Governance

Grant in Aid for Rural Local Bodies

Why in News

Recently, the Ministry of Finance has released an amount of Rs. 13,385.70 crore to 25 States for providing grants to the Rural Local Bodies.

- This Grant-in-aid is the 1st installment of Tied grants of the year 2021-22.

- The grants have been released as per the recommendations of the 15th Finance Commission.

Key Points

- Finance Commission (FC) Grants:

- The Union Budget provides funds to local bodies, state disaster relief funds and compensates any revenue loss to states after devolution of taxes on the recommendation of FC.

- The 73rd Constitutional Amendment, 1992 requires both the Centre and states to help Panchayati Raj institutions to evolve as a unit of self-governance by assigning them funds, functions and functionaries.

- The 15th FC has recommended over 1 lakh 42 thousand crore rupees tied to Panchayats for water & sanitation during the period 2021-22 to 2025-26.

- The Union Budget provides funds to local bodies, state disaster relief funds and compensates any revenue loss to states after devolution of taxes on the recommendation of FC.

- Tied vs United Grant:

- Out of the total Grant-in-aid allocated for Panchayati Raj institutions, 60% is ‘Tied Grant’. Tied grants are meant to ensure availability of additional funds to the Rural local bodies over and above the funds allocated by the Centre for improving the sanitation and maintenance of Open-Defecation Free (ODF) status and supply of drinking water, rain water harvesting and water recycling under the Centrally Sponsored Schemes.

- Remaining 40% is ‘Untied Grant’ and is to be utilized at the discretion of the Panchayati Raj institutions for location specific needs, except for payment of salaries.

- Allocation of Resources: The States are required to transfer the grants to the Rural local bodies within 10 working days of their receipt from the Union Government.

- Any delay beyond 10 working days requires the State Governments to release the grants with interest.

Finance Commission (FC)

- The FC is a constitutional body that determines the formula for distributing the tax proceeds between the Centre and states, and among the states as per the constitutional arrangement and present requirements.

- Under Article 280 of the Constitution, the President of India is required to constitute a FC at an interval of five years or earlier.

- The 15th FC was constituted in November 2017, under the chairmanship of NK Singh.

- Its recommendations will cover a period of five years from the year 2021-22 to 2025-26.

Division of FC Grants

- Grants for Rural Local Bodies: The three-tier model of governance envisioned in the Constitution assigns clear roles and responsibilities to Gram Panchayats.

- The FC recommendations ensure that these local bodies are adequately funded.

- In fact, nearly half of the FC Grants in the Union Budget goes to village local bodies.

- Grants for Urban Local Bodies: In addition to units of self-governance at the village level, the Constitution also envisages cities as units of self-governance.

- Urban local bodies like municipal councils receive the largest chunk of FC Grants after Rural Local Bodies and Post Devolution Deficit Grants to states.

- Assistance to SDRF: The central government also provides funds to State Disaster Relief Funds in addition to funding the National Disaster Management Authority (NDMA).

- The assistance to the state government’s disaster relief authorities is provided as per the recommendations of the FC.

- Post Devolution Revenue Deficit Grants: About a third of the total revenue collected by the Centre is directly transferred to states as their share in the divisible pool.

- However, the FC also provides a mechanism for compensation of any loss incurred by states, which is called post-devolution revenue deficit grants.

- This grant forms the second largest chunk of FC transfers after the assistance to local rural bodies.

- In addition to the four main transfers under the FC Grants, the Centre also transfers a considerable sum to states and vulnerable groups from its own resources.

- Central pool of resources for north-eastern region and Sikkim

- Externally aided project grants

- Externally aided project loans

- Schemes for north-east council

- Schemes under Article 275 (1) of the Constitution

- Special central assistance to scheduled castes and special central assistance to tribal areas.

Indian Polity

E-ILP Platform: Manipur

Why in News

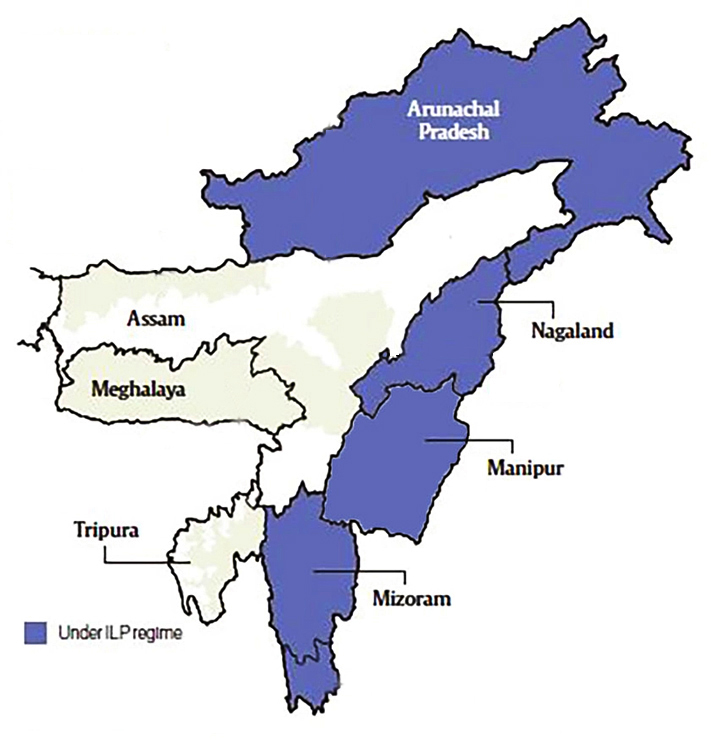

Recently, the Chief Minister of Manipur virtually launched the e-ILP platform for effective regulation of the Inner Line Permit (ILP) system in the state.

- The ILP system came into effect in Manipur on 1st January 2020.

- In Manipur, four types of permits are issued - temporary, regular, special and labour permits.

Key Points

- Background of ILP System:

- Under the Bengal Eastern Frontier Regulation Act, 1873, the British framed regulations restricting the entry and regulating the stay of outsiders in designated areas.

- This was to protect the Crown’s own commercial interests by preventing “British subjects” (Indians) from trading within these regions.

- In 1950, the Indian government replaced “British subjects” with “Citizen of India”.

- This was to address local concerns about protecting the interests of the indigenous people from outsiders belonging to other Indian states.

- About:

- ILP is a document that Indian citizens from other states are required to possess in order to enter states like Arunachal Pradesh, Mizoram, Nagaland and Manipur.

- It is issued by the concerned State Government and can be issued for travel purposes solely.

- Such states are exempted from provisions of the Citizenship Amendment Act (CAA).

- The CAA, which relaxes eligibility criteria for certain categories of migrants from three countries seeking Indian citizenship, exempts certain categories of areas, including those protected by the Inner Line system.

- Rules for Foreigners:

- Foreigners need a Protected Area Permit (PAP) to visit tourist places which are different from ILPs needed by domestic tourists.

- Under the Foreigners (Protected Areas) Order 1958, all areas falling between the 'Inner Line', as defined in the said order, and the International Border of the State have been declared as a Protected Area.

- A foreign national is normally not allowed to visit a Protected/Restricted Area unless it is established to the satisfaction of the Government that there are extraordinary reasons to justify such a visit.

- Foreigners need a Protected Area Permit (PAP) to visit tourist places which are different from ILPs needed by domestic tourists.

Indian Economy

Rule for Taxing Contributions to EPF

Why in News

Recently, the Finance Ministry has notified the rules for taxing interest income on contributions made to the Employees’ Provident Fund (EPF).

Employees’ Provident Funds Scheme

- EPF is the main scheme under the Employees’ Provident Funds and Miscellaneous Act, 1952.

- This scheme offers the institution of provident funds for factory employees and other establishments.

- The employee and employer each contribute 12% of the employee’s basic salary and dearness allowance towards EPF.

- The Economic Survey 2016-17 had suggested that employees be allowed to choose whether or not to save 12% of their salary into EPF or keep it as take home pay.

- As per current laws, a person mandatorily becomes a member of EPF if his monthly salary does not exceed Rs. 15,000.

Key Points

- Background:

- In February 2021, the Budget proposed that tax exemption will not be available on interest income on Provident Fund (PF) contributions exceeding Rs 2.5 lakh in a year.

- In March 2021, the government introduced an amendment to the Finance Bill, 2021 in which it proposed to double the cap on contribution from Rs 2.5 lakh to Rs 5 lakh for tax-exempt interest income, if the contribution is made to a fund where there is no contribution by the employer.

- With this, the government provided relief for contributions made to the General Provident Fund that is available only to government employees and there is no contribution by the employer.

- New Rules:

- Interest income on contributions made to the EPF beyond Rs. 2.5 lakh (for private sector employees) and Rs.5 lakh (for government sector employees) will be taxed.

- Beginning this Fiscal Year (FY) 2021-22, the government will tax interest on contributions made in excess of these limits, with separate accounts to be maintained within the provident fund account for 2021-22 and subsequent years for taxable contribution and non-taxable contribution made by an individual.

- A Fiscal Year (FY), also known as a budget year, is a period of time used by the government and businesses for accounting purposes to formulate annual financial statements and reports.

- The Central Board of Direct Taxes (CBDT) has inserted Rule 9D in the Income-Tax Rules, 1962, according to which income through interest accrued during the previous year that is not exempt (over Rs 2.5 lakh for private and Rs 5 lakh for government employees) shall be computed as the interest accrued during the previous year in the taxable contribution account.

- Perpetuity of Tax:

- As per the notification, the interest income on the additional contribution (over Rs 2.5 lakh for private and Rs 5 lakh for government employees) for a year will get taxed every year.

- This means that if one’s annual contribution to PF in FY 2021-22 is Rs 10 lakh, the interest income on Rs 7.5 lakh will get taxed not only for FY 2021-22 but also for all subsequent years.

- As per the notification, the interest income on the additional contribution (over Rs 2.5 lakh for private and Rs 5 lakh for government employees) for a year will get taxed every year.

- Need:

- The Budget proposal had noted that the government has found instances where some employees are contributing huge amounts to these funds and are getting the benefit of tax exemption at all stages — contribution, interest accumulation and withdrawal.

- With an aim to exclude High Net-Worth individuals (HNIs) from the benefit of high tax-free interest income on their large contributions, the government has proposed to impose a threshold limit for tax exemption.

Indian Economy

Additional Tier 1 Bonds

Why in News

Recently, State Bank of India (SBI) has raised Rs. 4,000 crore of the Basel compliant Additional Tier 1 (AT1) bonds at coupon rate of 7.72%.

- This is the first AT1 Bond issuance in the domestic market post the new SEBI regulations.

- This is also the lowest pricing ever offered on such debt issued by any Indian bank since the implementation of Basel III capital rules in 2013.

Bonds

- Bonds are units of corporate debt issued by companies and securitized as tradable assets.

- A bond is referred to as a fixed-income instrument since bonds traditionally paid a fixed interest rate (coupon) to debtholders. Variable or floating interest rates are also now quite common.

- Bond prices are inversely correlated with interest rates: when rates go up, bond prices fall and vice-versa.

- They have maturity dates at which point the principal amount must be paid back in full or risk default.

Key Points

- About:

- AT1 bonds, also called perpetual bonds, carry no maturity date but have a call option. The issuer of such bonds may call or redeem the bonds if it is getting money at a cheaper rate, especially when interest rates are falling.

- They are like any other bonds issued by banks and companies, but pay a slightly higher rate of interest compared to other bonds.

- Banks issue these bonds to shore up their core capital base to meet the Basel-III norms.

- These bonds are also listed and traded on the exchanges. So, if an AT-1 bondholder needs money, he can sell it in the secondary market.

- Investors cannot return these bonds to the issuing bank and get the money. i.e there is no put option available to its holders.

- Banks issuing AT-1 bonds can skip interest payouts for a particular year or even reduce the bonds’ face value.

- AT1 bonds, also called perpetual bonds, carry no maturity date but have a call option. The issuer of such bonds may call or redeem the bonds if it is getting money at a cheaper rate, especially when interest rates are falling.

- Regulated By:

- AT-1 bonds are regulated by the Reserve Bank of India (RBI). If the RBI feels that a bank needs a rescue, it can simply ask the bank to write off its outstanding AT-1 bonds without consulting its investors.

Basel III Norms

- It is an international regulatory accord that introduced a set of reforms designed to improve the regulation, supervision and risk management within the banking sector, post 2008 financial crisis.

- Under the Basel-III norms, banks were asked to maintain a certain minimum level of capital and not lend all the money they receive from deposits.

- According to Basel-III norms, banks' regulatory capital is divided into Tier 1 and Tier 2, while Tier 1 is subdivided into Common Equity Tier-1 (CET-1) and Additional Tier-1 (AT-1) capital.

- Common Equity Tier 1 capital includes equity instruments where returns are linked to the banks’ performance and therefore the performance of the share price. They have no maturity.

- Together, CET and AT-1 are called Common Equity. Under Basel III norms, minimum requirement for Common Equity Capital has been defined.

- Tier 2 capital consists of unsecured subordinated debt with an original maturity of at least five years.

- According to the Basel norms, if minimum Tier-1 capital falls below 6%, it allows for a write-off of these bonds.

Biodiversity & Environment

Report on Weather Disasters: WMO

Why in News

Recently, the World Meteorological Organization (WMO), has released a report, which stated that weather disasters killed 2 million in the last 50 years.

- WMO has published 'Atlas of Mortality and Economic Losses from Weather, Climate and Water Extremes, from 1970 to 2019'.

- WMO is a specialized agency of the United Nations.

Key Points

- Findings of the Report:

- No. of Disasters: The number of disasters has increased by a factor of five over the 50-year period, driven by climate change, more extreme weather and improved reporting.

- From 1970 to 2019, weather, climate and water hazards accounted for 50% of all disasters, 45% of all reported deaths and 74% of all reported economic losses.

- More than 91% of these deaths occurred in developing countries.

- Droughts, storms, floods and extreme temperature were the leading causes.

- Decreasing Number of Deaths: Due to improved early warning systems and disaster management, the number of deaths decreased almost threefold between 1970 and 2019.

- Spiralling Costs: During the 50-year period, US$ 202 million dollars in damage occurred on average every day. Economic losses have increased sevenfold from the 1970s to the 2010s.

- Storms, the most prevalent cause of damage, resulted in the largest economic losses around the globe.

- Climate Change Footprints: The number of weather, climate and water extremes are increasing and will become more frequent and severe in many parts of the world as a result of climate change.

- More water vapor in the atmosphere has exacerbated extreme rainfall and flooding, and the warming oceans have affected the frequency and extent of the most intense tropical storms.

- This has augmented the vulnerability of low-lying megacities, deltas, coasts and islands in many parts of the world.

- Failure of Sendai Framework: The report also warned that the failure to reduce disaster losses as set out in the 2015 Sendai Framework is putting at risk the ability of developing countries to eradicate poverty and to achieve other important Sustainable Development Goals (SDGs).

- Sendai Framework 2015 was adopted at the Third United Nations World Conference on Disaster Risk Reduction, held in 2015 in Sendai, Miyagi, Japan.

- The present Framework applies to the risk of small-scale and large-scale, frequent and infrequent, sudden and slow-onset disasters caused by natural or man-made hazards, as well as related environmental, technological and biological hazards and risks.

- No. of Disasters: The number of disasters has increased by a factor of five over the 50-year period, driven by climate change, more extreme weather and improved reporting.

- Recommendations:

- Need for Adaptability: Only half of WMO’s 193 member countries have multi-hazard early warning systems and severe gaps in weather and hydrological observing networks exist in Africa, some parts of Latin America and in Pacific and Caribbean island States.

- Thus, there is a need to install early warning systems in developing and under-developed countries.

- Comprehensive Disaster Risk Management: Need for a greater investment in comprehensive disaster risk management to ensure that climate change adaptation is integrated in national and local disaster risk reduction strategies.

- Review Hazard Exposure: The report further recommends countries to review hazard exposure and vulnerability considering a changing climate to reflect that tropical cyclones may have different tracks, intensity and speed than in the past.

- Proactive Policies: It also calls for the development of integrated and proactive policies on slow-onset disasters such as drought.

- Need for Adaptability: Only half of WMO’s 193 member countries have multi-hazard early warning systems and severe gaps in weather and hydrological observing networks exist in Africa, some parts of Latin America and in Pacific and Caribbean island States.

- Recent Initiatives Taken by India:

Biodiversity & Environment

State of the World's Trees Report: BGCI

Why in News

Recently, Botanic Gardens Conservation International (BGCI) launched the State of the World's Trees Report.

- The report warns that almost a third of the world’s tree species are at risk of extinction, while hundreds are on the brink of being wiped out.

- BGCI is a membership organisation, representing botanic gardens in more than 100 countries around the world. It is an independent UK charity established in 1987 to link the botanic gardens of the world in a global network for plant conservation.

Key Points

- Species Under Threat:

- 17,500 tree species which is some 30% of the total – are at risk of extinction, while 440 species have fewer than 50 individuals left in the wild.

- 11% of the flora or plant life of every country was made up of threatened species.

- Overall the number of threatened tree species is double the number of threatened mammals, birds, amphibians and reptiles combined.

- 17,500 tree species which is some 30% of the total – are at risk of extinction, while 440 species have fewer than 50 individuals left in the wild.

- Most At-Risk Trees:

- Among the most at-risk trees are species including magnolias and dipterocarps – which are commonly found in Southeast Asian rainforests. Oak trees, maple trees and ebonies also face threats.

- Countries with Highest Risk:

- Thousands of varieties of trees in the world’s top six countries for tree-species diversity are at risk of extinction.

- The greatest single number is in Brazil, where 1,788 species are at risk. The other five countries are Indonesia, Malaysia, China, Colombia and Venezuela.

- There were also 27 countries that had no threatened species of trees.

- Island Trees:

- Though megadiverse countries see the greatest numbers of varieties at risk of extinction, island tree species are more proportionally at risk.

- This is particularly concerning because many islands have species of trees that can be found nowhere else.

- Major Threats:

- The top three threats facing tree species are crop production, timber logging and livestock farming, while climate change and extreme weather are emerging threats.

- At least 180 tree species are directly threatened by rising seas and severe weather, especially island species such as magnolias in the Caribbean.

- Need of Saving Trees:

- Support System:

- Trees help support the natural ecosystem and are considered vital for combating global warming and climate change.

- The extinction of a single tree species could cause a domino effect, catalysing the loss of many other species.

- Act as Buffer:

- They store 50% of the world’s terrestrial carbon and provide a buffer from extreme weather, such hurricanes and tsunamis.

- Habitat & Food:

- Many threatened tree species provide the habitat and food for millions of other species of birds, mammals, amphibians, reptiles, insects and microorganisms.

- Support System:

- Suggestion for Policymakers:

- Extend Protection:

- Extend protected area coverage for threatened tree species that are currently not-well represented in protected areas.

- Conservation:

- Ensure that all globally threatened tree species, where possible, are conserved in botanic garden and seed bank collections.

- Increase Funding:

- Increase availability of Government and corporate funding for threatened tree species.

- Expand Schemes:

- Expand tree planting schemes, and ensure the targeted planting of threatened and native species.

- Increase Collaboration:

- Increase global collaboration to tackle tree extinction, by participating in international efforts.

- Extend Protection:

- Related Indian Initiatives:

Biodiversity & Environment

State Animal and Bird: Ladakh

Why in News

Recently, Ladakh has adopted Snow Leopard and Black-Necked Crane, as State animal and State bird, two years after it was carved out as a separate Union Territory (UT) from the erstwhile State of J&K (Jammu and Kashmir).

Key Points

- Snow Leopard:

- About:

- Snow leopards (Panthera uncia) act as an indicator of the health of the mountain ecosystem in which they live, due to their position as the top predator in the food web.

- Habitat:

- Mountainous regions of central and southern Asia. In India, their geographical range encompasses:

- Western Himalayas: Jammu and Kashmir, Himachal Pradesh.

- Eastern Himalayas: Uttarakhand and Sikkim and Arunachal Pradesh.

- Snow Leopard capital of the world: Hemis, Ladakh.

- Hemis National Park is the biggest national park in India and also has a good presence of Snow Leopard.

- Mountainous regions of central and southern Asia. In India, their geographical range encompasses:

- Threats:

- Reduction in prey populations.

- Illegal poaching and increased human population infiltration into the species habitat.

- Illegal trade of wildlife parts and products.

- Protection Status:

- IUCN: Vulnerable.

- CITES: Appendix I

- Wildlife (Protection) Act 1972: Schedule I

- It is also listed in the Convention on Migratory Species (CMS), affording the highest conservation status to the species, both globally and in India.

- About:

- Black-Necked Crane:

- About:

- The black-necked crane (Grus nigricollis), also known as Tibetan crane, is a large bird and medium-sized crane.

- Both the sexes are almost of the same size but male is slightly bigger than female.

- A conspicuous red crown adorns the head.

- Habitat:

- The high altitude wetlands of the Tibetan plateau, Sichuan (China), and eastern Ladakh (India) are the main breeding ground of the species; the birds spend winter at lower altitudes.

- In Bhutan and Arunachal Pradesh, it only comes during the winters.

- Threats:

- Damage to the eggs and chicks, caused by feral dogs.

- Loss of habitat due to human pressure (Development Projects) on the wetlands.

- Increased grazing pressure on the limited pastures near the wetlands.

- Protection Status:

- IUCN Red List: Near Threatened

- CITES: Appendix I

- Indian Wildlife (Protection) Act, 1972: Schedule I

- About:

Ladakh

- It was established as a Union Territory (UT) of India on 31st October 2019, following the enactment of the Jammu and Kashmir Reorganization Act.

- Before that, it was part of the Jammu and Kashmir state.

- It is the largest and the second least populous union territory of India.

- It extends from the Siachen Glacier in the Karakoram Range to the north to the main Great Himalayas to the south.

- The eastern end, consisting of the uninhabited Aksai Chin Plains, is claimed by the Indian Government as part of Ladakh, and has been under Chinese control since 1962.

- The largest town in Ladakh is Leh, followed by Kargil, each of which headquarters a district.

- The Leh district contains the Indus, Shyok and Nubra river valleys.

- The Kargil district contains the Suru, Dras and Zanskar river valleys.

- Earlier, in 2020 Indian and Chinese troops were engaged in a temporary and short duration face-off along the Line of Actual Control (LAC) at Naku La (Sikkim) and near Pangong Tso Lake (Eastern Ladakh).

- However, recently India and China have agreed in principle to disengage at a key patrol point in eastern Ladakh.

International Relations

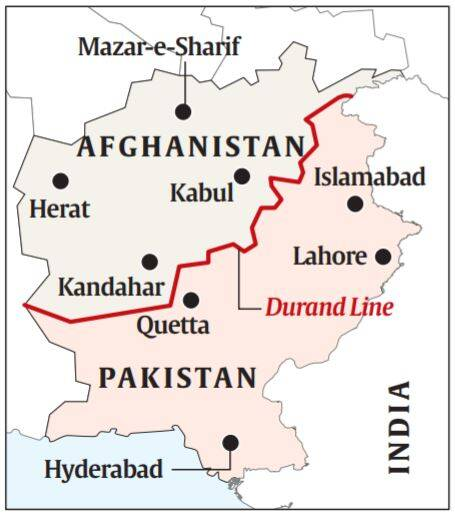

Durand Line: Afghanistan and Pakistan

Why in News

Recently, Taliban has said that Afghans oppose the fence erected by Pakistan along the Durand Line.

- The fencing of the 2,640 km land border with Afghanistan began in March 2017 after a spate of attacks from across the porous border.

Key Points

- Established in the Hindu Kush in 1893, it runs through the tribal lands between Afghanistan and British India. In modern times it has marked the border between Afghanistan and Pakistan.

- It is a legacy of the 19th century Great Game between the Russian and British empires in which Afghanistan was used as a buffer by the British against a feared Russian expansionism to its east.

- The agreement demarcating what became known as the Durand Line was signed between the British civil servant Sir Henry Mortimer Durand and Amir Abdur Rahman, then the Afghan ruler in 1893.

- Abdur Rahman became king in 1880, two years after the end of the Second Afghan War in which the British took control of several areas that were part of the Afghan kingdom. His agreement with Durand demarcated the limits of his and British India’s “spheres of influence” on the Afghan “frontier” with India.

- The seven-clause agreement recognised a 2,670-km line, which stretches from the border with China to Afghanistan’s border with Iran.

- It also put on the British side the strategic Khyber Pass.

- It is a mountain pass in the Hindu Kush, on the border between Pakistan and Afghanistan.

- The pass was for long of great commercial and strategic importance, the route by which successive invaders entered India, and was garrisoned by the British intermittently between 1839 and 1947.

- The line cut through Pashtun tribal areas, leaving villages, families, and land divided between the two “spheres of influence”.

- With independence in 1947, Pakistan inherited the Durand Line, and with it also the Pashtun rejection of the line, and Afghanistan’s refusal to recognise it.

- When the Taliban seized power in Kabul the first time, they rejected the Durand Line. They also strengthened Pashtun identity with an Islamic radicalism to produce the Tehreek-e-Taliban Pakistan, whose terrorist attacks since 2007 left the country shaken.

Other Important Boundary Lines

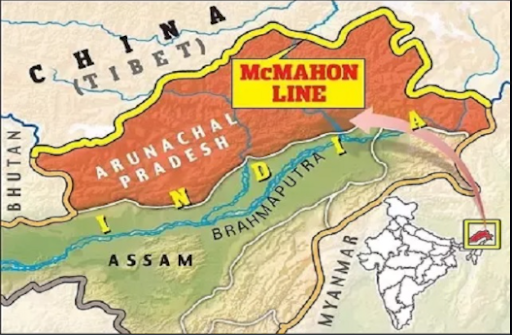

- McMahon Line:

- Named after the British Indian Army officer Lieutenant Colonel Sir Arthur Henry McMahon, who was also an administrator in British India, the McMahon line is a demarcation that separates Tibet and north-east India.

- It was proposed by Colonel McMahon as the boundary between Tibet, China, and India at the Shimla Convention of 1914.

- It runs from the eastern border of Bhutan along the crest of the Himalayas until it reaches the great bend in the Brahmaputra River where that river emerges from its Tibetan course into the Assam Valley.

- It was accepted by Tibetan authorities and British India, and is now acknowledged by the Republic of India as the official boundary.

- China, however, disputes the validity of the McMahon line.

- It claims that Tibet isn’t a sovereign government, and therefore any treaty made with Tibet stands invalid.

- The alignment of the Line of Actual Control (LAC) in the eastern sector is along the 1914 McMahon Line.

- The LAC is the demarcation that separates Indian-controlled territory from Chinese-controlled territory.

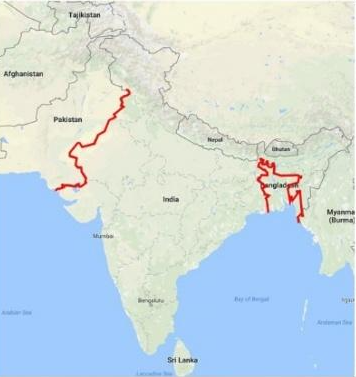

- Radcliffe Line:

- It divided British India into India and Pakistan.

- It is named after the architect of this line, Sir Cyril Radcliffe, who was also the chairman of the Boundary Commissions.

- The Radcliffe Line was drawn between West Pakistan (now Pakistan) and India on the western side and between India and East Pakistan (now Bangladesh) on the eastern side of the subcontinent.

- The western side of the Radcliffe Line still serves as the Indo-Pakistani border and the eastern side serves as the India-Bangladesh border.

Indian History

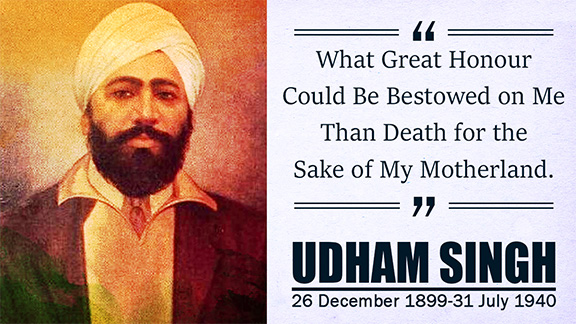

Udham Singh

Why in News

Amid criticism of the renovated Jallianwala Bagh memorial, some people raise questions over the statue of Shaheed Udham Singh installed at the Bagh.

Key Points

- About:

- Born in Sunam in Punjab’s Sangrur district in 1899, also referred to as Shaheed-i-Azam Sardar Udham Singh which means ‘Great Martyr’.

- He is regarded as one of the foremost revolutionaries of the Indian Freedom Struggle.

- Following the Jallianwala Massacre on 13th April 1919, he got profoundly involved in revolutionary activities and politics. He was deeply influenced by Bhagat Singh.

- He joined the Ghadar Party in 1924 to organise overseas Indians with the purpose of overthrowing colonial rule.

- In 1927, while returning to India with associates and weapons to carry out revolutionary activities, he was arrested for illegal possession of firearms and sentenced to five years in prison.

- On 13th March, 1940, Singh shot Michael O’Dwyer instead of General Dyer at a meeting of the East India Association and the Royal Central Asian Society at Caxton Hill.

- General Dyer, who ordered open firing on people protesting against the Rowlatt Act.

- He was sentenced to death and was hanged on 31st July, 1940 at Pentonville Prison in London.

- Ghadar Party:

- It was an Indian revolutionary organisation, with the aim to liberate India from British rule.

- ‘Ghadar’ – also written as ‘Ghadr’ in English – is an Urdu word for rebellion.

- The party was formed in the United States in 1913, by migrant Indians, mostly Punjabis. However, the party also included Indians from all parts of India.

- Motive was to wage a nationwide armed struggle against British colonialism in India.

- The party was established as the Hindi Association of Pacific Coast under the leadership of Lala Har Dayal with Baba Sohan Singh Bhakna as its president.

- The party is known for setting the foundation for future Indian revolutionary movements and served as a stepping stone for independence.

- Most members of the Ghadar party came from the peasantry who first began migrating from Punjab to cities in Asia like Hong Kong, Manila and Singapore at the dawn of the 20th century.

- Later, with the rise in the lumber industry in Canada and the US, many moved to North America, where they thrived – but also became victims of institutionalised racism.

- The Ghadar movement ‘inspired to transpose egalitarian values (Egalitarianism) of American culture in the social framework of colonial India’.

- Egalitarianism is a doctrine based on the notion of equality, namely, that all people are equal and deserve equal treatment in all things.

- It was an Indian revolutionary organisation, with the aim to liberate India from British rule.

Important Facts For Prelims

63rd Ramon Magsaysay Award

Why in News

Recently the Ramon Magsaysay Award 2021 was announced. The award is presented in a formal ceremony in Manila, the capital of the Philippines on 31st August each year.

Key Points

- The Ramon Magsaysay Award was established in 1957 and is considered Asia's premier prize and highest honour.

- It is named after Ramon Magsaysay, the third president of the Republic of the Philippines.

- Recognises and honours individuals and organisations in Asia, regardless of race, creed, gender, or nationality, who have achieved distinction and have helped others generously without aiming for public recognition.

- Till 2009, awards were traditionally given in five categories:

- Government service; public service; community leadership; journalism, literature and creative communication arts; and peace and international understanding.

- However, post 2009, the Ramon Magsaysay Award Foundation annually selects the awardees for the field of Emergent Leadership.

- Awardees are presented with a certificate, a medallion with an embossed image of Ramon Magsaysay and cash prize.

- The award is internationally-recognized as the Nobel Prize counterpart of Asia.

- Winners for 2021: Bangladesh’s Dr. Firdausi Qadri (Affordable Vaccine Champion), Pakistan’s Muhammad Amjad Saqib (Poverty Alleviation Visionary), Filipino fisher and community environmentalist Roberto Ballon, American Steven Muncy for humanitarian work and refugee assistance and Indonesian torch bearer for investigative journalism, Watchdoc.

-min.jpg)