Economy

Relaxation of Fumigation Norms on Import of Onions

Why in News

The Ministry of Agriculture and Farmers Welfare has allowed the relaxation of fumigation norms for the import of onions for a limited time period.

- The liberalized fumigation norms will facilitate private import of onions from Afghanistan, Egypt, Turkey, and Iran. It will help to boost the availability and check price rise of onions.

- The norms will also provide relaxation from the endorsement on the Phytosanitary Certificate (PSC) as per the Plant Quarantine Order, 2003 for onion imports.

- The imported onions which arrive at Indian ports without fumigation and endorsement to that effect on the PSC would be fumigated in India by the importer through an accredited treatment provider.

- On a regular basis, imported onions are allowed in the country only after the commodity is fumigated and certified by the exporting nation.

- Importers are subjected to four times additional inspection fees on account of non-compliance.

- However, current consignments of onions under liberalized norms will not be penalised for non-compliance.

Fumigation

- Fumigation is a pest control method that involves filling the airspace within a structure with toxic gas. Eg. Methyl Bromide, Phosphine, etc.

- Methyl bromide is forbidden in developed nations, and its use was restricted by the Montreal Protocol due to its role in ozone depletion.

- It is mainly used to control pests in storage buildings (structural fumigation), soil, and grains.

- It is also used during processing of goods to be imported or exported to prevent transfer of exotic organisms.

- It is seen as the most effective way to kill all pests, insects, and nematodes.

Phytosanitary Certificate

- Phytosanitary certificates are issued to indicate that consignments of plants, plant products meet specified phytosanitary import requirements under International Plant Protection Convention (IPPC), 1951.

- Phytosanitary measures are aimed at the protection of human, animal and plant health from diseases, pests, and contaminants.

- Usually, PSCs are generated by the exporting country.

- It can only be issued by an authorized officer from a government department that is authorized by a National Plant Protection Agency (NPPO).

- NPPO is in force to protect the threat of spreading pests, contamination or diseases into the country of import.

Plant Quarantine Order, 2003

- It ensures the import of pest and fungus free agricultural commodities in the country which is or may be destructive to crops.

- Plant quarantine is a technique that ensures disease- and pest-free plants.

- During the process, a plant is isolated while tests are performed to detect the presence of a problem

Indian Economy

Rising NPAs due to Unrated Loans

Why in News

- According to data from the Reserve Bank of India (RBI), Non-Performing Assets (NPAs) for unrated loans has increased to 24 % (2018) from about 6 % (2015).

- Unrated Loans are loans that are not rated by credit rating agencies.

- High levels of NPAs in unrated loans indicate more economical risk for the banks as unrated loans are not secured through ratings.

Key Points

- Unrated borrowers account for about 60% of the total number and 40% of the total exposure of large borrowers.

- The central bank requires banks to report individual exposure of more than Rs 5 crore with the Central Repository of Information on Large Credits (CRILC), to capture data on large borrowers.

- The borrowers having an aggregate fund-based working capital of Rs 150 crore and above are termed as large borrowers.

How Unrated Loans and Related NPAs can be Reduced?

- By regularising credit ratings for loan exposure, RBI has raised risk-weighted Assets on unrated loans.

- Higher risk-weighted assets on unrated loans reduce the capacity of banks to lend such loans, thereby encouraging them to get such loans rated.

- The risk-weighted assets are used to determine the minimum amount of capital that must be held by banks to reduce the risk of insolvency.

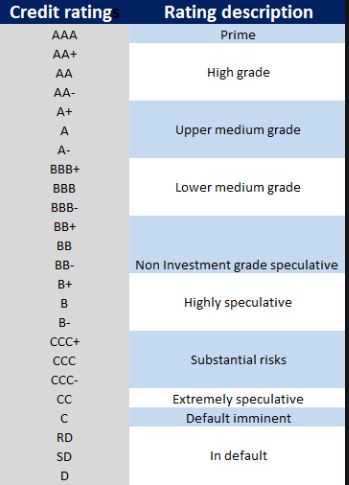

- Banks also need to consider rated exposures as some of the private sector banks experienced significant stress in their exposures to the credit rating of BB category (and below it) rated loan accounts.

- However, the RBI’s Financial Stability Report projected the gross NPA ratio of all banks to come down from 9.3% in March 2019 to 9.0 %by March 2020.

- The recoveries pick up pace due to the resolution of some cases under the Insolvency and Bankruptcy Code and banks write off their bad loans.

Central Repository of Information on Large Credits (CRILC)

- It has been constituted by RBI in 2014 to collect, store, and publish data on all borrower’s credit exposures

- Banks will have to provide credit information to CRILC about their borrowers with an aggregate fund-based and non-fund based exposure of and over Rs.5 Crores (Rs.50 million).

- It also helps financial institutions and banks to assess their non-performing assets (NPAs) and also share this information with other institutions.

Indian Economy

A Special Fund For Housing Projects

Why in News

The Union Cabinet has approved the creation of an Alternative Investment Fund (AIF) of ₹25,000 crore to revive stalled affordable and middle-income housing projects across the country.

Key Points

- Fund Size

- The fund size will initially be ₹25,000 crore with the government providing ₹10,000 crore and the State Bank of India (SBI) and the Life Insurance Corporation (LIC) providing the balance.

- However, the fund is not capped at ₹25,000 crore and will likely grow as a lot of sovereign funds have shown interest.

- Fund Management

- The fund will be set up as Category-II Alternative Investment Fund registered with the Securities and Exchange Board of India (SEBI).

- It will be managed by SBICAP Ventures Limited (SVL). It is a wholly owned subsidiary of SBI Capital Markets Ltd.

- Eligible Projects

- All affordable and middle-income housing projects that are

- Net worth positive

- Registered with the Real Estate Regulatory Authority (RERA) and

- That have not been deemed liquidation-worthy.

- Stuck projects classified as Non Performing Assets and those undergoing resolution under the National Company Law Tribunal will also be eligible for funding — a change from the announcement made in September 2019.

- All affordable and middle-income housing projects that are

- Funding Procedure

- The fund will provide money in escrow accounts that can be used only for completion of the identified projects.

- The receivables from the project will be used to repay the fund.

Expected Benefits

- There are more than 1,600 housing projects which are stalled. The fund is expected to revive the same.

- This will help in alleviating stress for homebuyers, real estate players as well as banks that have backed these projects.

- Impact on Other Sectors

- Revival of the real estate sector will also lead to demand of cement, iron & steel industries, thus also generating employment.

- The fund will also generate commercial return for its investors.

- The AIF is expected to pool investments from government-related and private investors, including public financial institutions, sovereign wealth funds, public and private banks, etc.

Alternative Investment Fund

- Meaning: AIF means any fund established in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

- An alternative investment is a financial asset that does not fall into one of the conventional equity/income/cash categories.

- Private equity or venture capital, hedge funds, real property, commodities, and tangible assets are all examples of alternative investments.

- It is regulated by the SEBI.

- Categories

- Category I AIFs: These generally invest in start-ups or early stage ventures which the government or regulators consider as socially or economically desirable.

- e.g. venture capital funds, infrastructure funds.

- Category II AIFs: These are AIFs which do not fall in Category I and III and which do not undertake leverage or borrowing other than to meet day-to-day operational requirements and as permitted in the SEBI (Alternative Investment Funds) Regulations, 2012.

- e.g. real estate funds, private equity funds.

- Categories III AIFs: AIFs which employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives.

- e.g. hedge funds, private investment in Public Equity Funds.

- Category I AIFs: These generally invest in start-ups or early stage ventures which the government or regulators consider as socially or economically desirable.

Indian Economy

Core Investment Companies

Why in News

A working group formed by the Reserve Bank of India (RBI) has recommended measures to strengthen Core Investment Companies (CIC). The group is headed by the former Corporate Affairs Secretary - Tapan Ray.

Core Investment Companies

- Core Investment Companies (CICs) are a specialized Non-Banking Financial Companies (NBFCs).

- A Core Investment Company registered with the RBI has an asset size of above Rs 100 crore.

- Their main business is acquisition of shares and securities with certain conditions.

- For e.g. these should not hold less than 90% of its net assets in the form of investment in equity shares, preference shares, bonds, debentures, debt or loans in group companies.

- Group companies are an arrangement involving two or more entities related to each other through any of the following relationships, viz.,subsidiary, joint venture, associate, promoter-promotee for listed companies, a related party, common brand name, and investment in equity shares of 20% and above.

Key Recommendations

- Registration: The current threshold of Rs 100 crore asset size and access to public funds for registration as CIC should be retained.

- Related to Group Companies:

- Every group having a CIC should have a Group Risk Management Committee.

- The number of layers of CICs in a group should be restricted to two. As such, any CIC within a group shall not make investments through more than a total of two layers of CICs, including itself.

- The word “layer”, means subsidiary or subsidiaries of the holding company.

- For Better Governance:

- CICs need to induct independent directors, conduct internal audits and prepare consolidated financial statements.

- There is a need for ring fencing boards of CICs by excluding employees/executive directors of group firms from its board.

- CICs should constitute board-level committees — Audit Committee, Nomination and Remuneration Committee and Group Risk Management Committee.

- For Step - down CICs:

- A Step-down CIC means the subsidiary company of a company which is a subsidiary of another company.

- Step-down CICs may not be permitted to invest in any other CIC, while allowing them to invest freely in other group companies.

- Capital contribution by a CIC in a step-down CIC, over and above 10% of its owned funds, should be deducted from its adjusted net worth, as applicable to other NBFCs.

International Relations

India and Brazil Signed Amended DTAC

Why in News

Recently, the Union Cabinet has approved the signing of the Protocol amending the Convention between India and Brazil for the Double Taxation Avoidance Convention (DTAC).

- The amendments aim to implement the recommendations contained in the G20 OECD Base Erosion and Profit Shifting Project (BEPS).

- It will also help to streamline the existing DTAC with international standards which will help to provide tax certainty to investors and businesses of both countries.

- The amending protocol will augment the flow of investment through the lowering of tax rates and fees for technical services.

Double Tax Avoidance Agreements (DTAAs)

- A DTAA is a tax treaty signed between two or more countries.

- Its key objective is that tax-payers in these countries can avoid being taxed twice for the same income.

- It applies in cases where a taxpayer resides in one country and earns income in another.

- The relief is provided by exempting income earned abroad from tax in the resident country or providing credit to the extent taxes have already been paid abroad.

- It can either be comprehensive to cover all sources of income or be limited to certain areas such as taxing of income from shipping, air transport, inheritance, etc.

- DTAAs are intended to make a country an attractive investment destination by providing relief on dual taxation.

Base Erosion and Profit Shifting (BEPS)

- BEPS is a term used to describe tax planning strategies that exploit mismatches and gaps that exist between the tax rules of different jurisdictions.

- It minimizes the corporation tax that is payable overall, by either making tax profits ‘disappear’ or shift profits to low tax jurisdictions where it is little or no genuine activity.

- BEPS takes advantage of different tax rules operating in different jurisdictions.

- BEPS is of major significance for developing countries due to their heavy reliance on corporate income tax, particularly from multinational enterprises (MNEs).

- The BEPS initiative is an OECD initiative, approved by the G20, to identify ways of providing more standardized tax rules globally.

OECD/G20 Base Erosion and Profit Shifting (BEPS)Project

- In 2013, OECD and G20 countries adopted a 15-point Action Plan to address BEPS.

- The OECD/G20 BEPS Project aims to create a single set of consensus-based international tax rules to address BEPS, and hence to protect tax bases.

- In 2016, the OECD and G20 established an Inclusive Framework on BEPS. Over 100 countries and jurisdictions have joined the Inclusive Framework.

Difference Between Convention, Agreement, and Protocol

- Agreement: It is a negotiated and usually legally enforceable understanding between two or more legally competent parties.

- A binding contract can (and often does) result from an agreement.

- Convention: It is a formal agreement between States. These are normally open for participation of a large number of States.

- The generic term ‘convention’ is thus synonymous with the generic term ‘treaty’.

- Protocol: A protocol is an agreement that negotiators formulate and sign as the basis for a final convention or treaty.

Important Facts For Prelims

Reconstitution of National Integration Council

Why in News

In the backdrop of due Ayodhya verdict, the reconstitution of the National Integration Council (NIC) has gained prominence.

National Integration Council

- It is an extra-constitutional body.

- Chaired by: Prime Minister of India.

- Composition: Council members include Cabinet ministers, Chief Ministers of states, political leaders, Chairman of the University Grants Commission, Commissioner for Scheduled Castes and Scheduled Tribes, representatives of industry, business and trade unions.

- Background: The NIC was constituted to combat the evils of communalism, casteism, regionalism, and linguism as a follow up of National Integration Conference held under the chairmanship of the then Prime Minister Pt. Jawaharlal Nehru in 1961.

- The main task of the council is to examine the problem of national integration in all its aspects and make necessary recommendations to deal with it.

- Meetings: Sixteen meetings of NIC have been held till 2019.

- First meeting of NIC took place in 1962.

- The last meeting of the NIC took place in September 2013 which passed resolution on maintaining communal harmony and ending discrimination by condemning atrocities on Scheduled Castes and Scheduled Tribes.

Important Facts For Prelims

Kyasanur Forest Disease

Why in News

Recently, Karnataka State Government proposed to establish a ‘monkey park’ in Malnad region to contain the problem of crop-raiding primates. Environmentalists fear that this may trigger infections like Kyasanur Forest Disease (KFD) and also upset the natural food chain.

Kyasanur Forest Disease

- It is caused by Kyasanur Forest disease Virus (KFDV), a member of the virus family Flaviviridae.

- It was first identified in 1957 in a sick monkey from the Kyasanur Forest in Karnataka. Since then, between 400-500 humans cases per year have been reported.

- KFD is endemic to the Indian state of Karnataka.

- Rodents, shrews, and monkeys are common hosts for KFDV after being bitten by infected Hard ticks (Haemaphysalis Spinigera). KFDV can cause epizootics (outbreak of disease in animals) with high fatality in primates.

- Transmission: To humans, it may occur after a tick bite or contact with an infected animal (a sick or recently dead monkey).

- Signs and Symptoms: After an incubation period of 3-8 days, the symptoms like chills, fever, headache, severe muscle pain, vomiting, gastrointestinal symptoms and bleeding may occur. Patients may experience abnormally low blood pressure, and low platelet, red blood cell, and white blood cell counts.

- Diagnosis: It can be diagnosed in the early stage of illness by molecular detection by Polymerase Chain Reaction (PCR) or virus isolation from blood. Later, serologic testing using enzyme-linked immunosorbent serologic assay (ELISA) can be performed.

- Treatment and Prevention: There is no specific treatment for KFD although a vaccine is available.

Important Facts For Prelims

NEERI-IndAIR

Why in News

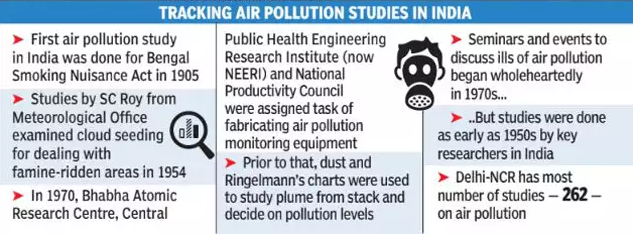

The Council of Scientific Industrial Research-National Environmental Engineering Research Institute (CSIR-NEERI) recently launched the country’s first interactive online repository named as IndAIR (Indian Air quality Studies Interactive Repository).

Key Points

- The aim of the project is to make air quality research available to everyone. It presents these studies in an easily accessible web format for the media, researchers, and academics.

- It is the first comprehensive effort to enlist existing Indian research and analysis on air pollution, its causes and effects.

- IndAIR has archived scanned documents from pre-Internet times (1950-1999), research articles, reports and case studies, and over 2,000 statutes to provide the history of air pollution research and legislation in the country.

- It includes all major legislations in the country dating back to 1905.

- NEERI received support from institutions such as the National Institute of Science Communication and Information Resources (NISCAIR), BARC and National Archives of India (NAI). Institutions such as TERI, MoEFCC, and CPCB also partnered with NEERI for the project.

Council of Scientific & Industrial Research- National Environmental and Engineering Research Institute

- CSIR-NEERI is a research institute created and funded by the Government of India. It functions under the Ministry of Science & Technology.

- It was established in Nagpur in 1958 with focus on water supply, sewage disposal,communicable diseases and to some extent on industrial pollution and occupational diseases found common in post-independent India.

- CSIR has 38 national laboratories working in various areas of science and technology. CSIR-NEERI is one of those laboratories.

Important Facts For Prelims

Wasteland Atlas-2019

Why in News?

Recently, the Ministry of Rural Development has released the fifth edition of Wastelands Atlas (2019).

- It has been prepared by the Department of Land Resources (Ministry of Rural Development) in collaboration with the National Remote Sensing Centre (NRSC), Department of Space.

Significance of Wasteland Atlas

- Unprecedented pressure on the land beyond its carrying capacity is resulting in the degradation of lands in the country.

- Therefore, robust geospatial information on wastelands will be helpful in rolling back the wastelands for productive use through various land development programmes.

Key Points

- A reduction in the wasteland area was observed in the categories of land with dense scrub, marshy land, sandy areas, and degraded pastures.

- The wastelands have undergone a positive change in the states of Rajasthan, Bihar, Uttar Pradesh, Andhra Pradesh, Mizoram, Madhya Pradesh, Jammu & Kashmir, and West Bengal.

- The majority of wastelands have been changed into categories of croplands, plantation and industrial areas.

Wastelands

- Wastelands are a barren and uncultivated land lying unproductive or which is not being utilized to its potential.

- It includes degraded forests, overgrazed pastures, drought-struck pastures, eroded valleys, hilly slopes, waterlogged marshy lands, barren land, etc.

Important Facts For Prelims

Bengal Partition

Why in News

Recently, the West Bengal Heritage Commission has proposed to set up a museum dedicated to the Bengal partition that took place during the bifurcation of the country in 1947.

Key Points

- The museum will focus on the historical facts and the consequences of the Partition of Bengal.

- The museum is proposed to be housed in the Alipore Jail that is a heritage building.

- The Partition of India in 1947 that led to the creation of Pakistan involved the division of Bengal and Punjab provinces based on district-wise Hindu or Muslim majorities.

- It not only led to violence but also marked one of the largest mass migration in human history.

- After the Partition, Bengal was bifurcated into East Bengal and West Bengal.

- East Bengal became a part of Pakistan and was renamed as East Pakistan in 1956. It later became an independent nation of Bangladesh after the Bangladesh Liberation War of 1971.

- In the proposed museum, documents, articles, documentaries, and films on the Partition will be highlighted.