.

- Promote carbon trading incentives and circular economy models to foster sustainable industrial growth, ultimately driving higher GFCF and private capex.

|

Drishti Mains Question: How does a decline in Gross Fixed Capital Formation impact long-term economic growth in India? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. A decrease in tax to GDP ratio of a country indicates which of the following? (2015)

- Slowing economic growth rate

- Less equitable distribution of national income

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Mains:

Q.1 “Industrial growth rate has lagged behind in the overall growth of Gross-Domestic-Product(GDP) in the post-reform period” Give reasons. How far the recent changes in Industrial Policy capable of increasing the industrial growth rate? (2017)

Indian Economy

MP Salary Hike vs. Worker Wage Stagnation

For Prelims: Members of Parliament, Cost Inflation Index, SDG 10, Food inflation, e-Shram portal, 8th Pay Commission

For Mains: Economic Disparities and Wage Stagnation, Minimum wage laws and wage indexation

Why in News?

The Central government has notified a 24% hike in the salaries and pensions of Members of Parliament (MPs) with retrospective effect from 1st April 2023.

- However, the India Employment Report (IER) 2024 reveals stagnation and decline in real wages for India's working population, highlighting the growing economic divide.

Note: MP salaries increased to Rs 1.24 lakh/month, daily allowance to Rs 2,500, and pensions to Rs 31,000/month.

How are MPs' Salaries Revised?

- Legal Framework: Since 2018, salaries and pensions of MPs are revised every five years based on the Cost Inflation Index (CII) instead of requiring a separate parliamentary approval.

- This adjustment mechanism was established under the Finance Act, 2018, which amended the Salaries, Allowances, and Pension of Members of Parliament Act, 1954.

- Cost Inflation Index: The CII is notified every year under under Section 48 of the Income Tax Act, 1961 by the Income Tax department,

- CII is used to adjust the purchase price of assets based on inflation.

- CII helps in indexation and ensures that taxpayers do not pay excessive taxes on long-term capital gains (LTCG) due to the rise in asset prices over time.

- The CII for FY 2024-25 is 363, meaning prices have risen 3.63 times since the 2001 base year (earlier 1981), which has a fixed value of 100.

What Does the IER 2024 Say About Wage Trends in India?

- Wage Trends: Average real wages for regular salaried workers declined from Rs 10,925 in 2022 to Rs 10,790 in 2023 and average casual wages dropped slightly from Rs 4,712 to Rs 4,671.

- The average earnings for self-employed individuals rose from Rs 6,843 in 2022 to Rs 7,060 in 2023.

- Average earnings for women in self-employment and casual work declined, while men in self-employment saw marginal gains.

- Quality of employment generation: The report states that poor real wage growth reflects weak quality of employment generation, despite rising Gross Domestic Product (GDP).

What are the Concerns of Rising Political Pay Vs. Worker wage Stagnation?

- Weakening of Democratic Accountability: India's per capita income in 2022-23 was estimated at Rs 1.72 lakh, or roughly Rs 14,333 per month.

- A retired MP now receives over twice the average Indian income, while a sitting MP earns nearly nine times as much.

- When political leaders receive substantial salary hikes while the general populace experiences wage stagnation, it may lead to perceptions of self-serving governance.

- This can undermine the legitimacy of democratic institutions, erode public trust in elected officials and widen the divide between the rulers and the ruled.

- Asymmetry in Governance Priorities: While MPs' salaries were hiked by 24% in 2025, India's National Floor Level Minimum Wage (NFLMW) remains at a meagre Rs 176/day (unchanged since 2017) and among the lowest in the Asia-Pacific.

- This stark contrast reveals a mismatch in urgency and prioritisation, undermining the moral credibility of democratic governance.

- Fueling Populism: With wages stagnating, inflation rising (food inflation at 9.04% in 2024), and household savings remain low at 5.3% of GDP in FY24,, the electorate is increasingly reliant on state-led freebies.

- Rising political pay without addressing these vulnerabilities may reinforce short-term populist politics over long-term welfare reforms.

- Undermining Inclusive Growth Goals: Disparity in wages threatens the idea of “shared prosperity”, a key Sustainable Development Goal (SDG 10: Reduced Inequalities), and may weaken India’s global image as a growth-inclusive economy.

- Weak Social Protection Infrastructure: Unlike the European Union, which has moved towards fair minimum wages and legal redress mechanisms for wage disputes.

- India’s minimum wage Minimum Wages Act,1948 remains narrowly defined (focused mostly on food/calorie norms) it does not comprehensively address other essential aspects such as housing, health, and education, keeping labour pay survival-focused.

How Can India Bridge the Wage-Inflation Gap?

- Need for systemic reform: The Second Administrative Reforms Commission and experts like the 14th Finance Commission have recommended independent emoluments commissions to depoliticize pay revisions and align them with economic performance.

- Index Minimum Wages to Inflation: Indexing minimum wages to inflation can prevent wage erosion and ensure stable real income.

- A National Wage Indexation Mechanism with periodic base floor revisions can be implemented.

- Shift from Minimum Wage to Fair Wage: Aligning with the Article 43 of the Indian Constitution, expand the definition of a “decent standard of living” to include health, education, housing, and social mobility.

- Align with the ILO’s Decent Work Agenda (aims to promote productive employment and decent work through job creation) and EU fair wage frameworks.

- Compliance through Digital Governance: Leverage the e-Shram portal, and Employees' Provident Fund Organisation (EPFO) databases, and real-time reporting tools to monitor wage compliance, especially in the informal sector.

- 8th Pay Commission for Wage Parity: The 8th Pay Commission should align government salaries with inflation and economic conditions, linking public and private sector wage trends for a balanced income structure.

|

Drishti Mains Question: Q. How can India bridge the wage-inflation gap while ensuring inclusive growth? Suggest policy reforms. |

Important Facts For Prelims

Impact of Cloud Band on Monsoon

Why in News?

A study by the Indian Institute of Science (IISc) highlights that the strength of a monsoon cloud band plays a crucial role in determining its movement and the intensity of rainfall over the Indian subcontinent.

What are the Findings of the Study on Monsoon Cloud Bands?

- Strength of Cloud Bands: Only strong equatorial cloud bands can move northward and trigger wet spells in India. Weak bands fail to propagate, contradicting earlier models which assumed consistent propagation regardless of strength.

- The study finds that the duration and intensity of wet spells depend on the size and strength of the cloud band and Boreal Summer Intraseasonal Oscillation (BSISO) influences monsoon wet and dry spells by moving cloud bands from the equator to the Indian subcontinent.

- Air-Sea Interaction: Air-sea interactions in the equatorial Indian Ocean are crucial for moisture buildup and wind strength. Stronger coupling enhances atmospheric moisture, intensifying the monsoon.

- Climate Change Impact: A warmer atmosphere will result in higher background moisture, increasing the intensity of wet spells.

- Rainfall during wet spells is projected to increase by 42% to 63% over India and adjoining seas in the future.

- Improving Climate Models: Findings will help improve the efficacy of seasonal and sub-seasonal monsoon forecasting models.

Boreal Summer Intraseasonal Oscillation

- The BSISO is a monsoon pattern that moves convection (heat and cloud activity) from the Indian Ocean to the western Pacific during June - September.

- It controls monsoon’s ‘active’ (rainy) and ‘break’ (dry) phases influencing rainfall, wind patterns, and ocean waves.

- Accurate BSISO predictions help in coastal management and climate forecasting. Its strength and movement are modulated by El Nino Southern Oscillation (ENSO), with La Niña enhancing northward propagation and El Niño weakening it.

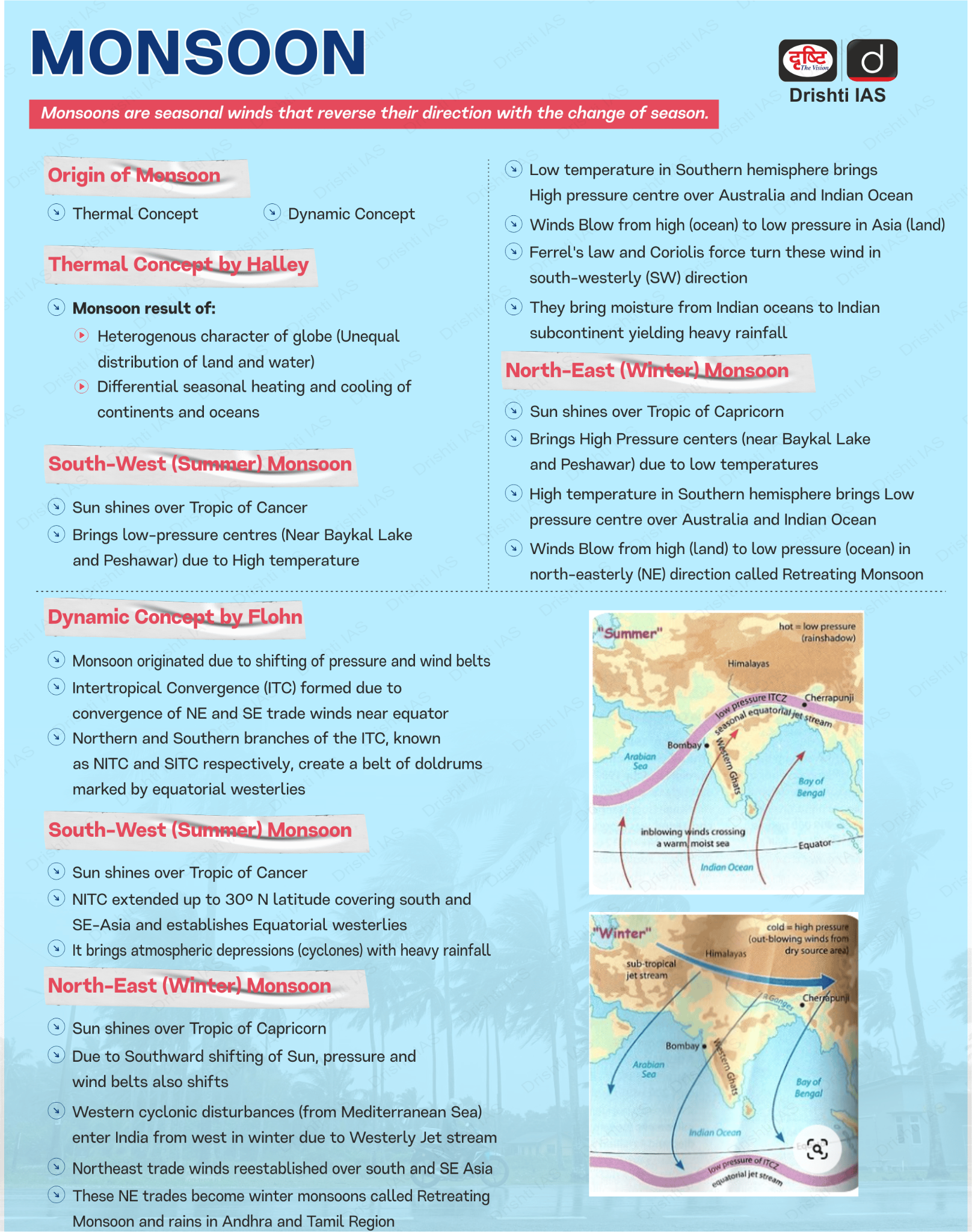

What are the Key Facts About India’s Monsoon?

- Etymology: The term "monsoon" is derived from the Arabic word "mausim", meaning season.

- Types of Monsoon in India:

- Southwest Monsoon (June-September): Also known as "advancing monsoon", brings moisture-laden winds from the Indian Ocean.

- Brings heavy rainfall to most parts of India, caused by low pressure over Tibet and high pressure over the Indian Ocean.

- Northeast Monsoon (October-December): Also known as “retreating monsoon”, results from the southward movement of monsoon troughs and the withdrawal of the southwest monsoon.

- Brings rain to southeastern India, especially Tamil Nadu and coastal Andhra Pradesh.

- Southwest Monsoon (June-September): Also known as "advancing monsoon", brings moisture-laden winds from the Indian Ocean.

- Factors Affecting Indian Monsoon: The Inter-Tropical Convergence Zone (ITCZ) shifts northward in summer, creating low pressure over India. The Tibetan Plateau heats up intensely, generating the Tropical Easterly Jet.

- These combined factors pull in moisture-laden winds from the Indian Ocean, triggering the Southwest Monsoon.

- Subtropical westerly jet streams (associated with the northeast monsoon) also regulate monsoon intensity. Additionally, the Somali Jet strengthens the southwest monsoon winds

- The Indian Ocean Dipole (IOD) is a temperature anomaly between the western and eastern Indian Ocean; a positive IOD (warmer west) enhances monsoon and negative IOD weakens it.

- El Niño is often linked with weak monsoons and droughts in India. La Niña typically brings stronger monsoon activity.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to ‘Indian Ocean Dipole (IOD)’ sometimes mentioned in the news while forecasting Indian monsoon, which of the following statements is/are correct? (2017)

- The IOD phenomenon is characterized by a difference in sea surface temperature between tropical Western Indian Ocean and tropical Eastern Pacific Ocean.

- An IOD phenomenon can influence an El Nino’s impact on the monsoon.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Mains:

Q. How far do you agree that the behavior of the Indian monsoon has been changing due to humanizing landscape? Discuss. (2015)

Rapid Fire

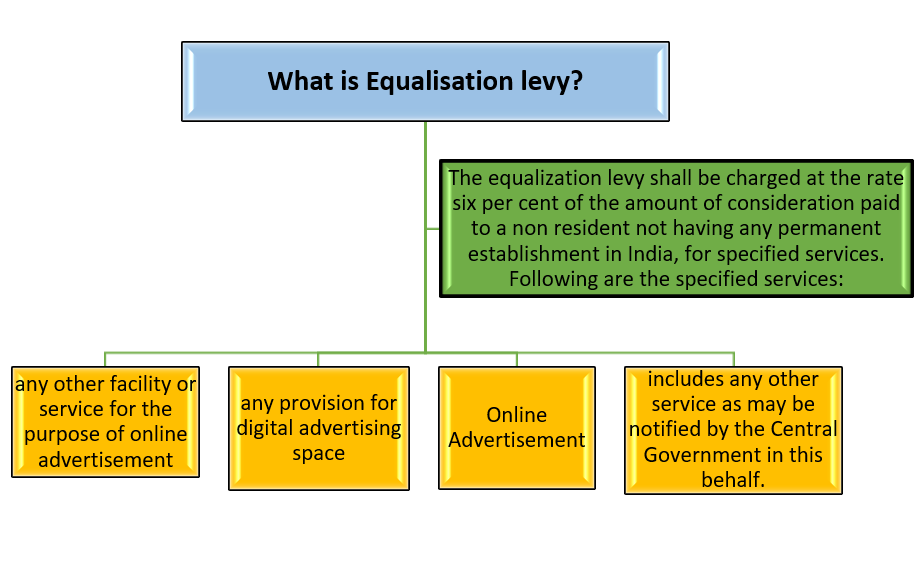

Proposed Abolition of Equalisation Levy

The Union Government has proposed abolishing the Equalisation Levy which will benefit advertisers on digital platforms like Google, X (formerly Twitter), and Meta by reducing tax burdens.

Equalisation Levy (Digital services tax):

- About: Equalisation Levy, introduced in 2016, is a direct tax imposed on foreign digital service providers to tax income generated from digital transactions in India.

- Objective: It aims to ensure fair taxation of digital businesses that do not have a physical presence in India, aligning with the BEPS (Base Erosion and Profit Shifting) Action Plan to curb tax avoidance.

- Applicability: It is deducted at the time of payment by the service recipient if:

- The payment is made to a non-resident service provider.

- The annual payment to a single provider exceeds Rs. 1,00,000 in a financial year.

- Covered Services & Tax Rates: The Equalisation Levy initially applied to online ads (6%) and was expanded in 2020 to cover digital services and e-commerce (2%), with the latter abolished in August 2024.

- Exemptions: It does not apply if the non-resident has a permanent office in India, payments are below Rs.1 lakh, or the income is covered under Section 10(50) to prevent double taxation.

- Income taxed as royalties or fees for technical services is excluded.

| Read More: Key Economic Reforms in the Budget 2024-25 |

Rapid Fire

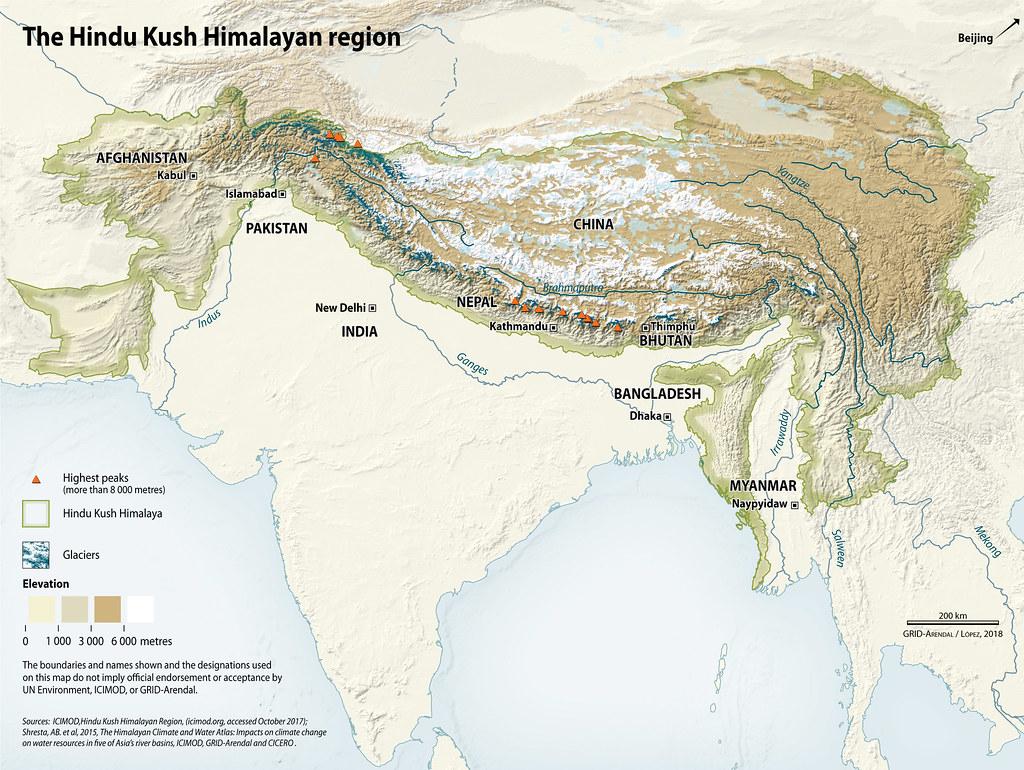

Accelerating Global Glaciers Loss

On the first World Day for Glaciers (21st March 2025), the United Nations (UN) World Water Development (WWD) Report 2025 revealed that glacier retreat in the Hindu Kush Himalayas (HKH) accelerated by 65% between 2011 and 2020.

- Key Findings of UN WWD Report 2025: HKH glaciers may lose 30–50% of their volume by 2100 if global temperatures rise by 1.5°C-2°C, and nearly 45% (from 2020 levels) if it exceeds 2°C.

- Mountain glaciers worldwide could lose 26-41% of their total mass by 2100, affecting 1.1 billion people in high-altitude regions.

- Glacial Lake Outburst Floods (GLOFs) are increasing, causing flash floods and landslides.

- They have caused over 12,000 deaths globally in the past 200 years, and the risk of GLOFs may triple by 2100.

- World Day for Glaciers: The UN has declared 2025 as the International Year of Glaciers' Preservation (IYGP).

- It will also mark the beginning of the Decade of Action on Cryospheric Science (2025–2034), aimed at strengthening glacier conservation efforts.

- Hindu Kush Himalaya (HKH): The HKH, known as the "Water Tower of Asia," stretches across 8 countries, including India, and encompasses four global biodiversity hotspots — Himalaya, Indo-Burma, Southwest China, and Central Asia.

| Read More: Sea Ice Loss and Climate Disruptions |

Rapid Fire

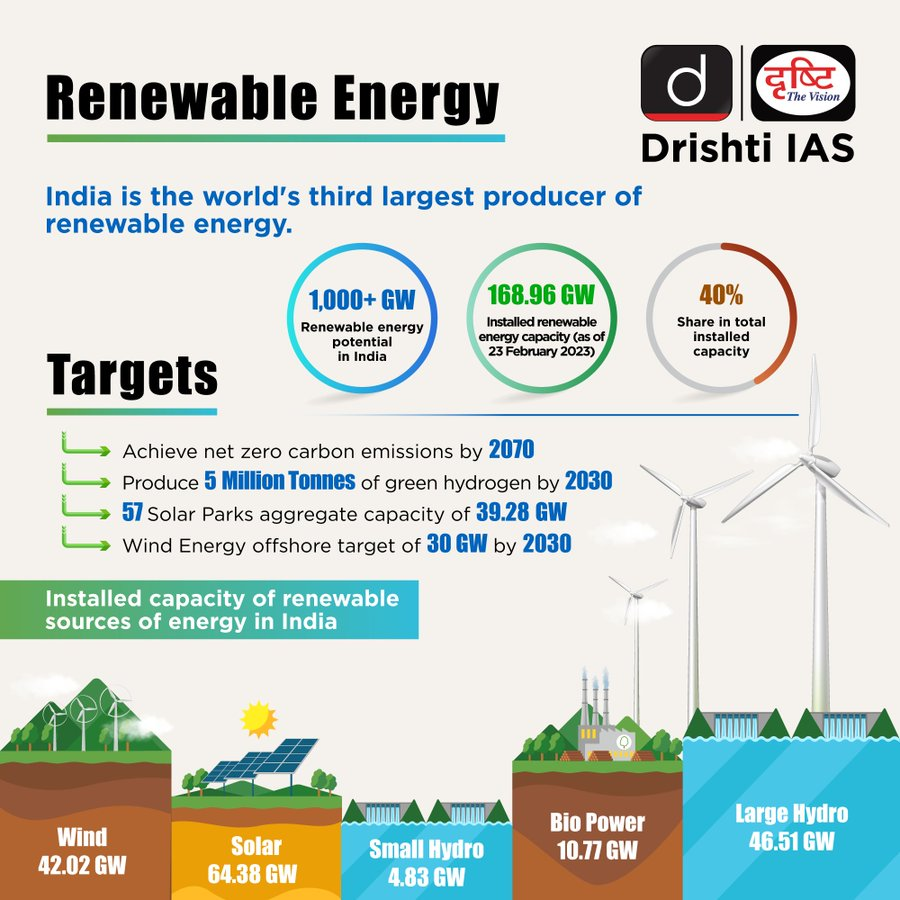

Global Energy Review 2024

The International Energy Agency (IEA) released the Global Energy Review (GRE) 2024, analyzing trends in energy demand, supply, technology, and CO₂ emissions.

- Key Highlights of GRE 2024:

- Global Energy Demand Growth: Increased by 2.2%, with emerging economies contributing 80% of the rise.

- Rise of Renewables & Natural Gas: Renewables accounted for 38% of growth, adding a record 700 GW. China (340 GW solar, 80 GW wind) and India (30 GW solar) were key contributors.

- Natural gas demand rose 2.7%, led by China’s LNG adoption.

- Coal Demand Trends: Globally rose 1%, with China (60% electricity from coal) and India (75%) as top consumers.

- Coal's global electricity share fell to 35%, the lowest since 1974.

- Crude Oil Demand Slows: Growth was 0.8%, primarily due to the petrochemical sector, while EVs, LNG trucks, and high-speed rail reduced transport-related oil consumption.

- International Energy Agency (IEA):

- Established: 1974 by OECD nations (due to 1973-74 oil crisis).

- Headquarters: Paris, France.

- Mandate: Ensures energy security, economic development and global engagement through analysis, data, and policy recommendations.

- Members: 31 member countries, 13 association countries (including India), and 4 accession countries. Only OECD members can become IEA members.

- Major Reports: World Energy Outlook reports, India Energy Outlook Report, World Energy Investment Report.

| Read More: IEA Report Electricity 2024 |

Rapid Fire

Samarth Incubation Program

The Centre for Development of Telematics (C-DoT) has launched the ‘Samarth’ Incubation Program to foster innovation in Telecom and IT sectors by startup collaboration and attracting investments.

- Samarth Program: It aims to support DPIIT- recognized startups developing next-generation technologies in Telecom Software, Cyber Security, 5G/6G, AI, IoT, and Quantum Technologies.

- It will provide sustainable and scalable business models, cutting-edge resources, and facilitate startup growth from ideation to commercialization.

- Implementation: Implemented in partnership with Software Technology Parks of India (STPI) under MeitY.

- Support Offered: Programme supports 36 startups in 2 six-month cohorts, offering hybrid learning, mentorship, infrastructure, and investor access to foster innovation in telecom and IT.

- Startups are offered Rs 5 lakh grants, 6-month C-DOT’s office space & lab facilities and mentorship.

- Successful startups may gain future collaboration opportunities under the C-DOT Collaborative Research Program.

- C-DoT: The C-DoT is an autonomous R&D center under DoT, established in 1984, focusing on indigenous telecom innovations like 5G, IoT, AI etc to support Atma Nirbhar Bharat.

| Read More: The Indian Telecom Revolution |

Rapid Fire

CBDT Expands Safe Harbour Rules

The Central Board of Direct Taxes (CBDT) has amended the Income-Tax Rules, 1962 to broaden the safe harbour provisions, aiming to enhance tax certainty and reduce disputes related to transfer pricing in the EV sector.

- Amendments: The threshold for availing safe harbour has been increased from Rs 200 crore to Rs 300 crore, applicable for Assessment Years 2025-26 and 2026-27.

- Lithium-ion batteries used in electric or hybrid vehicles are now part of the core auto components eligible under safe harbour rules.

- Industry Impact: For large companies, higher thresholds provide a broader safety net against transfer pricing disputes.

- For the EV industry, the changes incentivize investment and manufacturing in the Indian clean mobility ecosystem.

- Safe Harbour: Refers to circumstances in which income-tax authorities accept the transfer price as declared by the assessee.

- Transfer Price is the actual price charged in a transaction between related entities which are part of the same multi national enterprises (MNE) group.

- Safe harbour rules are defined under Section 92CB of the Income-tax Act, 1961, and Under Sections 92C and 92CA companies can declare Arm’s Length Price (price at which unrelated parties would trade in an open market) without disputes if within safe harbour limits.

| Read more: CBDT to Overhaul Income Tax Act 1961 |