Infographics

International Relations

WTO Needs to Relook at Farm Subsidies

For Prelims: WTO, GATT, Subsidy Boxes, Peace Clause, Di Minimus Clause

For Mains: WTO reforms, Issues with Subsidy Boxes, India’s suggestions on WTO reforms

Why in News?

The finance minister of India has urged the World Trade Organisation (WTO) to look at the issue of farm subsidies with an open mind as it impacts the food security needs of emerging economies in the backdrop of COVID-19 pandemic and the Russia-Ukraine war.

- The FM said this while Speaking at the Asian Development Bank (ADB) Governor’s seminar on ‘Policies to support Asia’s rebound.

Note:

- The Asian Development Bank (ADB) Governor’s Seminar is an annual event that brings together the Governors of ADB's member countries, leading policy makers, development experts, etc. to discuss developmental issues in the Asia-Pacific region.

- Headquartered in Manila (Philippines), the ADB is a regional development bank established in 1966 to promote economic and social development in Asia and the Pacific.

- The Board of Governors is ADB's highest policy-making body; comprised of one representative from each member nation.

What are the Subsidies under WTO?

- Amber Box:

- Amber box subsidies are those that can distort international trade by making a country's products cheaper in comparison to those of other countries.

- Examples: Subsidies for inputs such as fertilisers, seeds, electricity, irrigation, and Minimum Support Price (MSP).

- According to the WTO, agriculture's amber box is used for all domestic support measures that are deemed to distort production and trade.

- As a result, the trade agreement requires signatories to commit to reducing trade-distorting domestic supports that fall into the amber box.

- Members who do not make these commitments must keep their amber box support within 5-10% of their value of production. (Di Minimus Clause)

- 10% for developing countries

- 5% for developed countries

- Amber box subsidies are those that can distort international trade by making a country's products cheaper in comparison to those of other countries.

- Blue box:

- It is the “amber box with conditions” — conditions, designed to reduce distortion.

- Any support that would normally be in the amber box is placed in the blue box if it requires farmers to limit production.

- These subsidies aim to limit production by imposing production quotas or requiring farmers to set aside part of their land.

- At present there are no limits on spending on blue box subsidies.

- Green Box:

- Green Box is domestic support measures that don’t cause trade distortion or at most cause minimal distortion.

- The Green box subsidies are government funded without any price support to crops.

- They also include environmental protection and regional development programmes.

- “Green box” subsidies are therefore allowed without limits (except in certain circumstances).

Why is there a Need to Relook into Subsidy Norms?

- Unequal Opportunities to Global South:

- Ever since the establishment of WTO, there has been a complaint regarding the export of agricultural goods, and in general, the viewpoints of the Global South and emerging markets have not been given equal weight as those of the developed nations in trade discussions.

- The ‘Global South’ largely refers to countries in Asia, Africa and South America.

- Issues with Food Subsidy Limit: There is an issue with the reference price adopted under global trade norms - a WTO member country’s food subsidy bill should not breach the limit of 10% of the value of production based on the reference price of 1986-88.

- Subsidies for agriculture and poor farmers in developing countries were not counted at all and were frozen by the WTO.

- Food security is comparatively stronger in developed nations than in developing countries because of the unbalanced nature of trade agreements.

- Rising Food Insecurity: The challenges on food security posed by the Covid-19 pandemic and Russia-Ukraine conflict have once again emphasized to relook the subsidy norms as food and fertilizer security have become more important now.

- India’s Demand: As part of permanent solution, India has asked for measures like amendments in the formula to calculate the food subsidy cap and inclusion of programmes implemented after 2013 under the ambit of ‘Peace Clause’.

What is the WTO’s Peace Clause?

- As an interim measure, the WTO members agreed on a mechanism called the 'Peace Clause' in December 2013 and pledged to negotiate a permanent solution.

- Under the Peace Clause, WTO members agreed to refrain from challenging any breach in prescribed ceiling by a developing nation at the dispute settlement forum of the WTO.

- This clause will stay till a permanent solution is found to the food stockpiling issue.

What is the World Trade Organisation (WTO)?

- About:

- WTO is an international organization that regulates and promotes global trade.

- It was established in 1995 and currently has 164 member countries (including the European Union).

- It provides a forum for member countries to negotiate and enforce trade agreements, resolve disputes, and promote economic growth and development.

- It’s headquartered in Geneva, Switzerland.

- Origin of WTO:

- The WTO is the successor to the General Agreement on Tariffs and Trade (GATT), which was created in 1947.

- The Uruguay Round (1986-94) of the GATT led to the WTO's creation.

- WTO began operations on 1st January 1995.

- The Agreement Establishing the WTO, commonly known as the “Marrakesh Agreement”, was signed in Marrakesh, Morocco in 1994.

- India was one of the founding members of the 1947 GATT and its successor, the WTO.

- Main difference between GATT and WTO was that GATT mostly dealt with trade in goods, the WTO and its agreements could not only cover goods but also trade in services and other intellectual properties like trade creations, designs, and inventions.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q1. India enacted the Geographical Indications of Goods (Registration and Protection) Act, 1999 in order to comply with the obligations to (2018)

(a) ILO

(b) IMF

(c) UNCTAD

(d) WTO

Ans: (d)

Q2. The terms ‘Agreement on Agriculture’, ‘Agreement on the Application of Sanitary and Phytosanitary Measures’ and ‘Peace Clause’ appear in the news frequently in the context of the affairs of the (2015)

(a) Food and Agriculture Organization

(b) United Nations Framework Conference on Climate Change

(c) World Trade Organization

(d) United Nations Environment Programme

Ans: (c)

Q3. In the context of which of the following do you sometimes find the terms ‘amber box, blue box and green box’ in the news? (2016)

(a) WTO affairs

(b) SAARC affairs

(c) UNFCCC affairs

(d) India-EU negotiations on FTA

Ans: (a)

Q4. Consider the following statements: (2017)

- India has ratified the Trade Facilitation Agreement (TFA) of WTO.

- TFA is a part of WTO’s Bali Ministerial Package of 2013.

- TFA came into force in January 2016.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (a)

Q5. With reference to Trade-Related Investment Measures (TRIMS), which of the following statements is/are correct? (2020)

- Quantitative restrictions on imports by foreign investors are prohibited.

- They apply to investment measures related to trade in both goods and services.

- They are not concerned with the regulation of foreign investment.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3 only

Ans: (c)

Mains

Q1. WTO is an important international institution where decisions taken affect countries in a profound manner. What is the mandate of WTO and how binding are their decisions? Critically analyse India’s stand on the latest round of talks on Food security. (2014)

Q2. “The broader aims and objectives of WTO are to manage and promote international trade in the era of globalization. But the Doha round of negotiations seem doomed due to differences between the developed and the developing countries.” Discuss in the Indian perspective. (2016)

Q3. What are the key areas of reform if the WTO has to survive in the present context of ‘Trade War’, especially keeping in mind the interest of India? (2018)

Buy Now

Indian Polity

Mercy Petition

For Prelims: Mercy Petition, Supreme Court, Article 21, Article 72, Article 161, Pardoning Powers.

For Mains: Mercy Petition.

Why in News?

In a recent ruling, the Supreme Court (SC) has declined to direct the government to commute the death penalty of Balwant Singh Rajoana, instead, it has allowed the government to decide on the Mercy Petition when necessary.

- Balwant Singh Rajoana was convicted for the assassination of former Punjab Chief Minister Beant Singh in 1995.

- The petitioner argued that since the state and the Union of India have not been able to decide on the mercy petition, which is pending for more than 10 years, the death penalty should be commuted to life imprisonment.

What is the Court’s Observation?

- The court cited the Home Ministry's conclusion that a decision on the mercy petition now would compromise national security.

- The court has observed that it is not up to the court to "delve" to the Ministry's decision to defer a decision on the clemency plea.

- The court said that the Ministry's call to postpone its decision on the mercy petition actually amounted to declining the plea for the time being.

What is Mercy Petition?

- About:

- A mercy petition is a formal request made by someone who has been sentenced to death or imprisonment seeking mercy from the President or the Governor, as the case may be.

- The idea of Mercy Petition is followed in many countries like the United States of America, the United Kingdom, Canada, and India.

- Everyone has the basic right to live. It is also mentioned as a fundamental right mentioned under Article 21 of the Indian Constitution.

- A mercy petition is a formal request made by someone who has been sentenced to death or imprisonment seeking mercy from the President or the Governor, as the case may be.

- Constitutional Framework:

- As per the Constitutional framework in India, mercy petition to the President is the last constitutional resort a convict can take when he is sentenced by the court of law. A convict can present a mercy petition to the President of India under Article 72 of the Constitution of India.

- Similarly, the power to grant pardon is conferred upon the Governors of States under Article 161 of the Constitution of India.

- Article 72:

- The President shall have the power to grant pardons, reprieves, respites or remissions of punishment or to suspend, remit or commute the sentence of any person convicted of any offense:

- In all cases where the punishment or sentence is by a Court Martial;

- In all cases where the punishment or sentence is for an offence against any law relating to a matter to which the executive power of the Union extends;

- In all cases where the sentence is a sentence of death.

- The President shall have the power to grant pardons, reprieves, respites or remissions of punishment or to suspend, remit or commute the sentence of any person convicted of any offense:

- Article 161:

- It provides that the Governor of a State shall have the power to grant pardons, reprieves, respites or remissions of punishment or to suspend, remit or commute the sentence of any person convicted of any offence against any law relating to a matter to which the executive power of the State extends.

- The SC in 2021 held that the Governor of a State can pardon prisoners, including death row ones, even before they have served a minimum 14 years of prison sentence.

- It provides that the Governor of a State shall have the power to grant pardons, reprieves, respites or remissions of punishment or to suspend, remit or commute the sentence of any person convicted of any offence against any law relating to a matter to which the executive power of the State extends.

- Article 72:

- Process of making a Mercy Petition:

- There is no statutory written procedure for dealing with mercy petitions, but in practice, after extinguishing all the reliefs in the court of law, either the convict in person or his relative on his behalf may submit a written petition to the President. The petitions are received by the President’s secretariat on behalf of the President, which is then forwarded to the Ministry of Home Affairs for their comments and recommendations.

- Grounds for filing Mercy Petition:

- The act of mercy is not the right of the prisoner. He cannot claim it.

- The mercy or clemency is granted on the grounds based on his health, physical or mental fitness, his family financial conditions as he is the only sole earner of bread or butter or not.

- Judicial Review:

- In the case of Epuru Sudhakar & Anr. v. Government of Andhra Pradesh (2006) the SC held that the clemency power of the President and Governor under Article 72 and Article 161 is subject to judicial review.

- The court laid down certain grounds on which clemency power can be claimed by the petitioner for judicial review:

- If the order is passed without any application of mind.

- If the order passed is malafide.

- If the order passed on completely irrelevant considerations.

- If the order suffers from arbitrariness.

What are some of the Important Judgments Related to Mercy Petition?

- Maru Ram v. Union of India (1981): The SC held that the power to grant pardon under Article 72 is to be exercised on the advice of the Council of ministers.

- Dhananjoy Chatterjee State of West Bengal (1994): The SC said that “The power under Articles 72 and 161 of the Constitution can be exercised by the Central and State Governments, not by the President or Governor on their own.

- Kehar Singh v. Union of India (1989): The SC had examined the scope of the President’s pardoning power under Article 72 in detail.

- The SC held that the exercise of the pardoning power vested in him under Article 72, could “scrutinize the evidence on the record of the criminal case and come to a different conclusion from that recorded by the Court in regard to guilt of and sentence imposed on the accused.

What are some of the Keywords Related to Pardoning Power?

- Pardon: The president can totally absolve/acquit the person for the offence and let him go free like a normal citizen.

- Commute: To reduce the type of punishment into a less harsh one. For example Rigorous imprisonment to simple imprisonment.

- Remission: To reduce the punishment without changing the nature of the punishment. For example 20 years rigorous imprisonment to 10 years rigorous imprisonment.

- Reprieve: A delay is allowed in the execution of a sentence, usually a death sentence for a guilty person to prove his innocence.

- Respite: Reduce the degree of punishment looking at specific grounds like pregnancy, old age etc.

What do the Laws of other Countries Provide?

- USA:

- The Constitution of America gives the President the similar powers to grant reprieves or pardon for offences under Federal law, except in cases of impeachment. However, in cases of violation of state law, the power has been given to the concerned Governor of the state.

- UK:

- In the UK, the Constitutional monarch can pardon or reprieve for offences on ministerial advice.

- Canada:

- The National Parole Board under the Criminal Records Act is authorized to grant such reliefs.

Conclusion

- Mercy petition acts as a double-edged sword which can be both boon or bane depending on the situation and circumstances. Unnecessary hurdles and delays in approving the mercy petition can cause severe discomfort to both the convicts and the victims.

- This can unintentionally delay justice and victims can never get access to proper and unbiased justice.

- This will further intensify the victim’s pain and suffering. There is a need for a proper limitation period and proper policies to restrict the unnecessary delay in filing and granting mercy petitions for proper facilitation and smooth functioning of the Indian judiciary.

UPSC Civil Services Examination, Previous Year Question

Prelims:

Q. Which of the following are the discretionary powers given to the Governor of a State? (2014)

- Sending a report to the President of India for imposing the President’s rule

- Appointing the Ministers

- Reserving certain bills passed by the State Legislature for consideration of the President of India

- Making the rules to conduct the business of the State Government

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2, 3 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Mains

Q. Discuss the essential conditions for exercise of the legislative powers by the Governor. Discuss the legality of re-promulgation of ordinances by the Governor without placing them before the Legislature. (2022)

Indian Economy

Report on Currency and Finance 2022-23

For Prelims: RBI’s Report on Currency and Finance, net-zero emission target

For Mains: Growth & Development, India's renewable energy targets and the role of the financial sector.

Why in News?

The cumulative total expenditure for India's adaptation to climate change could reach 85.6 lakh crore by 2030, according to an estimate made by Reserve Bank of India(RBI) in its Report on Currency and Finance 2022–23.

What is Report on Currency and Finance?

- About:

- It is an annual publication of the RBI.

- The report covers various aspects of the Indian economy and financial system.

- Theme:

- The theme of Report on Currency and Finance 2022–23 is 'Towards a Greener Cleaner India'.

- It focuses on the challenges and opportunities of climate change for India and the role of the financial sector in achieving a low-carbon and climate-resilient development path.

- The theme of Report on Currency and Finance 2022–23 is 'Towards a Greener Cleaner India'.

- Aim:

- It aims to provide analytical insights into the macroeconomic and financial developments in India and their policy implications.

- Dimensions:

- The report covers four major dimensions of climate change to assess future challenges to sustainable high growth in India, the unprecedented scale and pace of climate change; its macroeconomic effects; implications for financial stability; and policy options to mitigate climate risks.

What are the Key Highlights of the Report?

- Renewable Energy Target:

- India needs to significantly increase its use of renewable energy to achieve its goal of net zero emissions by 2070. The report suggests that India should aim for renewables to account for 80% of its energy mix by 2070-71.

- This would require an accelerated reduction in the energy intensity of GDP by about 5% annually.

- Green Financing Requirement:

- India’s green financing requirement is estimated to be at least 2.5% of GDP annually till 2030 to address the infrastructure gap caused by climate events.

- The financial system may need to mobilize adequate resources and reallocate current resources to contribute effectively to India’s net-zero target.

- India’s green financing requirement is estimated to be at least 2.5% of GDP annually till 2030 to address the infrastructure gap caused by climate events.

- Policy Intervention:

- The report also highlights the need for a balanced policy intervention to ensure progress across all policy levers, which would enable India to achieve its green transition targets by 2030 and make the net-zero goal by 2070 attainable.

- Financial Risks due to Climate Change:

- The public sector banks (PSBs) in India may be more vulnerable to climate-related financial risks than private sector banks.

- Policy Instruments:

- Central banks have several policy instruments at their disposal to influence investment decisions and the allocation of resources and credit to achieve sustainability targets.

- This includes mandating banks and other financial institutions to consider climate and environmental risks through various regulations.

- Central banks have several policy instruments at their disposal to influence investment decisions and the allocation of resources and credit to achieve sustainability targets.

UPSC Civil Services Examination Previous Year Questions (PYQs)

Q. Consider the following statements:

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Explanation:

- The Reserve Bank of India was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934.

- Though originally privately owned, since nationalization in 1949, the Reserve Bank is fully owned by the Government of India.

- The RBI’s affairs are governed by a central board of directors. The board is appointed by the Government of India in line with the Reserve Bank of India Act.

Governance

Regulating Artificial Intelligence

For Prelims: Regulating Artificial Intelligence, OpenAI's ChatGPT, Black Box, Eu’s Artificial Intelligence Act, Responsible AI for All report.

For Mains: Regulating Artificial Intelligence and Way Forward.

Why in News?

The European Parliament has reached a preliminary agreement on a new draft of the Artificial Intelligence Act, which aims to regulate systems like OpenAI's ChatGPT.

- The legislation was drafted in 2021 with the aim of bringing transparency, trust, and accountability to Al and creating a framework to mitigate risks to the safety, health, Fundamental Rights, and democratic values of the EU.

What is the EU’s Artificial Intelligence Act?

- About:

- It defines AI as software that generates outputs such as content, predictions, recommendations, or decisions.

- It prohibits the use of AI technologies in the highest risk category, including real-time facial and biometric identification systems in public spaces, social scoring of citizens, subliminal techniques to influence behavior, and technologies that exploit vulnerable people.

- Focus:

- It focuses on AI systems that have the potential to harm people's health, safety, or fundamental rights.

- These include AI in healthcare, education, employment, law enforcement, and access to essential services.

- Before high-risk AI systems can be sold, they will undergo strict reviews to ensure they are transparent, explainable, and allow human oversight.

- AI systems with lower risks, like spam filters or video games, have fewer requirements.

- It focuses on AI systems that have the potential to harm people's health, safety, or fundamental rights.

- Objective:

- It aims to address ethical questions and implementation challenges in various sectors ranging from healthcare and education to finance and energy.

- The legislation seeks to strike a balance between promoting “the uptake of AI while mitigating or preventing harms associated with certain uses of the technology”.

- Similar to how the EU’s 2018 General Data Protection Regulation (GDPR) made it an industry leader in the global data protection regime, the AI law aims to “strengthen Europe’s position as a global hub of excellence in AI from the lab to the market” and ensure that AI in Europe respects the 27-country bloc’s values and rules.

What is the Need for Regulating Artificial Intelligence?

- Uncertainty in Risks Involved:

- The use of artificial intelligence is increasing, and as technology becomes more advanced and capable of various tasks such as recommending music, driving cars, detecting cancer etc., there are also increased risks and uncertainties associated with it.

- Black Box:

- Some AI tools are so complicated that they are like a "black box." This means that even the people who create them can't fully understand how they work and how they come up with certain answers or decisions.

- It's like a secret box that generates an output, but nobody knows exactly how it does it.

- Inaccuracy and Biases:

- AI tools have already caused problems such as mistaken arrests due to Facial Recognition Software, unfair treatment due to biases built into AI systems, and more recently, with Chatbots based on large language models like GPT-3 and 4 creating content that may be inaccurate or use copyrighted material without permission.

- These chatbots are capable of producing high-quality content that is difficult to distinguish from content written by humans but may not always be accurate or legally permissible.

- Unsure of Future Behavior:

- AI poses a unique challenge because, unlike in traditional engineering systems, designers cannot be sure how AI systems will behave. When a traditional automobile was shipped out of the factory, engineers knew exactly how it would function. But with self-driving cars, the engineers can never be sure how it will perform in novel situations.

How is Global AI currently Governed?

- India:

- NITI Aayog, has issued some guiding documents on AI Issues such as the National Strategy for Artificial Intelligence and the Responsible AI for All report.

- Emphasises social and economic inclusion, innovation, and trustworthiness.

- United Kingdom:

- Outlined a light-touch approach, asking regulators in different sectors to apply existing regulations to AI.

- Published a white paper outlining five principles companies should follow: safety, security and robustness; transparency and explainability; fairness; accountability and governance; and contestability and redress.

- US:

- The US released a Blueprint for an AI Bill of Rights (AIBoR), outlining the harms of AI to economic and civil rights and lays down five principles for mitigating these harms.

- The Blueprint, instead of a horizontal approach like the EU, endorses a sectorally specific approach to AI governance, with policy interventions for individual sectors such as health, labour, and education, leaving it to sectoral federal agencies to come out with their plans.

- China:

- In 2022, China came out with some of the world’s first nationally binding regulations targeting specific types of algorithms and AI.

- It enacted a law to regulate recommendation algorithms with a focus on how they disseminate information.

Way Forward

- Regulating artificial intelligence involves the creation of a simple regulatory framework that defines the capabilities of AI and identifies those more susceptible to misuse.

- The government should prioritize data privacy, integrity, and security while ensuring businesses have access to data.

- Mandatory explainability should be enforced to eliminate the black-box approaches, which will bring transparency and help businesses understand the rationale behind every decision made.

- To formulate effective regulations, policymakers must try to strike a balance between the scope of the regulation and the vocabulary used, and they should seek input from a variety of stakeholders, including industry experts and businesses.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q1. With the present state of development, Artificial Intelligence can effectively do which of the following? (2020)

- Bring down electricity consumption in industrial units

- Create meaningful short stories and songs

- Disease diagnosis

- Text-to-Speech Conversion

- Wireless transmission of electrical energy

Select the correct answer using the code given below:

(a) 1, 2, 3 and 5 only

(b) 1, 3 and 4 only

(c) 2, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Q2. Consider the following pairs: (2018)

| Terms sometimes seen in news | Context/Topic | |

| 1. | Belle II experiment | Artificial Intelligence |

| 2. | Blockchain technology | Digital/Cryptocurrency |

| 3. | CRISPR–Cas9 | Particle Physics |

Which of the pairs given above is/are correctly matched?

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

Buy Now

Biodiversity & Environment

Debt-for-Climate Swaps

For Prelims: Debt-for-climate swaps, Paris Agreement, Small island developing states .

For Mains: Importance of Climate Finance, Significance debt-for-climate swapsto addressing the climate change

Why in News?

Climate change is a global problem that impacts everyone, but it affects some countries more than others. Unfortunately, the countries most vulnerable to the effects of climate change are often the least able to afford the investment needed to strengthen their resilience.

- This puts these countries in danger of facing prolonged fiscal crises, forcing them to rely on aid from the international community.

- Debt-for-climate swaps are an innovative financial instrument that aims to address this issue by creating fiscal space for climate investments.

What is Debt-for-Climate Swaps?

- About:

- Debt-for-climate swaps can incentivize debtor countries to take meaningful action on climate while reducing their debt burdens.

- These swaps involve reducing debt in exchange for policy commitments or spending by debtor countries.

- Both official bilateral and commercial debt can be involved in debt-for-climate swaps.

- Bilateral debt swaps involve redirecting previously committed debt service payments to official bilateral creditors towards financing mutually agreed projects in areas such as climate action.

- In the past decade, debt-for-climate swaps have become relatively popular among low- and middle-income countries.

- Multilateral development banks and multilateral organizations such as the United Nations Development Programme (UNDP) have been advocating this instrument as a debt-relief measure.

- History:

- Debt-for-climate swaps are a variation of debt-for-nature swaps, which were first proposed in the 1980s as a way to conserve biodiversity and protect tropical forests in exchange for debt relief.

- The first debt-for-nature swap was implemented in 1987 between Bolivia and Conservation International, a non-governmental organization (NGO).

- Debt-for-climate swaps emerged in the 2000s as a broader concept that encompasses not only nature conservation but also climate mitigation and adaptation.

- The first debt-for-climate swap was implemented in 2006 between Germany and Indonesia, with the latter committing to reduce greenhouse gas emissions from deforestation and forest degradation (REDD+) in return for debt relief.

- Benefits:

- For Creditors:

- Debt-for-climate swaps can enhance their development cooperation and climate finance objectives, improve their debt recovery prospects, and strengthen their diplomatic relations with debtor countries.

- For Debtors:

- Debt-for-climate swaps can reduce their external debt stock and service, free up fiscal resources for other development needs, increase their domestic investment in climate action, and improve their environmental and social outcomes.

- For Both Parties:

- Debt-for-climate swaps can foster mutual trust and collaboration, create win-win solutions, and contribute to the global efforts to achieve the Paris Agreement and the Sustainable Development Goals.

- For Creditors:

- Challenges:

- Creditor countries are primarily hesitant to go for debt-for-climate swaps unless they are structured to make sure that the public expenditure commitment towards climate action is superior in value to the remaining debt service.

- However, conditional climate grants are designed and structured to make them impossible to divert and are targeted only for climate investment purposes.

- Creditor countries are primarily hesitant to go for debt-for-climate swaps unless they are structured to make sure that the public expenditure commitment towards climate action is superior in value to the remaining debt service.

Why should Creditor Countries Engage in Debt-for-Climate Swaps?

- Creditor countries should engage in debt-for-climate swaps because signatories to the Paris Agreement and the Glasgow Financial Alliance for Net Zero (GFANZ), a global coalition of financial institutions, have the commitment to provide financial assistance to developing countries to build clean, climate-resilient futures.

- Debt-for-climate swaps are one way to fulfill their commitments.

How do Debt-for-Climate Swaps Help Small Island Countries?

- Small island developing states (SIDS) are eyeing debt-for-climate swaps to address the two challenges they face: adapting to increasing climate risk and recovering from financial distress.

- Debt-for-climate swaps offer a possible solution for SIDS to address these issues. These involve reducing external debt in exchange for policy commitments or spending by the debtor country.

- By participating in debt-for-climate swaps, SIDS can reduce its external debt and free up fiscal resources for other developmental needs, including climate action. This can help them increase their domestic investment in climate action.

Important Facts For Prelims

Nationwide AHDF KCC Campaign

Why in News?

As part of the Aazadi Ka Amrit Mahostav celebrations, the Union Ministry for Fisheries, Animal husbandry and Dairying has launched the Nationwide Animal Husbandry, Dairying, and Fisheries (AHDF) KCC Campaign from 1st May 2023 to 31st March 2024.

What is the Nationwide AHDF KCC Campaign?

- About:

- The campaign aims to expand the benefits of the Kisan Credit Card (KCC) to all eligible animal husbandry, dairy, and fishery farmers in the country.

- The campaign will provide credit facilities to small landless farmers engaged in animal husbandry and fisheries activities.

- Outcome of Previous Campaigns:

- Since June 2020, the Ministry of Fisheries, Animal Husbandry and Dairying, in association with the Department of Financial Services, has organized various campaigns to provide Kisan Credit Card facilities to all eligible animal husbandry and fishery farmers.

- More than 27 lakh fresh KCCs were sanctioned to animal husbandry and fishery farmers during these campaigns.

- Since June 2020, the Ministry of Fisheries, Animal Husbandry and Dairying, in association with the Department of Financial Services, has organized various campaigns to provide Kisan Credit Card facilities to all eligible animal husbandry and fishery farmers.

- Current Campaign:

- During the current campaign, District Level KCC Camps will be organized every week by the KCC Coordination Committee coordinated by Lead District Manager (LDM) for on-the-spot scrutiny of applications sourced by the officials of the State Animal Husbandry and Fisheries department from the farmers.

What is Kisan Credit Card?

- About:

- The Kisan Credit Card (KCC) scheme was introduced in 1998 to provide timely credit support to farmers.

- It offers credit for cultivation, purchase of agriculture inputs, and other needs.

- The scheme was extended to cover the investment credit requirement of farmers in 2004.

- In 2018-19, the facility was extended to fisheries and animal husbandry farmers.

- Objectives:

- The scheme aims to meet the short-term credit requirements of farmers for crop cultivation, post-harvest expenses, produce marketing loan, consumption requirements, and working capital for maintenance of farm assets.

- It also provides investment credit for agriculture and allied activities.

- Features:

- KCC comes with an ATM-enabled RuPay debit card and flexible/simplified procedures.

- Aadhaar seeding is mandatory to avail interest subvention.

- The facility helps fisheries and animal husbandry farmers meet their short-term credit requirements.

- Implementing Agencies:

- Commercial Banks

- Regional Rural Banks (RRBs)

- Small Finance Banks

- Cooperatives

- Recent Achievements:

- As of February 25, 2022, 2.92 crore KCCs have been issued with a sanctioned credit limit of Rs. 3.20 lakh crores.

- The government offers interest subvention of 2% and prompt repayment incentive of 3% to farmers on short-term crop loans up to Rs. 3 lakhs.

UPSC Civil Services Exam, Previous Year Questions (PYQ)

Prelims

Q. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes?

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- post-harvest expenses

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Important Facts For Prelims

International Leopard Day 2023

Why in News?

On International Leopard Day (May 3, 2023), the Cape Leopard Trust (CLT), an active predator conservation working group, launched a new portal dedicated to leopards to promote and celebrate leopards globally.

- The portal was launched at the Global Leopard Conference.

What are the Characteristics of Leopard?

- Scientific Name:

- Panthera pardus

- About:

- Leopards are elusive and nocturnal animals whose size and colour depend on the habitat. They are great climbers and hide in trees, where they hide their prey to avoid competition.

- Geographical Extent:

- Members of the cat family, leopards live in Asia, sub-Saharan Africa, Southern Russia, and the Indian subcontinent.

- The Indian leopard (Panthera pardus fusca) is a leopard widely distributed on the Indian subcontinent.

- Members of the cat family, leopards live in Asia, sub-Saharan Africa, Southern Russia, and the Indian subcontinent.

- Habitat:

- In comparison to other large carnivores, leopards are quite adaptable with respect to their habitat needs and food requirements, being found in:

- Agro-pastoral landscapes

- Plantations

- Near human habitation (both rural and urban)

- In comparison to other large carnivores, leopards are quite adaptable with respect to their habitat needs and food requirements, being found in:

- Population in India:

- As per ‘Status of leopards in India, 2018’ report released by MoEF&CC, there has been a “60% increase in the population count of leopards in India from 2014 estimates’’.

- The 2014 estimates placed the population of leopards at nearly 8,000 which has increased to 12,852.

- The largest number of leopards have been estimated in Madhya Pradesh (3,421) followed by Karnataka (1,783) and Maharashtra (1,690).

- As per ‘Status of leopards in India, 2018’ report released by MoEF&CC, there has been a “60% increase in the population count of leopards in India from 2014 estimates’’.

- Threat:

- Habitat loss

- Poaching

- Human-wildlife conflict

- Protection Status:

- IUCN Red List: Vulnerable

- CITES: Appendix I.

- Wildlife Protection Act 1972: Schedule I

- Human-Leopard Conflict:

- The areas that often witness leopard-human conflicts include Srinagar in the Kashmir Valley, the Brahmaputra Valley in Assam, Gir National Park in Gujarat, and Kalakkad-Mundanthurai Tiger Reserve in southern Tamil Nadu.

UPSC Civil Services Exam, Previous Year Questions (PYQ)

Q. Consider the following: (2012)

- Black-necked crane

- Cheetah

- Flying squirrel

- Snow leopard

Which of the above are naturally found in India?

(a) 1, 2 and 3 only

(b) 1, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Rapid Fire

Rapid Fire Current Affairs

Use of 3D Printing

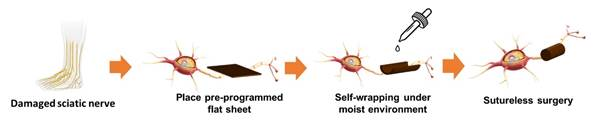

Using three-dimensional (3D) printing technology, a smart gel sheet can self-roll into a tube to form a nerve conduit during surgery, reducing the complexity of the surgery and ensuring rapid nerve healing.

In 3D printing, a virtual model of the part is created using design software, and the part is then fabricated using a 3D printer by layer-upon-layer deposition of the material. 3D printed parts can further undergo a shape change on demand upon activation after fabrication. Such technologies are now widely known as four-dimensional (4D) printing, where time is the extra dimension.

Such 4D-printed parts have not been used in the clinic as yet. But such emerging technologies could pave the way for a new generation of medical devices that surgeons can deploy during surgery to heal nerves and many other tissues in coming years. They can offer benefits such as reduced complexity of surgeries, deployment by minimally-invasive procedures, and faster healing.

Read More: 3D Printing

Ekatha Harbour

Recently, India and Maldives marked a major step in their growing defence cooperation by launching the construction of a harbour- ‘Ekatha Harbour’ for the Coast Guard of the Maldives National Defence Force (MNDF) at Sifavaru in Uthuru Thila Falhu (UTF) atoll (a few miles northwest of Male).

The development of the coast guard is one of the biggest grant-in-aid projects of India. The UTF Harbour Project was announced in 2021.

Maldives is among India’s key maritime neighbours in the Indian Ocean Region (IOR) and New Delhi has been seeking to expand ties with Male including in areas of defence and security amid China’s efforts to expand its influence in the IOR.

Read More: India Maldives Relations

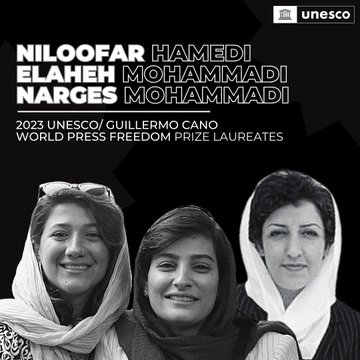

World Press Freedom Prize

Three imprisoned women journalists- Niloofar Hamedi, Elaheh Mohammadi and Narges Mohammadi from Iran have been awarded the UNESCO World Press Freedom Prize 2023 for their commitment to truth and accountability. World Press Freedom Day is observed on 3rd May, every year.

UNESCO has a mandate to ensure freedom of expression and the safety of journalists around the world. Globally, women journalists and media workers face increasing attacks, whether in real life or online, including stigmatization, sexist hate speech, trolling, physical assault, rape and even murder. The agency advocates for their safety and collaborates with partners to identify and implement good practices and share recommendations aimed at countering these attacks.

The UNESCO/Guillermo Cano World Press Freedom Prize was established in 1997. It is presented annually to a person, organization or institution that has made an outstanding contribution to press freedom, and especially when this has been achieved in the face of danger.

Read More: World Press Freedom Index 2023

ASEAN-India Maritime Exercise 2023

To expand India-ASEAN (Association of South East Asian Nations) military cooperation, the maiden ASEAN-India Maritime Exercise (AIME-2023) is being conducted. The harbour phase of the exercise is scheduled to be held in Singapore from 02 – 04 May 2023 and the Sea Phase will be conducted from 07 to 08 May 2023 in the South China Sea.

AIME 2023 will provide an opportunity for Indian Navy and ASEAN navies to work together closely and conduct seamless operations in the maritime domain.

INS Delhi, India's first indigenously built guided missile destroyer and INS Satpura, an indigenously built guided missile stealth frigate are a part of the Indian Navy's Eastern Fleet will also participate in International Maritime Defence Exhibition (IMDEX-23) and International Maritime Security Conference (IMSC), hosted by Singapore.

Read More: ASEAN

.png)