Protectionism vs Globalization

For Prelims: Globalization, Protectionism, Atmanirbhar Bharat Initiative

For Mains: Pros and Cons of Globalization, Decline of Globalization, Protectionism in India.

Why in News

The External Affairs Minister of India (EAM), at the recent Global Technology summit, has asserted that the Covid-19 pandemic has brought India’s capabilities and need for more domestic production rather than unchecked globalization.

- He further held that, to foster tech growth, nations must seek more start-ups, supply chains and jobs to be created internally.

- This speech of EAM has sparked a debate between protectionism vs globalization.

Key Points

- Globalization:

- About: Globalization envisages a borderless world or seeks a world as a global village.

- Origin of Modern Globalization: What today is referred to as globalization, started with the end of the Cold war and the disintegration of the Soviet Union in 1991.

- Driving Factors: Globalization was the offshoot of two systems — democracy and capitalism — that emerged victorious at the end of the Cold War.

- Dimensions of Globalization: It may be attributed to accelerated flow of goods, people, capital, information, and energy across borders, often enabled by technological developments.

- Manifestation of Globalization: Trade without tariffs, international travel with easy or no visas, capital flows with few impediments, cross-border pipelines and energy grids, and seamless global communication in real-time appeared to be the goals towards which the world was moving.

- Pros of Globalization:

- Access to Goods and Services: Globalization results in increased trade and standard of living.

- It heightens competition within the domestic product, capital, and labour markets, as well as among countries adopting different trade and investment strategies.

- Vehicle of Social Justice: The proponents say globalization represents free trade which promotes global economic growth, creates jobs, makes companies more competitive, and lowers prices for consumers.

- Increases Cultural Awareness: By reducing cross-border distances, globalization has increased cross-cultural understanding and sharing.

- Sharing Technology and Values: It also provides poor countries, through infusions of foreign capital and technology, with the chance to develop economically and by spreading prosperity.

- Access to Goods and Services: Globalization results in increased trade and standard of living.

- Cons of Globalization:

- Rise of Global Problems: Globalization has been criticised on account of exacerbating global disparities, spread of international terrorism and cross-border organised crime, and allow for the rapid spread of disease.

- Backlash of Nationalism: Despite the economic aspect of globalization, it has resulted in National competition, advancement of national ambitions.

- Moving Towards Cultural Homogeneity: Globalization promotes people's tastes to converge which may lead to more cultural homogeneity.

- Due to this, there is a danger of losing precious cultural practices and languages.

- Also, there are threats of cultural invasion of one country over another.

De-Globalisation or Protectionism

- Meaning:

- Protectionism refers to government policies that restrict international trade to help domestic industries.

- Tariffs, import quotas, product standards, and subsidies are some of the primary policy tools a government can use in enacting protectionist policies.

- Protectionism in Global Arena:

- Globalization had already begun to plateau or stagnate since the 2008-09 global financial crisis (GFC).

- This is reflected in Brexit and US’ America First Policy.

- Further, trade wars and the halting of WTO talks is another recognition of the retreat of globalization.

- These trends pave the way for an anti-globalization or protectionism sentiment, which may further amplify due to the spread of the Covid-19 pandemic.

- Protectionism in India:

- In the past few years, many countries have criticized the Indian economy for becoming protectionist. This can be depicted in the following instances:

- Not opening up for imports, particularly after the Indian Government failed to agree on terms for a mini trade deal with the US.

- India walked out of the 15-nation Regional Comprehensive Economic Partnership of Asian countries.

- The “Aatmanirbhar Bharat (Self-Reliance) initiative”, launched in May 2020, after the beginning of the pandemic, was also perceived internationally as a protectionist move.

- In the past few years, many countries have criticized the Indian economy for becoming protectionist. This can be depicted in the following instances:

Way Forward

- De-bureaucratisation: India needs to put in place such policies that improve its competitiveness, de-bureaucratise some sectors such as agriculture, and make labour laws less complicated.

- A holistic and easily accessible ecosystem, from the procuring of raw materials to the outlet of finished products, must be made available.

- People-centric policies: The only way to trigger employment is to step-up value addition in the local area. There is a need for such people-centric and sector-specific policies in order to accelerate growth.

- Alternative global alliance: India needs to now move beyond regional alliances and look forward to a cooperative alliance between like-minded countries in terms of trade such as the USA, EU, and Japan, to figure out an alternative to break the hegemony of China in the global supply chain.

- Promote R&D and capacity building: There’s a need to prioritize building capacity and policy framework to become cost-competitive and quality competitive.

- Increasing Production: Enhance domestic Production as well as put thrust to increase exports and promote research to become more independent. India needs to plan now for the next 20 years.

UNCLOS

For Prelims: Continental Shelf, Exclusive Economic Zone, UNCLOS

For Mains: UNCLOS and maritime disputes such as in the South China Sea and East China Sea.

Why in News

Recently, India reiterated its support for the United Nations Convention on the Law of the Sea (UNCLOS).

- India also supported freedom of navigation and overflight, and unimpeded commerce, based on the principles of international law, reflected notably in the UNCLOS 1982.

- India is a state party to the UNCLOS.

Key Points

- The United Nations Convention on the Law of the Sea (UNCLOS), 1982 is an international agreement that establishes the legal framework for marine and maritime activities.

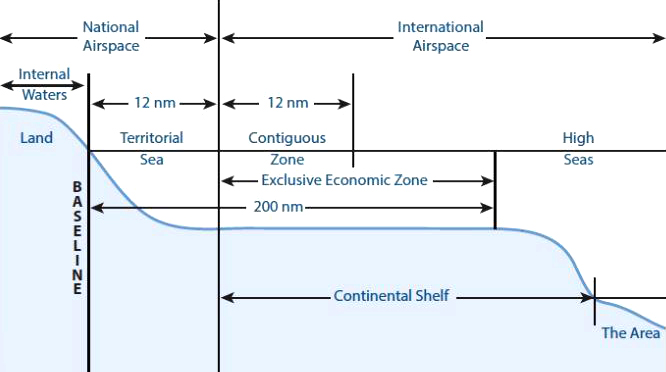

- It is also known as Law of the Sea. It divides marine areas into five main zones namely- Internal Waters, Territorial Sea, Contiguous Zone, Exclusive Economic Zone (EEZ) and the High Seas.

- It is the only international convention which stipulates a framework for state jurisdiction in maritime spaces. It provides a different legal status to different maritime zones.

- It provides the backbone for offshore governance by coastal states and those navigating the oceans.

- It not only zones coastal states’ offshore areas but also provides specific guidance for states’ rights and responsibilities in the five concentric zones.

- While UNCLOS has been signed and ratified by nearly all the coastal countries in the South China Sea, its interpretation is still hotly disputed.

- There is a maritime dispute in the East China Sea as well.

Maritime Zones

- Baseline:

- It is the low-water line along the coast as officially recognized by the coastal state.

- Internal Waters:

- Internal waters are waters on the landward side of the baseline from which the breadth of the territorial sea is measured.

- Each coastal state has full sovereignty over its internal waters as like its land territory. Examples of internal waters include bays, ports, inlets, rivers and even lakes that are connected to the sea.

- There is no right of innocent passage through internal waters.

- The innocent passage refers to the passing through the waters which are not prejudicial to peace and security. However, the nations have the right to suspend the same.

- Territorial Sea:

- The territorial sea extends seaward up to 12 nautical miles (nm) from its baselines.

- A nautical mile is based on the circumference of the earth and is equal to one minute of latitude. It is slightly more than a land measured mile (1 nautical mile = 1.1508 land miles or 1.85 km).

- The coastal states have sovereignty and jurisdiction over the territorial sea. These rights extend not only on the surface but also to the seabed, subsoil, and even airspace.

- But the coastal states’ rights are limited by the innocent passage through the territorial sea.

- The territorial sea extends seaward up to 12 nautical miles (nm) from its baselines.

- Contiguous Zone:

- The contiguous zone extends seaward up to 24 nm from its baselines.

- It is an intermediary zone between the territorial sea and the high seas.

- The coastal state has the right to both prevent and punish infringement of fiscal, immigration, sanitary, and customs laws within its territory and territorial sea.

- Unlike the territorial sea, the contiguous zone only gives jurisdiction to a state on the ocean’s surface and floor. It does not provide air and space rights.

- Exclusive Economic Zone (EEZ):

- Each coastal State may claim an EEZ beyond and adjacent to its territorial sea that extends seaward up to 200 nm from its baselines.

- Within its EEZ, a coastal state has:

- Sovereign rights for the purpose of exploring, exploiting, conserving and managing natural resources, whether living or nonliving, of the seabed and subsoil.

- Rights to carry out activities like the production of energy from the water, currents and wind.

- Unlike the territorial sea and the contiguous zone, the EEZ only allows for the above-mentioned resource rights. It does not give a coastal state the right to prohibit or limit freedom of navigation or overflight, subject to very limited exceptions.

- High Seas:

- The ocean surface and the water column beyond the EEZ are referred to as the high seas.

- It is considered as “the common heritage of all mankind” and is beyond any national jurisdiction.

- States can conduct activities in these areas as long as they are for peaceful purposes, such as transit, marine science, and undersea exploration.

Black Money

For Prelims: Meaning of terms: Tax Havens, Round tripping, Fugitive Economic Offender, Transfer Pricing, whistleblower, Effects of black money on economy, Sources of black money, Financial Intelligence Unit, Financial Action Task Force

For Mains: Tackling black money in India, Relevance of Panama and Paradise Paper Leaks.

Why in News

Recently, the government has said in the Parliament that Rs 2,476 crore has been collected as tax and penalty under the one-time three months compliance window during 2015.

- It has also been said that there is no official estimation how much worth of black money is lying in foreign accounts over the last five years.

- Total undisclosed credits amounting to Rs 20,353 crore have been detected with respect to 930 India linked entities in the Panama and Paradise Paper Leaks.

Key Points

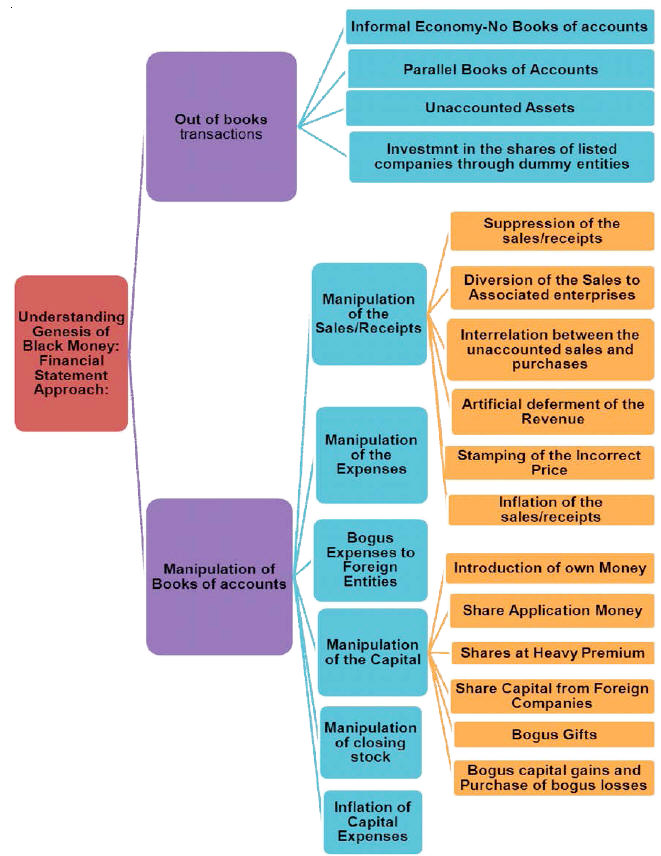

- Black Money:

- There is no official definition of black money in economic theory, with several different terms such as parallel economy, black money, black incomes, unaccounted economy, illegal economy and irregular economy all being used more or less synonymously.

- The simplest definition of black money could possibly be money that is hidden from tax authorities.

- According to a secret study commissioned by the Finance Ministry concluded in 2014 that about 90% of unaccounted wealth, or black money, was lying within India and not outside.

- Source of Black Money:

- It can come from two broad categories:

- Illegal Activity:

- Money that is earned through illegal activity is obviously not reported to the tax authorities, and so is black.

- Legal but Unreported Activity:

- The second category comprises income from legal activity that is not reported to the tax authorities.

- Illegal Activity:

- It can come from two broad categories:

Examples for Sources of Black Money

- Multi-Level Marketing Scheme:

- International debit or credit cards issued by offshore banks are used to create black money.

- Disguised Ownership:

- Increasingly, criminals want to own legitimate businesses. It could be to earn a return or to convert black money into white.

- Mixed Sales:

- Mixing illicit money sources with legit ones is a popular method because it's hard to detect, especially if there is a large cash component in the legal business.

- Smurfing:

- This type of transaction is usually done to evade notice by authorities monitoring transactions above a certain threshold.

- Trade Mispricing:

- Traditionally, goods exported and imported were either priced lower or higher to enable money laundering.

- With current technology, the Organization for Economic Cooperation and Development (OECD) says it's easy to modify invoices or produce fictitious invoices.

- Money Transfers To Benami Entities:

- In a Benami transaction, a property is transferred or held by one person and the consideration for such property is paid by another person for whose benefit such property is held.

- Impacts:

- Loss of Revenue:

- Black money eats up a part of the tax and, thus, the government’s deficit increases.

- The government has to balance this deficit by increasing taxes, decreasing subsidies and increasing borrowings.

- Borrowing leads to a further increase in the government’s debt due to interest burden. If the government is unable to balance the deficit, it has to decrease spending, which affects development.

- Money Circulation:

- People generally tend to keep black money in the form of gold, immovable property and other secret manners.

- Such money does not become part of the main economy and, therefore, remains generally out of circulation.

- The black money keeps circulating among the wealthy and creates more opportunities for them.

- Higher Inflation:

- The infusion of unaccounted black money in the economy leads to higher inflation, which obviously hits the poor the most.

- It also increases the disparity between the rich and the poor.

- Loss of Revenue:

- Government’s Initiatives:

- Legislative Action:

- The Fugitive Economic Offenders Act, 2018

- The Central Goods and Services Tax Act, 2017

- The Benami Transactions (Prohibition) Amendment Act, 2016

- The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

- Prevention of Money Laundering Act, 2002

- Gold Amnesty scheme: This is similar to the Voluntary Income Disclosure scheme to tap black money in income taxes.

- International Cooperation:

- Double Taxation Avoidance Agreements (DTAAs):

- India is proactively engaging with foreign governments with a view to facilitate and enhance the exchange of information under Double Taxation Avoidance Agreements (DTAAs)/Tax Information Exchange Agreements (TIEAs)/Multilateral Conventions.

- Automatic Exchange of Information:

- India has been a leading force in the efforts to forge a multilateral regime for proactive sharing of financial information known as Automatic Exchange of Information which will greatly assist the global efforts to combat tax evasion.

- The Automatic Exchange of Information based on Common Reporting Standard has commenced from 2017 enabling India to receive financial account information of Indian residents in other countries.

- Foreign Account Tax Compliance Act of USA:

- India has entered into an information sharing agreement with the USA under the act.

- Financial Action Task Force (FATF):

- India is a member of the FATF.

- Double Taxation Avoidance Agreements (DTAAs):

- Legislative Action:

Way Forward

- Appropriate legislative framework related to Public Procurement, Prevention of Bribery of foreign officials, citizens grievance redressal, whistleblower protection, UID Aadhar is needed.

- Setting up and strengthening institutions dealing with illicit money: Directorate of Criminal Investigation Cell for Exchange of Information, Income Tax Overseas Units- ITOUs at Mauritius and Singapore have been very useful, Strengthening the Foreign TAX, Tax Research and Investigation Division of the CBDT.

- Electoral Reforms: Appropriate reforms are needed to reduce money power in elections, since elections are one of the biggest channels to utilize the black money.

- Training Personnel: Both domestic and international training to personnel for effective action pertaining to the concerned area can also help.

- For instance, the Financial Intelligence Unit-India makes proactive efforts to regularly upgrade the skills of its employees by providing them opportunities for training on anti-money laundering, terrorist financing, and related economic issues.

- Incentivising Bank Transactions: To curb the menace of black money, industry body Federation of Indian Chambers of Commerce and Industry has suggested incentivisation of transactions through banking channels and a suitable framework for taxation of agricultural income.

- Besides, it suggested reforms in the real estate sector and creation of IT infrastructure to track tax evasion.

SMILE Scheme

For Prelims: SMILE Scheme, Central Sector Schemes, National Institute of Social Defence, National Backward Classes Finance & Development Corporation

For Mains: SMILE Scheme for beggars and its significance in enhancing their livelihood, Decriminalization of begging, status of beggars in India.

Why in News

Recently, the Ministry of Social Justice and Empowerment has formulated a scheme SMILE - Support for Marginalized Individuals for Livelihood and Enterprise.

- It includes a sub-scheme - ‘Central Sector Scheme for Comprehensive Rehabilitation of persons engaged in the act of Begging.

- Currently, a pilot project of it is ongoing in 7 cities namely Delhi, Bangalore, Hyderabad, Indore, Lucknow, Nagpur and Patna.

Key Points

- About:

- It is a new Scheme after the merger of existing Schemes for Beggars and Transgenders.

- Scheme provides for the use of the existing shelter homes available with the State/UT Governments and Urban local bodies for rehabilitation of the persons engaged in the act of Begging.

- In case of non-availability of existing shelter homes, new dedicated shelter homes are to be set up by the implementing agencies.

- Focus:

- The focus of the scheme is extensively on rehabilitation, provision of medical facilities, counseling, basic documentation, education, skill development, economic linkages and so on.

- It is estimated that an approximate 60,000 poorest persons would be benefited under this scheme for leading a life of dignity.

- Implementation:

- It will be implemented with the support of State/UT Governments/Local Urban Bodies, Voluntary Organizations, Community Based Organizations (CBOs) , institutions and others.

- Scheme for Comprehensive Rehabilitation of Beggars:

- It will be a comprehensive scheme for persons engaged in the act of begging.

- The scheme has been implemented in the selected cities on pilot basis having large concentrations of the Beggar community.

- During the year 2019-20, this Ministry had released an amount of Rs. 1 Crore to National Institute of Social Defence (NISD) and Rs. 70 Lakh to National Backward Classes Finance & Development Corporation (NBCFDC) for skill development programmes for beggars.

- Status of Beggars In India:

- According to the Census 2011 ,the total number of beggars in India is 4,13,670 (including 2,21,673 males and 1,91,997 females) and the number has increased from the last census.

- West Bengal tops the chart followed by Uttar Pradesh and Bihar at number two and three respectively. Lakshadweep merely has two vagrants according to the 2011 census.

- Among the union territories, New Delhi had the largest number of beggars 2,187 followed by 121 in Chandigarh.

- Among the northeastern states, Asam topped the chart with 22,116 beggars, while Mizoram ranked low with 53 beggars.

- Recently, the Supreme Court has agreed to examine a plea for decriminalising begging which has been made an offense in various states under Prevention of Begging Act.

National Backward Classes Finance & Development Corporation

- It is a Government of India Undertaking under the aegis of Ministry of Social Justice and Empowerment.

- It was incorporated under Section 25 of the Companies Act 1956 on 13th January 1992 as a Company not for profit.

- Its objective is to promote economic and developmental activities for the benefit of Backward Classes and to assist the poorer section of these classes in skill development and self-employment ventures.

National Institute of Social Defence

- The NISD is an Autonomous Body and is registered under Societies Act XXI of 1860 with the Government of National Capital Territory (NCT), Delhi.

- It is a central advisory body for the Ministry of Social Justice and Empowerment.

- It is the nodal training and research institute in the field of social defence.

- The institute currently focuses on human resource development in the areas of drug abuse prevention, welfare of senior citizens, beggary prevention, transgender and other social defence issues.

- The mandate of the institute is to provide inputs for the social defence programmes of the Government of India through training, research & documentation.

Bank Deposit Insurance Programme

For Prelims: Deposit Insurance, its limit and coverage, DICGC

For Mains: Importance of Deposit Insurance and the need of the Deposit Insurance and Credit Guarantee Corporation (DICGC)

Why in News

Recently, the Prime Minister said that Rs 1,300 crore had been paid to over 1 lakh depositors who could not access their money as their banks faced financial crises.

- The deposits worth Rs 76 lakh crore were insured under the Deposit Insurance and Credit Guarantee Corporation (DICGC) Act providing full coverage to around 98% of bank accounts.

- Earlier, the Union Cabinet cleared the Deposit Insurance and Credit Guarantee Corporation (DICGC) Bill, 2021.

Deposit Insurance: It is a protection cover against losses accruing to bank deposits if a bank fails financially and has no money to pay its depositors and has to go in for liquidation.

Credit Guarantee: It is the guarantee that often provides for a specific remedy to the creditor if his debtor does not return his debt.

Key Points

- Limit for Deposit Insurance:

- Currently, a depositor has a claim to a maximum of Rs 5 lakh per account as insurance cover. This amount is termed ‘deposit insurance’

- The cover of Rs 5 lakh per depositor is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

- Depositors having more than Rs 5 lakh in their account have no legal recourse to recover funds in case a bank collapses.

- Premium for the insurance has been raised from 10 paise for every Rs 100 deposit, to 12 paise and a limit of 15 paise has been imposed.

- The premium for this insurance is paid by banks to the DICGC, and not be passed on to depositors.

- The Insured banks pay advance insurance premiums to the corporation semi-annually within two months from the beginning of each financial half year, based on their deposits as at the end of previous half year.

- Currently, a depositor has a claim to a maximum of Rs 5 lakh per account as insurance cover. This amount is termed ‘deposit insurance’

- Coverage:

- Banks, including regional rural banks, local area banks, foreign banks with branches in India, and cooperative banks, are mandated to take deposit insurance cover with the DICGC.

- Types of Deposits Covered:

- DICGC insures all bank deposits, such as saving, fixed, current, recurring, etc. except the following types of deposits:

- Deposits of foreign Governments.

- Deposits of Central/State Governments.

- Inter-bank deposits.

- Deposits of the State Land Development Banks with the State co-operative banks.

- Any amount due on account of any deposit received outside India.

- Any amount which has been specifically exempted by the corporation with the previous approval of the RBI.

- DICGC insures all bank deposits, such as saving, fixed, current, recurring, etc. except the following types of deposits:

- Need of Deposit Insurance:

- Troubles for depositors in getting immediate access to their funds in banks in recent cases such as Punjab & Maharashtra Co-operative (PMC) Bank, Yes Bank and Lakshmi Vilas Bank had put spotlight on the subject of deposit insurance.

DICGC

- About:

- It came into existence in 1978 after the merger of Deposit Insurance Corporation (DIC) and Credit Guarantee Corporation of India Ltd. (CGCI) after passing of the Deposit Insurance and Credit Guarantee Corporation Act, 1961 by the Parliament.

- It serves as a deposit insurance and credit guarantee for banks in India.

- It is a fully owned subsidiary of and is governed by the Reserve Bank of India (RBI).

- Funds:

- The Corporation maintains the following funds :

- Deposit Insurance Fund

- Credit Guarantee Fund

- General Fund

- The first two are funded respectively by the insurance premia and guarantee fees received and are utilized for settlement of the respective claims.

- The General Fund is utilized for meeting the establishment and administrative expenses of the Corporation.

- The Corporation maintains the following funds :

National Energy Conservation Day 2021

For Prelims: National Energy Conservation Day, Bureau of Energy Efficiency (BEE), National Energy Conservation Awards, SAMEEEKSHA Portal.

For Mains: National and global efforts to ensure energy conservation, Scenario of Power Sector in India and need of energy conservation.

Why in News

The National Energy Conservation Day is observed on December 14th, every year by the Bureau of Energy Efficiency (BEE).

- The day focuses on making people aware of global warming and climate change and promotes efforts towards saving energy resources. It also highlights the achievements of the country in the fields of energy efficiency and conservation.

- The Ministry of Power celebrated Energy Conservation Week (8-14 Dec) in 2021 under Azadi Ka Amrit Mahotsav. As part of celebrations, the BEE under the Ministry of Power has organized various programs.

Key Points

- Energy Conservation:

- It refers to the efforts made to ensure that energy is used efficiently by either using less energy for a particular constant purpose – like switching off lights and fans when not being used – or reducing the use of a particular service that uses energy – like driving less and using public transport instead.

- Energy conservation is a conscious, individual effort, and at a macro level, it leads to energy efficiency.

- The end goal of energy conservation is to reach towards sustainable energy.

- It is different from the term ‘energy efficiency’, which is using technology that requires less energy to perform the same function.

- Energy Conservation Act, 2001:

- The Act was enacted with the goal of reducing the energy intensity of the Indian economy. It provides regulatory mandates for:

- Standards & labeling of equipment and appliances;

- Energy conservation building codes for commercial buildings; and

- Energy consumption norms for energy intensive industries.

- The Act was enacted with the goal of reducing the energy intensity of the Indian economy. It provides regulatory mandates for:

- Energy Conservation Week:

- The Ministry of Power is celebrating Energy Conservation Week under Azadi Ka Amrit Mahotsav from 8th to 14th December 2021.

- The BEE and the Ministry of Micro, Small and Medium Enterprises (MSMEs) have together taken a number of initiatives to ensure the growth of this sector in an energy-efficient and environmentally-friendly way.

- To ensure synergy among various players in the MSME sector, BEE and the Ministry of MSME have also promoted a collaborative platform--"SAMEEEKSHA" (Small and Medium Enterprises Energy Efficiency Knowledge Sharing).

- The platform aims to pool the knowledge and synergise the efforts of various organisations for the promotion and adoption of clean, energy technologies and practices.

- The BEE has organized an Interactive Workshop on Outcomes of Energy and Resource Mapping of the MSMEs Clusters.

- National Energy Conservation Awards:

- The Ministry of Power had launched the National Energy Conservation Awards in 1991, to give national recognition through awards to industries and establishments that have taken special efforts to reduce energy consumption while maintaining their production.

- It recognizes the energy efficiency achievements in 56 sub-sectors across industry, establishments and institutions.

- Other Related Initiatives:

- National:

- Perform Achieve and Trade Scheme (PAT): It is a market based mechanism to enhance the cost effectiveness in improving the Energy Efficiency in Energy Intensive industries through certification of energy saving which can be traded.

- Standards and Labeling: The scheme was launched in 2006 and is currently invoked for equipment/appliances.

- Energy Conservation Building Code (ECBC): It was developed for new commercial buildings in 2007.

- Demand Side Management: It is the selection, planning, and implementation of measures intended to have an influence on the demand or customer-side of the electric meter.

- Global Efforts:

- International Energy Agency: It works with countries around the world to shape energy policies for a secure and sustainable future.

- India is not a member country but an association country. However IEA has invited India to be a full time member.

- The IEA and Energy Efficiency Services Ltd. (EESL - Ministry of Power) co-produced a case study on the Indian Government's domestic efficient lighting programme - UJALA - to showcase the multiple benefits of energy efficient lighting.

- Sustainable Energy for All (SEforALL):

- It is an international organization that works in partnership with the United Nations and leaders in government, the private sector, financial institutions and civil society to drive faster action towards the achievement of Sustainable Development Goal 7 (SDG7) – access to affordable, reliable, sustainable and modern energy for all by 2030 – in line with the Paris Agreement on climate.

- Paris Agreement:

- It is a legally binding international treaty on climate change. Its goal is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels.

- As a part of the Paris Agreement, India has committed to reducing its energy intensity (units of energy use per unit of GDP) by 33-35% by 2030 compared to the 2005 levels.

- Mission Innovation (MI):

- It is a global initiative of 24 countries and the European Commission (on behalf of the European Union) to accelerate clean energy innovation.

- India is one of the member countries.

- International Energy Agency: It works with countries around the world to shape energy policies for a secure and sustainable future.

- National:

- Scenario of Power Sector in India:

- Overall Capacity: India is the third-largest electricity producer in the world. The overall capacity of about 392 GW is added into its electricity grid, as of November 2021.

- Thermal, nuclear, and renewable energy systems are the major sources for generating India’s electricity.

- The installed power generation capacities for thermal, nuclear, and renewable energy technologies hold shares of 60% (234.69 GW), 2% (6.78 GW), and 38% (150.54 GW), respectively.

- Renewable Energy Sector: The renewable energy sector in India is the fourth most attractive renewable energy market globally.

- In terms of wind energy installation capacity, India was ranked fourth, while it was placed fifth in solar energy installation capacity.

- India has achieved a milestone by crossing 150 GW of renewable energy (RE) capacity.

- As of November 2021, the overall RE installed capacity stood at 150.54 GW against the ambitious RE target of 175 GW by 2022 and 450 GW by 2030.

- Thermal, nuclear, and renewable energy systems are the major sources for generating India’s electricity.

- Overall Capacity: India is the third-largest electricity producer in the world. The overall capacity of about 392 GW is added into its electricity grid, as of November 2021.

Bureau of Energy Efficiency (BEE)

- The BEE is a statutory body established through the Energy Conservation Act, 2001 under the Union Ministry of Power.

- It assists in developing policies and strategies with the primary objective of reducing the energy intensity of the Indian economy.

- BEE coordinates with designated consumers, designated agencies, and other organizations to identify and utilize the existing resources and infrastructure, in performing its functions.

Log4Shell Vulnerability

For Prelims: Log4Shell, open-source logging software Apache Log4J, vulnerability in computer security, Application Logging

For Mains: Impact of Log4Shell Vulnerability on India and World.

Why in News

A critical vulnerability called Log4Shell, detected last week in widely used open-source logging software Apache Log4J, is now being exploited by attackers to target organizations all over the world, including India.

- The vulnerability is based on an open-source logging library used in most applications by enterprises and even government agencies.

Vulnerability

- In computer security, a vulnerability is a weakness which can be exploited by a threat actor, such as an attacker, to cross privilege boundaries (i.e. perform unauthorized actions) within a computer system.

- To exploit a vulnerability, an attacker must have at least one applicable tool or technique that can connect to a system weakness. The vulnerabilities are also known as the attack surface.

Application Logging

- Application Logging is the process of saving application events. It varies from other event logs within IT systems in that the information collected by an application event log is dictated by each individual application, instead of the operating system.

- They help provide visibility into how our applications are running on each of the various infrastructure components.

- Log data contains information such as out of memory exceptions or hard disk errors.

Key Points

- Name:

- The vulnerability is dubbed Log4Shell and is officially called CVE-2021-44228.

- CVE number is the unique number given to each vulnerability discovered across the world.

- The vulnerability was first detected on websites that were hosting servers of a Microsoft-owned game called Minecraft.

- Log4j library:

- Log4j is open-source software maintained by a group of volunteer programmers as part of the nonprofit Apache Software Foundation and is a key Java-logging framework.

- The Log4j library is embedded in every Java-based web service or application and is used by a wide number of companies to enable logging in on applications.

- Java is one of the most commonly used programming languages in the world.

- The problem impacts Log4j 2 versions which is a very common logging library used by applications across the world.

- Logging lets developers see all the activity of an application.

- Tech companies such as Apple, Microsoft, Google all rely on this open-source library, as do enterprise applications from CISCO, Netapp, CloudFare, Amazon and others.

- Severe Rating:

- Log4Shell has been assigned a severity rating of 10 by security experts, the highest level possible.

- The vulnerability could allow a hacker to take control of a system.

- Data supplied by an untrusted outsider – data that you are merely printing out for later reference, or logging into a file – can take over the server on which you are doing the logging.

- This could turn what should be a basic “print” instruction into a leak-some-secret-data-out-onto-the-internet situation, or even into a download-and-run-my-malware-at-once command.

- Simply put, a log entry that you intended to make for completeness, perhaps even for legal or security reasons, could turn into a malware implantation event.

- Remote Code Execution:

- The vulnerability can be exploited by using a single line of code and allows attackers to execute remote commands on a victim’s system.

- It can be exploited by attackers to take control of any Java-based web server and carry out Remote Code Execution (RCE) attacks.

- In an RCE attack, attackers take control over the targeted system and can perform any function they want.

- The exploits for this vulnerability are already being tested by hackers, according to several reports, and it grants them access to an application, and could potentially let them run malicious software on a device or servers.

- Impact of Log4Shell Vulnerability:

- Cryptocurrency Mining: Most of the attacks they have observed appear to focus on the use of cryptocurrency mining at the expense of the victims. However, new variations of the original exploit are being introduced rapidly.

- Successful exploitation of this vulnerability could lead to disclosure of sensitive information, addition or modification of data, or Denial of Service (DoS).

- Global: The Australia-New Zealand (ANZ) area was the most impacted region with 46% of corporate networks facing an attempted exploit.

- While North America was the least impacted with 36.4% of organizations facing such an attempt.

- India: About 41% of corporate networks in India have already faced an attempted exploit.

- Indian companies are not more vulnerable than their western counterparts because they use Java-based applications.

- Indian companies are at high risk because of their weak security posture, especially the smaller companies that may not have the know-how or resources to detect and fix the issue quickly.

- Cryptocurrency Mining: Most of the attacks they have observed appear to focus on the use of cryptocurrency mining at the expense of the victims. However, new variations of the original exploit are being introduced rapidly.

Pinaka Extended Range Rocket System

Why in News

Recently, the DRDO (Defence Research and Development Organization) successfully test fired the Pinaka Extended Range (Pinaka-ER) Multiple Launch Rocket System (MLRS).

- Earlier, the DRDO also launched the Supersonic Missile Assisted Torpedo System (SMART).

Key Points

- About:

- The Pinaka, a Multi-Barrel Rocket-Launcher (MBRL) system named after Shiva’s bow, can fire a salvo of 12 rockets over a period of 44 seconds.

- The new version is equipped with advanced technology to enhance its strength. The metal weight is lesser compared to the earlier version.

- The newly tested system can achieve a range of up to 45km which is a big feat for the Indian Army.

- The existing Pinaka system, which is already in the Army, has a range of up to 35-37km.

- Significance:

- The new incarnation of pinaka represents one of the few examples of an evolutionary process being followed with an indigenous Indian weapon system.

Background & Variants of Pinaka

- Background:

- The development of the Pinaka multi-barrel rocket systems was started by the DRDO in the late 1980s, as an alternative to the Multi Barrel Rocket Launcher systems of Russian make called the ‘Grad’, which are still used by some regiments.

- After successful tests of Pinaka Mark-1 in the late 1990, it was first used successfully in the battlefield during the 1999 Kargil War. Subsequently, multiple regiments of the system came up over the 2000s.

- Variants:

- DRDO has also developed and successfully tested the Mk-II and guided variants of the Pinaka, which has a range of around 60 km, while the Guided Pinaka system has a range of 75 km and has integrated navigation, control and guidance system to improve the end accuracy and enhance the range.

- The navigation system of the Guided Pinaka missile is also aided by the Indian Regional Navigation Satellite System (IRNSS).

- In 2020, an enhanced version of the Pinaka Mark (Mk)-1 missile was successfully flight-tested from the Integrated Test Range in Chandipur, off the coast of Odisha.

- DRDO has also developed and successfully tested the Mk-II and guided variants of the Pinaka, which has a range of around 60 km, while the Guided Pinaka system has a range of 75 km and has integrated navigation, control and guidance system to improve the end accuracy and enhance the range.