Indian Economy

Key Trends and Challenges in Retail Inflation

- 16 Jan 2025

- 9 min read

For Prelims: Retail inflation, Consumer Price Index (CPI), Food Inflation, Consumer Food Price Index (CFPI), Kharif, Rabi, Core Inflation, Rupee Depreciation, Imported Inflation, Foreign Investment, National Statistical Office (NSO), Purchasing Power, CPI for Industrial Workers (CPI-IW), CPI for Agricultural Laborers (CPI-AL), CPI for Rural Labourer (CPI-RL), CPI for Urban Non-Manual Employees (CPI-UNME), Food and Agriculture Organization.

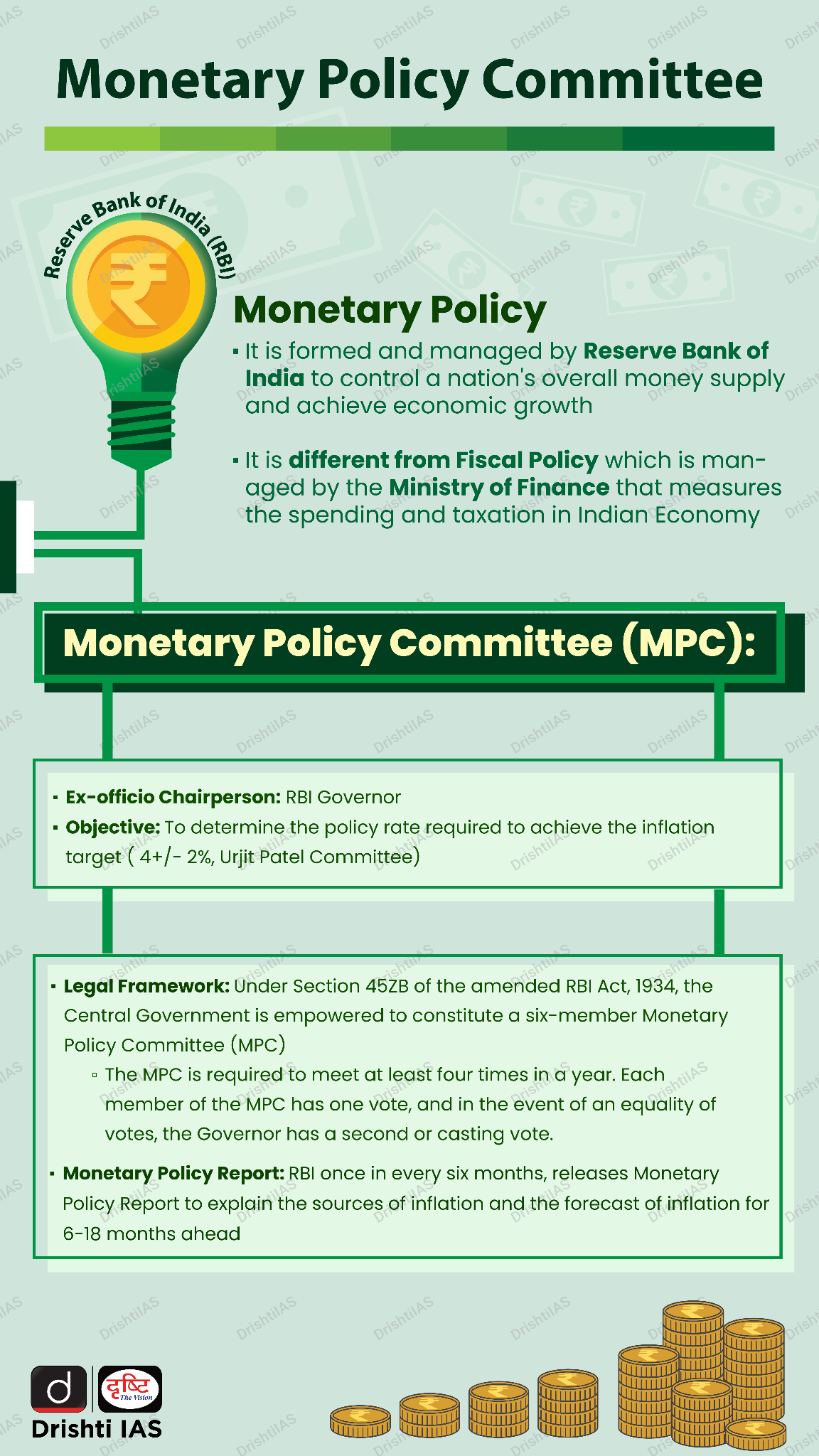

For Mains: Easing of inflation and related concerns, Monetary policy and Inflation management.

Why in News?

Retail inflation, based on the consumer price index (CPI), fell to 5.22% in December 2024 from 5.48% in November 2024, driven by easing food inflation.

- Retail inflation measures the rate at which the prices of goods and services purchased by consumers rise over time, reflecting changes in the cost of living.

What are the Reasons for Easing of Retail Inflation?

- Low Food Inflation: Food inflation, as measured by the Consumer Food Price Index (CFPI), fell to 8.39% in December 2024 from 9.04% in November 2024.

- Positive Agricultural Output: A strong kharif harvest, favorable rabi sowing conditions, and sufficient reservoir levels eased food inflation.

- Decline in Fuel Prices: Inflation in fuel prices remained in contraction at -1.39%, while for transport (2.64%) and education (3.89%) it remained unchanged, contributing to reduced overall inflationary pressures.

- Core inflation, which excludes volatile food and fuel items, fell to 3.5% in December 2024.

- Stability in Non-Food Categories: Housing (2.71%), clothing and footwear (2.74%), and household goods (2.75%) inflation remained stable with minor changes.

What are the Concerns Related to Inflation?

- Inflation Above RBI's Target: Seven states recorded inflation above RBI’s 6% threshold, while ten states exceeded the national average.

- Chhattisgarh reported the highest inflation at 7.63%, followed by Bihar (7.4%) and Odisha (7%), reflecting localized inflation challenges.

- Imported Inflation: Rupee depreciation increases the cost of imported crude oil and global commodities, raising domestic prices and making it harder to control inflation.

- The reliance on imported commodities, such as edible oils, exposes India to global price volatility.

- A weaker rupee makes imports more expensive because more rupees are needed to buy the same amount of foreign commodities.

- High Global Interest Rates: High global interest rates could deter foreign investment in India, impacting financial stability and worsening currency depreciation.

- It could lead investors to shift capital to countries like the US and Europe, offering higher yields, which reduces foreign investment inflows into emerging markets like India.

What is the Consumer Price Index?

- About: CPI measures the overall change in consumer prices based on a representative basket of goods and services over time, with 2012 as the base year.

- The basket of goods includes food, clothing, transportation, medical care, electricity, education, and more.

- The CPI is published monthly by the National Statistical Office (NSO) under the Ministry of Statistics and Program Implementation (MoSPI).

- Objective: CPI is used for targeting price stability, adjusting dearness allowance, and understanding cost of living, purchasing power, and the expensiveness of goods and services.

- Calculation: CPI is calculated by dividing the cost of a fixed basket in the current year by the cost in the base year, then multiplying by 100.

- Types: There are 4 different types of CPI measured.

- CPI for Industrial Workers (CPI-IW): It tracks price changes in a fixed basket of goods and services used by industrial workers over time. The Labour Bureau, under the Ministry of Labour and Employment, compiles CPI-IW.

- CPI for Agricultural Laborers (CPI-AL): The Labour Bureau compiles CPI-AL to assist in revising minimum wages for agricultural workers across different states.

- CPI for Rural Labourer (CPI-RL): It measures changes in the retail prices of goods and services consumed by agricultural and rural laborers.

- The Labour Bureau compiles CPI-RL.

- CPI for Urban Non-Manual Employees (CPI-UNME): CPI-UNME is compiled by NSO. An urban non-manual employee earns 50% or more of their income from non-manual work in the urban non-agricultural sector.

- Components: The following are the primary components of CPI (along with their weightage).

- Food and Beverage (45.86%)

- Housing (10.07%)

- Fuel and Light (6.84%)

- Clothing and Footwear (6.53%)

- Pan, tobacco, and intoxicants (2.38%)

- Miscellaneous (28.32%)

Consumer Food Price Index

- About: Consumer Food Price Index (CFPI) is a measure of change in retail prices of food products consumed by a defined population group in a given area with reference to a base year.

- The base year presently used is 2012.

- Releasing Body: NSO, MoSPI started releasing CFPI for three categories i.e., rural, urban and combined separately on an all India basis with effect from May, 2014.

- Like CPI, the CFPI is also calculated on a monthly basis.

- Note: FAO Food Price Index: Globally, food price index is being released by the Food and Agriculture Organization of the United Nations on a monthly basis.

- The basket of food commodities consists of the average of 5 commodity group price indices (Cereal, Vegetable Oil, Dairy, Meat and Sugar) weighted with the average export shares of each of the groups for 2002-2004.

Conclusion

Retail inflation in India eased to 5.22% in December 2024, driven by reduced food inflation and stable non-food categories. However, concerns remain due to localized inflation, rupee depreciation, and high global interest rates, which may affect domestic inflation control and foreign investment.

|

Drishti Mains Question: Analyze the role of the Consumer Price Index (CPI) in shaping monetary policy and its impact on the Indian economy. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following statements: (2020)

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do?(2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q.Define potential GDP and explain its determinants. What are the factors that have been inhibiting India from realizing its potential GDP? (2020)

Q. Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments (2019)