Economy

Stagflation

- 06 Jun 2022

- 4 min read

For Prelims: Stagflation, Inflation, Recession

For Mains: Concerns Related to Stagflation and Way Forward

Why in News?

Central banks across the World are trying to formulate policies to ensure that Inflation, in some advanced economies including the U.S., is cooled without triggering a Recession, since some of the experts are seeing Stagflation in the near future.

What is Stagflation?

- About:

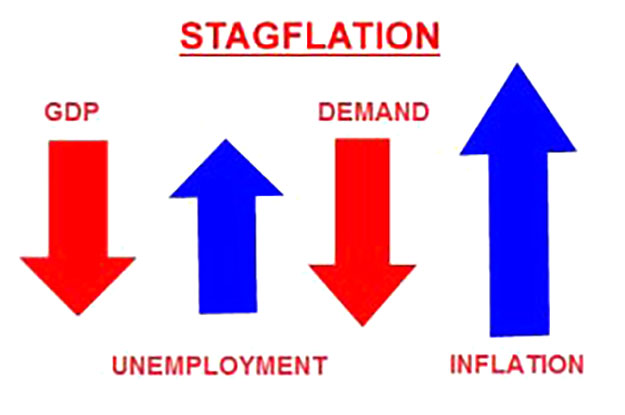

- Stagflation means a situation characterized by simultaneous increase in prices and stagnation of economic growth.

- The term Stagflation was coined by Iain Macleod, a Conservative Party MP in the United Kingdom, in November 1965.

- It is described as a situation in the economy where the growth rate slows down, the level of unemployment remains steadily high and yet the inflation or price level remains high at the same time.

- It is Dangerous for the economy.

- In a usually low growth situation, central banks and governments try to stimulate the economy through higher public spending and low interest rates to create demand.

- These measures also tend to elevate prices and cause inflation. So, these tools cannot be adopted when inflation is already running high, which makes it difficult to break out of the low growth-high inflation trap.

- Stagflation means a situation characterized by simultaneous increase in prices and stagnation of economic growth.

- Case of Stagflation:

- In the early and mid-1970s when OPEC (The Organisation of Petroleum Exporting Countries), which works like a cartel, decided to cut supply and sent oil prices soaring across the world.

- On the one hand, the rise in oil prices constrained the productive capacity of most western economies that heavily depended on oil, thus hampering economic growth. On the other hand, the oil price spike also led to inflation and commodities became more costly.

- For instance, in 1974, the oil prices went up by almost 70% and it leads to a consequent rise in inflation.

What has sparked the latest concerns about stagflation?

- Covid-19 and Subsequent Fiscal and Monetary Measures:

- While the outbreak of the Covid-19 pandemic and the curbs imposed to contain the spread of the virus caused the first major recent economic slowdown worldwide, the subsequent fiscal and Monetary Measures taken to address the downturn, including substantial increases in liquidity in most of the advanced economies, fuelled a sharp upsurge in inflation.

- Russia- Ukraine Situation and Sanctions on Moscow:

- While the Fed and the Bank of England are among central banks that have started raising interest rates to cool soaring prices, the ongoing war in Ukraine following Russia’s invasion of its southern neighbour and the consequent Western sanctions on Moscow have caused a fresh and as yet hard-to-quantify ‘supply shock’.

- Supply Factors:

- With the prices of commodities ranging from oil and gas to foodgrains, edible oils and fertilizers all surging sharply in the wake of the conflict, authorities face an uphill battle to contain inflation that is now less a function of demand (and so can be controlled by regulating credit) and almost entirely caused by supply factors that are far harder to manage.

Way Forward

- Policy support for a sustained and inclusive recovery may be needed for longer.

- The focus is likely to be on the normalisation of prudential policies and the strengthening of insolvency frameworks and restructuring mechanisms, including for the overhang of public and private debt.