Indian Polity

Electoral Bonds

Why in News

The Supreme Court flagged the possibility of misuse of money received by political parties through electoral bonds for ulterior objects like funding terror or violent protests.

- The court also asked the government whether there is any “control” over how these donations were used by political parties.

Electoral Bond

- Electoral Bond is a financial instrument for making donations to political parties.

- The bonds are issued in multiples of Rs. 1,000, Rs. 10,000, Rs. 1 lakh, Rs. 10 lakh and Rs. 1 crore without any maximum limit.

- State Bank of India is authorised to issue and encash these bonds, which are valid for fifteen days from the date of issuance.

- These bonds are redeemable in the designated account of a registered political party.

- The bonds are available for purchase by any person (who is a citizen of India or incorporated or established in India) for a period of ten days each in the months of January, April, July and October as may be specified by the Central Government.

- A person being an individual can buy bonds, either singly or jointly with other individuals.

- Donor’s name is not mentioned on the bond.

Key Points

- Background: The Electoral Bond Scheme acts as a check against traditional under-the-table donations as it insists on cheque and digital paper trails of transactions, however, several key provisions of the scheme make it highly controversial.

- Misuse of Electoral Bonds as Pointed Out in the Supreme Court:

- Anonymity: Neither the donor (who could be an individual or a corporate) nor the political party is obligated to reveal whom the donation comes from.

- Asymmetrically Opaque: Because the bonds are purchased through the State Bank of India (SBI), the government is always in a position to know who the donor is.

- This asymmetry of information threatens to colour the process in favour of whichever political party is ruling at the time.

- Chanel of Blackmoney: Elimination of a cap of 7.5% on corporate donations, elimination of requirement to reveal political contributions in profit and loss statements and also the elimination of the provision that a corporation must be three years in existence, undercuts the intent of the scheme.

- A shell company can donate an unlimited amount anonymously to a political party giving it a convenient channel for business to round-trip its cash parked in tax havens for a favour or advantage granted in return for something.

- Government’s Defence:

- Conditions for Electoral Bonds: Only parties registered under the Representation of the People Act 1951 could receive donations through electoral bonds, and they also should not have secured less than 1% of the votes polled in the previous elections.

- To Take on the Menace of Black Money in Politics: Only white money is involved in the Bonds as the amounts are paid only through cheque or demand draft.

- KYC norms are also followed.

- Election Commision of India’s Support: ECI was not opposed to the bonds but was only concerned about the aspect of anonymity.

- It also urged the court not to stay the bonds and said the scheme is one step forward compared to the old system of cash funding, which was unaccountable.

Way Forward

- There is a need for effective regulation of political financing along with bold reforms to break the vicious cycle of corruption and erosion of quality of democratic polity.

- It is crucial to plug the loopholes in the current laws to make the entire governance machinery more accountable and transparent.

- Voters can also help bring in substantial changes by demanding awareness campaigns. If voters reject candidates and parties that overspend or bribe them, democracy would move a step higher.

Biodiversity & Environment

India: Transforming to a Net-Zero Emissions Energy System

Why In News

Recently, The Energy and Resources Institute (TERI) and Shell have released a report titled “India: Transforming to a Net-Zero Emissions Energy System''.

- It illustrates a pathway to steer the domestic energy system towards net-zero emissions by 2050, while achieving India’s sustainable economic development ambitions.

Key Points

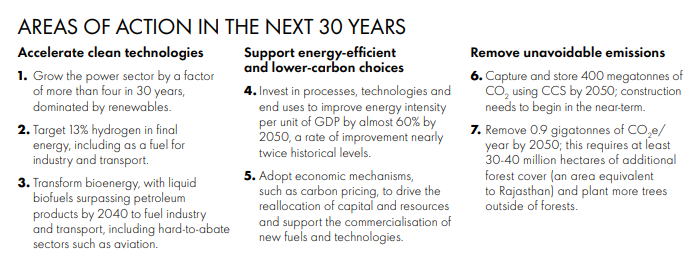

- Possible yet Challenging: India needs a suitable policy and innovation-driven context to deploy clean energy technologies on a massive scale.

- Increase Renewables: The share of renewables in the power mix needs to increase to 90% for India to meet its net-zero goal. This is around 11% in 2019-2020.

- Coal-fired Power Plants: India must phase out its coal-fired power plants and remove it altogether by 2050.

- Technology Access: The availability, or absence, of Carbon Capture and Storage (CCS) would define the shape of India’s energy systems. If CCS technology were commercially unviable:

- Biofuels would have to account for 98% of India’s oil, compared to a negligible share currently.

- Over two-thirds of India’s industrial and transport energy use would have to be electrified, compared to less than 20% share of electricity in industrial energy use and negligible share in transport energy use as of now.

- Suggestion by TERI:

- Focus on Energy Efficiency:

- Will need energy efficient buildings, lighting, appliances and industrial practices to meet the net-zero goal.

- Use of Biofuels:

- Can help reduce emissions from light commercial vehicles, tractors in agriculture.

- In aviation, the only practical solution for reducing emissions is greater use of biofuels, until hydrogen technology gains scale.

- Carbon Sequestration:

- India will have to rely on natural and man-made carbon sinks to soak up those emissions. Trees can capture 0.9 billion tons, the country will need carbon capture technologies to sequester the rest.

- Carbon Pricing:

- India, which already taxes coal and petroleum fuels, should consider putting a tax on emissions to drive change.

- Deploying lower-carbon Energy:

- There are four main types of low-carbon energy: wind, solar, hydro or nuclear power. The first three are renewable, which means these are good for the environment – as natural resources are used (such as wind or sun) to produce electricity.

- Deploying lower carbon energy would help address both domestic and international climate challenges while simultaneously improving the economic well-being of India’s citizens.

- Focus on Energy Efficiency:

Net-Zero Emissions

- About:

- ‘Net zero emissions’ refers to achieving an overall balance between greenhouse gas emissions produced and greenhouse gas emissions taken out of the atmosphere.

- First, human-caused emissions (like those from fossil-fueled vehicles and factories) should be reduced as close to zero as possible. Second, any remaining GHGs should be balanced with an equivalent amount of carbon removal, for example by restoring forests.

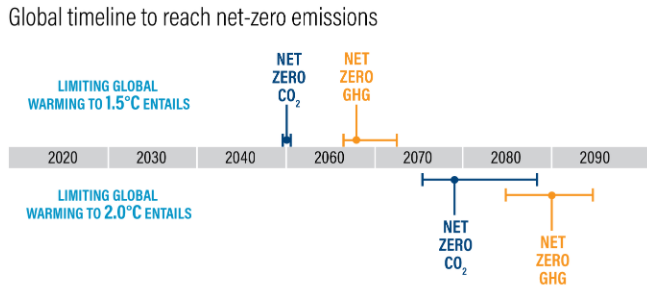

- Time-Frame:

- The time frame for reaching net-zero emissions differs significantly if one is referring to CO2 alone, or referring to all major GHGs (including methane, nitrous oxide, and HFCs).

- For non-CO2 emissions, the net-zero date is later because some of these emissions — such as methane from agricultural sources — are somewhat more difficult to phase out.

- In scenarios that limit warming to 1.5 degrees C, carbon dioxide (CO2) reaches net-zero on average by 2050. Total GHG emissions reach net-zero between 2063 and 2068.

- The time frame for reaching net-zero emissions differs significantly if one is referring to CO2 alone, or referring to all major GHGs (including methane, nitrous oxide, and HFCs).

- Global Scenario:

- As of June 2020, twenty countries and regions have adopted net-zero targets. This list only includes countries that adopted a net-zero target in law or another policy document.

- The Kingdom of Bhutan is already carbon-negative, i.e. absorbs more CO2 than it emits.

- Indian Scenario:

- Emissions: India’s per capita CO2 emissions – at 1.8 tonnes per person in 2015 – are around a ninth of those in the USA and around a third of the global average of 4.8 tonnes per person.

- However, overall, India is now the planet’s third-largest emitter of CO2, behind China and the USA.

- Debate around Commitment: There is global pressure on India to commit net-zero emissions by 2050.

- On one hand, few argue that India should pledge to reduce its “net” emissions (emissions minus uptake of emissions) to zero by 2050, backed by a climate law. This will make India “hypercompetitive”, attract investment and create jobs.

- For example, more ambitious policies to promote electric vehicles along with cleaner electricity and hydrogen electrolysis can create jobs in the auto manufacturing industry and in the electricity and construction sectors

- While, on the other hand, there is a long-standing principle of “common but differentiated responsibility” that requires richer countries to lead and argue against any pledge that risks prematurely limiting Indian energy use for development.

- On one hand, few argue that India should pledge to reduce its “net” emissions (emissions minus uptake of emissions) to zero by 2050, backed by a climate law. This will make India “hypercompetitive”, attract investment and create jobs.

- Sectors that are the largest emitters:

- Energy>Industry>Forestry>Transport>Agriculture>Building

- Emissions: India’s per capita CO2 emissions – at 1.8 tonnes per person in 2015 – are around a ninth of those in the USA and around a third of the global average of 4.8 tonnes per person.

The Energy and Resources Institute (TERI)

- TERI is a non-profit research institution in New Delhi that conducts research work in the fields of energy, environment and sustainable development.

- Established in 1974 as Tata Energy Research Institute and was renamed The Energy and Resources Institute in 2003.

- It aims to focus on formulating local and national level strategies for shaping global solutions to critical issues.

- It conducts research work in the fields of energy, environment and sustainable development.

- Its key focus lies in promoting clean energy, water management, pollution management, sustainable agriculture and climate resilience

Way Forward

- A vital step should be explicitly including policies for climate mitigation in the government budget, along with energy, roads, health and education. Specifically, growth targets should include timelines for switching to cleaner energy.

- There is also a need to launch a major campaign to mobilise climate finance and focus should be given on energy efficiency, use of biofuels, Carbon sequestration, carbon pricing.

- Strong environmental policies can create prosperity and well-being. With imaginative policies, robust institutions, and international finance, India will be able to declare its freedom from polluting fossil fuels in the hundredth year of its independence.

Indian Economy

Helium Crisis for India

Why in News

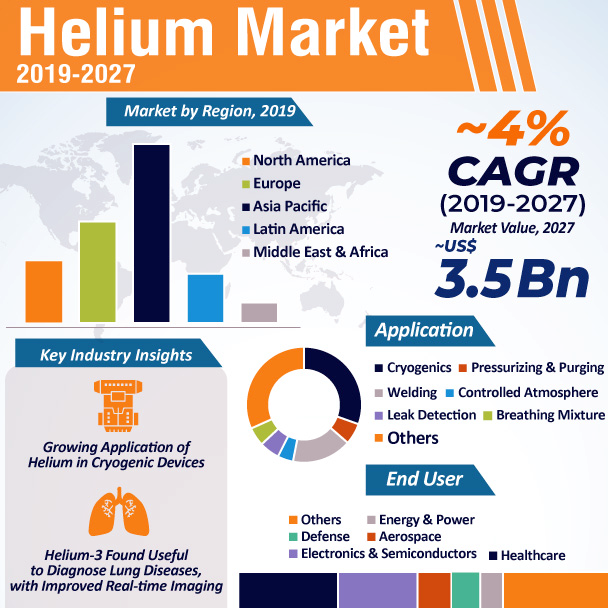

India imports helium for its needs, and with the USA appearing set to cut off exports of helium since 2021, Indian industry stands to lose out heavily.

- The Federal Helium Reserve which is the major helium reserve of the USA is set to close down production in 2021, and scientists are looking for new reserves to replace it.

Key points

- About Helium:

- Helium is a chemical element with the symbol He and atomic number 2.

- It is a colourless, odourless, tasteless, non-toxic, inert, monatomic gas, the first in the noble gas group in the periodic table.

- Its boiling point is the lowest among all the elements.

- Discovery of Helium:

- Atmosphere Surrounding the Sun:

- Helium was discovered in the gaseous atmosphere surrounding the Sun by the French astronomer Pierre Janssen, who detected a bright yellow line in the spectrum of the solar chromosphere during an eclipse in India in the year 1868.

- Joseph Norman Lockyer recorded the same line by observing the sun through London smog and, assuming the new element to be a metal, he named it helium.

- On Earth:

- The British chemist Sir William Ramsay discovered the existence of helium on Earth in 1895.

- In India:

- In 1906 a young Englishman by the name of Morris Travers extracted helium in small quantities by heating up monazite sand abundantly available in Kerala beach, in a pioneering effort.

- Monazite is a primarily reddish-brown phosphate mineral that contains rare-earth elements.

- In 1906 a young Englishman by the name of Morris Travers extracted helium in small quantities by heating up monazite sand abundantly available in Kerala beach, in a pioneering effort.

- Atmosphere Surrounding the Sun:

- Indian Reserves:

- India’s Rajmahal volcanic basin in Jharkhand is the storehouse of helium trapped for billions of years, since the very birth of Earth from the Sun.

- At present, researchers are mapping the Rajmahal basin extensively for future exploration and harnessing of helium.

- Need for India:

- To Reduce Import Burden:

- Every year, India imports helium worth Rs. 55,000 crores from the USA to meet its needs.

- Vast Use:

- Helium is used in medicine, scientific research, for blimp inflation, party balloons as well as for welding applications.

- It finds many applications, mainly in magnetic resonance imaging (MRI) scans, in rockets and in nuclear reactors.

- To Reduce Import Burden:

- USA’s Monopoly:

- After discovering that helium was concentrated in large quantities under the American Great Plains.

- The USA became the most important exporter of helium across the world.

- It was soon realized that the USA was also the biggest storehouse of helium.

- Other Option:

- Qatar is a possible exporter but acute political and diplomatic wrangles have made Qatar unreliable.

Indian Economy

Recommendations to Amend the Consumer Protection (E-Commerce) Rules, 2020

Why in News

Recently, a parliamentary panel on the Consumer Protection (E-Commerce) Rules, 2020 has recommended that the government should amend the rules to provide better protection to consumers rights and stop unfair practices.

- Electronic commerce or e-commerce is a business model that lets firms and individuals buy and sell things over the Internet.

Key Points

- Issues:

- Predatory Pricing:

- Predatory pricing as a short-term strategy, adopted by some of the market giants, may lead to wiping out competition from the market and could be detrimental to the consumers in the long run.

- Predatory Pricing: It is the pricing of goods or services at such a low level that other firms cannot compete and are forced to leave the market.

- Predatory pricing as a short-term strategy, adopted by some of the market giants, may lead to wiping out competition from the market and could be detrimental to the consumers in the long run.

- Unfair Practices:

- While e-commerce enterprises offer many benefits, the development of the segmentation has rendered consumers vulnerable to new forms of unfair trade practices, violation of privacy and issues of unattended grievances.

- There are increasing cases of fake reviews and unfair favouritism in the display of goods.

- Predatory Pricing:

- Major Recommendations:

- Clear Definition:

- There should be a more clear-cut definition of what constitutes Unfair Trade Practice and practical legal remedy to tackle such circumventing practices by e-commerce entities specifically Multinational Companies (MNCs) and Kirana Small Vendors.

- Clearly define ‘drip pricing’ wherein the final cost of the product goes up due to additional charges, and provide for protecting consumers against this by including penal provisions for violation.

- Fixing Delivery Charges:

- The Ministry of Consumer Affairs, Food and Public Distribution should issue broad guidelines for the fixation of delivery charges charged by the e-commerce entities along with a cap on the highest limits of the delivery charges in peak hours of service.

- It should clearly distinguish in the Rules itself the cases of misinformation, no information and the information which is otherwise correct but creates a false impression and provides for penal provision for each case in the Rules itself.

- Categorization of Personal Data:

- For protection of privacy of users and security of their data, the panel has recommended that users’ personal data may be categorised as per the level of sensitivity and appropriate protection may be assigned for each level.

- Payment Security:

- A secured and robust system of payment gateway should be made available to the consumers so that the transaction-related data of the users is not compromised in any way.

- Local Data Centres:

- All major e-marketplace entities should establish their data centre in India, so that consumer data are not hosted on a server outside the borders of the country, which may be misused by an enemy country.

- Customer Care:

- E-commerce entities should provide a dedicated customer care number as well as a mechanism to monitor the time taken by customer care executives to resolve an issue.

- Protection to Small/Local Vendors:

- There is a need to devise some regulatory mechanism to protect the local vendors/kirana, therefore, sufficient protection to such small/local vendors and ways in which such small retailers may also become part of e-commerce should be given by the Ministry.

- Discourage Deceptive Techniques:

- Some corrective mechanisms to discourage deceptive tactics including manipulation of algorithms, fake product reviews & ratings must be created so that the consumer interest is not harmed in any way.

- Clear Definition:

Consumer Protection (E-Commerce) Rules, 2020

- About:

- The Consumer Protection (E-commerce) Rules, 2020 are mandatory and are not advisories.

- Applicability:

- Apply to all e-commerce retailers, whether registered in India or abroad, offering goods and services to Indian consumers.

- Nodal officer:

- E-commerce entities need to appoint a nodal person, resident in India to ensure compliance with the provisions of the act or rules.

- Prices and Expiry Dates:

- The sellers through the e-commerce entities will have to display the total price of goods and services offered for sale along with the break-up of other charges.

- Expiry date of the good needs to be separately displayed.

- Importer and Relevant Details:

- All relevant details about the goods and services offered for sale by the Seller including country of origin and in case of imported goods the name and details of the importer, and guarantees related to the authenticity or genuineness of the imported products need to be provided to enable the consumer to make an informed decision at the pre-purchase stage.

- Grievance Redressal Mechanism:

- Marketplaces, as well as sellers, need to appoint a grievance officer.

- Marketplace Model of E-commerce: It means providing an information technology platform by an e-commerce entity on a digital and electronic network to act as a facilitator between buyer and seller.

- Marketplaces, as well as sellers, need to appoint a grievance officer.

- Restriction on Unfair Trade Practice, Manipulation and Discrimination:

- No e-commerce entity shall manipulate the price of goods or services to gain unreasonable profit or discriminate between consumers of the same class or make any arbitrary classification of consumers affecting their rights.

- Should not Post Fake Reviews or Mislead:

- No seller or inventory e-commerce entity shall falsely represent itself as a consumer and post reviews about goods or services or misrepresent the quality or the features of any goods or services.

- No Cancellation Charges:

- No e-commerce entity shall impose cancellation charges on consumers.

- Sellers should not refuse to take back goods, or withdraw or discontinue services if such goods and services are defective, deficient or spurious.

- Record Information of Sellers Selling Counterfeit Products:

- E-commerce entities need to maintain a record of information for the identification of all sellers who have repeatedly offered goods or services that have previously been removed or restricted under the Copyright Act, 1957, the Trade Marks Act, 1999 or the Information Technology Act, 2000.

- Penalty:

- The violation of the rules will attract penal action under the Consumer Protection Act, 2019.

Indian Economy

National Bank for Financing Infrastructure and Development Bill, 2021

Why in News

Recently, the Rajya Sabha cleared the National Bank for Financing Infrastructure and Development (NBFID) Bill, 2021.

- The Bill seeks to establish the National Bank for Financing Infrastructure and Development (NBFID) as the principal Development Financial Institution (DFIs) for infrastructure financing.

- NBFID was announced in the Budget 2021.

Development Financial Institution

- DFIs are set up for providing long-term finance for such segments of the economy where the risks involved are beyond the acceptable limits of commercial banks and other ordinary financial institutions.

- Unlike banks, DFIs do not accept deposits from people.

- They source funds from the market, government, as well as multilateral institutions, and are often supported through government guarantees.

Key Points

- About:

- NBFID will be set up as a corporate body with authorised share capital of one lakh crore rupees.

- Objective:

- Financial Objective:

- To directly or indirectly lend, invest, or attract investments for infrastructure projects located entirely or partly in India.

- Developmental Objective:

- Includes facilitating the development of the market for bonds, loans, and derivatives for infrastructure financing.

- Financial Objective:

- Functions of NBFID:

- Extending loans and advances for infrastructure projects.

- Taking over or refinancing such existing loans.

- Attracting investment from private sector investors and institutional investors for infrastructure projects.

- Organising and facilitating foreign participation in infrastructure projects.

- Facilitating negotiations with various government authorities for dispute resolution in the field of infrastructure financing.

- Providing consultancy services in infrastructure financing.

- Source of Funds:

- It may raise money in the form of loans or otherwise both in Indian rupees and foreign currencies, or secure money by the issue and sale of various financial instruments including bonds and debentures.

- It may borrow money from the central government, Reserve Bank of India (RBI), scheduled commercial banks, mutual funds, and multilateral institutions such as the World Bank and Asian Development Bank.

- Initially, the central government will own 100% shares of the institution which may subsequently be reduced up to 26%.

- Management of NBFID:

- NBFID will be governed by a Board of Directors. The Chairperson will be appointed by the central government in consultation with RBI.

- A body constituted by the central government will recommend candidates for the post of the Managing Director and Deputy Managing Directors.

- The Board will appoint independent directors based on the recommendation of an internal committee.

- Support from the Central Government:

- The central government will provide grants worth Rs. 5,000 crore to NBFID by the end of the first financial year.

- The government will also provide guarantee at a concessional rate of up to 0.1% for borrowing from multilateral institutions, sovereign wealth funds, and other foreign funds.

- Costs towards insulation from fluctuations in foreign exchange (in connection with borrowing in foreign currency) may be reimbursed by the government in part or full.

- Upon request by NBFID, the government may guarantee the bonds, debentures, and loans issued by NBFID.

- Prior Sanction For Investigation And Prosecution:

- No investigation can be initiated against employees of NBFID without the prior sanction of the central government in case of the chairperson or other directors, and the managing director in case of other employees.

- Courts will also require prior sanction for taking cognisance of offences in matters involving employees of NBFID.

- Other Development Financial Institutions:

- The Bill also provides for any person to set up a DFI by applying to RBI.

- RBI may grant a licence for DFI in consultation with the central government.

- RBI will also prescribe regulations for these DFIs.

Indian Economy

Business Responsibility and Sustainability Report

Why in News

The Securities and Exchange Board of India (SEBI) has decided to introduce new requirements for business sustainability reporting by listed entities.

- This new report will be called the Business Responsibility and Sustainability Report (BRSR) and will replace the existing Business Responsibility Report (BRR).

Key Points

- Background:

- SEBI, in 2012, mandated the top 100 listed entities by market capitalisation to file Business Responsibility Reports (BRR) as per the disclosure requirement emanating from the 'National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business' (NVGs).

- In 2019, the Ministry of Corporate Affairs revised NVGs and formulated the National Guidelines on Responsible Business Conduct (NGRBC).

- In December 2019, SEBI extended the BRR requirement to the top 1000 listed entities by market capitalisation, from the financial year 2019-20.

- Listed Entity: A company whose shares are traded on an official stock exchange.

- Market Capitalization: It refers to how much a company is worth as determined by the stock market. It is defined as the total market value of all outstanding shares.

- To calculate a company's market cap, multiply the number of outstanding shares by the current market value of one share.

- SEBI, in 2012, mandated the top 100 listed entities by market capitalisation to file Business Responsibility Reports (BRR) as per the disclosure requirement emanating from the 'National Voluntary Guidelines on Social, Environmental and Economic Responsibilities of Business' (NVGs).

- About Business Responsibility and Sustainability Report (BRSR):

- BRSR, which is from an Environmental, Social and Governance (“ESG”) perspective, is intended to enable businesses to engage more meaningfully with their stakeholders.

- It will encourage businesses to go beyond regulatory financial compliance and report on their social and environmental impacts.

- The BRSR will be applicable to the top 1000 listed entities (by market capitalization), for reporting on a voluntary basis for FY 2021 – 22 and on a mandatory basis from FY 2022 – 23.

- Sustainability Reporting:

- It is the disclosure and communication of environmental, social, and governance (ESG) goals—as well as a company’s progress towards them.

- The benefits of sustainability reporting include improved corporate reputation, building consumer confidence, increased innovation, and even improvement of risk management.

- Environmental, Social, and Governance Goals:

- Environmental, social, and governance (ESG) goals are a set of standards for a company’s operations that force companies to follow better governance, ethical practices, environment-friendly measures and social responsibility.

- Environmental criteria consider how a company performs as a steward of nature.

- Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates.

- Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Responsible Business

- The philosophy of responsible business is based on the principle of business being accountable to all its stakeholders towards global developments which are increasingly seeking businesses to be responsible and sustainable towards their environment and society.

- In light of ever-increasing global challenges relating to climate change, environmental risks, growing inequality, etc., business leaders have been compelled, and have also found it to be in their interest, to reimagine the role of businesses in the society and not view them merely as economic units for generating wealth.

- The performance of a company must be measured not only on the return to shareholders, but also on how it achieves its environmental, social, and good governance objectives.

Important Facts For Prelims

N.V. Ramana: 48th Chief Justice of India

Why in News

N.V. Ramana, the senior most judge of the Supreme Court, has been recommended as the next top judge by the present Chief Justice of India (S A Bobde).

- Justice Ramana will take over as the 48th Chief Justice of India (CJI) from 24th April 2021. He would be the CJI till 26th August, 2022.

Key Points

- Appointment of the CJI:

- The Chief Justice of India and the Judges of the Supreme Court (SC) are appointed by the President under clause (2) of Article 124 of the Constitution.

- As far as the CJI is concerned, the outgoing CJI recommends his successor.

- The Union Law Minister forwards the recommendation to the Prime Minister who, in turn, advises the President.

- SC in the Second Judges Case (1993), ruled that the senior most judge of the Supreme Court should alone be appointed to the office of the CJI.

- The Supreme Court collegium is headed by the Chief Justice of India and comprises four other senior most judges of the court.

- The collegium system is the system of appointment and transfer of judges that has evolved through judgments of the Supreme Court (Judges Cases), and not by an Act of Parliament or by a provision of the Constitution.

- Administrative Powers of CJI (Master of Roster):

- It is common to refer to the office as primus inter pares – first amongst equals.

- Besides his adjudicatory role, the CJI also plays the role of the administrative head of the Court.

- In his administrative capacity, the Chief Justice exercises the prerogative of allocating cases to particular benches.

- The Chief Justice also decides the number of judges that will hear a case.

- Thus, he can influence the result by simply choosing judges that he thinks may favour a particular outcome.

- Such administrative powers can be exercised without collegial consensus, and without any stated reasons.

- Recent Development:

- In 2019, the SC ruled that the office of Chief Justice of India (CJI) comes under the purview of the Right to Information (RTI) Act, 2005.