Agriculture

Inclusion of Urea in Nutrient-Based Subsidy Regime

For Prelims: Kharif Crops, CACP, Urea, DAP, LPG Subsidy, NBS Regime.

For Mains: Inclusion of Urea in Nutrient-Based Subsidy Regime.

Why in News?

In its non-price policy recommendations for the Kharif crops 2023-2024 season, the Commission for Agricultural Costs and Prices (CACP) has recommended that Urea should be brought under the Nutrient-Based Subsidy (NBS) regime to address the problem of imbalanced nutrient usage in agriculture.

- Currently, urea is excluded from the NBS scheme, which has led to disproportionate use and deteriorating soil health.

Commission for Agricultural Costs and Prices

- The CACP is a statutory body of the Ministry of Agriculture and Farmers Welfare, formed in 1965.

- Currently, the Commission comprises a Chairman, Member Secretary, one Member (Official) and two Members (Non-Official).

- The non-official members are representatives of the farming community and usually have an active association with the farming community.

- It is mandated to recommend Minimum Support Prices (MSPs) to incentivize the cultivators to adopt modern technology and raise productivity and overall grain production.

- CACP submits separate reports recommending prices for Kharif and Rabi seasons.

What is the Need for Urea to be Included under NBS Regime?

- Inadequate Supply of Natural Gas:

- Due to inadequate natural gas supplies, the capacity to produce urea fertilizer in India is limited, leading to an increase in imports. These imported urea fertilizers have a higher subsidy burden per tonne compared to domestic urea.

- Additionally, the high global prices of raw materials for complex fertilizers further complicate the government's efforts to contain fertilizer subsidies in the medium-term.

- As a result, the government's efforts to control fertilizer subsidies will face challenges in the medium-term, and subsidy amounts are likely to increase due to rising demand.

- Imbalanced Nutrient Usage:

- Over the years, the excessive use of urea in agriculture has contributed to worsening plant nutrient imbalance. Non-urea fertilizers like phosphorus and potassium are covered under the NBS, where subsidies are linked to their nutrient content.

- However, urea remains outside this regime, enabling the government to retain direct control over its maximum retail price (MRP) and subsidy.

- This discrepancy in pricing has led farmers to overuse urea, neglecting other essential nutrients and causing soil health degradation.

- Impact of Pricing Policies:

- While the MRP of urea has remained unchanged at Rs 5,360 per metric tonne (MT), the prices of other fertilizers, such as Diammonium Phosphate (DAP) have increased over time.

- The freedom granted to manufacturers of non-urea fertilizers to set MRPs within reasonable limits, along with fixed per-tonne subsidies based on nutrient content, has contributed to their rising prices.

- Consequently, the sales of urea have been significantly higher compared to other fertilizers, exacerbating the nutrient imbalance in agriculture.

What are the Recommendations?

- Bringing Urea under the NBS Regime:

- It will enable subsidies to be linked to the nutrient content of urea and promote the balanced application of fertilizers.

- Introducing a Cap on Subsidized Fertilizer Bags:

- The government should set a cap on the number of subsidised bags of fertilizers per farmer as has been done for subsidised LPG cylinders, to reduce the government’s subsidy burden.

- Leveraging Technology and Identification Systems:

- The CACP highlights the ease of implementing the proposed cap on subsidized fertilizers by utilizing Point of Sale devices installed at retailer shops.

- Beneficiaries can be identified through Aadhaar Card, Kisan Credit Card (KCC), Voter Identity Card, among other identification methods.

What is the NBS Regime?

- About:

- Under the NBS regime – fertilizers are provided to the farmers at subsidized rates based on the Nutrients (N, P, K & S) contained in these fertilizers.

- Also, the fertilizers which are fortified with secondary and micronutrients such as molybdenum (Mo) and zinc are given additional subsidy.

- The subsidy on P&K fertilizers is announced by the Government on an annual basis for each nutrient on a per kg basis – which are determined taking into account the international and domestic prices of P&K fertilizers, exchange rate, inventory level in the country etc.

- NBS policy intends to increase the consumption of P&K fertilizers so that optimum balance (N:P: K= 4:2:1) of NPK fertilization is achieved.

- Significance:

- This will improve soil health and as a result the yield from the crops would increase, resulting in enhanced income to the farmers.

- It will make rational use of fertilizers; this would also ease off the burden of fertilizer subsidy.

What are the Challenges Related to NBS?

- Economic and Environmental Costs:

- The fertilizer subsidy, including the NBS policy, imposes a significant financial burden on the economy. It ranks as the second-largest subsidy after food subsidy, straining fiscal health.

- Additionally, imbalanced fertilizer usage due to the pricing disparity has adverse environmental consequences, such as soil degradation and nutrient runoff, impacting long-term agricultural sustainability.

- Black Marketing and Diversion:

- Subsidized urea is susceptible to black marketing and diversion. It is sometimes illegally sold to bulk buyers, traders, or non-agricultural users like plywood and animal feed manufacturers.

- Moreover, there are instances of subsidized urea being smuggled to neighboring countries like Bangladesh and Nepal, leading to the loss of subsidized fertilizers intended for domestic agricultural use.

- Leakage and Misuse:

- The NBS regime relies on an efficient distribution system to ensure that subsidized fertilizers reach the intended beneficiaries, i.e., farmers.

- However, there may be instances of leakage and misuse, where subsidized fertilizers do not reach farmers or are used for non-agricultural purposes. This undermines the effectiveness of the subsidy and denies genuine farmers access to affordable fertilizers.

- Regional Disparities:

- Agricultural practices, soil conditions, and crop nutrient requirements vary across different regions of the country.

- Implementing a uniform NBS regime may not adequately address the specific needs and regional disparities, potentially leading to suboptimal nutrient application and productivity variations.

Way Forward

- A uniform policy for all fertilizers is necessary, as nitrogen (N), phosphorus (P), and potassium (K) are crucial for crop yields and quality.

- In the long term, NBS could be replaced by a flat per-acre cash subsidy that allows farmers to purchase any fertilizer.

- This subsidy should encompass value-added and customized products that provide efficient nitrogen delivery and other essential nutrients.

- It is crucial to strike a balance between price control, affordability, and sustainable nutrient management to achieve the desired outcomes of the NBS regime.

UPSC Civil Services Examination, Previous Year’s Question (PYQs)

Q. With reference to chemical fertilizers in India, consider the following statements: (2020)

- At present, the retail price of chemical fertilizers is market-driven and not administered by the Government.

- Ammonia, which is an input of urea, is produced from natural gas.

- Sulphur, which is a raw material for phosphoric acid fertilizer, is a by-product of oil refineries.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

Ans: (b)

Q. Why does the Government of India promote the use of ‘Neem-coated Urea’ in agriculture? (2016)

(a) Release of Neem oil in the soil increases nitrogen fixation by the soil microorganisms.

(b) Neem coating slows down the rate of dissolution of urea in the soil.

(c) Nitrous oxide, which is a greenhouse gas, is not at all released into atmosphere by crop fields.

(d) It is a combination of a weedicide and a fertilizer for particular crops.

Ans: (b)

Governance

Primary Agricultural Credit Societies

For Prelims: Primary Agricultural Credit Societies, Sahkar Se Samridhi, Cooperatives, Fertilizers, Atmanirbhar Bharat.

For Mains: Primary Agricultural Credit Societies.

Why in News?

In the direction of realizing the Prime Minister’s vision of “Sahkar Se Samridhi”, the Government has taken five new decisions to increase the income of Primary Agricultural Credit Societies (PACS), as well as increase the employment opportunities in rural areas.

- Government aims to achieve overall prosperity in the country through the mantra of “Sahkar Se Samriddhi”. It was proposed to strengthen Cooperatives by bringing transparency, modernization, and creating competitiveness.

What are the New Five Decisions?

- PACS which are not functioning as fertilizer retailers will be identified and they will be encouraged to function as retailers on the basis of feasibility in a phased manner.

- PACS which are not currently functioning as Pradhan Mantri Kisan Samridhi Kendras (PMKSK) will be brought under the ambit of PMKSK.

- The Prime Minister inaugurated 600 PMKSK in 2022 under the Ministry of Chemicals & Fertilisers.

- PMKSK will cater to a wide variety of needs of the farmers and provide agri-inputs, testing facilities for soil, seeds, and fertilisers.

- PACS will be connected with the marketing of organic Fertilizers, especially Fermented Organic Manure (FoM) / Liquid Fermented Organic Manure (LFOM) / Phosphate Enriched Organic Manure (PROM).

- Under the Market Development Assistance (MDA) scheme of Department of Fertilizers, fertilizer companies will act as an aggregator for small bio-organic producers to market the end product, in this supply and marketing chain of bio-organic fertilizers PACS will also be included as wholesalers/retailers.

- PACS can also be employed as Drone entrepreneurs for spraying fertilizers and pesticides. Drones can also be used for survey of property.

What are Primary Agricultural Credit Societies?

- About:

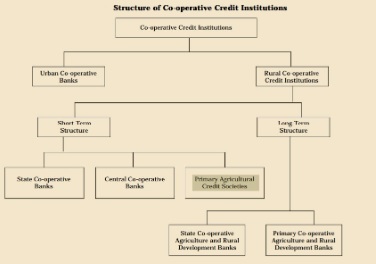

- PACS are village level cooperative credit societies that serve as the last link in a three-tier cooperative credit structure headed by the State Cooperative Banks (SCB) at the state level.

- Credit from the SCBs is transferred to the District Central Cooperative Banks (DCCBs), which operate at the district level. The DCCBs work with PACS, which deal directly with farmers.

- PACSs provide short-term, and medium-term agricultural loans to the farmers for the various agricultural and farming activities.

- The first PACS was formed in 1904.

- PACS are village level cooperative credit societies that serve as the last link in a three-tier cooperative credit structure headed by the State Cooperative Banks (SCB) at the state level.

- Status:

- A report published by the Reserve Bank of India on December 27, 2022 put the number of PACS at 1.02 lakh. At the end of March 2021, only 47,297 of them were in profit.

- Significance:

- Access to Credit:

- They provide small farmers with access to credit, which they can use to purchase seeds, fertilizers, and other inputs for their farms. This helps them to improve their production and increase their income.

- Financial Inclusion:

- PACS help to increase financial inclusion in rural areas, where access to formal financial services is limited. They provide basic banking services, such as savings and loan accounts, to farmers who may not have access to formal banking services.

- Convenient Services:

- PACS are often located in rural areas, which makes it convenient for farmers to access their services. PACS have the capacity to extend credit with minimal paperwork within a short time.

- Promoting Savings Culture:

- PACS encourage farmers to save money, which can be used to improve their livelihoods and invest in their farms.

- Enhancing Credit Discipline:

- PACS promote credit discipline among farmers by requiring them to repay their loans on time. This helps to reduce the risk of default, which can be a major challenge in the rural financial sector.

- Access to Credit:

What are the Issues with the PACS?

- Inadequate Coverage:

- Though geographically active PACS cover about 90% of 5.8 villages, there are parts of the country, especially in the north-east, where this coverage is very low.

- Further, the rural population covered as members is only 50% of all the rural households.

- Inadequate Resources:

- The resources of the PACS are much too inadequate in relation to the short-and medium-term credit needs of the rural economy.

- The bulk of even these inadequate funds come from higher financing agencies and not through owned funds of societies or deposit mobilization by them.

- Overdues and NPAs:

- Large over-dues have become a big problem for the PACS.

- As per the RBI report in 2022, PACS had reported lending worth Rs 1,43,044 crore and NPAs of Rs 72,550 crore. Maharashtra has 20,897 PACS of which 11,326 are in losses.

- They curb the circulation of loanable funds, reduce the borrowing as well as lending power of societies, and give them the bad image that the societies of defaulting debtors are willful.

- Large over-dues have become a big problem for the PACS.

Way Forward

- PACS are important institutions in India's rural financial sector and can contribute significantly to the vision of Atmanirbhar Bharat (self-reliant India) and the Vocal for Local campaign. These century-old institutions can serve as the foundation for a self-reliant village economy.

- To maximize their potential, PACS need to be made more efficient, financially sustainable, and accessible to farmers. This requires improvements in their operations and management.

- Additionally, the regulatory framework governing PACS must be strengthened to ensure effective governance and the ability to meet the needs of farmers.

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims

Q1. Consider the following statements: (2020)

- In terms of short-term credit delivery to the agriculture sector, District Central Cooperative Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks.

- One of the most important functions of DCCBs is to provide funds to the Primary Agricultural Credit Societies.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Q2. With reference to ‘Urban Cooperative Banks’ in India, consider the following statements: (2021)

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q.“In the villages itself no form of credit organization will be suitable except the cooperative society.” – All India Rural Credit Survey. Discuss this statement in the background of agricultural fi nance in India. What constraints and challenges do financial institutions supplying agricultural fi nance face? How can technology be used to better reach and serve rural clients? (2014)

Economy

Global Dependence on Oil and Natural Gas

For Prelims: UNFCCC COPs, Oil and Gas Production and Consumption

For Mains: India’s dependence on oil and natural gas, Challenges and Measures related to restricting oil and gas production

Why in News?

According to a new report from Climate Action Tracker (CAT), a non-profit organisation, the world’s largest fossil fuel-producing countries have neither made a commitment to end oil and gas production nor have they set a global target for renewable energy.

- The upcoming UNFCCC COP 28 shall focus on putting an end to oil and gas production.

What are the Key Highlights of the Report?

- Lack of Global Consensus:

- New oil and gas investments should have ended by now; there exists a globally accepted consensus on phasing out coal but there’s no such agreement on oil and gas.

- Though India called for a phasedown of all fossil fuels at COP27 in Egypt, a concrete decision regarding the same could not be finalized.

- Performance of Developed Countries:

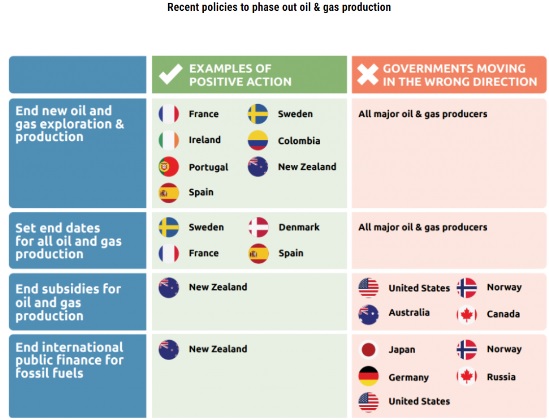

- As of now, only Sweden, Denmark, France and Spain have set an end date while France, Sweden, Colombia, Ireland, Portugal, New Zealand and Spain have halted new oil and gas exploration and production.

- On the contrary, the US - world’s largest oil and gas producer, has more than doubled oil production since 2010.

- Australia - world's largest LNG exporter, projects an 11% increase in its LNG production between 2020 and 2030.

- CSS as an Alternative and its Challenges:

- The UAE - world’s 7th largest oil producer and 15th largest fossil gas producer has been pushing for the use of Carbon Capture and Storage (CCS) in the energy sector instead of phasing out oil and gas.

- CCS involves capturing CO2 from power plants and other industrial processes, instead of emitting them into the atmosphere.

- Currently, CCS captures less than 0.1% of global carbon emissions accounting to technological, economic, institutional, ecological, environmental and socio-cultural barriers.

- CCS is expensive and could end up becoming a stranded asset; investments in CCS could rob funds from renewable energy projects.

- Other countries already investing in CSS techniques include the US, Australia and Canada. Saudi Arabia is looking to deploy CCS to reach its net zero climate targets.

- The UAE - world’s 7th largest oil producer and 15th largest fossil gas producer has been pushing for the use of Carbon Capture and Storage (CCS) in the energy sector instead of phasing out oil and gas.

What is the Scenario of Oil and Gas Production/Consumption?

- Global Scenario:

- According to the International Energy Agency (IEA), global production, transportation and processing of oil and gas emitted the equivalent of 5.1 billion tonnes of CO2 in 2022 - almost 15% of total energy-related greenhouse gas emissions.

- Oil and gas production is one of the largest emitters of methane, a potent greenhouse gas and a significant contributor of air pollution emissions.

- Under the IEA’s Net Zero by 2050 (NZE) scenario, the emissions intensity of oil and gas activities needs to be roughly halved by the end of this decade, leading to a 60% overall reduction in total emissions from oil and gas operations.

- According to the International Energy Agency (IEA), global production, transportation and processing of oil and gas emitted the equivalent of 5.1 billion tonnes of CO2 in 2022 - almost 15% of total energy-related greenhouse gas emissions.

- Major Producers and Consumers:

- The top oil-producing nations in 2022 were the United States, Saudi Arabia, Russia, Canada, and China, with OPEC remaining a powerful cartel of oil producers.

- The US became the top petroleum liquids producer in the world accounting for 20% of the world’s production in 2022.

- The top oil consuming countries of 2022 were the US < China < India < Russia < Japan < Saudi Arabia < Brazil < South Korea < Canada < Germany.

- The top oil-producing nations in 2022 were the United States, Saudi Arabia, Russia, Canada, and China, with OPEC remaining a powerful cartel of oil producers.

- India’s Scenario:

- India is still highly exposed to the industrial activities related to fossil fuels - it is the world's 3rd largest oil consumer at around 5 million barrels a day with an annual growth rate of oil demand at 3-4%.

- India’s import dependency in oil and natural gas has also increased - in the case of natural gas, the net import dependency rose from just over 30% (2012-13) to nearly 48% (2021-22).

- Crude oil has also seen a similar increase in imports.

Why are the Countries not Restricting Oil and Gas Production?

- Economic Considerations: Oil and natural gas production often play a significant role in a country's economy, contributing to government revenues, employment, and overall economic growth.

- Energy Security: Oil and natural gas are essential for energy security; countries prioritise ensuring a steady and reliable supply of energy to increased production to meet domestic demand and reduce dependence on imports.

- Geopolitical Considerations: Some nations may use energy production as a tool for political leverage or to exert influence over other nations, which can impact production control efforts.

- Domestic Political Factors: Political considerations, including domestic pressure and competing interests, can influence production decisions. Governments may face opposition from stakeholders, including industry groups, local communities, or political factions, which can complicate efforts to control production.

How can the Dependence on Oil and Gas be Reduced?

- Setting Concrete Targets: Developed countries have absolutely no excuse - new oil and gas investments should have ended already. All the countries, especially richer countries, need to lead on this, and set phase-out dates for all fossil fuel production.

- Embrace Renewable Energy Innovation: Countries shall invest in research and development to accelerate the advancement of renewable energy technologies.

- This includes funding for breakthrough technologies such as next-generation solar panels, advanced wind turbines, and energy storage solutions.

- Foster International Collaboration: Countries can collaborate on research, knowledge sharing, and joint initiatives to develop innovative solutions for reducing oil and natural gas consumption.

- Sharing best practices and lessons learned can accelerate progress globally.

- Aid for Capacity Building: Developed countries shall assist developing countries in building their capacity to implement sustainable energy projects through technical assistance, training programs, and knowledge sharing.

- Green Industrialisation: Countries shall promote the development of green industries, such as renewable energy manufacturing, to create local job opportunities, increase energy self-sufficiency, and reduce dependence on fossil fuel imports.

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims:

Q.1 With reference to furnace oil, consider the following statements: (2020)

- It is a product of oil refineries.

- Some industries use it to generate power.

- Its use causes sulphur emissions into environment.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q.2 The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of (2020)

(a) Crude oil

(b) Bullion

(c) Rare earth elements

(d) Uranium

Ans: (a)

Mains:

Q. The question of India’s Energy Security constitutes the most important part of India’s economic progress. Analyse India’s energy policy cooperation with West Asian countries. (2017)

Geography

Delayed Monsoon

For Prelims: Inter Tropical Convergence Zone (ITCZ) , westerly jet stream,Southern Oscillation (SO), India Meteorological Department (IMD).

For Mains: Significance of the southwest monsoon, Indo-Pacific region.

Why in News?

In 2023, the monsoon arrived over the Kerala coast on June 8, which is a delay compared to its normal onset date of June 1.

What is Monso on?

- About:

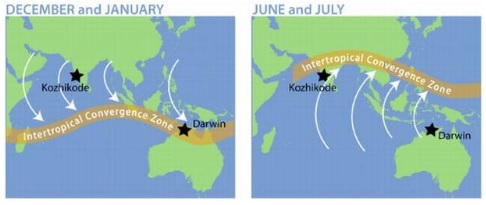

- Monsoons are seasonal winds (Rhythmic wind movements or Periodic Winds) which reverse their direction with the change of season.

- Factors Influencing South-West Monsoon:

- The differential heating and cooling of land and water creates a low pressure on the landmass of India while the seas around experience comparatively high pressure.

- The shift of the position of Inter Tropical Convergence Zone (ITCZ) in summer, over the Ganga plain (this is the equatorial trough normally positioned about 5°N of the equator.

- It is also known as the monsoon-trough during the monsoon season).

- The presence of the high-pressure area, east of Madagascar, approximately at 20°S over the Indian Ocean. The intensity and position of this high-pressure area affect the Indian Monsoon.

- The Tibetan plateau gets intensely heated during summer, which results in strong vertical air currents and the formation of low pressure over the plateau at about 9 km above sea level.

- The movement of the westerly jet stream to the north of the Himalayas and the presence of the tropical easterly jet stream over the Indian peninsula during summer.

- Southern Oscillation (SO):

- It is a shift in wind and sea surface temperature between the tropical eastern Pacific Ocean and the Indian Ocean. It is commonly referred to as the phenomenon of shifting air pressure.

- La Nina is the cooling phase, and El Nino is the warming phase.

- La Nina generally impacts positively on Indian Monsoon.

- Indian Ocean Dipole (IOD):

- IOD is the difference between the temperature of eastern (Bay of Bengal) and the western Indian Ocean (Arabian Sea).

- A positive IOD brings more rainfall in India while negative IOD impacts negatively.

What is the Onset of Monsoon?

- Monsoon Onset:

- The onset of the monsoon over the Kerala coast signifies the start of the four-month southwest monsoon season, which accounts for over 70% of India's annual rainfall.

- Contrary to common assumptions, the onset does not refer to the first rain of the season but rather follows specific technical criteria set by the India Meteorological Department (IMD).

- Conditions for Monsoon Onset:

- The IMD determines the monsoon onset based on significant transitions in atmospheric and ocean circulations in the Indo-Pacific region.

- The declaration of onset relies on specific parameters related to rainfall consistency, intensity, and wind speed.

- Rainfall:

- The onset is declared when at least 60% of 14 designated meteorological stations in Kerala and Lakshadweep record at least 2.5 mm of rain for two consecutive days after May 10.

- The onset is declared on the second day if specific wind and temperature criteria are met.

- Wind Field:

- The depth of westerlies within the equator to 10ºN latitude and the 55ºE to 80ºE longitude range should extend up to 600 hectopascal (hPa).

- The zonal wind speed between 5-10ºN latitude and 70-80ºE longitude should be around 15-20 knots (28-37 kph) at 925 hPa.

- Heat:

- The Outgoing Longwave Radiation (OLR) value, derived from INSAT, should be below 200 watt per sq m (wm2) in the area between 5ºN and 10ºN latitudes and 70ºE and 75ºE longitudes.

- Rainfall:

- Impact of Delayed Onset:

- Agriculture:

- Delayed monsoon onset can affect agricultural activities, particularly sowing of crops.

- Farmers heavily rely on monsoon rains for irrigation and crop growth.

- A delay in rainfall can lead to a postponement of sowing, affecting crop yields and agricultural productivity.

- Water Resources:

- Delayed monsoon onset can result in water scarcity, especially in regions dependent on rainfall for replenishing water reservoirs, rivers, and lakes.

- Energy Sector:

- Delayed monsoon can impact hydropower generation, which relies on sufficient water availability.

- Environment:

- It can affect the growth and distribution of vegetation, delay the migration of certain species, and disrupt ecological cycles.

- Delayed monsoon can also contribute to soil erosion, land degradation, and reduced biodiversity in affected regions.

- Agriculture:

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims;

Q. With reference to ‘Indian Ocean Dipole (IOD)’ sometimes mentioned in the news while forecasting Indian monsoon, which of the following statements is/are correct? (2017)

1. IOD phenomenon is characterised by a difference in sea surface temperature between tropical Western Indian Ocean and tropical Eastern Pacific Ocean.

2. An IOD phenomenon can influence an El Nino’s impact on the monsoon.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Exp;

- The Indian Ocean Dipole (IOD) is an atmosphereocean coupled phenomenon in the tropical Indian Ocean (like the El Nino is in the tropical Pacific), characterised by a difference in Sea-Surface Temperatures (SST).

- A ‘positive IOD’ is associated with cooler than normal sea-surface temperatures in the eastern equatorial Indian Ocean and warmer than normal sea-surface temperatures in the western tropical Indian Ocean.

- The opposite phenomenon is called a ‘negative IOD’, and is characterised by warmer than normal SSTs in the eastern equatorial Indian Ocean and cooler than normal SSTs in the western tropical Indian Ocean.

- Also known as the Indian Nino, it is an irregular oscillation of sea-surface temperatures in the Indian Ocean in which the western Indian Ocean becomes alternately warmer and colder than the eastern part of the Indian Ocean. Hence, statement 1 is not correct.

- The IOD is one aspect of the general cycle of global climate, interacting with similar phenomena like the El Nino-Southern Oscillation (ENSO) in the Pacific Ocean. An IOD can either aggravate or weaken the impact of El Nino on Indian monsoon. If there is a positive IOD, it can bring good rains to India despite of an El Nino year. Hence, statement 2 is correct.

- Therefore, option (b) is the correct answer

Mains:

Question: How far do you agree that the behaviour of the Indian monsoon has been changing due to humanizing landscape? Discuss.(2015)

Indian Economy

Expected Credit Loss -Based Loan Loss Provisioning Norms

For Prelims: Expected Credit Loss (ECL) Non Performing Assets, RBI, Loan Provisioning

For Mains: Problems of Loan loss, measures to strengthen banking sector

Why in News?

Recently, the Reserve Bank of India (RBI) said that the banks will be given ample time to implement Expected Credit Loss (ECL)-based loan loss provisioning norms.

What is the Expected Credit Loss -Based Loan Loss Provisioning Norms?

- Background:

- The RBI had previously proposed the adoption of the ECL approach for credit impairment, and banks were given a one-year period for implementation once the final guidelines are released.

- While the final guidelines are yet to be announced, it is expected that they may be notified by FY2024 for implementation starting from April 1, 2025.

- The Indian Banks Association (IBA) have requested the RBI to grant an additional year for lenders to prepare for the implementation of the ECL norms.

- About:

- RBI has proposed a framework for adopting an expected loss (EL)-based approach for provisioning by banks in case of loan defaults.

- Under this, banks will need to classify financial assets into one of three categories (Stage 1, Stage 2, or Stage 3).

- Asset Classification:

- Stage 1 Assets:

- These are financial assets that have not experienced a significant increase in credit risk since their initial recognition or have low credit risk at the reporting date.

- For these assets, 12-month expected credit losses are recognized, and interest revenue is calculated based on the gross carrying amount of the asset.

- These are financial assets that have not experienced a significant increase in credit risk since their initial recognition or have low credit risk at the reporting date.

- Stage 2 Assets:

- These are financial instruments that have undergone a significant increase in credit risk since their initial recognition, although there is no objective evidence of impairment.

- Lifetime expected credit losses are recognized for these assets, but interest revenue is still calculated based on the gross carrying amount of the asset.

- Stage 3 Assets:

- These are financial assets that have objective evidence of impairment at the reporting date.

- For these assets, lifetime expected credit loss is recognized, and interest revenue is calculated based on the net carrying amount.

- These are financial assets that have objective evidence of impairment at the reporting date.

- Stage 1 Assets:

- Benefits:

- The expected credit losses approach will enhance the resilience of the banking system in line with globally accepted standards.

- It is expected to result in higher provisions compared to the shortfall seen under the incurred loss approach.

- ECL vs IL Model:

- This new approach replaces the current "incurred loss (IL)" model, which delays loan loss provisioning, potentially increasing credit risk for banks.

- A key drawback in the IL model was that usually banks made provisions with a significant delay after the borrower may have started facing financial difficulties, thereby increasing their credit risk. This led to systemic issues.

- Furthermore, the delayed recognition of loan losses resulted in an overstatement of banks' income, combined with dividend payouts, which further eroded their capital base.

- Transitional Arrangement:

- To prevent a capital shock, the RBI has proposed a transitional arrangement for the introduction of ECL norms.

- This phased implementation will help banks absorb any additional provisions without adversely impacting their profitability.

What is the Concept of Loan-Loss Provision?

- About:

- Loan-loss provision, as defined by the RBI, refers to the allocation of funds set aside by banks to cover losses incurred from defaulted loans.

- In simpler terms, it is a reserve of cash that banks keep to mitigate the impact of losses resulting from borrowers' failure to repay their loans.

- Provision:

- This provision acts as an expense on the bank's income statement and can be utilized when borrowers are deemed unlikely to repay their loans.

- By using the loan-loss reserves, banks can cover the losses they incur instead of facing a direct reduction in their cash flows.

- Example:

- Consider a scenario where a bank has issued a total of USD 100,000 in loans and has a loan loss provision of USD 10,000.

- If a borrower defaults on a USD 1,000 loan but repays only USD 500, the bank would deduct USD 500 from the loan loss provision to cover the loss.

- Consider a scenario where a bank has issued a total of USD 100,000 in loans and has a loan loss provision of USD 10,000.

- Example:

- Determinants:

- The level of loan loss provision is determined based on the expected level required to ensure the bank's safety and stability.

What is the Current Approach for Loan Loss Provisions?

- Banks in India follow the incurred loss model for making loan loss provisions.

- This model assumes that all loans will be repaid unless evidence suggests otherwise, such as a trigger event indicating a loss.

- Only when such an event occurs is the impaired loan or portfolio of loans written down to a lower value.

What are the Challenges?

- The incurred loss approach requires banks to provide for losses that have already occurred or been incurred.

- However, during the financial crisis of 2007-09, this delayed recognition of expected losses worsened the downturn.

- As defaults increased across the system, the delayed recognition of loan losses forced banks to make higher provisions, depleting their capital reserves.

- This, in turn, weakened the resilience of banks and posed systemic risks.

- Additionally, the delays in recognizing loan losses led to an overstatement of banks' generated income.

- Combined with dividend payouts, this impacted their capital base by reducing internal accruals, further compromising their resilience.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Consider the following statements: (2018)

1. Capital Adequacy Ratio (CAR) is the amount that banks have to maintain in the form of their own funds to offset any loss that banks incur if the account-holders fail to repay dues.

2. CAR is decided by each individual bank.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Exp:

- Capital Adequacy Ratio (CAR) is a measurement of a bank’s available capital expressed as a percentage of a bank’s risk-weighted credit exposures. It is used to protect depositors and promote the stability and efficiency of financial systems

- It is the amount that banks have to maintain in the form of their own funds to offset any loss that banks incur if the account-holders fail to repay dues. Hence, statement 1 is correct.

- Two types of capital measured under CAR are:

- Tier 1 Capital: It is the core capital, which consists of equity capital, ordinary share capital, intangible assets and audited revenue reserves.

- Tier 2 Capital: It comprises of unauditedretained earnings, unaudited reserves and general loss reserves.

- CAR = (Tier 1 Capital + Tier 2 Capital)/Risk Weighted Assets

- CAR is decided by the Central bank or Reserve Bank of India (RBI) to prevent commercial banks from taking excess leverage and becoming insolvent in the process.

- Basel III norms stipulated a capital to risk weighted assets of 8%. As per RBI norms, Indian scheduled commercial banks are required to maintain a CAR of 9%, while Indian public sector banks are emphasized to maintain a CAR of 12%. Hence, statement 2 is not correct.

- Therefore, option (a) is the correct answer

International Relations

Atlantic Declaration

For Prelims: Atlantic Declaration, Atlantic Charter, NATO, G20, Five Eyes intelligence alliance, AUKUS, Decarbonization, Artificial intelligence, Quantum computing, Biotechnology.

For Mains: Major Pillars of UK-US Partnership.

Why in News?

The United States and the United Kingdom have announced the Atlantic Declaration for a Twenty-First Century U.S.-UK Economic Partnership.

- This declaration aims to adapt, reinforce, and reimagine the longstanding alliance between the two nations to effectively address the challenges of the current era.

- With this new declaration, both nations seek to strengthen their collaboration in defence, security, science, technology, and economic domains.

What are the Major Highlights of the Atlantic Declaration?

- About:

- The Atlantic Declaration is focused on building a resilient, diversified, and secure supply chain, reducing strategic dependencies.

- The partnership aims to leverage the energy transition and technological breakthroughs to drive shared growth, create employment opportunities, and uplift communities.

- Atlantic Declaration Action Plan (ADAPT):

- The ADAPT sets forth a comprehensive strategy to enhance economic growth, competitiveness, and resilience while prioritising workers, businesses, climate, and national security.

- The plan encompasses five key pillars and involves regular high-level meetings to drive progress and increase ambition over time.

- Five Pillars:

- Leadership in Critical and Emerging Technologies: Sharing best practices in areas such as artificial intelligence, quantum computing, biotechnology, and advanced manufacturing.

- Cooperation on Economic Security and Technology Protection: This will include sharing information and best practices on cybersecurity, supply chain resilience, and technology governance.

- Partnering on an Inclusive and Responsible Digital Transformation: Collaborating on digital skills training and workforce development to ensure the readiness of individuals for the digital economy.

- Building the Clean Energy Economy of the Future.

- Strengthening Alliance across Defense, Health Security, and Space.

What are the Major Pillars of UK-US Partnership?

- Historical Significance of the U.S.-UK Partnership: The partnership between the US and the UK has played a pivotal role in leading on global issues.

- The signing of the Atlantic Charter in 1941 laid the foundation for a rules-based international order.

- The New Atlantic Charter signed in 2021 reaffirmed the commitment to shared values and refreshed the vision of the partnership.

- Political Affairs: The two countries are also close allies in NATO and other multilateral organisations such as the UN, the G7 and the G20.

- Economic Ties: The United States is the largest source of direct investment in the United Kingdom, and the United Kingdom is also the single largest investor in the United States.

- Security and Defense Cooperation: The United States and the United Kingdom have a long history of joint military operations and intelligence sharing, dating back to World War I and World War II.

- The two countries are part of the Five Eyes intelligence alliance, along with Australia, Canada, and New Zealand.

- Significant steps have been taken to implement AUKUS, including supporting Australia's acquisition of conventionally armed, nuclear-powered submarines.

- The U.S.-UK Indo-Pacific Dialogue promotes closer coordination to support a free and open region.

- Collaboration with ASEAN, Pacific Islands, and trilateral joint exercises contributes to regional peace, stability, and technological advancement.

UPSC Civil Services Examination Previous Year Question (PYQ)

Mains

Q. The new tri-nation partnership AUKUS is aimed at countering China’s ambitions in the Indo-Pacific region. Is it going to supersede the existing partnerships in the region? Discuss the strength and impact of AUKUS in the present scenario. (2021)

Important Facts For Prelims

Limits on UPI Transactions

Why In News?

With record rise in Unified Payments Interface(UPI) transactions, Banks and UPI apps have decided to impose daily limits on UPI transactions on top of the limits set by the National Payments Corporation of India (NPCI) in 2021.

What Limits have been Imposed on UPI Transactions?

- Limits by NPCI:

- Currently, users can make up to 20 transactions or ₹1 lakh in a single day, either all at once or throughout the day.

- Certain specific categories of transactions, such as capital markets, collections, insurance, and forward inward remittances, have a higher limit of ₹2 lakh.

- For UPI-based ASBA (Application Supported by Blocked Amount system) IPO and retail direct schemes, the limit for each transaction was increased to ₹5 lakh in December 2021.

- ASBA is a facility for investors to participate in Initial Public Offerings (IPOs) and invest in the stock market.

- It enables investors to apply for shares without transferring the funds upfront to the IPO issuer or stockbroker. Instead, the investor's application money is temporarily blocked in their bank account until the shares are allotted.

- ASBA is a facility for investors to participate in Initial Public Offerings (IPOs) and invest in the stock market.

- Limits by Banks/Apps:

- Some banks and apps have set their own transaction limits.

- For example, Punjab National Bank (PNB) and Bank of Baroda have a lower limit of ₹25,000, with PNB's daily limit being ₹50,000.

- Google Pay users face a breach of the daily limit if they attempt to send money more than ten times in a single day across all UPI apps.

- Some banks and apps have set their own transaction limits.

What is the Significance of Limits?

- The imposition of limits helps maintain the security infrastructure of UPI and ensures its seamless functioning.

- Limits assist in preventing potential fraud and risk concerns while balancing customer convenience.

- Higher limits are set for specific categories with higher average transaction values, such as capital markets or credit card bill payments.

What are the Most Recent Trends Observed with respect to UPI?

- In May,2023, the total number of transactions facilitated using UPI reached 9,415.19 million, with a combined value of ₹14.89 lakh crore.

- Share of P2P (peer-to-peer) transactions among total UPI transactions is about 43%, while the rest are P2M (peer-to-merchant).

- In the P2P category, the majority of transactions were in the below ₹500 bracket (54.2%), while in the P2M category, the share in the same amount bracket was 84.3%.

What is National Payments Corporation of India (NPCI)?

- It is an umbrella organisation for operating retail payments and settlement systems in India.

- It is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

- It has been incorporated as a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013).

- The ten core promoter banks are State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC.

- In 2016 the shareholding was broad-based to 56 member banks to include more banks representing all sectors.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q1. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q2. Which of the following is a most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (2017)

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Ans: (a)

Q3. Consider the following statements: (2017)

- National Payments Corporation of India (NPCI) helps in promoting the financial inclusion in the country.

- NPCI has launched RuPay, a card payment scheme.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

Rapid Fire

Rapid Fire Current Affairs

Soul of Steel Challenge

The final phase of ‘Soul of Steel’ challenge is taking place on the Amritganga Glacier, Uttarakhand, where participants are undergoing intensive training in ice craft.

It was launched in Uttarakhand in January,2023 which aims to test one’s high-altitude endurance and to also promote adventure tourism in Uttarakhand, globally. The general area of the expedition has been Nanda Devi National Park.

It is an initiative of CLAW Global and is being supported by the Indian Army.

The underlying idea is pooling of skill sets and creating a challenge that will unlock the human ability to survive, stabilise and thrive in high altitude areas.

It is based on the lines of the ‘Ironman triathlon’ long-distance triathlon challenge in Europe, which tests an individual’s grit and endurance.

Read more: ‘Soul of Steel’

Tomb like Structure at Siri Fort

During renovation work at the Siri Fort Children's Park, New Delhi, the Archaeological Survey of India (ASI) made an accidental discovery of a tomb-like structure. The arched opening of the structure has been uncovered, but further excavation is not planned. Instead, the structure will be preserved to educate children visiting the museum about the process of uncovering buried structures.

Siri Fort, built by Alauddin Khilji in the 13th Century, served as a garrison town for his army. The Siri Fort Children's Museum, established in 2011, showcases 30 replicas of famous global monuments. Recent renovations aimed to add 100 more replicas, leading to the discovery of the tomb-like structure. The excavation has revealed a low-height structure of 2 to 3 meters, suggesting it is not a tunnel.

Iran Develops Hypersonic Missile

Iran has claimed regarding the development of a hypersonic missile capable of traveling 15 times the speed of sound, as tensions with the United States persist over Iran's nuclear program. According to Iran's state television, the missile, named ‘Fattah’ or "Conqueror" in Farsi, boasts a range of up to 1,400 kilometers (870 miles). The report also asserts that the missile can penetrate any regional missile defense system, although no evidence was provided to support this claim.

A hypersonic missile is a weapon system which flies at least at the speed of Mach 5 i.e. five times the speed of sound and is manoeuvrable. While China and the United States are believed to be pursuing hypersonic weapons, Russia claims to have already deployed them in Ukraine.

Read More: Hypersonic Missiles

Cannabis Research Project

The 'Cannabis Research Project' of CSIR-IIIM (Council of Scientific and Industrial Research - Indian Institute of Integrative Medicine) Jammu has the potential to produce export quality medicine for neuropathies, cancer & epilepsy. It also has the potential to give an impetus for huge investment in Jammu and Kashmir.

According to the WHO, cannabis is a generic term used to denote the several psychoactive preparations of the plant Cannabis Sativa. It is by far the most widely cultivated, trafficked and abused illicit drug in the world.

The major psychoactive constituent in cannabis is Delta9 tetrahydrocannabinol (THC).

The unpollinated female plants are called hashish. Cannabis oil (hashish oil) is a concentrate of cannabinoids (compounds which are structurally similar to THC) obtained by solvent extraction of the crude plant material or of the resin.

Read More: Cannabis