Infographics

Indian Economy

Regulatory Framework for Online Bond Platform Providers

For Prelims: SEBI, Online Bond Platform Providers, Bonds, Debt.

For Mains: Need for a Regulatory Framework for Online Bond Platform Providers.

Why in News?

Securities and Exchange Board of India (SEBI) has come out with a regulatory framework for online bond platform providers in a bid to streamline their operations.

- Online Bond Platform Providers (OBPPs) would be companies incorporated in India and they should register themselves as stock brokers in the debt segment of the stock exchange, as per the framework that would be effective immediately.

What is the Need for a Regulatory Framework?

- With the bond market offering tremendous scope for development, particularly in the non-institutional space, there is a need to place checks and balances in the form of transparency in operations and disclosures to the investors dealing with such Online Bond Platforms (OBPs), measures for mitigation of payment.

- During the past few years, there has been an increase in the number of OBPPs offering debt securities to non-institutional investors. Most of them are fintech companies or are backed by stock brokers.

- There has been a significant increase in the number of registered users who have transacted through them.

- Operations of OBPs were outside SEBI's regulatory purview.

What are the New Rules?

- After obtaining registration as a stock broker in the debt segment of a stock exchange, an entity would have to apply to the bourse to act as an OBPP.

- The new rules mandate registration certificate as a stock broker from SEBI to act as an online bond platform provider.

- Those acting as an online bond platform provider without registration certificate provider prior to 9th november 2022 continue to do so for a period of three months.

- People will have to comply with the conditions of registrations as specified by the SEBI from time to time.

- The entity would have to ensure compliance with the minimum disclosure requirements. It would also have to disclose on its platform all instances of conflict of interest, if any, arising from its transactions or dealings with related parties.

What Is the Bond Market?

- Bonds:

- Bonds are units of corporate debt issued by companies and securitized as tradeable assets.

- A bond is referred to as a fixed-income instrument since bonds traditionally paid a fixed interest rate (coupon) to debtholders.

- Variable or floating interest rates are also now quite common.

- Bond prices are inversely correlated with interest rates: when rates go up, bond prices fall and vice-versa.

- Types of Bonds:

- Convertible Bond:

- Unlike regular bonds that are redeemed upon maturity, a convertible bond gives the purchaser a right or an obligation to convert the bond into shares of the issuing company.

- It features a fixed tenure and pays out interest payments periodically at predetermined intervals.

- Fixed Coupon Rate Bonds:

- In these types of bonds, the interest is fixed from the date of issue. Most of the corporate and government bonds are of fixed coupon rate and the interest or coupon is provided annually, semi-annually, quarterly or monthly till the redemption date.

- Floating Coupon Rate Bonds (FRB):

- In these bonds, the coupon rate fluctuates at a predefined time till the date of maturity. Here interest rate depends on a benchmark which it follows to determine the coupon rate in each coupon payment. In the case of FRB Bond, the coupon rate depends on the T-bills yield.

- Zero Coupon Bonds:

- These bonds are those bonds where the issuer does not provide any coupon payment to the holder till the maturity date. Here the bonds are issued below the face value amount and on the date of redemption or maturity. Bonds are redeemed on the face value amount. Here the difference between the redemption price and the issue price is the return for an investor. In India, Treasury-Bills are the Zero-Coupon Bonds.

- Cumulative Coupon Rate Bonds:

- These bonds are issued with a coupon rate but the coupon payment is done at the time of redemption. Usually, corporates issue these types of bonds.

- Inflation Indexed Bonds:

- These bonds provide protection from inflation. It is primarily issued by the government. Here the coupon rate is dependent on the inflation rate. Usually, the coupon rate equals the inflation rate and the additional rate provided over the inflation rate.

- Sovereign Gold Bonds (SGBs):

- As per the Reserve Bank of India SGBs are government securities denominated in grams of gold.

- These are the substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity.

- Convertible Bond:

- Bond Market:

- The bond market broadly describes a marketplace where investors buy debt securities that are brought to the market by either governmental entities or corporations.

- National governments generally use the proceeds from bonds to finance infrastructural improvements and pay down debts.

- Companies issue bonds to raise the capital needed to maintain operations, grow their product lines, or open new locations.

- Bonds are either issued on the primary market, which rolls out new debt, or traded on the secondary market, in which investors may purchase existing debt via brokers or other third parties.

- Online Bond Platform:

- As per SEBI, it is an electronic system other than a recognised stock exchange or an electronic book providing platform, on which debt securities are listed or proposed to be listed are offered and transacted.

- The online bond platform provider means any person operating or providing such a platform.

- As per SEBI, it is an electronic system other than a recognised stock exchange or an electronic book providing platform, on which debt securities are listed or proposed to be listed are offered and transacted.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q1. With reference to India, consider the following statements: (2021)

- Retail investors through demat account can invest in ‘Treasury Bills’ and ‘Government of India Debt Bonds’ in primary market.

- The ‘Negotiated Dealing System-Order Matching’ is a government securities trading platform of the Reserve Bank of India.

- The ‘Central Depository Services Ltd.’ is jointly promoted by the Reserve Bank of India and the Bombay Stock Exchange.

Which of the statements given above is/are correct?

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: (b)

- The RBI has allowed retail investors with online access to the government securities market – both primary and secondary – directly through the Reserve Bank. The facility of buying government securities directly through RBI is called RBI Retail Direct. Under it, retail investors can open and maintain a Retail Direct Gilt (RDG) account with the RBI through the dedicated online portal. The account can be opened singly or jointly with another retail investor.

- Gilt account is opened by the bank for individuals who wish to invest in government securities and treasury bills. Banks in effect maintain a Demat account for these instruments in the name of the individuals. Hence, statement 1 is correct.

- Negotiated Dealing System-Order Matching (NDSOM) is RBI’s screen-based, anonymous electronic order matching system for trading in government securities in the secondary market. Hence, statement 2 is correct.

- Central Depository Services Ltd (CDSL), is the first listed Indian central securities depository based in Mumbai. CDSL is promoted by BSE Ltd. jointly with leading banks such as State Bank of India, Bank of India, Bank of Baroda, HDFC Bank, and Standard Chartered Bank. Hence, statement 3 is not correct.

- Therefore, option (b) is the correct answer.

Q2. With reference to the Indian economy, consider the following statements: (2020)

- ‘Commercial Paper’ is a short-term unsecured promissory note.

- ‘Certificate of Deposit’ is a long-term instrument issued by the Reserve Bank of India to a corporation.

- ‘Call Money’ is a short-term finance used for interbank transactions.

- ‘Zero-Coupon Bonds’ are the interest-bearing short-term bonds issued by the Scheduled Commercial Banks to corporations.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 4 only

(c) 1 and 3 only

(d) 2, 3 and 4 only

Ans: (c)

Q3. With reference to Convertible Bonds, consider the following statements: (2022)

- As there is an option to exchange the bond for equity, Convertible Bonds pay a lower rate of interest.

- The option to convert to equity affords the bondholder a degree of indexation to rising consumer prices.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

Indian Economy

Russian Banks open Vostro Accounts in India

For Prelims: Foreign Trade, Currency Depreciation & Appreciation, Global Sanctions, Balance of Payments

For Mains: Effect of global sanctions on economy of India, Benefits and challenges of settling trade in Rupee, Intervention of government in economy

Why in News?

The Reserve Bank of India (RBI) has allowed the opening of nine special vostro accounts in two Indian Banks (UCO Bank and IndusInd Bank) for the settlement of payments in rupee for trade between India and Russia.

- Russia’s two largest banks — Sberbank and VTB Bank — are the first foreign lenders to have received approval from the RBI towards settling international trade transactions in rupee.

- A Vostro account is just another name for a Nostro account. It is an account held by a bank that allows the customers to deposit money on behalf of another bank.

What is the Background?

- In July 2022, the RBI had unveiled a mechanism to settle international transactions in rupee to promote the growth of global trade, with emphasis on exports from India, as well as pushing rupee as an international currency.

- It is also expected to enable trade with sanction-hit nations such as Russia.

- According to the mechanism finalised by the RBI, banks of partner countries can approach authorised dealer banks in India for opening special rupee vostro accounts. The authorised dealer bank will then have to seek approval from the central bank with details of such an arrangement.

What is a Nostro Account?

- A Nostro account is an account held by a bank in another bank. It allows the customers to deposit money in the bank's account in another bank. It is often used if a bank has no branches in a foreign country. Nostro is a Latin word that means “ours”.

- Let's presume bank "A" does not have any branches in the Russia, but bank "B" does. Now, to receive the deposits in the Russia, "A" will open a Nostro account with "B".

- Now, if any customers in the Russia want to send money to "A", they can deposit it into A's account in "B". "B" will transfer the money to "A".

- The main difference between a deposit account and a Nostro account is that the former is held by individual depositors while foreign institutions hold the latter.

What is a Vostro Account?

- The word Vostro means yours in Latin.

- A Nostro account is a Vostro account for the bank that opens the account.

- In the above example, the account will be called a Vostro account for bank "B". The Vostro account accepts the payments on behalf of the account holder's bank.

- If a person deposits money in the Vostro account, it will be transferred to the account holder's bank.

- Nostro and Vostro accounts are held in a foreign denomination.

- Vostro accounts enable domestic banks to provide international banking services to their clients who have global banking needs.

- Vostro account services include executing wire transfers, performing foreign exchange transactions, enabling deposits and withdrawals, and expediting international trade.

What is Rupee Payment Mechanism?

- About:

- Authorized Dealer Banks in India had been permitted to open Rupee Vostro Accounts.

- Indian importers undertaking imports via this mechanism will make payment in INR which will be credited into the Special Vostro account of the correspondent bank of the partner country, against the invoices for the supply of goods or services from the overseas seller.

- Indian exporters using the mechanism will be paid the export proceeds in INR from the balances in the designated Special Vostro account of the correspondent bank of the partner country.

- Indian exporters may receive advance payment against exports from overseas importers in Indian rupees through the above Rupee Payment Mechanism.

- Before allowing any such receipt of advance payment against exports, Indian banks need to ensure that available funds in these accounts are first used towards payment obligations arising out of already executed export orders/export payments in the pipeline.

- Balance in Special Vostro Accounts can be used for: payments for projects and investments, export/ import advance flow management, and investment in Government Treasury Bills, Government securities, etc.

- Authorized Dealer Banks in India had been permitted to open Rupee Vostro Accounts.

- Existing Mechanism:

- If a company exports or imports, transactions are always in a foreign currency (excluding with countries like Nepal and Bhutan).

- So, in case of imports, the Indian company has to pay in a foreign currency (mainly dollars and could also include currencies like pounds, Euro, yen etc.).

- The Indian company gets paid in foreign currency in case of exports and the company converts that foreign currency to rupee since it needs rupee for its needs, in most of the cases.

What are the Benefits of this Mechanism?

- Promote Growth:

- It will promote growth of global trade and will support the increasing interest of the global trading community in INR.

- Trade with Sanctioned Countries:

- Ever since sanctions were imposed on Russia, trade has been virtually at standstill with the country due to payment problems.

- As a result of the trade facilitation mechanism introduced by the RBI we see the payment issues with Russia easing.

- Ever since sanctions were imposed on Russia, trade has been virtually at standstill with the country due to payment problems.

- Forex Fluctuation:

- The move would also reduce the risk of forex fluctuation, especially looking at the Euro-Rupee parity.

- Arrest Fall of Rupee:

- Amid ongoing rupee weakness, this mechanism aims at reducing demand for foreign exchange, by promoting rupee settlement of trade flows.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Convertibility of rupee implies (2015)

(a) being able to convert rupee notes into gold

(b) allowing the value of rupee to be fixed by market forces

(c) freely permitting the conversion of rupee to other currencies and vice versa

(d) developing an international market for currencies in India

Ans: (c)

Indian Polity

Religious Conversion

For Prelims: States that have passed anti conversion laws, Constitutional provisions on freedom of religion, Article 21 of the Constitution, Articles 14, 21, 25 of the Constitution.

For Mains: Anti-conversions laws and associated issues, Related Supreme Court judgements.

Why in News?

Recently, the Supreme Court has asked the Centre to step in and make very serious and sincere efforts to tackle the issue of Forced Religious Conversion.

What was Petition and the Court's Ruling?

- The petition sought a declaration that fraudulent religious conversion by “intimidation, threatening, deceivingly luring through gifts and monetary benefits” offends Articles 14, 21, 25 of the Constitution.

- The plea pointed out that in the 1977 ruling in the Rev Stainislaus versus State of Madhya Pradesh case, the Supreme Court had said: “It has to be remembered that Article 25(1) guarantees ‘freedom of conscience’ to every citizen, and not merely to the followers of one particular religion and that, in turn, postulates that there is no fundamental right to convert another person to one’s own religion.

- The SC, while hearing the petition sought directions to the Centre and states to take stringent steps to check such conversions.

- The court has said that forced conversion is very dangerous and may affect security of the nation and freedom of religion and conscience.

- This is because if a person purposely undertakes the conversion of another person to his religion, as distinguished from his effort to transmit or spread the tenets of his religion, that would impinge on the freedom of conscience guaranteed to all the citizens of the country alike.

What is Religious Conversion?

- Religious conversion is the adoption of a set of beliefs identified with one particular religious denomination to the exclusion of others.

- Thus "religious conversion" would describe the abandoning of adherence to one denomination and affiliating with another.

- For example, Christian Baptist to Methodist or Catholic, Muslim Shi'a to Sunni.

- In some cases, religious conversion "marks a transformation of religious identity and is symbolized by special rituals".

What is the Need for Anti-Conversion Laws?

- No Right to Proselytize:

- The Constitution confers on each individual the fundamental right to profess, practice and propagate his religion.

- Proselytizing is the act of trying to convert another individual from the convertee's religion to the converter's religion.

- The individual right to freedom of conscience and religion cannot be extended to construe a collective right to proselytize.

- For the right to religious freedom belongs equally to the person converting and the individual sought to be converted.

- The Constitution confers on each individual the fundamental right to profess, practice and propagate his religion.

- Fraudulent Marriages:

- In the recent past, several instances have come to the notice that whereby people marry persons of other religion by either misrepresentation or concealment of their own religion and after getting married they force such other person to convert to their own religion.

- SC Observations:

- Recently, the Supreme Court took judicial notice of instances of people marrying by either misrepresentation or concealment of their own religion.

- According to the court, such incidents not only infringe the freedom of religion of the persons so converted but also militate against the secular fabric of our society.

What is the Status of Anti-Conversion Laws in India?

- Constitutional Provision:

- The Indian Constitution under Article 25 guarantees the freedom to profess, propagate, and practice religion, and allows all religious sections to manage their own affairs in matters of religion, subject to public order, morality, and health.

- However, no person shall force their religious beliefs and consequently, no person should be forced to practice any religion against their wishes.

- Existing Laws:

- There has been no central legislation restricting or regulating religious conversions.

- However, since 1954, on multiple occasions, Private Member Bills have been introduced in (but never approved by) Parliament, to regulate religious conversions.

- Further, in 2015, the Union Law Ministry stated that Parliament does not have the legislative competence to pass anti-conversion legislation.

- Anti-Conversion Laws in Various States:

- Over the years, several states have enacted ‘Freedom of Religion’ legislation to restrict religious conversions carried out by force, fraud, or inducements.

- Orissa Freedom of Religion Act, 1967, Gujarat Freedom of Religion Act, 2003, Jharkhand Freedom of Religion Act, 2017, Uttarakhand Freedom of Religious Act, 2018, The Karnataka Protection of Right to Freedom of Religion Act, 2021.

- Over the years, several states have enacted ‘Freedom of Religion’ legislation to restrict religious conversions carried out by force, fraud, or inducements.

What are the Issues Associated with Anti-Conversion Laws?

- Uncertain and Vague Terminology:

- The uncertain and vague terminology like misrepresentation, force, fraud, allurement presents a serious avenue for misuse.

- These terms leave room for ambiguities or are too broad, extending to subjects far beyond the protection of religious freedom.

- Antithetical to Minorities:

- Another issue is that the present anti-conversion laws focus more on the prohibition of conversion to achieve religious freedom.

- However, the broad language used by the prohibitive legislation might be used by officials to oppress and discriminate against minorities.

- Antithetical to Secularism:

- These laws may pose a threat to the secular fabric of India and the international perception of our society’s intrinsic values and legal system.

Way Forward

- The governments implementing such laws need to ensure that these do not curb one’s Fundamental Rights or hamper the national integration instead, these laws need to strike a balance between freedoms and malafide conversions.

Biodiversity & Environment

Climate Change and Global Health

For Prelims: Climate Change, fossil fuels, food insecurity, heatwave, zoonotic diseases, communicable disease, WHO

For Mains: Impact of Climate change on Global Health, Environmental Pollution & Degradation

Why in News?

According to the Lancet Countdown report on Health and Climate Change: Health at the Mercy of Fossil Fuels, reliance on fossil fuels is increasing the risk of disease, food insecurity and other illnesses related to heat.

What are the Findings of the Report?

- Impact on Health:

- Climate change affects the social and environmental determinants of health — clean air, safe drinking water, sufficient food and secure shelter.

- Population Exposed to Heatwave:

- Rapidly increasing temperatures exposed people, especially vulnerable populations (adults above 65 years old and children younger than one) to 3.7 billion more heatwave days in 2021 than annually in 1986–2005.

- Infectious Diseases:

- The changing climate is affecting the spread of infectious disease, raising the risk of emerging diseases and co-epidemics.

- For instance, it records that coastal waters are becoming more suited for the transmission of Vibrio pathogens.

- The number of months suitable for malaria transmission has increased in the highland areas of the Americas and Africa.

- The World Health Organization (WHO) has predicted that between 2030 and 2050, climate change is expected to cause approximately 2,50,000 additional deaths per year, from malnutrition, malaria, diarrhoea and heat stress.

- Food Security:

- Every dimension of food security is being affected by climate change.

- Higher temperatures threaten crop yields directly, with the growth season shortening for many cereal crops.

- Extreme weather events disrupt supply chains, thereby undermining food availability, access, stability, and utilisation.

- The prevalence of undernourishment increased during the Covid-19 pandemic, and up to 161 million more people face hunger in 2020 than in 2019.

- This situation is now worsened by Russia’s invasion of Ukraine.

- Fossil Fuel:

- The Russia-Ukraine war has led many countries to search for alternative fuels to Russian oil and gas, and some of them are still turning back to traditional thermal energy.

- Even if it were a temporary transition, renewed interest in coal could reverse gains in air quality and accelerate climate change that threatens human survival.

What are the Suggestions?

- Health-Centric Response:

- A health-centred response to the coexisting climate, energy, and cost-of-living crisis provides an opportunity to deliver a healthy, low-carbon future.

- Improvements in air quality will help prevent deaths resulting from exposure to fossil fuel-derived ambient PM2.5, and the stress on low-carbon travel and increase in urban spaces would result in promoting physical activity which would have an impact on physical and mental health.

- A health-centred response to the coexisting climate, energy, and cost-of-living crisis provides an opportunity to deliver a healthy, low-carbon future.

- Transition to Balanced and More Plant-Based Diets:

- An accelerated transition to balanced and more plant-based diets would help reduce emissions from red meat and milk production, and prevent diet-related deaths, besides substantially reducing the risk of zoonotic diseases.

- This sort of health-focused shifts would reduce the burden of communicable and non-communicable diseases, reduce the strain on health-care providers, and leading to more robust health systems.

- Global Coordination:

- Global coordination, funding, transparency, and cooperation between governments, communities, civil society, businesses, and public health leaders is required to reduce or prevent the vulnerabilities that the world is otherwise exposed to.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. ‘Climate change’ is a global problem. How India will be affected by climate change? How Himalayan and coastal states of India will be affected by climate change? (2017)

Biodiversity & Environment

India’s Net Zero Strategy

For Prelims: Paris Agreement, United Nations Conference on Climate Change (COP 27), Nationally Determined Contributions (NDC), Net zero, ethanol blending, Hydrogen fuel, Perform, Achieve and Trade (PAT) scheme, National Hydrogen Mission, Biofuel

For Mains: Paris Climate Agreement and its Impacts.

Why in News?

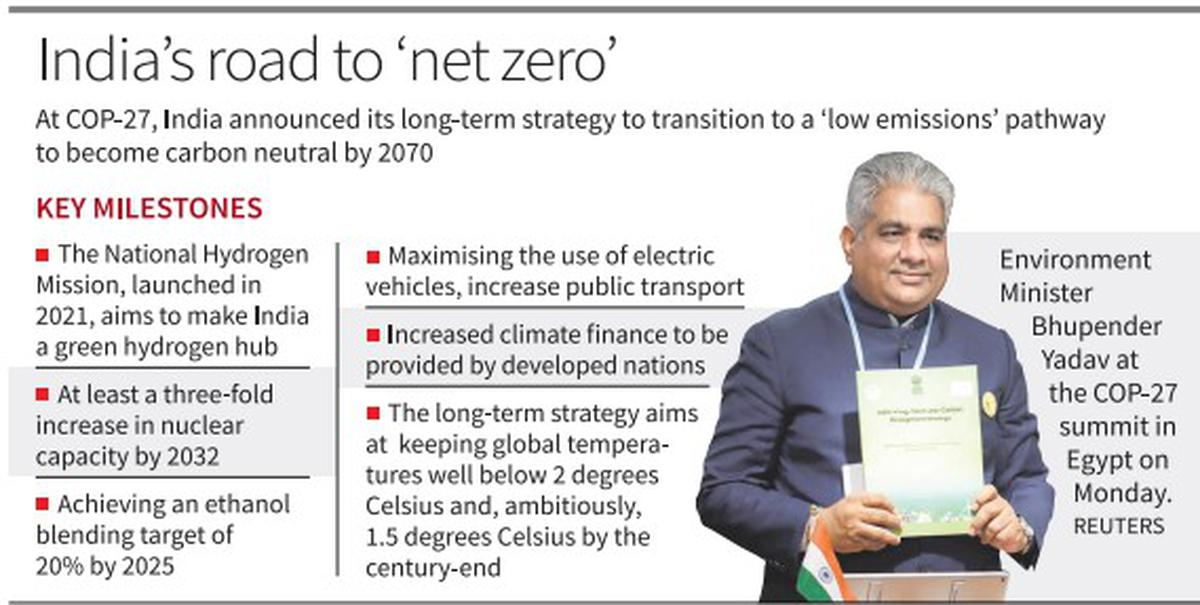

Recently, India submitted its Long-Term Low Emission Development Strategy to the United Nations Framework Convention on Climate Change (UNFCCC) at ongoing 27th Conference of Parties (COP27) in Sharm el-Sheikh, Egypt.

What is a Long-Term Low Emissions Development Strategy?

- The LT-LEDS are qualitative in nature and are a requirement emanating from the 2015 Paris Agreement.

- Under the Paris agreement, countries must explain how they will transition their economies beyond achieving near-term Nationally Determined Contributions (NDCs) targets and work towards the larger climate objective of cutting emissions by 45% by 2030 and achieve net zero around 2050.

- The Strategy is based on four key considerations that underpin India’s long-term low-carbon development strategy.

- India has contributed little to global warming, its historical contribution to cumulative global GreenHouse Gases emissions being minuscule despite having a share of ~17% of the world’s population

- India has significant energy needs for development

- India is committed to pursuing low-carbon strategies for development and is actively pursuing them, as per national circumstances

- India needs to build climate resilience

- The LT-LEDS is also informed by the vision of LiFE, Lifestyle for the Environment.

- LiFE calls for a world-wide paradigm shift from mindless and destructive consumption to mindful and deliberate utilization.

What are the Features of the LT-LEDS?

- The strategy will focus on rational utilization of national resources with due regard to energy security.

- The transitions from fossil fuels will be undertaken in a just, smooth, sustainable and all-inclusive manner.

- The strategy will promote increased use of biofuels, especially ethanol blending in petrol, the drive to increase electric vehicle penetration, and the increased use of green hydrogen fuel are expected to drive the low carbon development of the transport sector.

- India aspires to maximize the use of electric vehicles, ethanol blending to reach 20% by 2025, and a strong modal shift to public transport for passenger and freight.

- Low-base, future sustainable, and climate-resilient urban development will be driven by smart city initiatives, integrated planning of cities for mainstreaming adaptation and enhancing energy and resource efficiency, effective green building codes and rapid developments in innovative solid and liquid waste management.

- The industrial sector will continue in the perspective of ‘Aatmanirbhar Bharat’ and ‘Make in India’.

- India will also focus on improving energy efficiency by the Perform, Achieve and Trade (PAT) scheme, the National Hydrogen Mission, increasing electrification, enhancing material efficiency, and recycling and ways to reduce emissions.

What is Net Zero Target?

- It is referred to as carbon neutrality, which does not mean that a country would bring down its emissions to zero.

- Rather, it is a state in which a country’s emissions are compensated by the absorption and removal of greenhouse gases from the atmosphere.

- Further, absorption of the emissions can be increased by creating more carbon sinks such as forests.

- While the removal of gases from the atmosphere requires futuristic technologies such as carbon capture and storage.

- Further, absorption of the emissions can be increased by creating more carbon sinks such as forests.

- More than 70 countries have promised to become Net Zero by the middle of the century i.e., by 2050.

- India has promised to cut its emissions to net zero by 2070 at the conference of parties-26(COP) summit.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. The term ‘Intended Nationally Determined Contributions’ is sometimes seen in the news in the context of (2016)

(a) pledges made by the European countries to rehabilitate refugees from the war-affected Middle East

(b) plan of action outlined by the countries of the world to combat climate change

(c) capital contributed by the member countries in the establishment of the Asian Infrastructure Investment Bank

(d) plan of action outlined by the countries of the world regarding Sustainable Development Goals

Ans: (b)

Exp:

- Intended Nationally Determined Contributions is the term used under the UNFCCC for reductions in greenhouse gas emissions in all countries that signed the Paris Agreement.

- At COP 21 countries across the globe publicly outlined the actions they intended to take under the international agreement. The contributions are in the direction to achieve the long-term goal of the Paris Agreement; “to hold the increase in global average temperature to well below 2°C to pursue efforts to limit the increase to 1.5°C, and to achieve net zero emissions in the second half of this century.” Therefore, option (b) is the correct answer.

Mains

Q. Describe the major outcomes of the 26th session of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC). What are the commitments made by India in this conference? (2021)

Indian Economy

Financing India’s Urban Infrastructure

For Prelims: World Bank, Urban Local Bodies, Smart Cities Mission (SCM), Pradhan Mantri Awas Yojana (PMAY)

For Mains: Urbanisation and related issues

Why in News?

Recently, the report, titled “Financing India’s Urban Infrastructure Needs: Constraints to Commercial Financing and Prospects for Policy Action” was released by the World bank.

- The report underlines the urgent need to leverage more private and commercial investments to meet emerging financial gaps.

What are the Highlights of the Report?

- Investment Required:

- India will need to invest USD 840 billion over the next 15 years into urban infrastructure if it is to effectively meet the needs of its fast-growing urban population.

- People Living in Urban Cities:

- By 2036, 600 million people will be living in urban cities in India, representing 40% of the population.

- This is likely to put additional pressure on the already stretched urban infrastructure and services of Indian cities – with more demand for clean drinking water, reliable power supply, efficient and safe road transport amongst others.

- Currently, the central and state governments finance over 75% of city infrastructure, while Urban Local Bodies (ULB) finance 15% through their own surplus revenues.

- Only 5% of the infrastructure needs of Indian cities are currently being financed through private sources.

- By 2036, 600 million people will be living in urban cities in India, representing 40% of the population.

- Slow Implementation of Centre’s Flagship Urban Missions:

- There has also been slow implementation performance by states and Urban Local Bodies (ULBs) on several of the Centre’s flagship Urban Missions— such as the Smart Cities Mission (SCM) and the Pradhan Mantri Awas Yojana (PMAY) for instance— due to constraints on implementation capacity at the city level.

- ULBs across India have so far executed only about one-fifth of the cumulative cost or outlay of approved projects under SCM and (Atal Mission for Rejuvenation and Urban Transformation (AMRUT) over the last six financial years.

- There has also been slow implementation performance by states and Urban Local Bodies (ULBs) on several of the Centre’s flagship Urban Missions— such as the Smart Cities Mission (SCM) and the Pradhan Mantri Awas Yojana (PMAY) for instance— due to constraints on implementation capacity at the city level.

- PPP transactions for Urban Infrastructure:

- Public Private Partnership (PPP) transactions for urban infrastructure in India registered a marked decline in the last decade both in monetary value and transaction volume— 124 PPP projects have been awarded in the urban sector since the year 2000 worth a total cost of USD5.5 billion.

- However, PPP project awards have declined substantially after a “brief but substantial spike” between the years 2007 and 2012 when most of these projects were awarded. Only one-third of all PPP investments awarded since 2000 came in the last decade— including 55 projects worth USD17 billion,

What are the Suggestions?

- It is recommended to expand the capacities of city agencies to deliver infrastructure projects at scale.

- Currently, the 10 largest ULBs were able to spend only two-thirds of their total capital budget over three recent fiscal years.

- Over the medium term, the report suggests a series of structural reforms including those in the taxation policy and fiscal transfer system.

- It can allow cities to leverage more private financing.

- It recommended making the transfer of funds to cities formula-based and unconditional and increasing the mandates of city agencies gradually.

What is Urbanisation?

- About:

- Urbanization refers to the population shift from rural to urban areas, the corresponding decrease in the proportion of people living in rural areas, and the ways in which societies adapt to this change.

- Causes of Urbanisation:

- Natural Increase of Population: It occurs when the number of births exceeds the number of deaths.

- Rural to Urban Migration: It is driven by pull factors (that attract people to urban areas) and push factors (that drive people away from the rural areas).

- Employment opportunities, educational institutions and urban lifestyle are the main pull factors.

- Poor living conditions, lack of educational and economic opportunities and poor health care facilities are the main push factors.

- Global Urbanisation:

- The most urbanized regions include Northern America (with 83% of its population living in urban areas (as of 2022), Latin America and the Caribbean (81%), Europe (75%) and Oceania (67%).

- The level of urbanization in Asia is now approximately 52%.

- Africa remains mostly rural, with 44% of its population living in urban areas.

- Related Initiatives:

- India’s Initiatives for Urbanisation:

- Schemes/Programmes Related to Urban Development:

- Government Initiatives for Slum Dwellers/Urban Poor:

- India’s Initiatives for Urbanisation:

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Discuss the various social problems which originated out of the speedy process of urbanization in India. (2013)

Q. With a brief background of quality of urban life in India, introduce the objectives and strategy of the ‘Smart City Programme.”(2016)

Important Facts For Prelims

Leadership For Industry Transition Summit

Why in News?

India and Sweden hosted the Leadership for Industry Transition (LeadIT) Summit, on the sidelines of COP27 at Sharm El Sheikh in Egypt.

- The summit was followed by the public launch of the LeadIT Summit Statement 2022 in the India Pavilion at COP27.

What are the Highlights of the Summit?

- LeadIT members re-emphasized the commitment to pursuing the low-carbon transition.

- The event included roundtable discussions that focused on finance and other cross-sectoral issues and views on the requirements for successful low-carbon transitions.

- The members also committed to providing technical assistance to new members and emerging economies. The importance of de-risking investments in the transition of heavy industries in emerging and developing countries was also highlighted.

- The summit concluded with the adoption of the summit statement by the members of LeadIT .

What is LeadIT?

- About:

- The LeadIT initiative lays specific focus on hard to abate sectors that are key stakeholders in the global climate action and require specific interventions.

- It gathers countries and companies that are committed to action to achieve the Paris Agreement.

- It was launched by the governments of Sweden and India at the UN Climate Action Summit in 2019 and is supported by the World Economic Forum.

- LeadIT members subscribe to the notion that energy-intensive industries can and must progress on low-carbon pathways, aiming to achieve net-zero carbon emissions by 2050.

- Members:

- The total membership of LeadIT is 37 including countries and companies together.

- Japan and South Africa, the latest members of the initiative.

- The total membership of LeadIT is 37 including countries and companies together.

Important Facts For Prelims

Photonic Crystal

Why in News?

A soft tunable photonic crystal with enhanced thermal stability and optical purity developed by researchers that reflects vivid colours in the visible spectrum has potential applications in making more durable and better reflective displays and laser devices.

What are Photonic Crystals?

- About:

- Photonic crystals are optical nanostructures in which the refractive index changes periodically.

- Refractive index, also called index of refraction is the measure of the bending of a ray of light when passing from one medium into another.

- This affects the propagation of light in the same way that the structure of natural crystals gives rise to X-ray diffraction and that the atomic lattices (crystal structure) of semiconductors affect their conductivity of electrons.

- Photonic crystals occur in nature in the form of structural coloration and animal reflectors.

- Examples found in nature include opal, butterfly wings, peacock feathers, etc., exhibiting distinct iridescent colours.

- Photonic crystals are optical nanostructures in which the refractive index changes periodically.

- Uses:

- Photonic crystals promise to be useful in a range of applications ranging from reflection coatings to optical computers when artificially produced or engineered in laboratories.

- They enable the PCs to exhibit structural colours in the visible spectral regime.

- Researchers have also been on the constant lookout for tuning the properties in-situ post-fabrication.

- The development of advanced photonic materials and devices using Liquid Crystals (LC) that exhibit self-organization, phase transitions, and molecular orientation behaviors in response to external stimuli is attracting significant interest.

Important Facts For Prelims

National Press Day

Why in News?

National Press Day is celebrated across India every year on 16th November to commemorate the setting up of the Press Council of India.

What is the Press Council of India?

- About:

- It was first set up in 1966 under the Indian Press Council Act, 1965, on the recommendations of the first Press Commission, with the two-fold objective of preserving the freedom of the press by maintaining and improving the standards of newspapers and the news agencies in India

- As a quasi-judicial autonomous authority, it was reestablished in the year 1979 under an Act of Parliament, Press Council Act, 1978.

- The Press Council of India is the only body to exercise an authority even over the instruments of the State in its duty to safeguard the independence of the press.

- Structure:

- The Council is a body corporate having perpetual succession consisting of a Chairman and 28 members.

- The Chairman is selected by the Speaker of the Lok Sabha, the Chairman of the Rajya Sabha and a member elected amongst themselves by the 28 members of the Council.

- The Council is a body corporate having perpetual succession consisting of a Chairman and 28 members.

- Objectives:

- To preserve the freedom of the Press.

- To maintain and improve the standards of newspapers and news agencies in India.

- Roles & Responsibilities:

- Role:

- The council can undertake studies and express its opinion in regard to any bill, legislation, law or other matters concerning the Press and convey its opinion to the Government or the persons concerned.

- In matters of public importance, the Council may take cognizance and constitute a Special Committee to make an on-the-spot inquiry.

- Responsibilities:

- To help newspapers and news agencies to maintain their independence.

- To build up a code of conduct for newspapers, news agencies and journalists in accordance with high professional standards.

- To ensure on the part of the newspapers, news agencies and journalists, the maintenance of high standards of public taste and foster a due sense of both the rights and responsibilities.

- Role: