International Relations

Red Sea and Panama Canal

For Prelims: Red Sea trade route, Panama Canal, Cape of Good Hope, Houthi rebels, Suez Canal ,Ben Gurion Canal Project, MV Chem Pluto.

For Mains: Key Issues in the Red Sea and Panama Canal, Significance of Maritime Transport in Global Trade.

Why in News?

Recent attacks on ships in the Red Sea trade route and the ongoing drought problem at the Panama Canal have raised worries about global trade disruptions.

What are the Key Issues in the Red Sea and Panama Canal Presently?

- Red Sea:

- Issue: Chemical tanker MV Chem Pluto was struck by a drone attack, approximately 200 nautical miles off Gujarat's coast.

- MV Chem Pluto is a Liberia-flagged, Japanese-owned, and Netherlands-operated chemical tanker. It had started its journey carrying crude from Al Jubail, Saudi Arabia and was expected to arrive in New Mangalore, India.

- Alleged Involved Entity: It is believed to have been carried out by Houthi rebels based in Yemen, citing protest against Israel’s actions in Gaza.

- Houthi rebels are also engaged in a decade-long civil conflict with Yemen's government.

- Impact on India: Concerns arise for Indian oil importers and exporters of key commodities like basmati and tea due to disruptions in this critical trade route.

- Disruption in the Red Sea route could increase Indian agricultural product prices by 10-20% as shipments reroute through the Cape of Good Hope.

- Issue: Chemical tanker MV Chem Pluto was struck by a drone attack, approximately 200 nautical miles off Gujarat's coast.

Note

Global oil and petroleum flows have declined due to major shipping companies avoiding the Red Sea. However, India's oil imports from Russia remain unaffected.

- India's reliance on Russian oil, perceived as Iran’s ally, has remained stable amid the conflict in the Red Sea.

- Panama Canal:

- Issue: Due to drought conditions, shipping through the 51-mile stretch of the Panama Canal has decreased by over 50%.

- A naturally occurring El Nino climate pattern associated with warmer-than-usual water in the central and eastern tropical Pacific Ocean is contributing to Panama's drought.

- Impact: This shortage of water is compelling vessels traveling from Asia to the US to opt for the Suez Canal, adding six extra days compared to the Panama Canal route.

- While the Bab-el-Mandeb Strait that leads to the Suez Canal in the Red Sea region connects Asia to Europe, the 100-year-old Panama Canal connects the Atlantic and Pacific Oceans.

- Both these routes are among the busiest in the world.

- While the Bab-el-Mandeb Strait that leads to the Suez Canal in the Red Sea region connects Asia to Europe, the 100-year-old Panama Canal connects the Atlantic and Pacific Oceans.

- Issue: Due to drought conditions, shipping through the 51-mile stretch of the Panama Canal has decreased by over 50%.

|

|

What is the Significance of Maritime Transport in Global Trade?

- Unrivaled Volume and Value Carrier: Maritime transport shoulders a colossal 80% of global trade by volume and over 70% by value, far surpassing other modes of transportation as per the United Nations Conference on Trade and Development.

- As of 2019, the total value of the annual world shipping trade had reached more than 14 trillion US Dollars.

- Environmental Considerations: While shipping does contribute to around 3% of global greenhouse gas emissions, it is relatively more fuel-efficient and emits less per ton of cargo transported compared to other modes of transportation like air freight.

- Energy Transportation: The majority of the world's energy resources, such as oil and natural gas, are transported by sea. Tankers carry these resources from production areas to consuming regions, playing a critical role in meeting global energy demands.

What Measures India can Adopt to Reduce Vulnerability to These Issues?

- Joint Maritime Security Initiative: Propose a collaborative security framework with key Red Sea stakeholders (Egypt, Saudi Arabia, UAE, Yemen) involving intelligence sharing, coordinated patrols, and joint exercises.

- Deploy Advanced Surveillance Systems: Install integrated radar and drone surveillance systems along India's western coastline to enhance early threat detection and response capabilities.

- Negotiate Preferential Access: Engage with Panama Canal authorities to explore preferential passage for Indian vessels or potential toll discounts for specific routes.

Alternate Trade Routes Under Consideration

Recently, there has been renewed interest in the Ben Gurion Canal Project, a proposed 160-mile-long sea-level canal that would connect the Mediterranean Sea with the Gulf of Aqaba, bypassing the Suez Canal.

UPSC Civil Services Examination, Previous Year Question:

Q. Consider the following pairs: (2019)

Sea Bordering Country

- Adriatic Sea : Albania

- Black Sea : Croatia

- Caspian Sea : Kazakhstan

- Mediterranean Sea : Morocco

- Red Sea : Syria

Which of the pairs given above are correctly matched?

(a) 1, 2 and 4 only

(b) 1, 3 and 4 only

(c) 2 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Governance

Scheme of Special Assistance to States for Capital Investment

For Prelims: Scheme of Special Assistance to States for Capital Investment, Covid-19 Pandemic, 15th Finance Commission, Urban Planning, Make in India.

For Mains: Scheme of Special Assistance to States for Capital Investment.

Why in News?

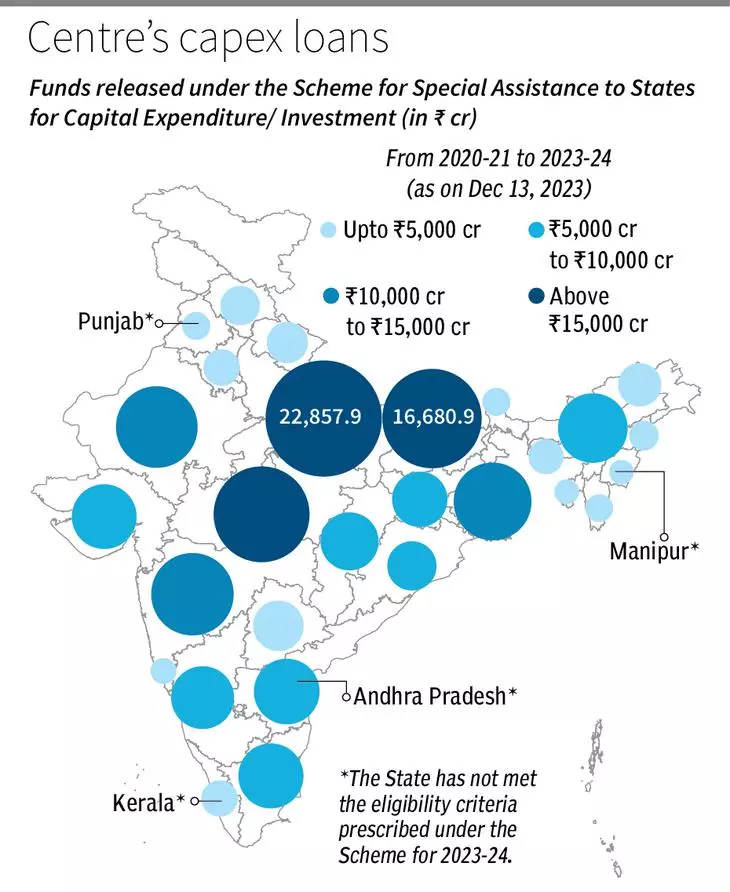

Out of the Rs 1,67,518.6-crore special assistance (loan) allocated by the Centre under the Scheme for Special Assistance to States for capital expenditure/investment, Uttar Pradesh (UP) has been the highest recipient over the last four years.

- The substantial financial support underscores the government’s commitment to bolstering development initiatives in UP.

What are the Trends in Capital expenditure as per the Ministry of Finance?

- UP and Bihar are the top two States which have fulfilled the criteria related to Capital Expenditure and received maximum allocation under the Scheme in the last four years.

- Uttarakhand, Haryana, Kerala and Punjab are among the States which have received about 1-2% of the total released amount under the Scheme.

- Andrha Pradesh, Kerala, Manipur and Punjab have not received any allocation in 2023-24 and as per the Ministry of Finance, these States have not met the eligibility criteria prescribed under the Scheme.

What is the Special Assistance to States for Capital Investment Scheme?

- About:

- The Scheme for Special Assistance to States for Capital Expenditure was launched in FY 2020-21 in the wake of Covid-19 Pandemic.

- The scheme has been expanded and continued as ‘Scheme for Special Assistance to States for Capital Investment 2023-24’ with allocation of Rs 1.3-lakh crore.

- Parts:

- The scheme has eight parts, Part-I being the largest with allocation of Rs. 1 lakh crore. This amount has been allocated amongst states in proportion to their share of central taxes and duties as per the award of the 15th Finance Commission.

- Other parts of the scheme are either linked to reforms or are for sector-specific projects.

- Part-II provides incentives to states for scrapping of old vehicles and setting up of automated vehicle testing facilities;

- Part-III and IV provide incentives to states for reforms in urban planning and urban finance;

- Part-V provides funds for increasing the housing stock for police personnel and their families within the police stations in urban areas.

- Part-VI of the scheme supports the vision of national integration, Make in India and One District One Product by promoting cultural diversity and local products through Unity Mall projects.

- Under Part-VII, Rs. 5,000 crore is provided as financial assistance to states for establishing libraries with digital infrastructure at the Panchayat and Ward level, primarily benefiting children and adolescents.

- Objectives of the Scheme:

- The scheme is expected to have a higher multiplier effect on the economy by stimulating demand and creating jobs.

- The scheme also aims to enhance the pace of projects in key sectors such as Jal Jeevan Mission and Pradhan Mantri Gram Sadak Yojana by providing funds for meeting the state share.

- The scheme also seeks to encourage states to undertake reforms in urban planning and urban finance to improve the quality of life and governance in cities.

What is Capital Expenditure in India?

- Capital Expenditure (Capex):

- It refers to the funds allocated by the government for the acquisition, construction, or improvement of physical assets such as infrastructure, buildings, machinery, and equipment.

- It is considered to be productive and growth enhancing as it adds to the productive capacity of the economy and generates income and employment in the future.

- The Indian government allocates capital expenditure through its annual budget, which is presented by the finance minister.

- The capital investment outlay has experienced a consecutive three-year increase, reaching Rs 10 lakh crore, which accounts for 3.3% of the GDP, marking a significant growth of 33% ( Union Budget 2023-24).

- Effective Capital Expenditure:

- The capital expenditure presented in the budget does not include the spending by the government on creating capital assets through grants-in-aid to states and other agencies.

- These grants are classified as revenue expenditure in the budget, but they also contribute to the creation of fixed assets such as roads, bridges, schools, hospitals, etc.

- Therefore, to capture the true extent of public investment by the central government, a concept of ‘effective capital expenditure’ has been introduced.

- Effective capital expenditure is defined as the sum of capital expenditure and grants for creation of capital assets.

- It is budgeted at Rs 13.7 lakh crore or 4.5% of GDP (Union Budget 2023-24).

- The capital expenditure presented in the budget does not include the spending by the government on creating capital assets through grants-in-aid to states and other agencies.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Which of the following is/are included in the capital budget of the Government of India? (2016)

- Expenditure on acquisition of assets like roads, buildings, machinery, etc.

- Loans received from foreign governments

- Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Biodiversity & Environment

Balancing Climate Goals and Biodiversity Protection

For Prelims: Balancing Climate Goals and Biodiversity Protection, Carbon Dioxide Removal (CDR) Strategies, Paris Agreement, Climate Change.

For Mains: Balancing Climate Goals and Biodiversity Protection, Environmental pollution and degradation.

Why in News?

Recently, a study has been published titled-Balancing climate goals and biodiversity protection: legal implications of the 30x30 target for land-based carbon removal, highlighting the conflicts between land-based Carbon Dioxide Removal (CDR) Strategies and the establishment of protected areas, focusing on international environmental law.

What are the Key Highlights of the Study?

- Limited Land Availability:

- The Limitations in land availability is a critical challenge in implementing both biodiversity targets and land-based climate mitigation strategies.

- With countries pledging significant portions of land for CDR activities, this poses a challenge to establishing protected areas due to limited available land.

- Global Targets and Current Status:

- Nations have committed to the “30x30” biodiversity target to safeguard 30% of the world’s terrestrial and marine areas by 2030. However, as of 2023, protected areas cover only around 16% of terrestrial areas and 8% of marine areas, falling short of the 30x30 goal.

- The 30×30 target implies protection of at least 30 % of the world’s land and ocean by 2030.

- The 30×30 target is a global target that aims to halt the accelerating loss of species and protect vital ecosystems that are the source of our economic security.

- Nations have committed to the “30x30” biodiversity target to safeguard 30% of the world’s terrestrial and marine areas by 2030. However, as of 2023, protected areas cover only around 16% of terrestrial areas and 8% of marine areas, falling short of the 30x30 goal.

- Land Use and Conflict:

- Certain land-based mitigation strategies conflict with the need to establish more protected areas due to land use constraints.

- Large-scale deployment of CDR could result in further biodiversity loss and competition for land used in food crop production.

- Insufficiency of Targets:

- Despite the ambitious nature of the 30x30 target, researchers estimate that a minimum of 44% of global land should be under protected areas to effectively conserve biodiversity.

- Moreover, CDR activities alone may not fulfill the goals outlined in the Paris Agreement to limit global warming to 1.5 or 2 degrees Celsius.

- Challenges in Implementation:

- Questions arise regarding how countries will allocate additional land for protected areas and restoration while expanding food production and implementing CDR strategies.

- Balancing these objectives poses a significant challenge.

- Legal Perspectives:

- While some land-based CDR approaches could benefit biodiversity, current international environmental law does not prevent the implementation of CDR techniques alongside protected areas on the same land parcels.

- Recommendations:

- There is a need to focus on CDR policies that effectively absorb greenhouse gases while also protecting biodiversity. They emphasize the urgent need to mitigate climate change, stating that the threat it poses to biodiversity far outweighs other concerns.

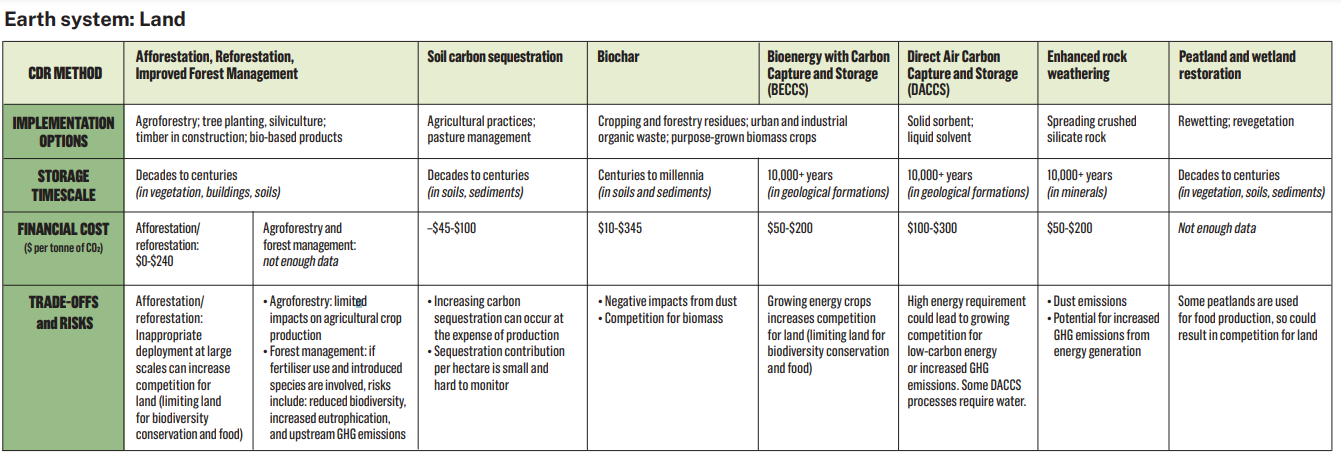

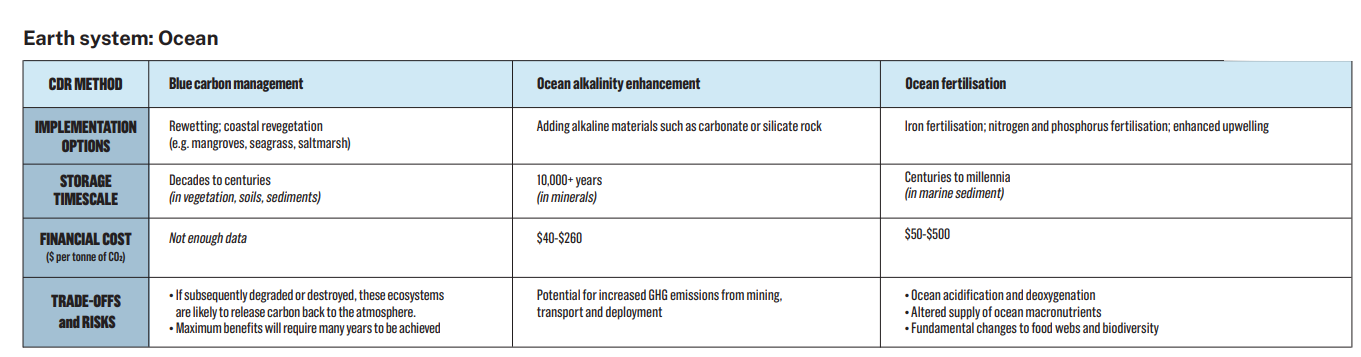

What is Carbon Dioxide Removal (CDR)?

- About:

- CDR refers to technologies, practices, and approaches that remove and durably store carbon dioxide (CO2) from the atmosphere.

- Methods:

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. “Momentum for Change: Climate Neutral Now” is an initiative launched by (2018)

(a) The Intergovernmental Panel on Climate Change

(b) The UNEP Secretariat

(c) The UNFCCC Secretariat

(d) The World Meteorological Organisation

Ans: (c)

- “Momentum for Change: Climate Neutral Now”, is an initiative launched by the UNFCCC secretariat in 2015.

- The initiative is a pillar under Momentum for Change which seeks to achieve climate neutrality.

- Climate neutrality is a three step process, which requires individuals, companies and governments to measure their climate footprint; reduce their emissions as much as possible and offset what they cannot reduce with UN certified emission reductions. Therefore, option (c) is the correct answer.

Q2. In the context of mitigating the impending global warming due to anthropogenic emissions of carbon dioxide, which of the following can be the potential sites for carbon sequestration? (2017)

- Abandoned and uneconomic coal seams

- Depleted oil and gas reservoirs

- Subterranean deep saline formations

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Governance

Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana

For Prelims: Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana, Ayushman Cards, Ayushman Arogya Mandir, Socio-Economic Caste Census (SECC), National Health Authority (NHA).

For Mains: Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana.

Why in News?

Recently, Ministry of Health & Family Welfare has released some statistics regarding Ayushman Bharat Pradhan Mantri — Jan Arogya Yojana (AB PM-JAY).

What are the Key Highlights of the AB PM-JAY Statistics?

- Ayushman Cards:

- Women account for approximately 49% of the total Ayushman cards created and approximately 48% of total authorised hospital admissions.

- As of December 2023, approximately 28.45 Crore Ayushman Cards have been created since the inception of the scheme, out of which, approximately 9.38 crore Ayushman Cards have been created during the year 2023.

- Health Coverage:

- 55 crore individuals corresponding to 12 crore families are covered under the scheme and many states and union territories implementing AB PM-JAY have further expanded the beneficiary base, at their own cost.

- Hospital Admissions:

- A total of 6.11 crore hospital admissions amounting to Rs 78,188 crores were authorised of which 1.7 crore hospitals admissions worth over Rs 25,000 crores were authorised during the year 2023 (Jan-Dec 2023).

What is Ayushman Bharat-PMJAY?

- About:

- PM-JAY is the world’s largest health insurance scheme fully financed by the government.

- Launched in 2018, it offers a sum insured of Rs.5 lakh per family for secondary care and tertiary care.

- Health Benefit Packages covers surgery, medical and day care treatments, cost of medicines and diagnostics.

- Beneficiaries:

- It is an entitlement-based scheme that targets the beneficiaries as identified by latest Socio-Economic Caste Census (SECC) data.

- The National Health Authority (NHA) has provided flexibility to States/UTs to use non- Socio-Economic Caste Census (SECC) beneficiary family databases with similar socio-economic profiles for tagging against the leftover (unauthenticated) SECC families.

- It is an entitlement-based scheme that targets the beneficiaries as identified by latest Socio-Economic Caste Census (SECC) data.

- Funding:

- The funding for the scheme is shared – 60:40 for all states and UTs with their own legislature, 90:10 in Northeast states and Jammu and Kashmir, Himachal and Uttarakhand and 100% Central funding for UTs without legislature.

- Nodal Agency:

- The National Health Authority (NHA) has been constituted as an autonomous entity under the Society Registration Act, 1860 for effective implementation of PM-JAY in alliance with state governments.

- The State Health Agency (SHA) is the apex body of the State Government responsible for the implementation of AB PM-JAY in the State.

Important Facts For Prelims

Banks’ Gross NPAs Drop to 3.2%

Why in News?

The gross non-performing asset (GNPA) ratio for Scheduled commercial banks (SCBs) witnessed a significant decline, falling from 3.9% at the end of March 2023 to 3.2% by the end of September, 2023, as per the recent report of Reserve Bank of India (RBI).

- Contributing factors: Write-offs, Upgrades, and Recoveries.

What is a Non-Performing Asset?

- About:

- As per RBI, an asset becomes non-performing when it ceases to generate income for the bank.

- NPA is usually a loan or advance for which the principal or interest payment remained overdue for a certain period of time.

- In most cases, debt is classified as non-performing, when the loan payments have not been made for a minimum period of 90 days.

- For agriculture, if principle and interest is not paid for 2 cropping seasons, the loan is classified as NPA.

- Types:

- Banks are required to classify NPAs further into the following three categories based on the period for which the asset has remained non-performing and the realizability of the dues:

- Sub-standard Assets: A substandard asset is an asset classified as an NPA for a period less than or equal to 12 months.

- Doubtful Assets: A doubtful asset is an asset that has been non performing for a period exceeding 12 months.

- Loss Assets: Assets that are uncollectible and where there is little, or no hope of recovery and that needs to be fully written off.

- Banks are required to classify NPAs further into the following three categories based on the period for which the asset has remained non-performing and the realizability of the dues:

- Gross NPA(GNPA) and Net NPA:

- GNPA: This is the total amount of NPAs without deducting the provisional amount.

- Net NPA: This is the gross NPA minus the provision.

- Provision refers to funds left aside by banks to cover potential losses arising from bad loans or NPAs.

- Provisions to Deal with NPAs in India:

- The Recovery of Debts due to Banks and Financial Institutions Act (RDB Act), 1993: It established Debt Recovery Tribunals (DRTs) and Debts Recovery Appellate Tribunals (DRATs) to quickly adjudicate and recover debts owed to banks and financial institutions.

- The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act), 2002: Empowers banks and financial institutions to take possession and sell secured assets of defaulting borrowers without court intervention.

- The Insolvency and Bankruptcy Code (IBC), 2016: Provides a fast-track corporate insolvency resolution process for stressed assets, including NPAs.

- IBC has helped resolve Rs 3.16 lakh crore of debt stuck in 808 cases, since its inception.

- Write-offs: Write-offs refer to the removal of a non-performing loan or asset from the bank's books as an acknowledgment that the debt is unlikely to be recovered.

- This action does not absolve the borrower from the obligation to repay but acknowledges the unlikelihood of recovery.

- Upgrades: It refers to the process of reclassifying a loan account from NPA back to a "standard" asset category, if certain conditions are satisfied including: arrears of interest and principal are paid by the borrower.

- Recoveries: Recoveries represent the funds or assets regained by the bank after taking actions to collect on defaulted loans or NPAs.

- These can include repayments, collateral liquidation, or settlements after pursuing recovery mechanisms.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news? (2017)

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented by the Government.

Ans: (b)

Important Facts For Prelims

PMLA Notice to Offshore Crypto Firms

Why in News?

The Financial Intelligence Unit India (FIU-IND) has issued show cause notices to 9 offshore cryptocurrency and virtual digital assets service providers (VDA SPs) including Binance Kucoin, Huobi for not being compliant with the requisite provisions of the Prevention of Money Laundering Act (PMLA).

What is the Prevention of Money Laundering Act (PMLA), 2002?

- About:

- PMLA is an Indian law enacted in 2002 to prevent money laundering and related offenses.

- Money laundering involves making illegally obtained funds appear legitimate or "clean" by integrating them into the financial system.

- It was enacted in a 2002 response to India’s global commitment (including the Vienna Convention) to combat the menace of money laundering.

- PMLA is an Indian law enacted in 2002 to prevent money laundering and related offenses.

- Regulating Authorities:

- The Directorate of Enforcement (ED) is the primary authority responsible for investigating and prosecuting money laundering.

- It functions under the Department of Revenue of the Ministry of Finance.

- Recently, the Supreme Court has ruled that the ED cannot arrest someone under the PMLA simply for not responding to their queries and summons.

- FIU-IND is the national agency responsible for receiving, processing, analyzing and disseminating information relating to suspect financial transactions to enforcement agencies and foreign FIUs.

- The agency works under the Finance Ministry.

- The Directorate of Enforcement (ED) is the primary authority responsible for investigating and prosecuting money laundering.

What are PMLA Compliance Obligations for VDA SPs?

- Registration Requirement: VDA SPs engaged in activities involving virtual digital assets and fiat currencies, transfers, safekeeping, or control over digital assets must register with FIU-IND as reporting entities.

- Activity-Based Compliance: Compliance obligations under PMLA are not contingent on physical presence but are activity-based, encompassing reporting, record-keeping, and other specified obligations.

- Regulatory Framework Expansion and Enforcement: The regulatory ambit expanded in March 2023, bringing VDA SPs under the Anti Money Laundering (AML) and Counter Financing of Terrorism (CFT) framework within the PMLA.

- Under the anti-money laundering law, reporting entities are obligated to maintain Know Your Customer (KYC) details, client identity records, beneficial owner information, account files, and business correspondence related to clients.

- Furthermore, reporting entities are required to file Statements of Financial Transactions (SFT) containing details of specific financial transactions or reportable accounts maintained during the year under the Income Tax Act.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q.1 Discuss how emerging technologies and globalization contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (2021)

Important Facts For Prelims

SHRESHTA

Why in News?

The Ministry of Social Justice & Empowerment recently highlighted the Scheme for Residential Education for Students in High Schools in Targeted Areas (SHRESHTA).

What are the Key Highlights of the SHRESHTA?

- About:

- SHRESHTA aims to fill the educational service gap in Scheduled Castes (SCs) dominant areas by providing high-quality education, socio-economic upliftment, and overall development for SC students.

- Admission will be provided in Class 9 and Class 11 of CBSE/State affiliated private schools.

- Eligibility:

- The students, belonging to SCs, studying in class 8th and 10th in the current academic year are eligible for availing the benefits of the scheme.

- Students from the SC community who come from a marginalized income group with an annual income of up to Rs 2.5 lakh are eligible.

- Operating Procedure:

- The scheme is being implemented in two Modes:

- Mode 1: SHRESHTA Schools:

- Selection Process:

- Meritorious SC students are selected annually through the National Entrance Test for SHRESHTA (NETS) conducted by the National Testing Agency (NTA).

- Selected students are admitted to the best CBSE/State Board-affiliated private residential schools in classes 9th and 11th.

- Meritorious SC students are selected annually through the National Entrance Test for SHRESHTA (NETS) conducted by the National Testing Agency (NTA).

- Financial Support:

- The Department covers the total fee for students, including school and hostel fees, amounting to Rs. 1,00,000 to Rs. 1,35,000 from class 9th to 12th.

- Admissible fee for each class under the Scheme.

- The Department covers the total fee for students, including school and hostel fees, amounting to Rs. 1,00,000 to Rs. 1,35,000 from class 9th to 12th.

- Bridge Course:

- A bridge course is provided outside regular school hours to enhance students' capability to adapt easily to the school environment.

- The Department bears 10% of the annual fee for the bridge course.

- A bridge course is provided outside regular school hours to enhance students' capability to adapt easily to the school environment.

- Monitoring:

- The Ministry monitors the progress of students regularly.

- Selection Process:

- Mode 2: NGO/VO Operated Schools/Hostels:

- Schools/Hostels run by VOs/NGOs with classes up to 12th grade receive grants for school fees and residential charges for SC students.

- Grants range from Rs. 27,000 to Rs. 55,000 per student based on the type of school.

- Schools/Hostels run by VOs/NGOs with classes up to 12th grade receive grants for school fees and residential charges for SC students.

- Mode 1: SHRESHTA Schools:

- The scheme is being implemented in two Modes:

- Monitoring:

- The Ministry monitors the progress of students regularly.

- Institutions are required to disclose performance on their websites and the e-Anudaan/online portal, ensuring transparency.

- Installation of cameras in institutions, providing live feeds for monitoring purposes.

- All the institutions are liable for a field visit by an inspection team constituted for this purpose.

- The Ministry monitors the progress of students regularly.

- Impact:

- 2023-24 (as of December 2023): 7,543 beneficiaries.

- Admissions in 2023-24: A total of 2,564 students were admitted to 142 Private Residential Schools, and Rs. 30.55 Crore has been reimbursed for school fees.

- 2023-24 (as of December 2023): 7,543 beneficiaries.

Rapid Fire

Constitution of the Sixteenth Finance Commission

The Government of India, in adherence to Article 280(1) of the Constitution, has established the Sixteenth Finance Commission, appointing Dr. Arvind Panagariya, former Vice-Chairman of NITI Aayog and Professor at Columbia University, as its Chairman.

- Specific terms of reference have been outlined, including the distribution of tax proceeds between the Union and States, principles governing grants-in-aid to States, and measures to bolster State funds for local bodies like Panchayats and Municipalities.

- The Commission has also been tasked with reviewing disaster management financing arrangements under the Disaster Management Act, 2005, and making recommendations for improvements.

- The Commission has been requested to make its report available by 31st October, 2025.

Read more: Sixteenth Finance Commission

Rapid Fire

Trial Essential to Define 'Religious Character of Place of Worship': Allahabad HC

The Allahabad High Court's recent stance in the Gyanvapi case suggests that the Places of Worship Act, 1991 does not clarify “religious character of any place of worship” and can only be determined in a trial, based on documentary and oral evidence, on a case-to-case basis.

- The Places of Worship Act,1991 bars the conversion of religious sites into places of worship for a different religion or sect.

- It also mandates preserving the religious identity of any place of worship as it stood on 15th August, 1947.

- The Gyanvapi case is a legal battle concerning the ownership and religious identity of Varanasi's Gyanvapi complex, housing both a mosque and a temple.

- Hindu plaintiffs argue that the entire area, including the mosque site, was originally a temple dedicated to Swayambhu Lord Adi Vishweshwar.

- They claim that this temple, once on the Gyanvapi plot, was demolished by Emperor Aurangzeb in 1669.

- Neither the government nor the Supreme Court has presented a clear stance on this issue to date.

Read more: Places of Worship Act, 1991

Rapid Fire

Ayodhya's Transformational Projects

Recently, the Indian Prime Minister inaugurated the newly constructed Maharishi Valmiki International Airport in Ayodhya.

- Pioneering sustainability features including LED lighting, rainwater harvesting, solar power, and a sewage treatment plant ensure a GRIHA - 5 star rating for the terminal, promoting environmental consciousness.

- Maharishi Valmiki, also known as Adi Kavi (the first poet), is revered as the author of the ancient Indian epic, the Ramayana. He is celebrated as a revered sage and a significant figure in Hindu mythology and literature.