Indian Economy

Payment Vision 2025: RBI

For Prelims: Payment Vision 2025, Achievements of Vision Document 2019-21, RBI

For Mains: Objectives and Significance of Payment Vision 2025

Why in News?

The Reserve Bank of India (RBI) has come out with “Payments Vision 2025” with an objective to provide every user with safe, secure, fast, convenient, accessible and affordable e-payment options.

What is Payment Vision 2025?

- About:

- Payments Vision 2025 has been prepared by considering the guidance from the Board for Regulation and Supervision of Payment and Settlement Systems of the RBI.

- It builds on the initiatives of Payments Vision 2019-21.

- The Payments Vision 2025 document is presented across the five anchor goalposts of Integrity, Inclusion, Innovation, Institutionalisation and Internationalisation.

- Theme: E-Payments for Everyone, Everywhere, Everytime (4Es).

- Objectives:

- To elevate the payment systems towards a realm of empowering users with affordable payment options accessible anytime and anywhere with convenience.

- To enable geotagging of digital payment infrastructure and transactions and revisiting guidelines for Prepaid Payment Instruments (PPIs), including closed system PPIs.

- Regulating all significant intermediaries in payments ecosystems and linking credit cards and credit components of banking products to UPI.

- To bring in enhancements to Cheque Truncation System (CTS), including One Nation One Grid clearing and settlement perspective, and creating a payment system for processing online merchant payments using internet and mobile banking.

- Regulation of BigTechs and FinTechs in the payments space.

- Examining of BNPL (Book Now Pay Later) methods and exploration of appropriate guidelines on payments involving BNPL.

- Goals to Achieve:

- Volume of cheque-based payments to be less than 0.25% of the total retail payments.

- Tripling the number of digital payment transactions.

- UPI to register average annualised growth of 50% and IMPS / NEFT at 20%.

- Increase of payment transaction turnover vis-à-vis GDP to 8.

- Increase in debit card transactions at PoS (Point of Sale) by 20%.

- Debit card usage to surpass credit cards in terms of value.

- Increase in PPI transactions by 150%.

- Card acceptance infrastructure to increase to 250 lakh.

- Increase of registered customer base for mobile based transactions by 50% CAGR.

- Reduction in Cash in Circulation (CIC) as a percentage of GDP.

What is the Significance of the Move?

- Shaping India’s Payment Ecosystem:

- The RBI’s Payments Vision 2025 will be significant in shaping India's payment ecosystem, propelling a safer, more secured, and seamless payment infrastructure.

- Yardstick to All Payment Players:

- This document will act as a yardstick for all payment players, FinTech's and other stakeholders, encouraging them to enhance their capabilities by aligning with the RBI’s overall objectives.

- Global Reach:

- Through initiatives such as UPI, the RBI has democratised payments within India. With the 2025 vision, payments will be available for ‘Everyone, Everywhere, Every time’, giving global reach to Indian payment systems, making them safe, secure, fast, convenient, and affordable.

What are the Achievements of Payments Vision 2019-21?

- The Payments Vision 2021 had envisaged empowering every Indian with access to a bouquet of e-payment options that is safe, secure, convenient, quick and affordable, and had set four goalposts of Competition, Cost, Convenience and Confidence.

- These goalposts have been accomplished through the following initiatives:

- Competition:

- Creation of regulatory sandbox, opening access of Centralised Payment Systems (CPS) to non-bank PSOs, facilitation of small value digital payments in offline mode, ‘on tap’ authorisation for payment systems, internationalisation of domestic payment systems, feature phone-based payment services, framework for self regulatory organisation for payment systems, etc.

- Cost:

- Waiver of charges levied by RBI for transactions processed in the Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) systems etc.

- Convenience:

- Availability of NEFT, RTGS and National Automated Clearing House (NACH) on 24x7x365 basis, harmonisation of Turn-Around-Time (TAT) for resolution and compensation in respect of failed transactions etc.

- Confidence:

- Framework for regulating Payment Aggregators (PAs), e-mandates for recurring transactions, tokenisation of card transactions and Card-on-File Tokenisation (CoFT) etc.

- Competition:

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Q. Consider the following statements: (2019)

The Reserve Bank of India’s recent directives relating to ‘Storage of Payment System Data, popularly known as data diktat, command the payment system providers that

- they shall ensure that entire data relating to payment systems operated by them are stored in a system only in India

- they shall ensure that the systems are owned and operated by public sector enterprises

- they shall submit the consolidated system audit report to the Comptroller and Auditor General of India by the end of the calendar year

Which of the statements given above is/are correct?

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Exp:

- In order to have unfettered access to all payment data for supervisory purposes, the Reserve Bank of India had directed that all the system providers shall ensure that the entire data relating to payment systems operated are stored in a system only in India. This data includes the full end-to-end transaction details/ information collected/carried/processed as part of the message/payment instruction. Hence, statement 1 is correct.

- No provision regarding the ownership and operation of the systems by public sector enterprises has been provided. Hence, statement 2 is not correct.

- RBI had also directed payment system providers to submit the System Audit Report (SAR) with audit mandatorily conducted by CERT-IN empaneled auditors. Hence, statement 3 is not correct. Therefore, option (a) is the correct answer.

Biodiversity & Environment

Need for Climate Finance for MSME

For Prelims: MSME, Climate Finance, CoP26, UNFCC

For Mains: Climate Finance, CoP26

Why in News?

According to a report by the Centre for Study of Science, Technology & Policy (CSTEP) published in 2018, Micro, Small and Medium Scale (MSME) generates around 110 million tonnes of CO2 equivalent. India’s MSMEs must pare emissions and climate finance maybe the nudge they need.

- The MSME sector contributes around 30% to India’s gross domestic product and employs around 120 million people.

Why are MSMEs needed to curb emissions?

- India’s Commitment to CoP 26:

- India committed to attain net zero carbon emissions by 2070 during the 26th Conference of Parties (CoP26) to the United Nations Framework Convention on Climate Change at Glasgow, Scotland in 2021.

- India would supply 50% of its energy needs through renewable sources by 2030.

- Solution: The only way to do this is to gradually phase out the use of coal, increase investment in renewable energy sources, stop deforestation and speed up the transition to electric vehicles.

- To Minimise its Carbon Footprints:

- The CSTEP report highlighted that the MSME sector used 13%of the total coal/lignite, 7% of petroleum products and 8% of the natural gas supplied in India in 2015-16.

- The MSME sector needs a push to adopt new technologies that quickly minimise its carbon footprints and make it less vulnerable to climate change and risk.

- The sector can achieve this transformation with the aid of climate finance.

- Traditional funds alone cannot help the sector to become decarbonised.

What is Climate Finance?

- Climate finance is money paid by developed countries (which are responsible for most of the historic emissions) to developing countries to help them pay for emissions reduction measures and adaptation.

- Climate finance will open doors and enable the transfer of technology and expertise from developed to developing nations, which require these resources and capacity to combat climate change at the rate that the world currently demands.

Why do MSMEs need Climate Finance?

- Huge Credit Gap:

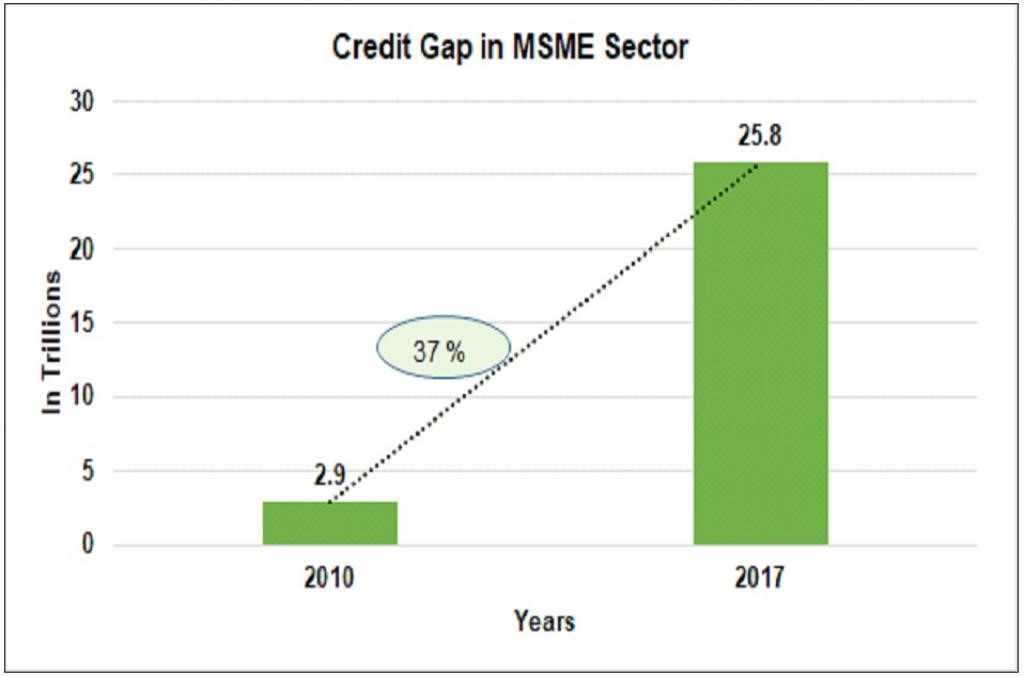

- The MSME sector in India faces a huge credit gap, which means the difference between the total supply of credit from formal channels in the country and the addressable demand.

- According to the International Finance Corporation, the credit gap was around $37 billion in 2010 and reached $330 billion in 2017.

- In 10 years, the gap compounded annually at a rate of 37%.

- Status of Flow of Finance:

- The overall debt demand of the MSME sector is USD 882.42 billion.

- But the irony is only 16% is catered to by the formal sector and the remaining are catered to by the informal sector.

What are the Challenges Faced by MSMEs?

- Lack of awareness:

- Climate finance is still a fantasy for MSMEs, as many still struggle to obtain traditional financing.

- The MSME sector does not have awareness regarding climate finance structures and policies.

- Their knowledge of how their businesses may earn profit from climate finance is constrained by a lack of awareness on the subject and a lack of financial literacy.

- Formal Financing structure:

- Only about 16% of MSMEs in India have been found to be financed through the country’s formal banking system.

- Most climate finance in India is routed through formal financial frameworks with strict guidelines, this also imposes a major barrier on the sector to avail the benefit.

- Comprehensive Procedural needs:

- Comprehensive procedures are needed to avail international climate funds procedures.

- These include the creation of a detailed project, energy and emission audit reports, etc.

- Many small and micro-businesses cannot implement these because they lack the means or the ability to do so.

Way Forward

- The Indian government needs to work on strategies and try to bring finance to MSMEs so that the sector can decarbonise.

- The sector needs to be connected with a more formal financial credit system, which will enable them to achieve climate finance and bridge the huge credit gap.

- The major focus should be on the most accelerated aspects of decarbonisation like cleaner fuel, common combustion facilities and energy efficiency technologies that can achieve a high level of decarbonisation in the sector.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which one of the following statements best describes the term ‘Social Cost of Carbon’? It is a measure, in monetary value, of the (2020)

(a) long-term damage done by a tonne of CO2 emissions in a given year.

(b) requirement of fossil fuels for a country to provide goods and services to its citizens, based on the burning of those fuels.

(c) efforts put in by a climate refugee to adapt to live in a new place.

(d) contribution of an individual person to the carbon footprint on the planet Earth.

Ans: (a)

Exp:

- The social cost of carbon (SCC) is an estimate, in dollars, of the economic damage that would result from emitting one additional ton of greenhouse gases into the atmosphere. The SCC puts the effects of climate change into economic terms to help policymakers and other decision makers understand the economic impacts of decisions that would increase or decrease emissions.

- India’s country-level social cost of carbon emission was estimated to be the highest at $86 per tonne of CO2. It means the Indian economy will lose $86 by emitting each additional tonne of CO2. India is followed by the US ($48) and Saudi Arabia ($47).

- Therefore, option (a) is the correct answer.

Indian Economy

Economic Impact of Select Decisions of the SC and NGT

For Prelims: Supreme Court, NITI Aayog, NGT

For Mains: Sustainability and Economic Development

Why in News?

Recently, the report titled Economic Impact of Select Decisions of the Supreme Court and National Green Tribunal of India (NGT) has been submitted to the NITI Aayog.

- The study was conducted by CUTS (Consumer Unity and Trust Society) which was commissioned and fully funded by the NITI Aayog.

What are the Key Highlights of the Study?

- CUTS studies the economic impacts of various judicial orders which includes five environment-related major orders of the Supreme Court and the NGT.

- The study includes:

- The Goa Foundation vs M/s Sesa Sterlite Ltd & Ors, 2018

- The Hanuman Laxman Aroskar vs Union of India (Mopa Airport Case), 2019

- The Tamil Nadu Pollution Control Board vs Sterlite Industries (I) Ltd (Sterlite Copper Plant Case), 2019

- The National Green Tribunal Bar Association vs Ministry of Environment & Forests and Ors (Sand Mining Case), 2013

- The Vardhman Kaushik vs Union of India & Ors (NCR Construction Ban Case), 2016

- Economic Impacts of Environment Related Five Judicial Orders:

- The analysis of economic impacts due to five select environment-related court orders estimates that 75,000 persons were adversely impacted from mid-2018 to mid-2021 due to restrictive orders related to environment.

- The Government of India lost revenue worth Rs 8,000 crore from mid-2018 to mid-2021.

- If this revenue had been spent as capital expenditure, the economic returns would have been to the tune of Rs 20,000 crore.

- Of the five verdicts, the study estimated 16,000 persons lost their jobs.

- The industry lost close to Rs 15,000 crore in revenues and workers lost around Rs 500 crore of income.

- Case Study of Ban on Mining in Goa:

- State Public Debt Increases:

- Due to the ban on mining in Goa, the state public debt increased at a Compound Annual Growth Rate (CAGR) of 10.06% from 2007 through 2021.

- The market loans taken by the state increased at a CAGR of 19.93%, consequently due to mining suspension.

- Revenue Deficit in both Centre and State:

- The central and state revenues cumulatively suffered an estimated deficit of Rs 668.39 crore in taxes paid by the mining companies,

- Whereas the state revenues exclusively suffered an estimated deficit of Rs 1,821.32 crore.

- Loss in Mining Companies:

- Mining companies are estimated to have lost Rs 6,976.71 crore during 2018-19 and 2020-2021.

- Loss of Employment:

- The net loss of employment (both direct and indirect) comes to almost 15,000 jobs in mining closure case.

- State Public Debt Increases:

What are the recommendations of the study?

- Strike Balance:

- It recommends the need to equip the judiciary and judges on how to strike a balance between the economy and the environmental factors.

- For instance, on the National Capital Region construction ban case, the ineffectiveness of procedures adopted by the judiciary and the executive in curbing pollution highlights the existence of loopholes in set procedures and system owing to various reasons such as capacity and expertise constraints, paucity of resources, etc.

- Need for Subject Specialists:

- It highlighted the need for subject specialists / experts guiding the judges on cases that involved economic impacts.

- It recommended that selection procedures of judges should also be changed.

- For better quality of judges, the law on National Judicial Commission could be revived.

- However, it is equally important for judicial officers to be exposed to (basic) economic issues to recognize the need for a holistic and balanced decision and approach.

- Accountability for the Judiciary:

- It also prescribed accountability for the judiciary to ensure a high standard of jurisprudence analysis and decision-making.

- In cases where strict adherence to legal provisions may lead to substantive economic losses, the decision-making of the SC should be guided by the larger public good.

- The apex court must demand accountability by levying fines and penalties on officers and politicians involved in outright corruption and maladministration cases.

- Transparency at All Levels:

- It is thus important to inform the decision-making process at all levels, including the judiciary, keeping in mind the larger objective of human-centricity of economic development and environmental sustainability, with equal considerations to the objective of equity, environment, and economy.

Indian Economy

Increase in Direct Tax Collections

For Prelims: Direct tax, Corporation Tax, STT, Vivad se Vishwas Scheme

For Mains: Mobilisation of Resources, Government initiatives to check tax evasion

Why in News?

The figures of Direct Tax collections for the Financial Year 2022-23, as of mid-June Show that net collections representing an increase of 45% over the collections of the preceding year.

- The largest share in Net Direct Tax collection is of Corporation Tax then Personal Income Tax (PIT) including Security Transaction Tax (STT) Constitutes the rest.

What is Direct tax?

- A direct tax is a tax that a person or organization pays directly to the entity that imposed it.

- An individual taxpayer, for example, pays direct taxes to the government for various purposes, including income tax, real property tax, personal property tax, or taxes on assets.

What is the Significance of Direct tax?

- Equity: Direct taxes like income tax, wealth tax, etc. are based on the principle of ability to pay, so the equity or justice in the allocation of tax burden is well secured by these taxes.

- Progressive: Usually direct taxation is progressive in effect. Since direct taxes can be designed with fine gradation and progressiveness, they can serve as an important fiscal weapon of reducing the gap of inequalities in income and wealth. Direct taxes thus lead to the objective of social equality.

- Productive: Direct taxes are elastic and productive. Revenue from direct taxes increases or decreases automatically with the change in the national income or wealth of the country.

- Certainty: The canon of certainty is perfectly embodied in direct taxation. Compared to indirect taxes, direct taxes are more exact and precise in estimating the revenue. Further, in direct taxes, the taxpayer knows how much he has to pay and the State can estimate the yields correctly.

- Economy: The canon of economy is also well maintained under direct taxation. Direct taxes like income tax etc. being collected annually in lump-sum, the administrative cost of such collection will be minimum as compared to the indirect taxes like sales tax, excise duties, etc., which are collected at short intervals (usually, quarterly), and which involve a high cost of collection.

- Further, chances of tax evasion are also minimised in direct taxes when they are collected at source. Gladstone, therefore, puts it as: “If you had only direct taxes you would have an economical government.”

- Educative: Direct taxes have an educative value as they create a civic sense among the taxpayers. Citizens realise their duty to pay taxes and because of the direct burden of taxes they become conscious and keep vigil on how the public income is spent by the government in a democratic country.

- Anti-inflationary: Direct taxation can serve as a good instrument of anti-inflationary fiscal policy designed to maintain the price level at a stable level. The excessive purchasing power during inflation can be mopped up from the community through increased direct taxes.

What are the Government Initiatives to Improve Direct Taxes?

- For Personal Income Tax - The Finance Act, 2020 has provided an option to individuals and co-operatives to pay income tax at concessional rates if they do not have avail of specified exemption and incentive.

- Vivad se Vishwas Scheme: Under Vivad se Vishwas, declarations for settling pending tax disputes are currently being filed.

- This will benefit the Government by generating timely revenue and to the taxpayers by bringing down mounting litigation costs.

- Expansion of scope of TDS/TCS: For widening the tax base, several new transactions were brought into the ambit of Tax Deduction at Source (TDS) and Tax Collection at Source (TCS).

- These transactions include huge cash withdrawal, foreign remittance, purchase of luxury cars, e-commerce participants, sale of goods, acquisition of immovable property, etc.

- ‘Transparent Taxation - Honoring The Honest’ platform: It is aimed at bringing transparency in income tax systems and empowering taxpayers.

What are the Different Types of Taxes?

- Corporation Tax: It is levied on a firm's profit by the government.

- It is taxed on operating earnings after expenses have been deducted.

- The rate of corporate tax in India varies from one type of company to another i.e., domestic corporations and foreign corporations pay tax at different rates.

- Dividend Distribution Tax (DDT): Dividend refers to the distribution of profits to shareholders of a company.

- Thus, the dividend distribution tax is a type of tax that is payable on the dividends offered to its shareholders by the corporation.

- Higher dividends mean a greater tax burden for the corporate entity.

- In Budget 2020, the Finance Minister has abolished Dividend Distribution Tax (DDT). Now the incidence of dividend income taxation is shifted to investors from the companies.

- Minimum Alternate Tax:

- At times it may happen that a taxpayer, being a company, may have generated income during the year, but by taking the advantage of various provisions of Income-tax Law (like exemptions, deductions, depreciation, etc.), it may have reduced its tax liability or may not have paid any tax at all.

- Due to an increase in the number of zero tax paying companies, Minimum Alternate Tax (MAT) was introduced.

- Security Transaction Tax (STT):

- It is a direct tax charged on purchase and sale of securities that are listed on the recognized stock exchanges in India.

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Q. Which one of the following effects of creation of black money in India has been the main cause of worry to the Government of India?

(a) Diversion of resources to the purchase of real estate and investment in luxury housing.

(b) Investment in unproductive activities and purchase of precious stones, jewellery, gold, etc.

(c) Large donations to political parties and growth of regionalism.

(d) Loss of revenue to the State Exchequer due to tax evasion.

Ans: (d)

Exp:

- The simplest definition of black money could possibly be money that is hidden from tax authorities. It is the money earned through illegal activity and not reported to the tax authorities, and so is black.

- Black money causes financial setbacks, as non-taxed income causes the government to lose revenue, which in turn affects the economic growth of the country.

- Taxation is the primary source of income for the government. Tax revenue can be regarded as one measure of the degree to which the government controls the economy’s resources. Therefore, loss of revenue to the State Exchequer due to tax evasion is the main cause of worry to the Government of India.

- Therefore, option (d) is the correct answer.

Indian Polity

Registered Unrecognised Political Parties (RUPP)

For Prelims: Election Commission,Recognised Political Party , Representation of the People Act, 1951

For Mains: Significance of the Representation of People Act

Why in News?

The Election Commission ordered the deletion of 111 registered unrecognised political parties that it found to be “non-existent” and referred three of the parties to the Department of Revenue for legal action for “serious financial impropriety".

- This was the second such action in the recent past against registered parties that have been found violating the Representation of the People Act, 1951.

- Earlier, the EC had deleted 87 non-existent registered unrecognised political parties.

- The EC said the 111 parties in question had violated sections of the Act that required them to submit their address of communication and any change in address to the EC.

What are the Key Points related to the Political Parties?

- Registered Unrecognised Political Parties (RUPP):

- Either newly registered parties or those which have not secured enough percentage of votes in the assembly or general elections to become a state party, or those which have never contested elections since being registered are considered unrecognised parties.

- Such parties don’t enjoy all the benefits extended to the recognised parties.

- Recognised Political Party:

- A recognised political party shall either be a National party or a State party if it meets certain laid down conditions.

- To become a recognised political party either at the state or national level, a party has to secure a certain minimum percentage of polled valid votes or certain number of seats in the state legislative assembly or the Lok Sabha during the last election.

- The recognition granted by the Commission to the parties determines their right to certain privileges like allocation of the party symbols, provision of time for political broadcasts on the state-owned television and radio stations and access to electoral rolls.

| What are the Conditions for Recognition of Political Parties? | |

| Conditions For Recognition of National Parties | Conditions for Recognition as a State Party |

|

|

The Representation of the People Act (RPA)

- Introduction:

- The holding of free and fair elections is the sine-qua-non of democracy. To ensure the conduct of elections in free, fair and in an impartial manner, the constitution-makers incorporated Part XV (Articles.324-329) in the constitution and empowered Parliament to make laws to regulate the electoral process.

- In this context, the Parliament has enacted the Representation of the People Act (RPA), 1950 and Representation of the People Act,1951.

- Representation of the People Act (RPA), 1950

- Key Provisions:

- Lays down procedures for delimitation of constituencies.

- Provides for the allocation of seats in the House of the People and in the Legislative Assemblies and Legislative Councils of States.

- Lays procedure for the preparation of electoral rolls and the manner of filling seats.

- Lays down the qualification of voters.

- Key Provisions:

- Representation of the People Act (RPA) of 1951:

- Key Provisions:

- It regulates the actual conduct of elections and by-elections.

- It provides administrative machinery for conducting elections.

- It deals with the registration of political parties.

- It specifies the qualifications and disqualifications for membership of the Houses.

- It provides provisions to curb corrupt practices and other offences.

- It lays down the procedure for settling doubts and disputes arising out of elections.

- Key Provisions:

UPSC Civil Services, Previous Year Questions (PYQ)

Q. Consider the following statements:

- In India, there is no law restricting the candidates from contesting in one Lok Sabha election from three constituencies.

- In the 1991 Lok Sabha Election, Shri Devi Lal contested from three Lok Sabha constituencies.

- As per the existing rules, if a candidate contests in one Lok Sabha election from many constituencies, his/her party should bear the cost of bye-elections to the constituencies vacated by him/her winning in all the constituencies.

Which of the statements given above is/are correct?

(a) 1 only

(c) 1 and 3

(b) 2 only

(d) 2 and 3

Ans:(b)

Exp:

- In 1996, the Representation of the People Act, 1951 was amended to restrict from ‘three’ to ‘two’ the number of seats one candidate could contest in Lok Sabha and Assembly elections. Hence, statement 1 is not correct.

- In 1991, Shri Devi Lal contested three Lok Sabha seats,Sikar, Rohtak and Ferozepur seats. Hence, statement 2 is correct.

- Whenever a candidate contests from more than one seat and wins more than one, the candidate has to retain only one, forcing bypolls in the rest. It results

in an unavoidable financial burden on the public exchequer, government manpower and other resources for holding by-election against the resultant vacancy. Hence, statement 3 is not correct. - Therefore, option (b) is the correct answer.

Governance

UNESCO recognizes ICT usage in Indian schools

For Prelims: UNESCO’s King Hamad Bin Isa Al-Khalifa Prize, PM eVIDYA, CIET, SDG, DIKSHA, ePathshala, NISHTHA, school MOOCs on SWAYAM

For Mains: National Education Policy, Education Related Policies of Government

Why in News?

Central Institute of Educational Technology (CIET) wins UNESCO’s King Hamad Bin Isa Al-Khalifa Prize for the year 2021.

- CIET is a constituent unit of National Council of Educational Research and Training (NCERT) under Department of School Education & Literacy.

- CIET has been awarded by United Nations Educational, Scientific and Cultural Organization (UNESCO) for use of ICT in Education under a comprehensive initiative called PM eVIDYA.

What is PM eVIDYA?

- The PM eVIDYA has been initiated as part of Atma Nirbhar Bharat Abhiyaan by the Ministry of Education on 17th May, 2020.

- It unifies all efforts related to digital/online/on-air education to enable multi-mode access for imparting education by using technology to minimise learning losses.

What is UNESCO’s King Hamad Bin Isa Al-Khalifa Prize?

- About:

- It is established in 2005 with the support of the Kingdom of Bahrain.

- This award “recognizes innovative approaches in leveraging new technologies to expand educational and lifelong learning opportunities for all, in line with the 2030 Agenda for Sustainable Development and its Goal 4 on Education.

- The Prize rewards individuals and organizations that are implementing outstanding projects and promoting the creative use of technologies to enhance learning, teaching and overall educational performance in the digital age.

- Awards:

- An international Jury selects two best projects annually.

- Each prizewinner receives USD 25,000, a medal and a diploma during the ceremony at UNESCO Headquarters in Paris.

What are the Efforts done by Ministry of Education through CIET, NCERT?

- Keeping in view the recommendations of NEP-2020, Ministry of Education through CIET, NCERT has been working tirelessly and meticulously in designing, developing and disseminating

- A large number of eBooks, eContent - audios, videos, interactives, augmented reality contents, Indian Sign Language (ISL) videos, audiobooks, talking books, etc.,

- A variety of eCourses for school and teacher education,

- Organizing digital events like online quizzes primarily for students and teachers through leveraging Online/Offline, On-Air technology One Class-One Channel, DIKSHA, ePathshala, NISHTHA, school MOOCs on SWAYAM, etc.

- Launch of PM eVidya:

- To further the objectives of NEP & Samagra Shiksha and address the aforementioned pillars, PM eVidya was launched in May 2020.

- Learning to Doorsteps:

- The CIET was proactive in taking learning to the doorsteps of the children through the extensive, resilient, ethical, and coherent use of 12 PM eVidya DTH TV channels and nearly 397 radio stations, including community radio stations under PM eVidya program.

- These efforts were especially helpful in pandemic situations, when schools were closed, in reaching out to students.

- These efforts helped in arresting the learning hiatus to a large extent.

What are the other Initiatives related to Education?

- National Programme on Technology Enhanced Learning

- Rashtriya Ucchatar Shiksha Abhiyan (RUSA)

- Prime Minister's Research Fellowship (PMRF)

- Scheme for Promotion of Academic and Research Collaboration (SPARC)

- Sarva Shiksha Abhiyan

- NEAT

- PRAGYATA

- Mid Day Meal Scheme

- Right To Education (RTE) Act, 2009

- Beti Bachao Beti Padhao

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Q. Consider the following statements: (2018)

- As per the Right to Education (RTE) Act, to be eligible for appointment as a teacher in a State, a person would be required to possess the minimum qualification laid down by the concerned State Council of Teacher Education.

- As per the RTE Act, for teaching primary classes, a candidate is required to pass a Teacher Eligibility Test conducted in accordance with the National Council of Teacher Education guidelines.

- In India, more than 90% of teacher education institutions are directly under the State Governments.

Which of the statements given above is/are correct?

(a) 1 and 2

(b) 2 only

(c) 1 and 3

(d) 3 only

Ans: (b)

Exp:

- The academic authority notified by the Central Government, under the Right of Children to Free and Compulsory Education (RTE), Act 2009, has laid down the minimum educational and professional qualifications for a person to be eligible for an appointment as a teacher for classes I-VIII, which are applicable to all schools imparting elementary education, including the schools under the State Governments. They have to clear a Teacher Eligibility Test (TET) in order to be eligible for being appointed as a teacher. Hence, statement 1 is not correct.

- Teacher Eligibility Test (TET) is conducted by the appropriate Government in accordance with the guidelines framed by the National Council of Teacher Education. Hence, statement 2 is correct.

- The 2012 Verma Commission on Teacher education in its report pointed out that 90% of teacher education bodies were private. Hence, statement 3 is not correct.

- Therefore, option (b) is the correct answer.

Important Facts For Prelims

Twin Deficit Problem

Why in News?

The finance ministry in its ‘Monthly Economic Review’ cautioned the re-emergence of the twin deficit problem in the economy, with higher commodity prices and rising subsidy burden leading to an increase in both fiscal deficit and Current Account Deficit (CAD).

- It’s also the first time the government has explicitly talked about the possibility of fiscal slippage in the current fiscal year.

What are the Major Highlights of the Report?

- The World is looking at a distinct possibility of widespread stagflation.

- India, however, is at low risk of stagflation, owing to its prudent stabilization policies.

- Meanwhile, Indian financial markets have witnessed hefty foreign investment outflows the past eight months. A weak GDP growth outlook has exacerbated the situation.

- In a black swan event comprising a combination of shocks, there is a 5% chance of outflows under portfolio investments of 7.7 %of GDP and short-term trade credit retrenchment of 3.9 %of Gross Domestic Product (GDP).

What will be the he Impact of Twin Deficit Problem?

- The twin deficit problem, especially the worsening current account deficit, may compound the effect of costlier imports, and weaken the value of the rupee thereby further aggravating external imbalances.

Way Forward

- Trim revenue expenditure (or the money government spends just to meet its daily needs).

- Promoting domestic manufacturing and decrease in imports of unessential items.

- Prudent Fiscal Policy: The government should rationalise both the capital and revenue expenditure and should go for a balance budget to avoid a fiscal slippage.

Key Terms

- Fiscal Deficit: It is the gap between the government’s expenditure requirements and its receipts. This equals the money the government needs to borrow during the year.

- Current Account Deficit (CAD): The current account measures the flow of goods, services, and investments into and out of the country. It represents a country’s foreign transactions and, like the capital account, is a component of a country’s Balance of Payments (BOP).

- Twin Deficit Problem: Current Account Deficit and Fiscal Deficit (also known as "budget deficit" is a situation when a nation's expenditure exceeds its revenues) are together known as twin deficits and both often reinforce each other, i.e., a high fiscal deficit leads to higher CAD and vice versa.

- Stagflation: It is described as a situation in the economy where the growth rate slows down, the level of unemployment remains steadily high and yet the inflation or price level remains high at the same time.

- Black Swan Event: It can be characterised by a combination of all adverse shocks experienced in the history coming together, leading to a perfect storm.

UPSC Civil Services,Previous Year Questions (PYQ)

Q. In the context of governance, consider the following: (2010)

- Encouraging Foreign Direct Investment inflows

- Privatization of higher educational Institutions

- Down-sizing of bureaucracy

- Selling/offloading the shares of Public Sector Undertakings

Which of the above can be used as measures to control the fiscal deficit in India?

A. 1, 2 and 3

B. 2, 3 and 4

C. 1, 2 and 4

D. 3 and 4 only

Ans: D

Exp:

- In general, fiscal deficit occurs when the total expenditures of the government exceed its revenue.The government takes various measures to reduce the fiscal deficit such as increasing tax-based revenue,reducing subsidies, disinvestment, etc.

- Downsizing of bureaucracy as well as selling offloading of the shares of public sector undertaking directly contributes to reduction in fiscal deficit.

- Without knowing the destination and the effect of FDI inflows, it is difficult to determine its actual impact on the fiscal deficit. Privatisation of higher educational institutions may improve the situation but its impact may not be effective in reduction of fiscal deficit. Hence, statements 3, 4 are correct and statements 1, 2 are not correct.

- Therefore, option (d) is the correct answer.

Important Facts For Prelims

Keibul Lamjao National Park

Why in News?

Manipur's Keibul Lamjao National Park (KLNP) residents oppose the site's relocation.

- People argues that the proposed site has no connection with efforts to save the endangered deer. On the other hand, the people in surrounding villages have been doing everything possible to protect the deer.

What are the Important Facts about Keibul Lamjao National Park?

- It is the only floating National Park in the world, the Keibul Lamjao National Park located on the Loktak Lake is the last natural habitat of the 'Sangai' (Rucervus eldii eldii), the dancing deer of Manipur.

- This is the last natural habitat of the brow-antlered deer (Sangai) the dancing deer of Manipur.

- In the 1950s, it was believed that the brow-antlered deer(Rucervus eldii eldii) had become extinct in the country. However, it was subsequently re-discovered in Manipur.

- Hog Deer, Otter, a host of water fowls and migratory birds are found here.

What are the Key Points of Loktak Lake?

- Loktak Lake is the largest freshwater lake in Northeast India and is famous for the phumdis floating over it.

- Phumdis are the heterogeneous mass of vegetation, soil and organic matter at various stages of decomposition.

- This ancient lake plays an important role in the economy of Manipur. It serves as a source of water for irrigation, drinking water supply and hydropower generation.

- Considering the ecological status and its biodiversity values, Loktak lake was initially designated as a wetland of international importance under the Ramsar Convention in 1990.

- Later it was also listed under the Montreux Record in 1993.

- Human activity has led to severe pressure on the lake ecosystem.

What is Brow Antlered Deer?

- Common Name: Sangai, Brow antlered deer, Dancing Deer

- Scientific Name: Rucervus eldii

- About:

- The brow-antlered deer, or sangai, is the state animal of Manipur.

- The animal’s coat is a dark reddish brown during winter months and it becomes a much lighter shade in summer.

- Native to Cambodia, China, India, Laos and Myanmar, these animals were earlier spread widely across habitats in south and south-east Asia.

- Habitat:

- The deer’s habitat has varied from shrubland and grassland to dry forests and marshland, depending on the country they’re found in.

- In India, these animals are found only in Manipur’s famed Loktak lake.

- The brow-antlered deer usually consumes grass.

- Threat:

- While globally habitat loss has been a grave concern in the conservation of this deer, hunting is an additional threat in Manipur.

- While the habitats have been encroached for grazing, cultivation, and fish farming, the animals are highly threatened by a hydro-electric project in the lake.

- Protection Status:

- IUCN Red List: Endangered

- CITES: Appendix I

- WPA 1972: Schedule-I

Important Facts For Prelims

Four Species of Azooxanthellate Corals

Why in News?

Scientists have recorded Four Species of Azooxanthellate Corals under the Genus Truncatoflabellum (Scleractinian: Flabellidae) for the first time from Indian waters.

What are the Findings?

- Truncatoflabellum crassum, T. incrustatum, T. aculeatum, and T. irregulare are the four species of corals found.

- These groups of coral were previously found from Japan to the Philippines and Australian waters while only T. crassum was reported within the range of Indo-West Pacific distribution including the Gulf of Aden and the Persian Gulf.

- They are found from the Waters of Andaman and Nicobar Islands.

- They are Azooxanthellate corals, which are a group of corals that do not contain zooxanthellae and derive nourishment not from the sun but from capturing different forms of plankton.

- Zooxanthellae are unicellular, golden-brown algae (dinoflagellates) that live either in the water column as plankton or symbiotically inside the tissue of other organisms.

- Zooxanthellate corals, meanwhile, are restricted to shallow waters.

- They are hard corals and are not only solitary but have a highly compressed skeletal structure.

- There are about 570 species of hard corals found in India and almost 90% of them are found in the waters surrounding Andaman and Nicobar Islands. The pristine and oldest ecosystem of corals share less than 1% of the earth’s surface but they provide a home to nearly 25% of marine life.

- They are deep-sea representatives, with the majority of species reporting from between 200 m to 1000 m.

- They also occur in shallow coastal waters.

What is the Significance of the Study?

- It illustrates the morphological features along with the global mapping of zoogeographic distributional ranges of the above said four newly recorded species of flabelliids from Indian waters.

- The most studies of hard corals in India have been concentrated on reef-building corals while much is not known about non-reef-building corals. These new records enhance knowledge about non-reef-building, solitary corals.

- The presently reported four species of solitary stony corals enhance the national database of biological resources of India and also define the expansion of scope to explore these unexplored and non-reefs building corals.

What are Corals?

- Corals are made up of genetically identical organisms called polyps. These polyps have microscopic algae called zooxanthellae living within their tissues.

- The corals and algae have a mutualistic relationship.

- The coral provides the zooxanthellae with the compounds necessary for photosynthesis. In return, the zooxanthellae supply the coral with organic products of photosynthesis, like carbohydrates, which are utilized by the coral polyps for the synthesis of their calcium carbonate skeletons.

- In addition to providing corals with essential nutrients, zooxanthellae are responsible for the unique and beautiful colors of corals.

- They are also called the “rainforests of the seas”.

- There are two types of corals:

- Hard, shallow-water corals—the kind that builds reefs.

- Soft corals and deepwater corals that live in dark cold waters.