International Relations

New Chinese Village in Bhutan

Why in News

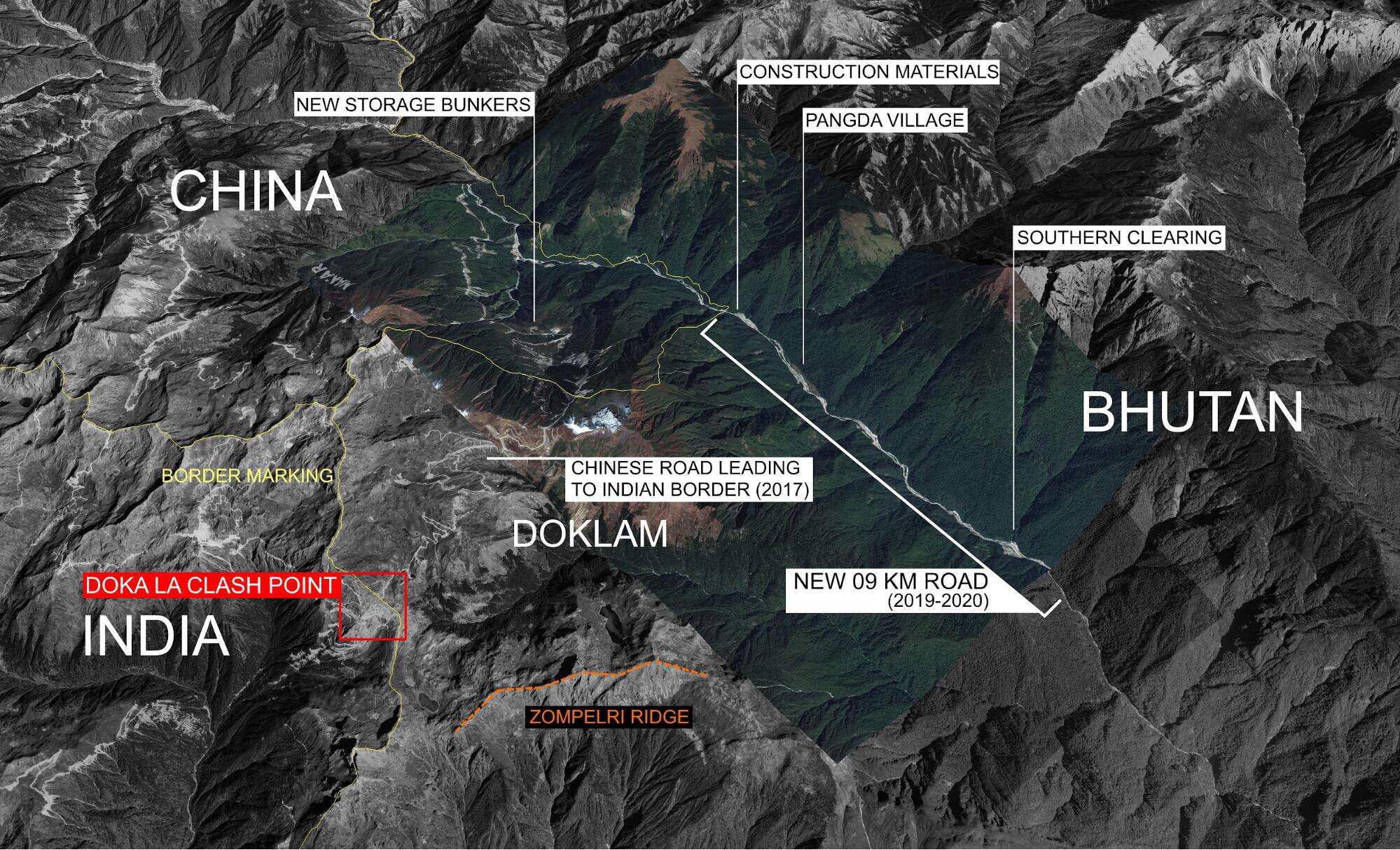

Recently, Chinese media has claimed that a new border village built by China near Bhutan was on Chinese territory.

- However, the released images of the village show its location on territory disputed by the two countries.

Key Points

- The village of Pangda has been newly built and authorities in Yadong county (an administrative region) of Southwest China’s Tibet Autonomous Region have confirmed that 27 households with 124 people voluntarily moved from Shangdui village to Pangda village in September 2020.

- It is for the first time since 2017 that a Chinese residential area has been noticed near the Doklam region, which is strategically important for India.

- Pangda is east of the India-Bhutan-China trijunction on the Doklam plateau, which was the site of a 72-day stand-off in 2017 triggered by China’s road-building up to where it sees its border.

- Bhutan’s Stand: It has officially denied the presence of any Chinese village in its territory.

- India’s Stand: India sees it as an attempt by China to unilaterally push the trijunction further.

- China in the past too, has tried to reinforce its territorial claims in disputed areas with the neighbouring countries by building civilian settlements.

- For example, on disputed South China Sea islands and Bhutan’s Trashigang district.

- China’s Stand: According to China’s maps, the village is within China’s territory.

- It also blames India for the unsettled China-Bhutan border and stalled negotiations by creating the illusion that China is encroaching on Bhutanese territory.

Indo-Bhutan Relationship

- Indo-Bhutan Treaty of Peace and Friendship, 1949:

- The treaty provides for, among other things, perpetual peace and friendship, free trade and commerce and equal justice to each other’s citizens.

- In 2007, the treaty was re-negotiated, and provisions were included to encourage Bhutan’s sovereignty, abolishing the need to take India’s guidance on foreign policy.

- Multilateral Partnership:

- Both of them share multilateral forums such as South Asian Association for Regional Cooperation (SAARC), Bangladesh, Bhutan, India, and Nepal Initiative (BBIN), Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC), etc.

- Hydropower Cooperation:

- Agreement on Cooperation in Hydropower 2006: Under a protocol to this agreement, India has agreed to assist Bhutan in the development of a minimum of 10,000 MW of hydropower and import of surplus electricity from the same by 2020.

- Trade:

- The trade between the two countries is governed by the India Bhutan Trade and Transit Agreement 1972 which was last renewed in November 2016.

- The agreement establishes a free-trade regime between the two countries and also provides for duty-free transit of Bhutanese exports to third countries.

- Economic Assistance:

- India is Bhutan’s leading development partner. Since the launch of the First Five Year Plan (FYP) of Bhutan in 1961, India has been extending financial support to Bhutan’s FYPs.

- India has allotted Rs. 4500 crore to Bhutan’s 12th FYP (2018-23).

- Educational and Cultural Cooperation:

- A large number of college-going Bhutanese students are studying in India. The Government of India provides a number of scholarships to Bhutanese students.

- Environment:

- In June 2020, the Union Cabinet approved the signing of a Memorandum of Understanding (MoU) with Bhutan for cooperation in the field of environment protection and management of natural resources.

- Support during Pandemic:

- India has maintained close coordination with Bhutan and has included it in plans for containment of the Covid-19 pandemic.

- It launched the second phase of the RuPay card in Bhutan to increase the domain of digital transactions in Bhutan.

- Bhutan is the second country to accept the RuPay card after Singapore.

International Relations

Withdrawal of US Troops from Afghanistan

Why in News

America's latest plan to speed up the withdrawal of more troops from Afghanistan may jeopardize the fragile peace process underway in Afghanistan.

Key Points

- India’s Stand:

- India has been concerned that the Afghan peace process and premature withdrawal of NATO/US coalition forces could leave opportunities for terrorist networks that could target both Afghanistan and India.

- As recently as May of this year, the UN issued a report providing evidence that despite assurances from the Taliban to the United States, Al Qaeda is still present and active in Afghanistan, harboured by the Taliban.

- In India, Al Qaeda continues to run a propaganda campaign that seeks to capitalise on differences between the Hindu majority and Muslim minority.

- At a recent United Nations Security Council (UNSC) meeting, convened under the Arria Formula (informally convened at the request of a UNSC member), India called for an “immediate comprehensive ceasefire” in Afghanistan, while welcoming all opportunities to bring peace to the country.

- India also described its reconstruction and development assistance to Afghanistan over the last nearly two decades.

- According to India, for durable peace in Afghanistan, there is a need to put an end to terrorist safe havens and sanctuaries operating across the Durand Line (in reference to Pakistan).

- The Durand Line is the international 2,670 km land border between Afghanistan and Pakistan in South-Central Asia.

- India outlined four requirements for peace and stability in Afghanistan:

- First, the process had to be Afghan-led and Afghan-owned.

- Second, there must be zero tolerance for terrorism.

- Third, the gains of the last two decades cannot be lost.

- In particular, India is convinced that the rights of women need to be strongly protected. Further, the rights of the minorities and the vulnerable need to be safeguarded.

- India has invested heavily in various Infrastructure projects in the region, for example - Zaranj Delaram Highway, Afghan Parliament etc.

- Fourth, the transit rights of Afghanistan should not be used by countries “to extract political price from Afghanistan”.

- A reference to Pakistan obstructing the flow of persons and materials outside of Afghanistan, impacting, for instance, India-Afghanistan trade.

- India assured Afghanistan of its support in its quest for peace during India’s UNSC term.

- India’s two year term on the non-permanent seat will begin on 1st January 2021.

- China’s Stand:

- China has called on foreign troops to leave Afghanistan in an orderly and responsible manner, give terrorist forces no breathing space and contribute to Afghanistan peace and reconciliation process.

- China is concerned that the war-torn country Afghanistan, which shares borders with the volatile Xinjiang province of China, could become a breeding ground for Uighur Muslim militants.

- Uighur is a predominantly Turkic-speaking ethnic group. They are primarily confined in China’s northwestern region of Xinjiang and is one of the largest Muslim group in that region.

- China insists that Uighur militants are waging a violent campaign for an independent state by plotting bombings, sabotage, and civic unrest.

- China has faced international criticism over allegations that it is holding over a million people, mostly ethnic Uyghurs, in internment camps in Xinjiang to curb religious extremism.

- USA's withdrawal also coincides with its move to lift the ban on the Uighur militant group - the East Turkestan Islamic Movement (ETIM).

- China is averse to ETIM, an al-Qaeda backed militant group regrouping in Afghanistan to carry out attacks in Xinjiang.

- ETIM was designated as a terrorist organisation by the UN's 1267 counter-terrorism committee in 2002 for its alleged association with al-Qaida, Osama bin Laden and the Taliban.

Indian Economy

Negative Yield Bonds

Why in News

Recently, demand for negative yield bonds is on rise in the global market.

Key Points

- Negative Yield Bonds: Are debt instruments that offer to pay the investor a maturity amount lower than the purchase price of the bond. These are generally issued by central banks or governments, and investors pay interest to the borrower to keep their money with them.

- Bond: Is an instrument to borrow money. A bond could be floated/issued by a country’s government or by a company to raise funds.

- Yield: The yield of a bond is the effective rate of return that it earns. But the rate of return is not fixed; it changes with the price of the bond.

- Generally, investors purchase the bonds at their face value, which is the principal amount invested. In return, investors typically earn a yield of a bond.

- Each bond has a maturity date, which is when the investor gets paid back the principal amount.

- Reasons behind buying Negative Yield Bonds:

- To create a diverse portfolio: Many hedge funds and investment firms that manage mutual funds invest in negative bonds in order to diversify their investment.

- To use them as collateral: Bonds are often used to pledge as collateral for financing and as a result, need to be held regardless of their price or yield.

- To take Benefit from Currency Gain: Foreign investors might believe the currency's exchange rate will rise, which would offset the negative bond yield.

- To Avoid Domestic Deflation Risk: Domestically, investors might expect a period of deflation, or lower prices in the economy.

- For Example: Consider a one-year bond that yields minus 5% but at the same time inflation is expected to be minus 10% over the same period.

- That means the investor in the bond would have more purchasing power at the end of the year because prices for goods and services would have declined far more than would the value of the investment in the fixed-income security.

- For Example: Consider a one-year bond that yields minus 5% but at the same time inflation is expected to be minus 10% over the same period.

- To Create Safe Haven Assets: Investors might also be interested in negative bond yields if the loss is less than it would be with another investment. In times of economic uncertainty, many investors rush to buy bonds because they're considered safe-haven investments.

- These purchases are called the flight-to-safety-trade in the bond market. During such a time, investors might accept a negative-yielding bond because the negative yield might be far less of a loss than a potential double-digit percentage loss in the equity markets.

- Current Scenario:

- Today when the world is fighting the Covid-19 pandemic and interest rates related to bonds and other financial instruments in developed markets across Europe are much lower, investors are looking for relatively better-yielding debt instruments to safeguard their interests.

- China sold its negative-yield bonds for the first time, and this saw a high demand from investors across Europe.

- Reason for High Demand:

- Low risk with Chinese Bonds : Yields offered in safe European bonds are much lower than ones offered by China.

- As against minus —0.15% yield on the 5-year bond issued by China, the yields offered in safe European bonds are much lower, between –0.5% and —0.75%.

- China’s positive Gross Domestic Product (GDP): Majority of the large economies are facing a contraction in their GDP for 2020-21 while China is one country that is set to witness positive growth as its GDP expanded by 4.9% in the third quarter of 2020.

- Increase in Covid-19 cases: While Europe, the United States and other parts of the world are facing a second wave of Covid-19 cases, China has demonstrated that it has controlled the spread of the pandemic and is therefore seen as a more stable region.

- Low risk with Chinese Bonds : Yields offered in safe European bonds are much lower than ones offered by China.

- Factor Driving the High Demand:

- Availability of money: Huge amount of liquidity injected by the global central banks after the pandemic.

- They have injected an estimated more than 10 trillion dollars of liquidity through various instruments in the financial system.

- Avoiding risk: Investors might also be temporarily parking money in negative yield bonds for the purpose of hedging their risk portfolio in equities. To gain profit and avoid losses in case the fresh wave of the Covid-19 pandemic leads to further lockdowns of economies.

- Availability of money: Huge amount of liquidity injected by the global central banks after the pandemic.

Science & Technology

Sentinel-6 Satellite: Jason-CS Mission

Why in News

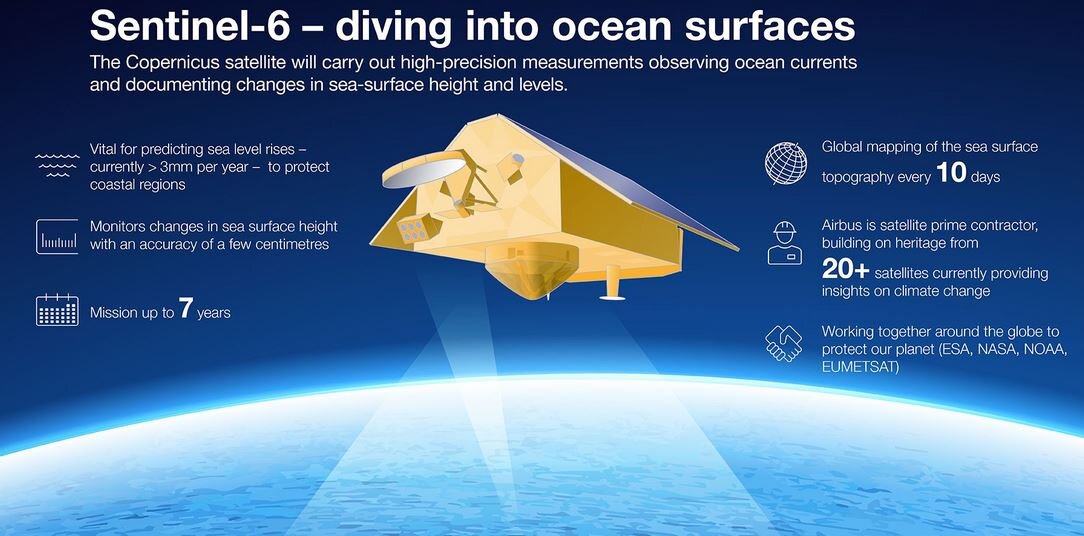

Recently, Copernicus Sentinel-6 Michael Freilich satellite was launched from the Vandenberg Air Force base in California aboard a SpaceX Falcon 9 rocket.

Key Points

- Jason-CS Mission: Sentinel-6-Satellite is a part of the mission dedicated to measuring changes in the global sea level. The mission is called the Jason Continuity of Service (Jason-CS) mission.

- Objective of the Mission: To measure the height of the ocean, which is a key component in understanding how the Earth’s climate is changing.

- Components: It consists of two satellites, Sentinel-6 and the other, called Sentinel-6B, to be launched in 2025.

- Joint collaboration of: The European Space Agency (ESA), National Aeronautics and Space Administration (NASA), European Organisation for the Exploitation of Meteorological Satellites (Eumetsat), the USA’s National Oceanic and Atmospheric Administration (NOAA) and the European Union (EU), with contributions from France’s National Centre for Space Studies (CNES).

- Mechanism:

- The satellite will send pulses to the Earth’s surface and measure how long they take to return to it, which will help in measuring the sea surface height. It will also measure water vapour along this path and find its position using GPS and ground-based lasers.

- As per NASA, this will help in monitoring critical changes in ocean currents and heat storage only from space, by measuring height of the sea surface.

- This will in turn help in foreseeing the effects of the changing oceans on the climate.

- Significant in:

- Ensuring the continuity of sea-level observations.

- Understanding how the ocean stores and distributes heat, water and carbon in the climate system.

- Supporting operational oceanography, by providing improved forecasts of ocean currents, wind and wave conditions.

- Improving both short-term forecasting for weather predictions, and long term forecasting for seasonal conditions like El Niño and La Niña.

- Other satellites (joint mission of NASA and CNES) that have been launched since 1992 to track changes in the oceans on a global scale include the TOPEX/Poseidon, Jason-1 and OSTN/Jason-2, among others.

Indian Economy

Unified Single-window Clearance System

Why in News

The government is working on a new, unified single-window clearance system for foreign direct investment (FDI) proposals.

- It is taking up several other active reform-related steps related to sovereign wealth funds and tax dispute settlements to continue the momentum of reforms. It also seeks feedback from global investors to make the system more functional.

Key Points

- Background:

- Despite the presence of several IT platforms for investing in India such as the Foreign Investment Facilitation Portal (FIFP) and state single-window clearances, investors need to visit multiple platforms to gather information and obtain clearances from different stakeholders.

- FIFP is the online single point interface of the Government of India with investors to facilitate FDI.

- It is administered by the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry.

- Despite the presence of several IT platforms for investing in India such as the Foreign Investment Facilitation Portal (FIFP) and state single-window clearances, investors need to visit multiple platforms to gather information and obtain clearances from different stakeholders.

- About Single-window System:

- To address this, the creation of a centralised Investment Clearance Cell was proposed by the DPIIT.

- The cell will be a one-stop digital national portal that integrates the existing clearance systems of various ministries/departments of the government and will have a single, unified application form.

- It would provide end-to-end facilitation support, including pre-investment advisory, information related to land banks and facilitating clearances at Central and state level.

- It will allow digital access to regulators, policymakers and facilitators at one point irrespective of their geographical location and also provide time-bound approvals and a real-time status update to investors.

- It will enable the potential investor to interact with all the ministries whose approvals are required, in the central government as well as in the states.

- To address this, the creation of a centralised Investment Clearance Cell was proposed by the DPIIT.

- Sovereign Wealth Funds:

- Despite the Covid-19 pandemic, the government has seen fresh interest from large sovereign wealth funds looking to invest in the country.

- In the Budget 2020-21, the government promised 100% tax exemption to the interest, dividend and capital gains income on the investment made in infrastructure and priority sectors before 31st March, 2024 with a minimum lock-in period of 3 years by the Sovereign Wealth Fund of foreign governments.

- A sovereign wealth fund is a state-owned investment fund composed of the money generated by the government, often derived from a country's surplus reserves.

- Despite lockdowns, the National Infrastructure Investment Fund (NIIF) actively engaged with the investors to find out the best way to facilitate them with the benefits of the tax exemptions.

- Despite the Covid-19 pandemic, the government has seen fresh interest from large sovereign wealth funds looking to invest in the country.

- Advance Pricing Agreements and Tax Dispute Settlements:

- Various MNCs highlighted the concerns about delays in bilateral Advance Pricing Agreements (APAs) and tax dispute settlements.

- APA is an agreement between a taxpayer and tax authority determining the transfer pricing methodology, for pricing the taxpayer’s international transactions for future years.

- In February 2020, Government approved an amendment to the Direct Tax Vivad se Vishwas Bill 2020 which provides a mechanism for resolution of pending tax disputes in a simple and speedy manner.

- India needs a robust system to resolve disputes on an ongoing basis instead of waiting for specific schemes to be announced for them. There should be simultaneous tracking of disputes and efforts to settle them at the earliest.

- Various MNCs highlighted the concerns about delays in bilateral Advance Pricing Agreements (APAs) and tax dispute settlements.

Foreign Direct Investment

- It is an investment made by a firm or individual in one country into business interests located in another country.

- Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets, including establishing ownership or controlling interest in a foreign company.

- It is different from Foreign Portfolio Investment (FPI) where the foreign entity merely buys equity shares of a company.

- FPI does not provide the investor with control over the business.

- Routes Through which India gets FDI:

- Automatic Route: In this, the foreign entity does not require the prior approval of the government or the Reserve bank of India (RBI).

- Government Route: In this, the foreign entity has to take the approval of the government through the existing FIFP.

Governance

KIIFB Controversy

Why in News

Recently, the Enforcement Directorate (ED) has opened a preliminary inquiry to examine if borrowings by the Kerala Infrastructure Investment Fund Board (KIIFB) from overseas markets violated the provisions of the Foreign Exchange Management Act (FEMA) 1999.

- KIIFB was established to manage the Kerala Infrastructure Investment Fund (KIIF), as per the KIIF Act 1999.

- In 2016, the government changed the role of KIIFB from handler of investment bonds to an entity to mobilise the resources for developmental projects over and beyond the budget.

Key Points

- The Comptroller and Auditor General (CAG) highlighted that the KIIFB had raised Rs. 2,150 crore from the international market without the consent of the Central government in 2019.

- A prior consent of the Government of India is necessary before a State Government raises a loan.

- KIIFB had also overstepped its legal bounds by issuing masala bonds to raise money from foreign markets in violation of Article 293 (1) of the Constitution.

- Article 293 (1): The executive power of a State extends to borrowing within the territory of India upon the security of the Consolidated Fund of the State within such limits. State governments can give guarantees within such limits as fixed by the legislature of the concerned State.

- The ED has also asked the Reserve Bank of India (RBI) about the details of ‘no objection certificate’ it had supposedly extended to the KIIFB, enabling the agency to take sizable loans from the foreign financial market.

- Implications of Inquiry:

- The investigation could potentially cause a fall in the revenues of the KIIFB.

- It might affect the extended loans being offered to KIIFB by the International Finance Corporation (IFC) - a part of the World Bank group.

- With an ongoing investigation, investors would not be willing to buy its masala bonds, which will further lead to loss of revenues.

- The investigation can also result in an administrative paralysis, halting all the infrastructure development projects for which the KIIFB had collected the funds.

- Kerala Government’s Stand:

- It disagrees with the CAG's finding on the basis that KIIFB is a corporate entity and not the State government.

- As per FEMA provisions, corporate entities can issue masala bonds to raise funds from foreign markets.

- Kerala also criticises the move because CAG has unilaterally submitted its audit observations without giving the State its right of reply.

- It disagrees with the CAG's finding on the basis that KIIFB is a corporate entity and not the State government.

Masala Bonds

- They are rupee-denominated bonds used by Indian companies to raise funds from the overseas market in Indian rupees.

- Eligibility for Issuance:

- According to RBI, any corporate, body corporate and Indian bank is eligible to issue these bonds overseas.

- These can be issued and subscribed by a resident of such country that is a member of the financial action task force (FATF) and whose securities market regulator is a member of the International Organisation of Securities Commission (IOSCO). It can also be subscribed by multilateral and regional financial institutions where India is a member country.

- IOSCO is the international body that brings together the world's securities regulators and is recognised as the global standard setter for the securities sector.

- Limitations:

- As per the RBI guidelines, the money raised through such bonds cannot be used for real estate activities other than for development of integrated township or affordable housing projects.

- Also, it cannot be used for investing in capital markets, purchase of land and on-lending to other entities for such activities as stated above.

Important Facts For Prelims

UMANG International

Why in News

The Ministry of Electronics and Information Technology, in coordination with the Ministry of External Affairs, has launched an international version of the government’s UMANG app.

- The international version of UMANG app called ‘UMANG International’ was launched to mark three years of UMANG (UMANG App was launched in 2017).

Key Points

- Coverage: The international version is for select countries that include USA, UK, Canada, Australia, UAE, Netherlands, Singapore, Australia and New Zealand.

- Expected Benefits:

- It will help Indian international students, NRIs and Indian tourists abroad, to avail Government of India services, anytime.

- It will also help in taking India to the world through ‘Indian Culture’ services available on UMANG and create interest amongst foreign tourists to visit India.

- UMANG App:

- The UMANG mobile app (Unified Mobile Application for New-age Governance) is a Government of India all-in-one single, unified, secure, multi-channel, multi-lingual, multi-service mobile app.

- It provides access to high impact services of various organizations of Centre and States. Presently it has 2000+ services.

- The aim of UMANG is to fast-track mobile governance in India.

- UMANG enables ‘Ease of Living’ for Citizens by providing easy access to a plethora of Indian government services ranging from – Healthcare, Finance, Education, Housing, Energy, Agriculture, Transport to even Utility and Employment and Skills.

- The key partners of UMANG are Employee Provident Fund Organization, Direct Benefit Transfer scheme departments, Employee State Insurance Corporation, Ministries of Health, Education, Agriculture, Animal Husbandry and Staff Selection Commission (SSC).

- The top 3 States based on average monthly transactions are - Gujarat, Haryana and Madhya Pradesh.

- UMANG was developed by the National e-Governance Division (NeGD), Ministry of Electronics & IT.

- It is a ‘Digital India’ initiative.

- UMANG attained ‘Best m-Government service’ award at the 6th World Government Summit held at Dubai, UAE in February 2018.