Governance

Supreme Court Invalidates Electoral Bonds Scheme

For Prelims: Supreme Court of India, Electoral Bond, Right to Information, Representation of the People Act (RPA), 1951, Finance Act, 2017, Proportionality test, Electoral trusts scheme

For Mains: Right to Information, Transparency & Accountability, Electoral Bonds Scheme

Why in News?

In a landmark decision, a five-judge Constitution Bench of the Supreme Court (SC) of India unanimously struck down the Electoral Bond Scheme (EBS) and associated amendments as unconstitutional, sparking significant ramifications for political financing in India.

- The SC asserted that the EBS violated the fundamental right to information guaranteed under Article 19(1)(a) of the Constitution.

What is the SC Ruling on the Electoral Bond Scheme?

- The SC declared the EBS and the amendments made to the Finance Act, 2017, the Representation of the People Act (RPA), 1951, the Income Tax Act, 1961, and the Companies Act, 2013, as unconstitutional.

- Before these amendments, political parties were subject to stringent requirements, including declaration of contributions above Rs 20,000 and a cap on corporate donations.

- Restoration of Status Quo by SC:

- The SC's judgement reinstated the legal framework before the Finance Act, 2017, in several statutes crucial to political party funding.

- Representation of the People Act, 1951:

- Section 29C mandated political parties to disclose donations exceeding Rs 20,000, balancing the right to information with donor privacy.

- Finance Act, 2017 Intervention:

- Introduced an exception exempting donations via Electoral Bonds from disclosure requirements.

- SC Verdict:

- Struck down the amendment, emphasising the importance of transparency and privacy balance.

- Companies Act, 2013:

- Section 182 restricted corporate donations, imposing a cap (7.5% of the average profits of the preceding three fiscal years) and disclosure requirements.

- Finance Act, 2017 Intervention:

- Removed the cap and disclosure obligations for corporate donations.

- SC Verdict:

- Nullified the amendment, citing concerns about unchecked corporate influence on elections.

- Income-tax Act, 1961:

- Section 13A(b) mandated the maintenance of records for contributions above Rs 20,000.

- Finance Act, 2017 Intervention:

- Exempted Electoral Bond contributions from record-keeping requirements.

- SC Verdict:

- Struck down the amendment, upholding voters' right to information.

- Proportionality Test:

- The SC applied the proportionality test to examine whether the scheme violated the right to information of the voters and the transparency of the electoral process.

- The proportionality test serves as a crucial judicial standard to evaluate the balance between state action and individual fundamental rights.

- The Constitution protects fundamental rights outlined in Part III, including the right to free speech (Article 19(1)). Any interference with these rights must comply with "reasonable restrictions" specified in Article 19(2), assessed through the proportionality test.

- Article 19(2) allows the government to impose reasonable restrictions on freedom of speech and expression.

- These restrictions can be in the interests of the sovereignty and integrity of India, the security of the State, friendly relations with Foreign States, public order, decency or morality or in relation to contempt of court, defamation or incitement to an offence.

- Article 19(2) allows the government to impose reasonable restrictions on freedom of speech and expression.

- The Constitution protects fundamental rights outlined in Part III, including the right to free speech (Article 19(1)). Any interference with these rights must comply with "reasonable restrictions" specified in Article 19(2), assessed through the proportionality test.

- The proportionality test gained prominence in the K.S. Puttaswamy v. Union of India, 2017 ruling, affirming privacy as a fundamental right.

- Upheld in the Aadhaar Act ruling of 2018, the proportionality test ensures that state actions do not disproportionately infringe upon fundamental rights while pursuing legitimate government interests.

- Government's Argument and State Interests:

- The government argued that curbing black money and protecting donor anonymity are legitimate state interests.

- Donor anonymity was presented as essential for upholding the right to privacy of donors, a fundamental right.

- The government contended that the right to information doesn't extend to seeking information that is not in the state's possession or knowledge.

- The government argued that curbing black money and protecting donor anonymity are legitimate state interests.

- SC Stance:

- The Court dismissed donor anonymity as a legitimate state aim, prioritising the voters' right to information under Article 19(1)(a) of the Constitution over anonymity.

- It emphasised the crucial role of the right to information in fostering participatory democracy and holding the government accountable.

- SC applied the concept of the "double proportionality" test. This approach involves balancing competing fundamental rights here, the right to information and the right to privacy.

- SC highlighted that the proportionality test applies when rights clash with state action. But for balancing both rights, the court goes further, ensuring the state chooses the least restrictive methods for both rights and avoids disproportionate impacts.

- SC highlighted the availability of less intrusive methods, such as the electoral trusts scheme, to achieve the state's objectives effectively.

- The Court dismissed donor anonymity as a legitimate state aim, prioritising the voters' right to information under Article 19(1)(a) of the Constitution over anonymity.

- Directions Issued:

- The State Bank of India (SBI) has been ordered to immediately stop the issuance of any further electoral bonds and furnish details of such bonds purchased by political parties since 12th April 2019, to the Election Commission of India (ECI). Such details must include the date of purchase of each bond, the name of the purchaser of the bond and the denomination of the bond purchased.

- The ECI shall subsequently publish all such information shared by the SBI on its official website by 13th March 2024.

- Electoral bonds within the validity period but not encashed by political parties must be returned, with refunds issued to purchasers by the issuing bank.

What are Electoral Bonds?

- About:

- Electoral bonds, the scheme introduced in 2018 allowing anonymous funding to political parties.

- These bonds function as financial instruments, akin to promissory notes or bearer bonds, specifically designed for contributions to political parties.

- The EBS was first announced in the 2017 Budget Session. It was later notified in January 2018 as a source of political funding through amendments to the Finance Act of 2017, the Representation of the People Act of 1951, the Income Tax Act of 1961, and the Companies Act of 2013, to enable the Electoral Bonds Scheme.

- The amendments allowed electoral bonds to cut through many of the restrictions on political party funding by completely doing away with the donation limit for companies and removing the requirements to declare and maintain a record of donations through electoral bonds.

- Electoral bonds, the scheme introduced in 2018 allowing anonymous funding to political parties.

- Donations Through Electoral Bonds:

- Electoral bonds are issued by the State Bank of India (SBI) and its designated branches and are sold in multiple denominations of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh, and Rs 1 crore.

- Donors can purchase electoral bonds through a Know Your Customer (KYC)- compliant account and subsequently transfer the funds to political parties.

- Donors, whether individuals or companies, can purchase these bonds, and the identities of the donors remain confidential, both to the bank and the recipient political parties.

- Donations made via electoral bonds enjoyed 100% tax exemption under the scheme.

- Notably, there is no limit on the number of electoral bonds that a person or company can purchase.

- Eligibility to Receive Funds via Electoral Bonds:

- Only political parties registered under Section 29A of the RPA, 1951, and which secured not less than 1% of the votes polled in the last elections to the Lok Sabha or a state legislative assembly, are eligible to receive electoral bonds.

What are the Recommendations on Funding of Political Parties?

- Indrajit Gupta Committee on State Funding of Elections, 1998:

- Endorsed state funding of elections to establish a fair playing field for parties with less financial resources.

- Recommended limitations:

- State funds to be allocated only to national and state parties with allotted symbols, not independent candidates.

- Initially, state funding should be provided in kind, offering certain facilities to recognised political parties and their candidates.

- Acknowledged economic constraints, advocating partial rather than full state funding.

- Election Commission's Recommendations:

- The 2004 report of the Election Commission emphasised the necessity for political parties to publish their accounts annually, allowing scrutiny by the general public and concerned entities.

- Audited accounts, ensuring accuracy, should be made public, with auditing performed by Comptroller and Auditor General-approved firms.

- The 2004 report of the Election Commission emphasised the necessity for political parties to publish their accounts annually, allowing scrutiny by the general public and concerned entities.

- Law Commission, 1999:

- Described total state funding of elections as "desirable" under the condition that political parties are prohibited from receiving funds from other sources.

- The Law Commission's 1999 report proposed amending the RPA, 1951, introducing section 78A for maintenance, audit, and publication of political party accounts, with penalties for non-compliance.

How does Global Political Funding Differ from India?

- Emphasis on Parties vs. Candidates:

- Global Example:

- In the United States, political funding often centres around individual candidates, with extensive fundraising efforts directed towards supporting their campaigns.

- India's Context:

- Conversely, India and other parliamentary systems prioritise funding frames centred on political parties, where donations are channelled to support party activities and campaigns collectively.

- Global Example:

- Donations Regulation:

- Global Practice:

- Many jurisdictions impose bans or limits on certain donors, such as foreign entities or corporations, to prevent undue influence in political funding.

- For instance, US federal law imposes varying contribution limits based on the type of donor.

- Conversely, countries like the UK do not set contribution limits but instead opt for expenditure limits as a method of regulation.

- India's Context:

- India regulates donations but lacks specific limits on individual contributions. This contrast raises concerns about the potential influence of large donors in Indian politics.

- Global Practice:

- Expenditure Limits:

- Global Norms:

- Expenditure caps are common in global funding frameworks to mitigate financial dominance and ensure a level playing field for candidates or parties.

- Jurisdictions like the UK enforce expenditure limits on political parties, such as the restriction of not spending more than 30,000 Euros (approximately Rs 30 lakh) per seat.

- Expenditure caps are common in global funding frameworks to mitigate financial dominance and ensure a level playing field for candidates or parties.

- India's Context:

- India's regulatory landscape lacks legal expenditure limits on parties, allowing them to spend freely on campaigns, potentially distorting electoral outcomes.

- Global Norms:

- Public Financing:

- Global Trend:

- Many countries offer public funding for political parties based on various criteria.

- For example, in Germany, parties receive funds based on factors like past election performance, membership fees, and private donations. Additionally, political party foundations receive state funding.

- Seattle, US, has experimented with "democracy vouchers," where eligible voters receive vouchers to donate to their chosen candidates.

- Indian Context:

- India's public financing mechanisms are limited, with initiatives like the Electoral Bonds Scheme raising concerns over transparency and accountability.

- Global Trend:

- Balancing Transparency and Anonymity:

- International Practices:

- Many jurisdictions aim to balance transparency and anonymity by allowing small donors to remain anonymous while requiring disclosures for large donations.

- For instance, in the UK, parties must report donations exceeding 7,500 pounds in a calendar year, while in Germany, the limit is 10,000 Euros.

- The rationale behind this approach is that small donors are less likely to wield significant influence and are more vulnerable to victimisation, while large donors are more prone to engage in quid pro quo arrangements.

- Indian Context:

- In contrast, India lacks donation limits on individuals and legal expenditure caps on parties, allowing unrestricted spending on campaigns.

- International Practices:

- Chilean Experiment:

- The Chilean experiment aimed to achieve anonymity in party funding to prevent quid pro quo arrangements.

- Under this system donors could transfer money to the Electoral Service, which would then forward it to the party without revealing the donor's identity.

- However, coordination between donors and parties undermined the system's effectiveness, as revealed by scandals in 2014-15.

- The Chilean experiment aimed to achieve anonymity in party funding to prevent quid pro quo arrangements.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. ‘Right to Privacy’ is protected under which Article of the Constitution of India? (2021)

(a) Article 15

(b) Article 19

(c) Article 21

(d) Article 29

Ans: (c)

Q2. Right to Privacy is protected as an intrinsic part of Right to Life and Personal Liberty. Which of the following in the Constitution of India correctly and appropriately imply the above statement? (2018)

(a) Article 14 and the provisions under the 42nd Amendment to the Constitution.

(b) Article 17 and the Directive Principles of State Policy in Part IV.

(c) Article 21 and the freedoms guaranteed in Part III.

(d) Article 24 and the provisions under the 44th Amendment to the Constitution.

Ans: (c)

Mains

Q. The Right to Information Act is not all about citizens’ empowerment alone, it essentially redefines the concept of accountability.” Discuss. (2018)

Q. Examine the scope of Fundamental Rights in the light of the latest judgement of the Supreme Court on Right to Privacy. (2017)

International Relations

India-UAE Relations

For Prelims: India-UAE Relations, Bilateral Investment Treaty (BIT), FDI (Foreign DIrect Investment), India-Middle East Economic Corridor (IMEC).

For Mains: India-UAE Relations, Economic and Strategic Significance of India UAE Relation, Measures to boost bilateral relations.

Why in News?

Recently, India and the United Arab Emirates (UAE) have signed eight pacts to bolster cooperation in key areas such as investments, electricity trade and digital payment platforms.

What are the Key Highlights of the Pact Signed Between India-UAE?

- Interlinking of Digital Payment Platforms:

- Interlinking of UPI and AANI:

- The two countries signed agreements on interlinking of digital payment platforms- UPI (India) and AANI (UAE).

- This will facilitate seamless cross-border transactions between India and UAE, enhancing financial connectivity and cooperation.

- Interlinking Domestic Debit/Credit Cards (RuPay and JAYWAN):

- Both countries signed a pact on interlinking domestic debit/ credit cards — RuPay (India) with JAYWAN (UAE).

- It is an important step in building financial sector cooperation and it will enhance the universal acceptance of RuPay across the UAE.

- UAE’s domestic card JAYWAN is based on the digital RuPay credit and debit card stack.

- Interlinking of UPI and AANI:

- Bilateral Investment Treaty:

- Both Countries signed Bilateral Investment Treaty (BIT), which is seen to be a “Key Enabler” for further investments in both countries.

- UAE has been a significant investor in India's infrastructure sector.

- In 2022-2023, UAE was the fourth biggest FDI (Foreign DIrect Investment) investor for India. It has committed to invest USD 75 billion in India’s infrastructure sector.

- Intergovernmental Framework Agreement on India-Middle East Economic Corridor (IMEC):

- It aims to be built to foster India-UAE cooperation, furthering regional connectivity. The IMEC was announced on the sidelines of the G20 leaders’ summit in New Delhi in September 2023.

- Energy Cooperation:

- The two sides also signed pacts on cooperation in the field of electrical interconnection and trade, which “opens new areas of collaboration in the field of energy, including energy security and energy trade.

- UAE being among the largest sources of crude and LPG, India is now entering into long-term contracts for LNG.

- Cultural Cooperation:

- The two countries signed a “cooperation protocol between the National Archives of the two countries” to restore and preserve archival material.

- Both countries aimed at supporting the Maritime Heritage Complex at Lothal, Gujarat,”.

- Gratitude for BAPS Temple Construction:

- India thanked the UAE for its support in granting land for the construction of the BAPS Temple in Abu Dhabi, emphasizing the significance of the temple as a symbol of UAE-India friendship and cultural bonds.

- Port Infrastructure Development:

- Agreements signed between RITES Limited and Gujarat Maritime Board with Abu Dhabi Ports Company to enhance port infrastructure and connectivity between India and the UAE.

- Bharat Mart:

- The foundation stone of Bharat Mart, which will combine retail, warehousing and logistics facilities at Jebel Ali Free Trade Zone in Dubai, was laid by the Indian Prime MInister.

- Bharat Mart can potentially play a key role in promoting the exports of India’s micro, small and medium sectors by providing them with a platform to reach international buyers in the Gulf, West Asia, Africa and Eurasia.

What is BAPS Temple?

- About:

- BAPS (Bochasanwasi Akshar Purushottam Swaminarayan Sanstha) temples are religious and cultural centres affiliated with the Swaminarayan Sampradaya, a Vaishnava sect of Hinduism.

- The doctrine of Swaminarayan Sampraday was given by Bhagwan Swaminarayan, which is firmly rooted in the traditional Hindu scriptures.

- BAPS has a network of around 1,550 temples across the world, including the Akshardham temples in New Delhi and Gandhinagar, and Swaminarayan temples in London, Houston, Chicago, Atlanta, Toronto, Los Angeles, and Nairobi.

- BAPS (Bochasanwasi Akshar Purushottam Swaminarayan Sanstha) temples are religious and cultural centres affiliated with the Swaminarayan Sampradaya, a Vaishnava sect of Hinduism.

- Features:

- Traditional Architecture: The Abu Dhabi temple is a traditional stone Hindu temple with seven shikhars. Built in the traditional Nagar style, the temple’s front panel depicts universal values, stories of harmony from different cultures, Hindu spiritual leaders and avatars.

- The height of the temple is 108 ft, length 262 ft and width 180 ft. While the external facade uses pink sandstone from Rajasthan, the interior uses Italian marble.

- Traditional Architecture: The Abu Dhabi temple is a traditional stone Hindu temple with seven shikhars. Built in the traditional Nagar style, the temple’s front panel depicts universal values, stories of harmony from different cultures, Hindu spiritual leaders and avatars.

- Architectural Features:

- Non-ferrous material (which resists corrosion) has been used in the temple.

- While many different types of pillars can be seen in the temple, such as circular and hexagonal, there is a special pillar, called the ‘Pillar of Pillars’, which has around 1,400 small pillars carved into it.

- Deities from all four corners of India have been featured in the temple. These include Lord Ram, Sita, Lakshman and Hanuman, Lord Shiv, Parvati, Ganpati, Kartikeya, Lord Jagannath, Lord Radha-Krishna, Akshar-Purushottam Maharaj (Bhagwan Swaminarayan and Gunatitanand Swami), Tirupati Balaji and Padmavati and Lord Ayappa.

- Apart from 15 value tales from Indian civilisation, stories from the Maya civilisation, Aztec civilisation, Egyptian civilisation, Arabic civilisation, European civilisation, Chinese civilisation and African civilisation have been depicted.

How have India-UAE Bilateral Relations Been So Far?

- About:

- India and the UAE established diplomatic relations in 1972.

- The greater push was achieved in bilateral relations when the visit of India’s Prime Minister to the UAE in August 2015 marked the beginning of a new strategic partnership between the two countries.

- Further, during the visit of the Crown Prince of Abu Dhabi to India in January 2017 as the chief guest at India’s Republic Day celebrations, it was agreed that bilateral relations were to be upgraded to a comprehensive strategic partnership.

- This gave momentum to launch negotiations for an India-UAE comprehensive economic partnership agreement.

- Economic Relations:

- The economic partnership between India and the UAE has flourished, with bilateral trade reaching USD 85 billion in 2022-23. The UAE is India's third-largest trading partner and second-largest export destination.

- The aim is to boost bilateral merchandise trade to above USD 100 billion and services trade to USD 15 billion in five years.

- Also, many Indian companies have set up manufacturing units either as joint ventures or in Special Economic Zones (SEZs) for cement, building materials, textiles, engineering products, consumer electronics, etc. in the UAE.

- Under India’s revamped FTA strategy, the Government has prioritised at least six countries/regions to deal with, in which the UAE figures at the top of the list for an early harvest deal (or Interim Trade Agreement), the others are the UK, the EU, Australia, Canada, Israel and a group of countries in the Gulf Cooperation Council (GCC).

- The UAE too announced earlier its intent to pursue bilateral economic agreements with India and seven other countries (U.K., Turkey, South Korea, Ethiopia, Indonesia, Israel, and Kenya).

- The economic partnership between India and the UAE has flourished, with bilateral trade reaching USD 85 billion in 2022-23. The UAE is India's third-largest trading partner and second-largest export destination.

- Cultural Relations:

- The UAE is home to more than 3.3 million Indians, and Emiratis are well acquainted with and open to Indian culture. India participated as the Guest of Honour Country in Abu Dhabi International Book Fair 2019.

- Indian cinema/TV/radio channels are easily available and have good viewership; major theaters/cinema halls in the UAE screen commercial Hindi, Malayalam and Tamil films.

- The Emirati community also participates in our annual International Day of Yoga events and various schools of yoga & meditation centres are running successfully in the UAE.

- Fintech Collaboration:

- Initiatives such as the acceptance of the RuPay card in the UAE since August 2019 and the operationalization of a Rupee-Dirham settlement system demonstrate mutual convergence in digital payment systems.

- The framework for the use of local currencies for transactions between India and the UAE aims to put in place a Local Currency Settlement System (LCSS).

- The creation of the LCSS would enable exporters and importers to invoice and pay in their respective domestic currencies, which in turn would enable the development of an INR-AED (United Arab Emirates Dirham) foreign exchange market, according to the RBI.

- Initiatives such as the acceptance of the RuPay card in the UAE since August 2019 and the operationalization of a Rupee-Dirham settlement system demonstrate mutual convergence in digital payment systems.

- Energy Security Cooperation:

- The UAE plays a crucial role in India's energy security, with strategic oil reserves stored facility in Mangaluru, India.

- Strategic Regional Engagement:

- India and the UAE are actively engaged in various regional groupings and initiatives such as the I2U2 and the India-Middle East-Europe Economic Corridor (IMEC), reflecting shared interests and strategic alignment.

What are the Challenges in India-UAE Relations?

- Trade Barriers Impacting Indian Exports:

- Non-tariff barriers (NTBs) like Sanitary and Phytosanitary (SPS) measures and Technical Barriers to Trade (TBT), notably mandatory Halal certification, have impeded Indian exports, particularly in sectors such as poultry, meat, and processed foods.

- These barriers have led to a significant decline in processed food exports to the UAE by almost 30% in recent years, according to a report from India's Ministry of Commerce and Industry.

- Non-tariff barriers (NTBs) like Sanitary and Phytosanitary (SPS) measures and Technical Barriers to Trade (TBT), notably mandatory Halal certification, have impeded Indian exports, particularly in sectors such as poultry, meat, and processed foods.

- Chinese Economic Influence in the UAE:

- China's "Cheque Book Diplomacy," characterized by offering low-interest loans, has overshadowed Indian economic endeavors in the UAE and the broader Middle East.

- Challenges of the Kafala System:

- The Kafala system in the UAE, which grants employers considerable power over immigrant labourers, especially those in low-wage jobs, presents significant human rights concerns.

- Instances of passport confiscation, delayed wages, and poor living conditions underscore the challenges faced by migrant workers under this system.

- The Kafala system in the UAE, which grants employers considerable power over immigrant labourers, especially those in low-wage jobs, presents significant human rights concerns.

- Concerns Over UAE's Financial Support to Pakistan:

- The UAE's substantial financial aid to Pakistan raises apprehensions about the potential misuse of these funds, considering Pakistan's history of sponsoring cross-border terrorism against India.

- Diplomatic Balancing Act Amid Regional Conflicts:

- India finds itself in a delicate diplomatic position due to the ongoing conflict between Iran and Arab nations, notably the UAE.

- The recent outbreak of war between Israel and Hamas further aggravates the challenges as it runs the proposed IMEC into rough weather.

Way Forward

- India and the UAE should work together to address non-tariff barriers that impede Indian exports, particularly in sectors such as processed foods. Both countries can engage in dialogues to streamline regulations and facilitate smoother trade flows.

- India can boost its economic presence in the UAE by increasing investments in key sectors and exploring opportunities for joint ventures and partnerships. Fostering a conducive business environment and promoting entrepreneurship can attract more Indian businesses to the UAE.

- India and the UAE can collaborate to counter Chinese economic influence in the region by promoting transparency, sustainability, and fair business practices.

- Both countries should work towards improving the rights and welfare of migrant workers in the UAE, including reforming the Kafala system. Ensuring fair wages, decent living conditions, and protecting workers' rights.

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims:

Q. Which of the following is not a member of ‘Gulf Cooperation Council’? (2016)

(a) Iran

(b) Saudi Arabia

(c) Oman

(d) Kuwait

Ans: (a)

Mains:

Q. The question of India’s Energy Security constitutes the most important part of India’s economic progress. Analyse India’s energy policy cooperation with West Asian countries. (2017)

Q. Religious indoctrination via digital media has resulted in Indian youth joining the ISIS. What is ISIS and its mission? How can ISIS be dangerous to the internal security of our country? (2015)

Indian Economy

Farmers Protest 2.0 and MSP

For Prelims: Minimum Support Price (MSP), Farmers Protest 2.0 and MSP, Land Acquisition Act of 2013, Electricity Amendment Bill 2020, Dr M S Swaminathan Commission’s report.

For Mains: Farmers Protest 2.0 and MSP, Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Why in News?

Farmers from Punjab, Haryana, and Uttar Pradesh are marching towards Delhi in the 'Delhi Chalo' protest, demanding legal guarantees for the Minimum Support Price (MSP).

- In 2020, farmers protested against three farm laws passed by the government, at Delhi borders, leading to their repeal in 2021.

- These laws were -- The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, The Farmers (Empowerment and Protection) Agreement of Price Assurance and Farm Services Act, and The Essential Commodities (Amendment) Act.

What are the Key Demands of Farmers?

- The headline demand in the farmers’ 12-point agenda is for a law to guarantee Minimum Support Price (MSP) for all crops, and the determination of crop prices in accordance with the Dr M S Swaminathan Commission’s report.

- The Swaminathan Commission Report states that the government should raise the MSP to at least 50% more than the weighted average cost of production. It is also known as the C2+ 50% formula.

- It includes the imputed cost of capital and the rent on the land (called ‘C2’ ) to give farmers 50% returns.

- Imputed cost is used to account for the opportunity cost of using resources like land, labour, and capital.

- The imputed cost of capital accounts for the interest or returns that could have been earned if the capital invested in farming were instead invested elsewhere.

- The other demands are:

- Full debt waiver for farmers and labourers;

- Implementation of the Land Acquisition Act of 2013, with provisions for written consent from farmers before acquisition, and compensation at four times the collector rate.

- A collector rate is the minimum value at which a property can be registered when buying or selling it. They serve as a reference point to prevent the undervaluation of properties and tax evasion.

- Punishment for the perpetrators of the October 2021 Lakhimpur Kheri killings;

- India should withdraw from the World Trade Organization (WTO) and freeze all free trade agreements (FTAs).

- Pensions for farmers and farm labourers.

- Compensation for farmers who died during the Delhi protest in 2020, including a job for one family member.

- The Electricity Amendment Bill 2020 should be scrapped.

- 200 (instead of 100) days’ employment under MGNREGA per year, the daily wage of Rs 700, and the scheme should be linked with farming;

- Strict penalties and fines on companies producing fake seeds, pesticides, fertilisers; improvements in seed quality;

- National commission for spices such as chilli and turmeric.

- Ensure the rights of indigenous peoples over water, forests, and land.

What is the Government’s Response?

- In November 2021, after repealing the three farm laws, the Indian Government announced to form a committee on MSP. Its purpose was to discuss MSP, promote zero-budget natural farming, and decide on cropping patterns. This committee was formed in July 2022 and hasn't yet produced any report.

- During a recent meeting between Cabinet ministers and farmer union leaders the government offered to create a new committee with representatives from agriculture, rural, and animal husbandry ministries.

- This committee would address farmers' demand for MSP for all crops. The government promised that this new committee would meet regularly and work within a set timeframe.

What are the Challenges with the Legalisation of MSP?

- Forced Procurement:

- Mandating the government to procure all produce at MSP could lead to overproduction, causing wastage of resources and storage problems.

- It might also distort cropping patterns as farmers might prioritise crops with MSP over others, affecting biodiversity and soil health.

- If the government has to buy the produce because there are no buyers offering the MSP, it doesn't have the resources to store and sell large amounts of it.

- Discrimination Among Farmers:

- Such a law could create disparities between farmers growing supported crops and those growing others.

- Farmers growing unsupported crops may face disadvantages in terms of market access and government support.

- Pressure From Traders:

- During peak harvest times, prices for agricultural produce are typically at their lowest, benefiting private traders who buy at these times. Because of this, private traders resist any legal assurance of MSP.

- Financial Burden:

- The government might face financial strain due to the obligation to procure all crops at MSP, leading to payment arrears and fiscal challenges.

- Societal Implications:

- Distorted cropping patterns and excessive procurement could have broader societal implications, affecting food security, environmental sustainability, and overall economic stability.

What Initiatives can be Taken to Protect Income of Farmers instead of Legalising MSP?

- Experts suggest giving money directly to farmers instead of just relying on MSP. This way, farmers get a stable income no matter how the market is.

- It's about fixing the bigger problem of farmers not having enough money, rather than just guaranteeing prices for certain crops.

- Implementing direct income support could involve various strategies, such as:

- Direct Cash Transfers: Providing direct cash payments to farmers to supplement their income and alleviate financial stress.

- The Government can think of Expanding the PM KISAN Scheme by rolling in the entire price support package and fertiliser subsidy and into much higher PM-KISAN payments to farmers in a revenue-neutral manner.

- This scheme currently provides farmers with Rs 6000 per year in direct cash payments.

- Insurance Schemes:

- Introducing insurance schemes that compensate farmers for income losses due to factors like crop failure, price volatility, or adverse weather conditions.

- Offering subsidies or grants to support agricultural inputs, equipment, technology adoption, and diversification into higher-value crops or alternative livelihoods.

- Price-Difference Payment Option: The government can also consider paying the price difference between the MSP and the rate at which the farmers sell.

- Haryana and Madhya Pradesh have tried this option under a scheme called Bhavantar Bharpai Yojana (price-difference compensation scheme).

- Under the MP's 'Bhavantar Bhugtan Yojana', the state government paid farmers the difference between MSP for crops and their average market rates. Farmers got money if they had to sell their produce in the open market below MSP.

- Direct Cash Transfers: Providing direct cash payments to farmers to supplement their income and alleviate financial stress.

What are the Concerns of Farmers Related to WTO and FTAs?

- Market Access:

- Farmers are concerned that the FTAs and WTO regulations lead to increased competition from cheaper agricultural imports, which can undercut domestic prices and harm local producers.

- Farmers perceive these agreements as favouring multinational corporations and large-scale agribusinesses over small and medium-sized farmers.

- Imported Goods:

- These agreements lead to the influx of subsidised agricultural products from other countries, which can flood the domestic market and depress prices for locally produced crops.

- This can make it difficult for Indian farmers to compete and sustain their livelihoods.

- Impact on Farming Practices:

- International trade agreements also impose regulations or standards on agricultural practices that Indian farmers find burdensome or incompatible with their traditional farming methods.

- This could include requirements related to pesticide use, genetically modified organisms (GMOs), or environmental standards.

- Sovereignty and Autonomy:

- Some farmers view withdrawal from WTO and freezing of free trade agreements as a way to regain sovereignty and control over India's agricultural policies.

- They argue that such agreements limit the government's ability to implement policies that prioritise the interests of small-scale farmers and ensure food security for the population.

What is the Current State of MSP and Farmers Demand?

- Current MSP vs. Farmer Demands:

- The MSP for wheat set by the government for the Rabi Marketing Season 2024-25 is Rs 2,275 per quintal, which is higher than the cost demanded by farmers, i.e., C2 plus 50%.

- However, the MSP is based on the formula A2+FL, which includes only paid-out costs incurred by farmers, resulting in a lower MSP compared to C2 plus 50%.

- CACP Recommendations and Methodology:

- The Commission for Agricultural Costs & Prices (CACP) recommends MSP based on the A2+FL formula, which considers only paid-out costs and imputed value of family labour.

- This is different from the C2 formula, which includes additional factors like rental value of owned land and interest on fixed capital.

- The Commission for Agricultural Costs & Prices (CACP) recommends MSP based on the A2+FL formula, which considers only paid-out costs and imputed value of family labour.

- Return over Cost of Production:

- For wheat in Punjab, the cost of production (C2) is Rs 1,503 per quintal, and the Minimum Support Price (MSP) is Rs 2,275 per quintal.

- This means farmers receive Rs 772 per quintal more than the cost of production, which is a return of 51.36% over C2.

- Similarly, for paddy, the return for Punjab farmers over C2 was 49%, and it was 152% over A2+FL

- For wheat in Punjab, the cost of production (C2) is Rs 1,503 per quintal, and the Minimum Support Price (MSP) is Rs 2,275 per quintal.

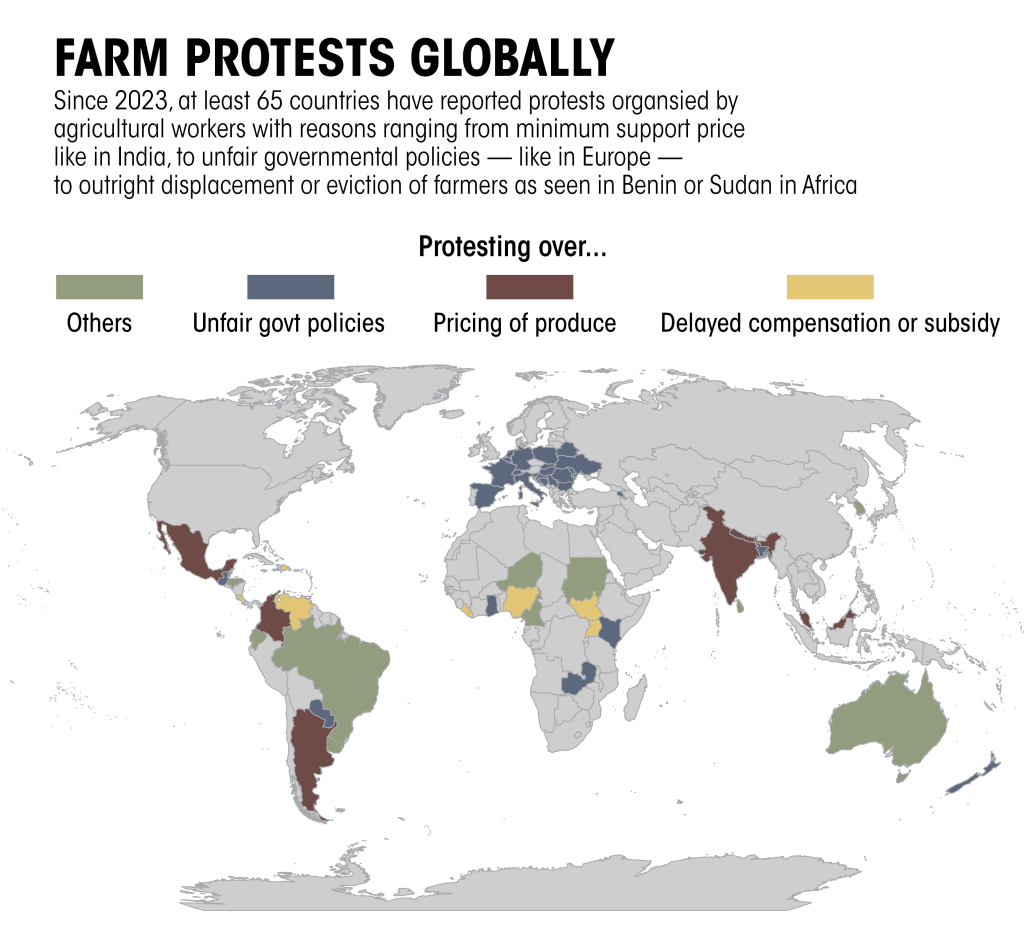

Why are Farmers Protesting Across the Globe?

- South America:

- Farmers are protesting due to factors such as unfavourable exchange rates for exports, high taxes, economic downturns, and natural disasters like droughts, which damage crops and reduce agricultural output.

- In Brazil, protests are against unfair competition from genetically modified maize.

- In Venezuela, farmers are seeking access to subsidised diesel.

- Colombian rice growers are demanding higher prices.

- Farmers are protesting due to factors such as unfavourable exchange rates for exports, high taxes, economic downturns, and natural disasters like droughts, which damage crops and reduce agricultural output.

- Europe:

- Farmers are protesting against low crop prices, rising costs, low-cost imports, and strict environmental regulations imposed by the European Union.

- In France, protests are against low-cost imports, insufficient subsidies, and high production costs.

- Farmers are protesting against low crop prices, rising costs, low-cost imports, and strict environmental regulations imposed by the European Union.

- North and Central America:

- Mexican farmers protest poor prices for corn and wheat, while Costa Rican farmers seek more government assistance for an industry burdened by debt.

- In Mexico's Chihuahua province, protests occurred over plans to export limited water supplies to the United States.

- Asia:

- Indian farmers are protesting for guaranteed crop prices, income doubling, and loan waivers.

- In Nepal, protests are due to unfair prices for imported Indian vegetables.

- Malaysian and Nepali farmers are protesting low rice and sugarcane prices, respectively.

- Oceania:

- New Zealand farmers protest against government regulations affecting food producers, while Australian farmers oppose high-voltage power lines passing through their land.

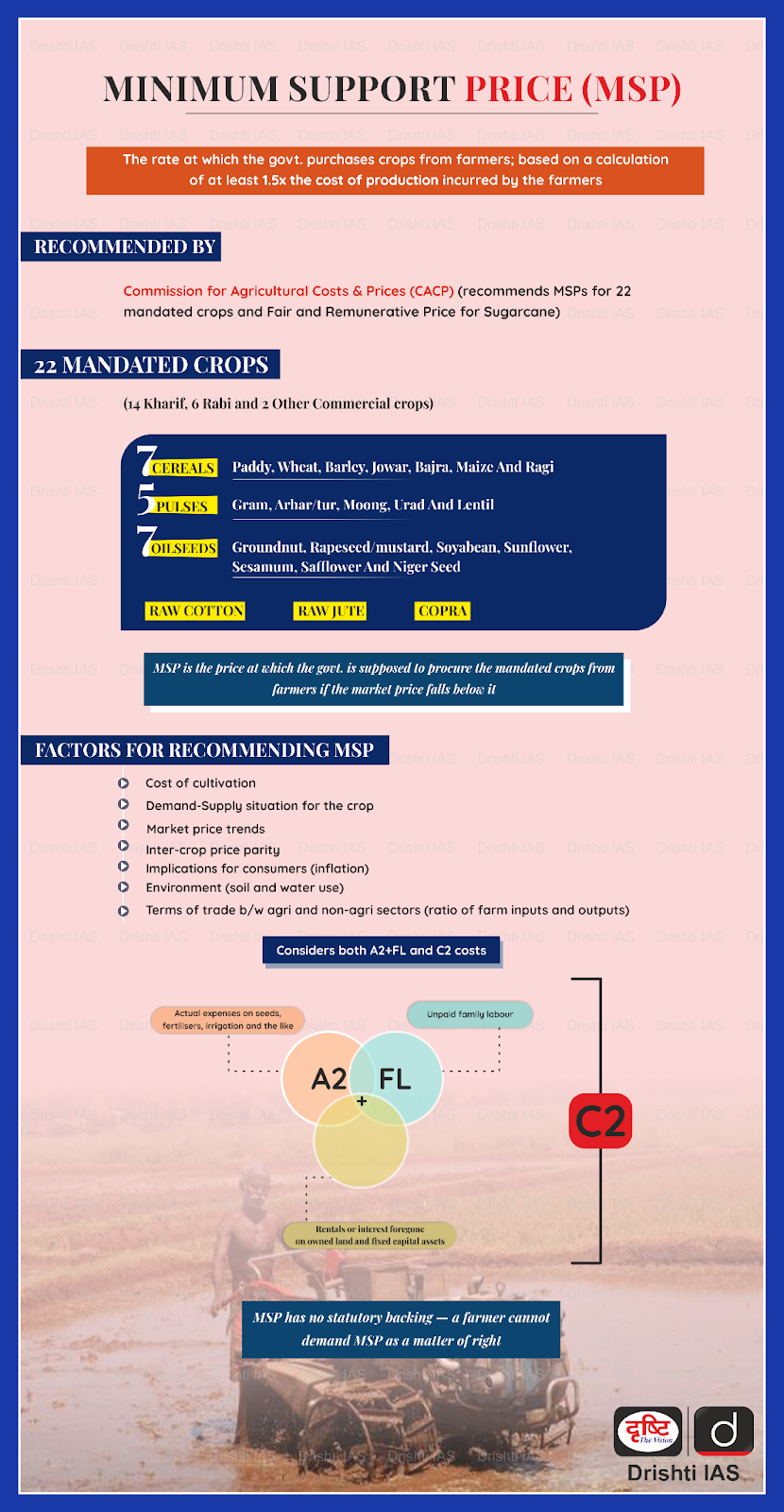

What is the Minimum Support Price?

- About:

- MSP is the guaranteed amount paid to farmers when the government buys their produce.

- MSP is based on the recommendations of the Commission for Agricultural Costs and Prices (CACP), which considers various factors such as cost of production, demand and supply, market price trends, inter-crop price parity, etc.

- CACP is an attached office of the Ministry of Agriculture and Farmers Welfare. It came into existence in January 1965.

- The Cabinet Committee on Economic Affairs (CCEA) chaired by the Prime Minister of India takes the final decision (approve) on the level of MSPs.

- The MSP is aimed at ensuring remunerative prices to growers for their produce and encouraging Crop Diversification.

- Crops Under MSP:

- The CACP recommends MSPs for 22 mandated crops and fair and remunerative price (FRP) for sugarcane.

- The mandated crops include 14 crops of the kharif season, 6 rabi crops and 2 other commercial crops.

- Three Kinds of Production Cost:

- The CACP projects three kinds of production cost for every crop, both at state and all-India average levels.

- ‘A2’: Covers all paid-out costs directly incurred by the farmer in cash and kind on seeds, fertilisers, pesticides, hired labour, leased-in land, fuel, irrigation, etc.

- ‘A2+FL’: Includes A2 plus an imputed value of unpaid family labour.

- ‘C2’: It is a more comprehensive cost that factors in rentals and interest for owned land and fixed capital assets, on top of A2+FL.

- CACP considers both A2+FL and C2 costs while recommending MSP.

- CACP reckons only A2+FL cost for return.

- However, C2 costs are used by CACP primarily as benchmark reference costs (opportunity costs) to see if the MSPs recommended by them at least cover these costs in some of the major producing States.

- The CACP projects three kinds of production cost for every crop, both at state and all-India average levels.

- Need for MSP:

- The twin droughts of 2014 and 2015 forced the farmers to suffer from declining commodity prices since 2014.

- The twin shocks of Demonetisation and the rollout of GST, crippled the rural economy, primarily the non-farm sector, but also agriculture.

- The slowdown in the economy after 2016-17 followed by the pandemic further ensured that the situation remains precarious for the majority of the farmers.

- Higher input prices for diesel, electricity and fertilisers have only contributed to the misery.

- It ensures that farmers receive a fair price for their crops, which helps in reducing farm distress and poverty. This is particularly crucial in states where agriculture is a major source of livelihood.

What are the Concerns Related to MSP in India?

- Limited Extent:

- The MSP is officially announced for 23 crops, but in practice, only two, rice and wheat, are extensively procured and distributed under the National Food Security Act (NFSA).

- For the rest of the crops, the MSP implementation is ad-hoc and insignificant. This means that the majority of farmers growing non-target crops do not benefit from the MSP.

- Ineffective Implementation:

- The Shanta Kumar Committee, in its 2015 report, revealed that only 6% of the MSP was actually received by farmers.

- This suggests that a significant portion of farmers, around 94%, do not benefit from the MSP. The primary reason for this is inadequate procurement mechanisms and market access for farmers.

- Skewed Crop Dominance:

- The focus on MSP for rice and wheat has led to a skewed cropping pattern in favour of these two staples. This overemphasis on these crops can have ecological, economic, and nutritional implications.

- It may not align with market demands, thereby limiting income potential for farmers.

- Middlemen Dependency:

- The MSP-based procurement system often involves intermediaries such as middlemen, commission agents, and officials from Agricultural Produce Market Committees (APMCs).

- Smaller farmers, in particular, may find it challenging to access these channels, leading to inefficiencies and reduced benefits for them.

- Burden on Government:

- The government shoulders a significant financial burden in procuring and maintaining buffer stocks of MSP-supported crops. This diverts resources that could be allocated to other agricultural or rural development programs.

Way Forward

- To encourage crop diversification and reduce the dominance of rice and wheat, the government can gradually expand the list of crops eligible for MSP support. This will provide farmers with more choices and promote the cultivation of crops in line with market demand.

- Addressing the MSP issue requires a balanced approach that considers both the interests of farmers and the broader economic implications.

- Revisiting the MSP calculation methodology and ensuring a fair and transparent process for determining MSP could help address some of the concerns raised by farmers.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q.1 Consider the following statements: (2020)

- In the case of all cereals, pulses, and oil seeds, the procurement at Minimum Support price (MSP) is unlimited in any State/UT of India.

- In the case of cereals and pulses, the MSP is fixed in any State/UT at a level to which the market price will never rise.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Q.2 Consider the following statements: (2023)

- The Government of India provides Minimum Support Price for niger (Guizotia abyssinica) seeds.

- Niger is cultivated as a Kharif crop.

- Some tribal people in India use niger seed oil for cooking.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

Ans: (c)

Mains:

Q.1 What do you mean by Minimum Support Price (MSP)? How will MSP rescue the farmers from the low income trap? (2018)

Q.2 How do subsidies affect the cropping pattern, crop diversity and economy of farmers? What is the significance of crop insurance, minimum support price and food processing for small and marginal farmers? (2017)

Q.3 What are the major factors responsible for making the rice-wheat system a success? In spite of this success how has this system become bane in India? (2020)

Q.4 In what way could replacement of price subsidy with direct benefit Transfer (DBT) change the scenario of subsidies in India? Discuss. (2015)

Q.5 WTO is an importantinternational institution where decisionstaken affect countriesin a profound manner. What is the mandate of WTO and how binding are their decisions? Critically analyse India’s stand on the latest round of talks on Food security. (2014)

Biodiversity & Environment

Marine Heatwaves in Arctic Ocean

For Prelims: Greenhouse Gas (GHG), Arctic Ocean, Marine Heatwave, Food Chains.

For Mains: Marine Heatwaves in Arctic Ocean, Environmental pollution and degradation.

Why in News?

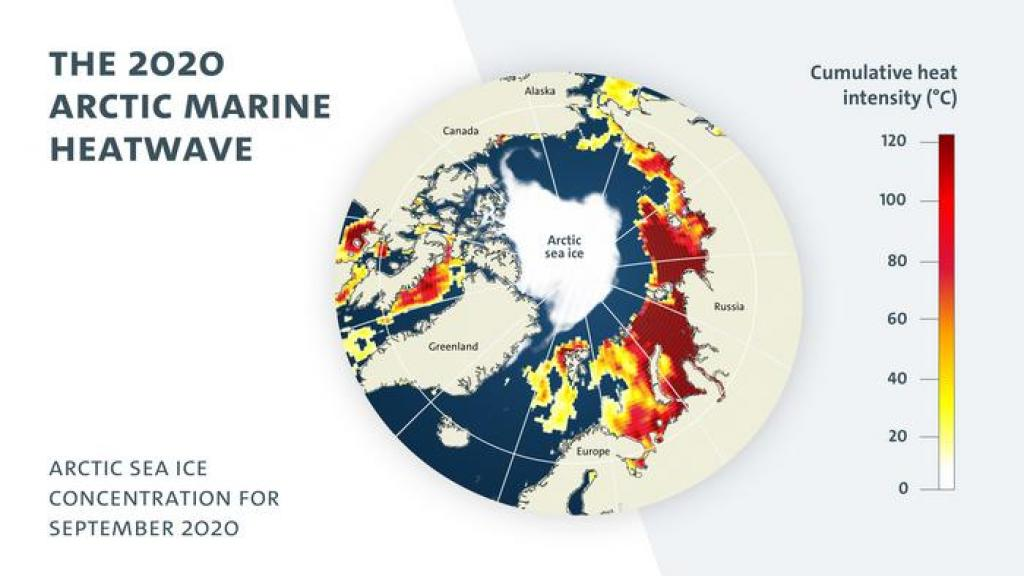

Recently, a new study has been published in the journal Nature Communications titled- ‘Arctic marine heatwaves forced by greenhouse gases and triggered by abrupt sea-ice melt’, which shows that since 2007, unprecedented Marine Heatwave (MHW) events have occurred over the Arctic Ocean.

What are the Key Highlights of the Study?

- Arctic Marine Heatwaves (MHWs) Characteristics:

- There have been 11 MHW events in the Arctic from 2007 to 2021, characterized by prolonged high Sea Surface Temperatures (SST).

- These events coincide with record declines in Arctic Sea ice.

- In 2022, the Arctic saw severe and extreme marine heatwaves in the Laptev and Beaufort seas from spring to autumn, according to the State of the Global Climate 2022 report.

- Decrease in Ice Cover:

- The perennial sea ice cover over the Arctic Ocean, known to reflect solar radiation, has seen a marked decrease in both summer and winter since the mid-1990s.

- Since 2007, there has been a pronounced regime shift from a thicker and deformed ice cover to a thinner and more uniform one.

- The thin ice is less durable and melts more quickly, allowing incoming solar radiation to warm the water’s surface.

- Drivers of Arctic MHWs:

- Arctic MHWs primarily occur over marginal seas, including the Kara, Laptev, East Siberian, and Chukchi seas.

- These regions are characterized by shallow mixed-layer depths and predominantly first-year ice cover, creating conditions conducive to MHW development.

- First-year ice refers to sea ice that forms and grows during a single winter season and typically melts away completely during the following summer melt season.

- Abrupt sea ice retreat is another concern as it could trigger marine heatwave events.

- Impact of GreenHouse Gas (GHG):

- Without GHGs, marine heatwaves exceeding 1.5°C couldn't happen.

- GHGs are a sufficient cause for moderate marine heatwaves, with a 66-99% probability.

- Without GHGs, marine heatwaves exceeding 1.5°C couldn't happen.

- Long-Term Trends:

- There is a pronounced long-term warming trend in the Arctic, with SST increasing at a rate of 1.2°C per decade from 1996 to 2021.

- Over the last two decades, there has been an increase in the frequency of extreme SST events in the eastern Arctic marginal seas.

- Concerns:

- The study warned of dramatic consequences of Marine heatwaves like impact on food chains, fish stocks and reduction of overall biodiversity.

- Technique Used in the Study:

- The study employs an Extreme Event Attribution (EEA) technique to assess the role of Greenhouse Gas (GHG) forcing in Arctic MHWs.

- The EEA technique determines the extent to which human-induced climate change influences the likelihood and severity of specific extreme weather events.

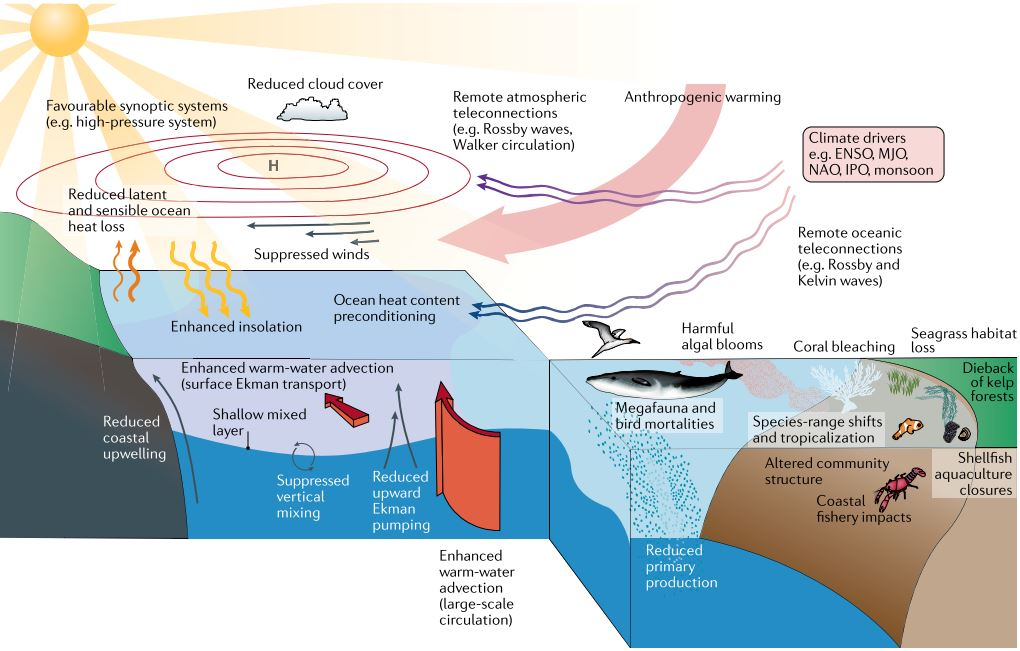

What are Marine Heat Waves (MHWs)?

- About:

- An MHW is an extreme weather event. It occurs when the surface temperature of a particular region of the sea rises to 3 or 4 degree Celsius above the average temperature for at least five days.

- According to the National Oceanic and Atmospheric Administration (NOAA), MHWs can last for weeks, months or even years.

- Impacts:

- Impact on Ocean: An increase of 3 or 4 degrees Celsius in average temperatures can be catastrophic for marine life.

- MHWs along the Western Australian coast in 2010 and 2011 caused some “devastating” fish kills, the sudden and unexpected death of many fish or other aquatic animals over a short period and mainly within a particular area.

- MHWs destroyed kelp forests and fundamentally altered the ecosystem of the coast.

- Kelps usually grow in cooler waters, providing habitat and food for many marine animals.

- Leading to Coral Bleach: In 2005 high ocean temperatures in the tropical Atlantic and Caribbean led to a massive coral bleaching event.

- Corals are very sensitive to the temperature of the water in which they live. When water gets too warm, they expel the algae known as zooxanthellae, living in their tissues, causing them to turn entirely white. This is called coral bleaching.

- Impact on Humans: Higher ocean temperatures, which are associated with MHWs, can make storms like hurricanes and tropical cyclones stronger.

- With warmer temperatures, the rate of evaporation escalates and so does the transfer of heat from the oceans to the air. When storms travel across hot oceans, they gather more water vapour and heat.

- This results in more powerful winds, heavier rainfall and more flooding when storms reach the land — meaning heightened devastation for humans.

- Impact on Ocean: An increase of 3 or 4 degrees Celsius in average temperatures can be catastrophic for marine life.

What are the other Impacts of Marine Heatwaves?

- Affect the Structure of Ecosystem:

- Marine heatwaves influence the composition of ecosystems by favouring certain species while inhibiting others.

- They have been linked to widespread mortality among marine invertebrates and can compel species to alter their behaviour, potentially exposing wildlife to greater risks of harm.

- Change Habitat Ranges:

- Marine heatwaves can change the habitat ranges of certain species, such as the spiny sea urchin off southeastern Australia which has been expanding southward into Tasmania at the expense of kelp forests which it feeds upon.

- Economic Losses:

- Marine heatwaves can cause economic losses through impacts on fisheries and aquaculture.

- Affect Biodiversity:

- Biodiversity can be drastically affected by marine heatwaves.

- The previous marine heatwave led to the bleaching of 85% of corals in the Gulf of Mannar near the Tamil Nadu coast.

- Biodiversity can be drastically affected by marine heatwaves.

- Increase the Risk of Deoxygenation and Acidification:

- Often, they occur alongside other stressors such as ocean acidification, deoxygenation, and overfishing.

- In such cases, MHWs not only further damage habitats but also increase the risk of deoxygenation and acidification.

What are the Key Facts About the Arctic?

- About:

- The Arctic is a polar region located in the northernmost part of Earth.

- The Arctic consists of the Arctic Ocean, adjacent seas, and parts of Alaska (United States), Canada, Finland, Greenland (Denmark), Iceland, Norway, Russia, and Sweden.

- The Arctic Ocean consists of the Barents Sea, Kara Sea, Laptev Sea, Chukchi Sea, Beaufort Sea, Wandel Sea, Lincoln Sea.

- Land within the Arctic region has seasonally varying snow and ice cover.

- Ecological Impact of Warming on the Arctic:

- The loss of ice and the warming waters will affect sea levels, salinity levels, current movement and precipitation patterns.

- The Tundra is returning to the swamp, the permafrost is thawing, sudden storms are ravaging coastlines and wildfires are devastating interior Canada and Russia.

- Tundra: A type of vegetation, found in regions north of the Arctic Circle and south of the Antarctic Circle. These are treeless regions.

- The Arctic is also home to about 40 different indigenous groups like Chukchi in Russia, Aleut, Yupik and Inuit in Alaska.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q.1 On 21st June, the Sun (2019)

(a) does not set below the horizon at the Arctic Circle

(b) does not set below the horizon at Antarctic Circle

(c) shines vertically overhead at noon on the Equator

(d) shines vertically overhead at the Tropic of Capricorn

Ans: (a)

Q.2 Which of the following statements is/are correct about the deposits of ‘methane hydrate’? (2019)

- Global warming might trigger the release of methane gas from these deposits.

- Large deposits of ‘methane hydrate’ are found in Arctic Tundra and under the sea floor.

- Methane in atmosphere oxidizes to carbon dioxide after a decade or two.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Exp:

- Methane hydrate is a crystalline solid that consists of a methane molecule surrounded by a cage of interlocking water molecules. It is an “ice” that only occurs naturally in subsurface deposits where temperature and pressure conditions are favourable for its formation.

- Regions with suitable temperature and pressure conditions for the formation and stability of methane hydrate– sediment and sedimentary rock units below the Arctic permafrost; sedimentary deposits along continental margins; deep-water sediments of inland lakes and seas; and, under Antarctic ice. Hence, statement 2 is correct.

- Methane hydrates, the sensitive sediments, can rapidly dissociate with an increase in temperature or a decrease in pressure. The dissociation produces free methane and water, which can be triggered by global warming. Hence, statement 1 is correct.

- Methane is removed from the atmosphere in about 9 to 12-year period by oxidation reaction where it is converted into Carbon Dioxide. Hence, statement 3 is correct.

- Therefore, option (d) is the correct answer.

Mains

Q1. Assess the impact of global warming on the coral life system with examples. (2017)

Q2. ‘Climate change’ is a global problem. How India will be affected by climate change? How Himalayan and coastal states of India will be affected by climate change? (2017)

Q3. Discuss global warming and mention its effects on the global climate. Explain the control measures to bring down the level of greenhouse gases which cause global warming, in the light of the Kyoto Protocol, 1997. (2022)

Biodiversity & Environment

Challenges of Sustainable Fashion

For Prelims: Challenges of Sustainable Fashion, Biodegradable, United Nations, Khadi and Village Industries Commission (KVIC).

For Mains: Challenges of Sustainable Fashion, Need of sustainable fashion for a healthy and inclusive environment, Environmental Pollution & Degradation.

Why in News?

An overwhelming majority of clothes and fashion items now claim to be made from "recycled materials." However, concerns are rising about the effectiveness and sustainability of this approach.

What is Sustainable Fashion?

- Sustainable fashion refers to the concept of creating fashion items in a way that reduces the environmental impact and promotes social responsibility throughout the entire production process. It aims to create fashion items that are environmentally friendly, socially responsible, and economically viable.

- One of the primary focuses of eco-fashion is on the materials used in production. Sustainable fashion emphasises using natural and organic materials, such as wool, linen, and cotton, grown and harvested without harmful pesticides and chemicals.

- These materials are biodegradable and do not contribute to the buildup of waste in landfills.

What is the Significance of Sustainable Fashion?

- Environmental Impact:

- The fashion industry is a major contributor to global carbon emissions, water consumption, and waste production.

- Sustainable fashion aims to minimise these impacts by using renewable materials, reducing resource consumption, and implementing eco-friendly production processes.

- Waste Reduction:

- Traditional fashion often leads to vast amounts of clothing ending up in landfills or being incinerated. Sustainable fashion promotes circularity, where materials are reused, recycled, or biodegraded, reducing waste and conserving resources.

- Health and Safety:

- The use of harsh chemicals in conventional textile production can lead to health issues for both workers and consumers.

- Sustainable fashion avoids or minimises the use of toxic chemicals, promoting safer and healthier products for all.

- Consumer Awareness:

- Sustainable fashion encourages consumers to consider the environmental and social impact of their clothing choices.

- By raising awareness and promoting conscious consumption, it empowers individuals to make more informed and ethical purchasing decisions.

What are the Challenges to Sustainable Fashion?

- Textile Recycling is More Complex:

- Textile recycling is more complex compared to recycling materials like glass or paper.

- The vast majority (93%) of recycled textiles come from plastic bottles or PET bottles (polyethylene terephthalate), which are made from fossil fuels.

- However, unlike plastic bottles that can be recycled multiple times, a T-shirt made from recycled polyester cannot be recycled again.

- In Europe, most textile waste is either dumped or burned, with only 22% being recycled. However, the recycled textile is often repurposed into insulation, mattress stuffing, or cleaning cloths, rather than being reused in clothing production.

- Less than 1% of fabric used in clothing production is recycled into new clothing.

- Expensive and Labor-Intensive:

- Clothes containing more than two fibres are considered unrecyclable.

- Recyclable clothes must undergo colour sorting and removal of zips, buttons, studs, and other materials. This process is usually expensive and labour-intensive.

- Decline in Quality:

- When materials are recycled, especially in the case of textiles like cotton, the quality often diminishes.

- This reduced quality can limit the applications of the recycled material and may necessitate blending with virgin materials, defeating the purpose of recycling.

- Contamination:

- Materials intended for recycling can become contaminated with other substances, such as food residue in plastic containers or dyes in textiles.

- Contamination can degrade the quality of the recycled material and complicate the recycling process.

- Technological Limitations:

- Recycling technologies are still developing, particularly for certain materials like mixed-fibre textiles or impure plastics. As a result, the effectiveness and efficiency of recycling processes may be limited.

- Carbon Footprint:

- After Western consumers deposit their unrecyclable polyester and mixed fabrics into recycling bins, a significant portion of this waste finds its way to African second hand markets, particularly in Ghana, or is dumped into open landfills.

- Approximately 41% of the textile waste collected in Europe is shipped to Asia, mainly to designated economic zones where it undergoes sorting and processing.

- Europe's textile waste sent to Asia ends up in Export Processing Zones, notorious for lax labour standards and environmental regulations.

- Exporting clothes to countries with low labour costs for sorting also raises concerns about the carbon footprint associated with transportation.

- After Western consumers deposit their unrecyclable polyester and mixed fabrics into recycling bins, a significant portion of this waste finds its way to African second hand markets, particularly in Ghana, or is dumped into open landfills.

What can be the Solution for Sustainable Fashion?

- Reducing Dependence on Polyester:

- Experts advocate for reducing reliance on polyester altogether, due to its detrimental environmental impact from production to recycling.

- Embracing Alternative Fibres:

- Some fashion brands are exploring alternative fibres, such as Pinatex made from pineapple leaves, as a more sustainable option. However, caution is advised, as these fibres may still require thermoplastic materials for cohesion, limiting recyclability.

- Addressing Overconsumption:

- Ultimately, tackling overconsumption is deemed essential for achieving sustainability in the fashion industry. Calls for consumers to buy fewer clothes and prioritise repair, reuse, and upcycling are echoed by environmental advocates.

What are the Initiatives for Sustainable Fashion?

- At Global level:

- United Nations Alliance for Sustainable Fashion:

- It is an initiative of United Nations agencies and allied organizations designed to contribute to the Sustainable Development Goals through coordinated action in the fashion sector.

- Traceability for Sustainable Garment and Footwear: As part of this initiative, UNECE (United Nations Economic Commission for Europe) has launched "The Sustainability Pledge" inviting governments, garment and footwear manufacturers and industry stakeholders to pledge to apply toolkit of measures and take a positive step towards improving the environmental and ethical credentials of the sector.

- World Cotton Day (7th October): It creates awareness of the need for market access for cotton and cotton-related products from least-developed countries, fosters sustainable trade policies and enables developing countries to benefit more from every step of the cotton value chain.

- United Nations Alliance for Sustainable Fashion:

- At National Level:

- Project SU.RE: SU.RE stands for ‘Sustainable Resolution’. It is the first-ever holistic effort towards gradually introducing a broader framework for establishing critical sustainability goals for the Indian textile industry. It was launched in 2020.

- Objective: The project aims to move towards sustainable fashion that contributes to a clean environment.

- Khadi Promotion: Khadi and Village Industries Commission (KVIC) promotes Khadi products. They have tied up with leading brands to promote Khadi products.

- Brown Cotton: Brown Cotton, is a local (to Karnataka) indigenous variety of desi cotton that is recognised for its natural brown colour. This effort is a larger encompassing exercise that involves the environment, the economy as well as local communities.

- Project SU.RE: SU.RE stands for ‘Sustainable Resolution’. It is the first-ever holistic effort towards gradually introducing a broader framework for establishing critical sustainability goals for the Indian textile industry. It was launched in 2020.

Way Forward

- People all around the world should be made aware that climate change is a reality and not a hoax, so they should understand their responsibility for protecting and conserving the environment.

- There should be public campaigns by the environmentalists against the companies that do not adhere to environmental standards and should refrain from purchasing any product manufactured by them.

- Governments around the world should increase CSR (Corporate Social Responsibility) which companies need to pay for causing harm to the environment. This will prompt them to adopt sustainable practices.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. The term ‘Intended Nationally Determined Contributions’ is sometimes seen in the news in the context of (2016)

(a) pledges made by the European countries to rehabilitate refugees from the war-affected Middle East

(b) plan of action outlined by the countries of the world to combat climate change

(c) capital contributed by the member countries in the establishment of the Asian Infrastructure Investment Bank

(d) plan of action outlined by the countries of the world regarding Sustainable Development Goals

Ans: (b)

Exp:

- Intended Nationally Determined Contributions is the term used under the UNFCCC for reductions in greenhouse gas emissions in all countries that signed the Paris Agreement.

- At COP 21 countries across the globe publicly outlined the actions they intended to take under the international agreement. The contributions are in the direction to achieve the long-term goal of the Paris Agreement; “to hold the increase in global average temperature to well below 2°C to pursue efforts to limit the increase to 1.5°C, and to achieve net zero emissions in the second half of this century.” Therefore, option (b) is the correct answer.

Rapid Fire

Security Printing and Minting Corporation of India Limited

The Union Minister for Finance and Corporate Affairs presided over the 19th Foundation Day celebrations of the Security Printing and Minting Corporation of India Limited (SPMCIL) in New Delhi.

- SPMCIL is a Miniratna Category–I, Central Public Sector Enterprise (CPSE), under the administrative control of the Department of Economic Affairs, Ministry of Finance.

- SPMCIL is responsible for printing various denominations of currency notes and coins for the Reserve Bank of India (RBI), ensuring the highest standards of security to prevent counterfeiting.

- SPMCIL's initiatives were highlighted including the production of visually impaired-friendly coin series and e-Passports with a Track and Trace system for enhanced security.

- The souvenir products of SPMCIL are presented by the Government of India to dignitaries of other countries at international forums and are appreciated globally.

Read more: India's e-passports: Passport Seva Programme (PSP)

Rapid Fire

RBI Regulates Card-Based Commercial Payments

Recently, the Reserve Bank of India (RBI) has directed Visa and Mastercard to stop card-based business-to-business payments routed through fintech firms.

- This only affects business payments processed through specific third-party services and does not impact other card transactions.

- A set of fintech firms in India currently operate in a category called Business Payment Service Providers (BPSPs) that enable businesses to use credit cards for payments to suppliers who do not accept cards directly.

- The BPSP then transfers the funds to these suppliers using standard bank channels like NEFT and RTGS, acting as a third party. This is the focal point of regulatory scrutiny.

- This move aligns with the RBI's broader objective of ensuring regulatory compliance within the fintech sector and preventing fraudulent or unauthorised transactions in digital platforms.

Read more: Payment and Settlement Systems in India

Rapid Fire

Sangam: Revolutionising Infrastructure through Digital Twins

The Department of Telecommunications (DoT) has introduced the 'Sangam: Digital Twin' initiative, a venture inviting Expressions of Interest (EoI) from industry pioneers, startups, MSMEs, academia, innovators and forward-thinkers.

- It is a proof-of-concept (PoC) distributed in two stages to be conducted in one of the major cities of India.

- The first stage focuses on exploratory activities and creative exploration, while the second stage involves practical demonstrations of specific use cases.

- POC is a demonstration of a product, service, or solution that shows it can meet customer needs and provides a business case for adoption.

- Digital Twin technology involves creating a virtual replica or simulation of a physical object or system.

- This digital counterpart mirrors the physical entity in real-time or near-real-time, allowing for monitoring, analysis, and simulation.

- Through Sangam, India aims to establish leadership in digital infrastructure and innovation.

Read more: India's Digital Public Infrastructure

Rapid Fire

United Kingdom Economy in Technical Recession

The United Kingdom economy entered a technical recession at the end of 2023. The Office for National Statistics reported that the UK's gross domestic product (GDP) shrank by 0.3% in the final three months of 2023, and by 0.1% in the third quarter.

- The National Bureau of Economic Research (an American NGO) defines recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.

- Very short periods of decline are not considered recessions.

- A recession occurs when a sustained decline in economic activity persists, while a technical recession specifically entails two consecutive quarters of GDP decline.

Read more: Recession and Yield Curve