Semiconductor Revolution | 20 Sep 2024

For Prelims: Semiconductors, Quantum Technology, Light Emitting Diodes (LED),Photodetector, India Semiconductor Mission, Electric vehicles, Doping, Nanotechnology, Light Emitting Diodes, Intellectual property (IP) rights, Artificial Intelligence, European Union, India Semiconductor Mission, Design Linked Incentive (DLI) Scheme, Semicon India

For Mains: Significance of semiconducting devices in Indian economy, Need for promoting electronics and semiconductor industry, Role of electronics industry in making India self-reliant

Semiconductors are the backbone of modern technology, powering everything from smartphones to electric vehicles. With global supply chain disruptions and rising demand, the semiconductor industry has come under the spotlight. Global nations including India are now racing to secure self-reliance in chip manufacturing, sparking a revolution that’s set to reshape global trade and technology.

What is a Semiconductor?

- Definition: Semiconductors are materials that have electrical conductivity between that of conductors (like metals) and insulators (like glass).

- Their ability to conduct electricity can be altered under certain conditions, such as changes in temperature, light, voltage, or the addition of impurities (a process called doping).

- This controllable conductivity makes semiconductors essential for electronic devices like transistors, diodes, solar cells, and Integrated Circuits (ICs).

- Materials: The most used semiconductor materials are silicon, germanium, and gallium arsenide, which are widely used in producing ICs, also known as microchips, containing multiple transistors that control the flow of electricity, enabling complex electronic functions.

- Types of Semiconductors:

- Intrinsic Semiconductors: It is composed of pure materials with no added impurities. Conductivity is based solely on the semiconductor’s inherent properties.

- Extrinsic Semiconductors: Composition includes intrinsic semiconductors doped with additional substances to alter their properties.

- Properties of Semiconductors:

- Semiconductor conductivity increases with temperature, making them suitable for temperature-dependent devices like thermistors and temperature sensors.

- Semiconductors act as insulators at absolute zero (0 K) but start conducting electricity when the temperature increases.

- Resistivity decreases as temperature increases due to the rise in mobile charge carriers, making the temperature coefficient negative.

- Semiconductors demonstrate the Hall effect, it refers to the generation of a transverse voltage difference across an electrical conductor due to a current and a perpendicular magnetic field, and is used to measure magnetic field strength.

- Semiconductors manage controlled heat dissipation, essential for ICs due to intermediate thermal conductivity.

- Semiconductor conductivity increases with temperature, making them suitable for temperature-dependent devices like thermistors and temperature sensors.

- Applications of Semiconductors in Daily Life: Their properties, particularly when combined with advancements in nanotechnology have opened doors to revolutionary applications.

- Semiconductors become more conductive when exposed to light, making them essential for photodetectors and solar cells.

- Semiconductors exhibit intermediate thermal conductivity, enabling controlled heat dissipation in devices like ICs.

- When subjected to a voltage, some semiconductors emit light through electroluminescence, which is crucial for Light Emitting Diodes (LED) and displays.

- On the nanoscale, semiconductors exhibit quantum effects like those in quantum dots and quantum wells which are harnessed for advanced technologies.

- Used in temperature sensors, 3D printers, and advanced technology like space vehicles.

- Semiconductors are used in devices like cell phones and satellite systems. They enable wireless communication systems, network equipment, and hardware essential for data transmission.

- Medical imaging, monitoring, and diagnostic equipment like Magnetic Resonance Imaging (MRI) scanner and heart monitors utilise semiconductors.

- Semiconductors are also critical in the functioning of medical implants and other healthcare devices.

- Microprocessors and memory chips are central to computers, servers, and data centres.

- Semiconductors enable computing in industries such as finance, healthcare, manufacturing, and logistics.

- Advantages of Semiconductors: Semiconductor devices are compact and lightweight. They require less input power than many other devices like Vacuum tubes.

- Semiconductor devices have a long operational lifespan and are shockproof. These devices operate with minimal electrical noise.

What is the Current Semiconductor Market Scenario in India?

- Surge in Semiconductor Demand:

- Domestic Demand: Increased consumption of mobile devices, computers, and digital technologies has driven up the demand for semiconductors in India.

- The rollout of 5G network and Artificial Intelligence (AI) requires advanced semiconductor components for enhanced connectivity and faster data transmission.

- Digitalization Efforts: Government initiatives aimed at digitising various sectors, including education and transactions, have led to a spike in semiconductor consumption.

- Global Supply Chain Disruptions: The Covid-19 pandemic and US-China tensions have exacerbated the semiconductor shortage, prompting a reevaluation of supply chain dependencies.

- Domestic Demand: Increased consumption of mobile devices, computers, and digital technologies has driven up the demand for semiconductors in India.

- Current State of the Indian Semiconductor Market:

- Market Valuation: The Indian semiconductor market in 2022 was valued at USD 26.3 billion and it is projected to expand at a Compounded Annual Growth Rate (CAGR) of 26.3%, reaching USD 271.9 billion by 2032.

- Semiconductor imports in 2022 stood at USD 5.36 billion, while exports rose to an all-time high of USD 0.52 billion.

- Market Valuation: The Indian semiconductor market in 2022 was valued at USD 26.3 billion and it is projected to expand at a Compounded Annual Growth Rate (CAGR) of 26.3%, reaching USD 271.9 billion by 2032.

- Importance of Securing Semiconductor Supply Chains: The pandemic highlighted the fragility of the global supply chain, particularly in the semiconductor industry, where disruptions led to a global chip shortage.

- Securing supply chains has become a priority for national security and economic stability, as semiconductors power everything from consumer electronics to advanced military systems.

- Countries like the US, China, and members of the European Union are investing heavily in domestic semiconductor production to avoid future vulnerabilities and maintain their economic independence.

- India’s Initiatives:

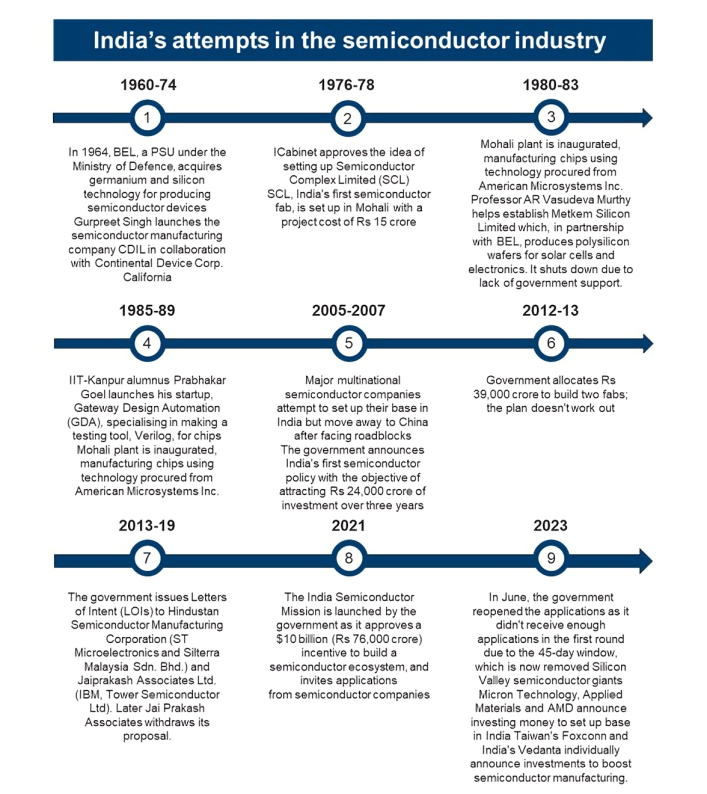

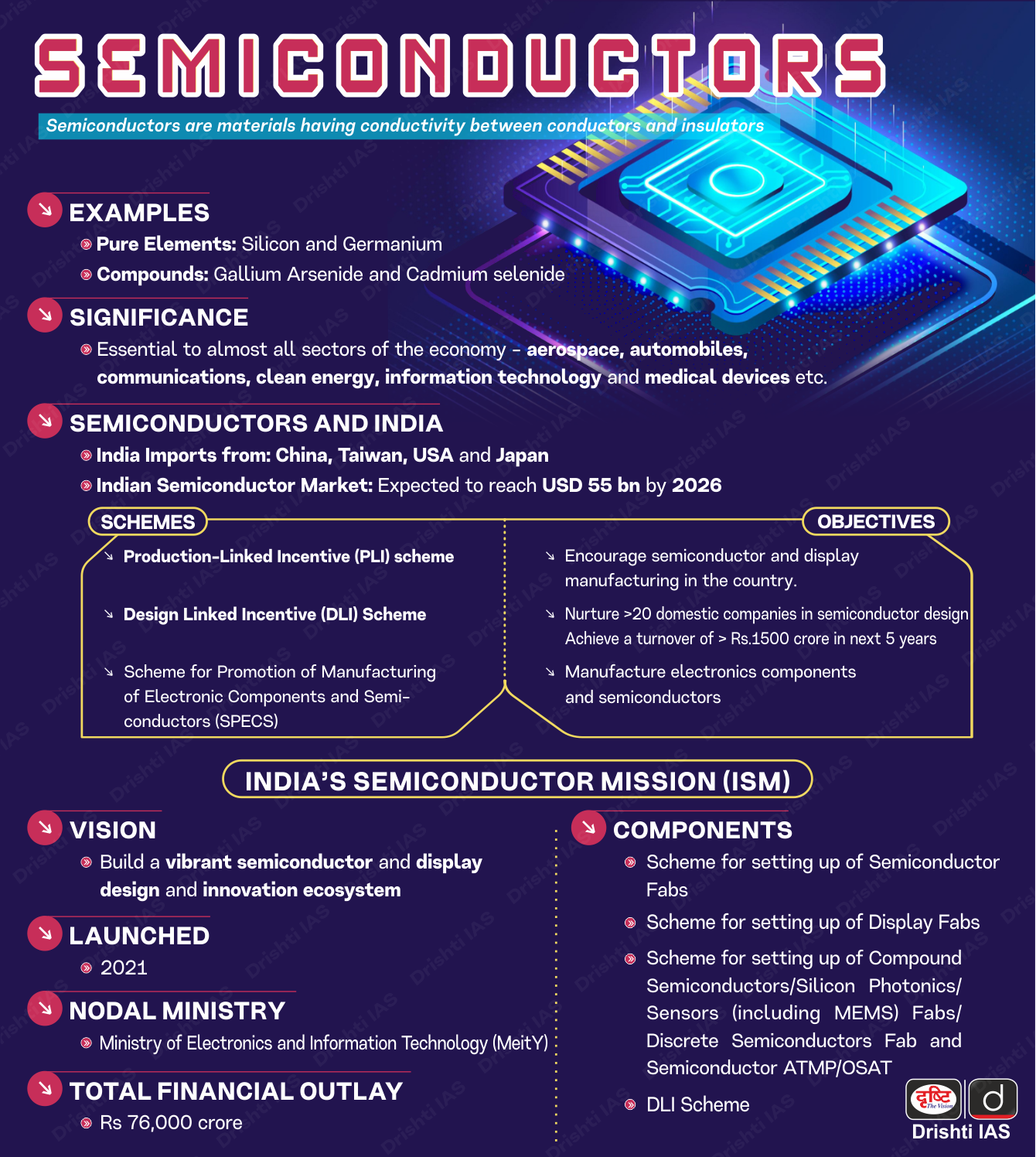

- India Semiconductor Mission (ISM): The ISM, launched in 2021 is an independent division under Digital India Corporation, will drive the implementation of the initiative, focusing on the development of semiconductor fabs, display fabs, compound semiconductors, and semiconductor design.

- The Indian government has committed USD 10 billion to the ISM to bolster the semiconductor ecosystem through capital investments and incentives.

- The ISM's comprehensive approach includes four schemes :

- Semiconductor Fabs: Fiscal support ranging from 30% to 50% of project costs, depending on the technology node.

- Display Fabs: Fiscal support up to 50% of project cost, with a ceiling of INR 12,000 crore per fab.

- Compound Semiconductors and Assembly, Testing, Marking and Packaging (ATMP) Facilities: The Scheme provides a fiscal support of 30% of the Capital Expenditure to the eligible applicants for setting up of Compound Semiconductors / Silicon Photonics (SiPh)/Sensors (including MEMS) Fab and Semiconductor ATMP in India.

- Design Linked Incentive (DLI) Scheme: Financial incentives and infrastructure support are offered through DLI scheme for semiconductor design, with a focus on ICs, chipsets, System on a chip (SoCs), and more.

- Semi-Conductor Laboratory, Mohali: Modernization of this brownfield facility has been approved to enhance semiconductor manufacturing capabilities.

- Production Linked Incentive (PLI) Scheme: PLI Scheme offers a USD 1.7 billion incentive package to companies establishing semiconductor manufacturing facilities in India.

- Semicon India Programme: This initiative focuses on the development of semiconductor and display manufacturing ecosystems. Semicon India aims to attract investments and provide financial support to companies in the semiconductor sector.

- Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS): A financial incentive of 25% on capital expenditure will be provided under SPECS for a specific list of electronic goods, including components, semiconductor fabrication, ATMP units, and specialized sub-assemblies, to promote high-value added manufacturing.

- Other MoUs Signed by India:

- India-European Commission MoU: Approved by the Union Cabinet to enhance collaboration in semiconductor ecosystems as part of the EU-India Trade and Technology Council. Aims to advance semiconductor industries and digital technology in both regions.

- India-Japan: The Memorandum of Cooperation (MoC) between India and Japan recognizes the significance of semiconductors for industry and digital advancements and focuses on mutual collaboration and creating a robust supply chain.

- India-US: India and the US have signed MoU on establishing the Semiconductor Supply chain during India – USA 5th Commercial Dialogue 2023, which can help India realise its long-nurtured dream of becoming a hub for electronic goods.

- India Semiconductor Mission (ISM): The ISM, launched in 2021 is an independent division under Digital India Corporation, will drive the implementation of the initiative, focusing on the development of semiconductor fabs, display fabs, compound semiconductors, and semiconductor design.

What are the Challenges in Semiconductor Manufacturing?

- Capital and Investment: Semiconductor manufacturing is extremely capital-intensive, with significant investments required in both Research and Development (R&D) and infrastructure. The high entry barriers make it difficult for new players to enter the market.

- Concerns about policy instability, high tariffs on component imports, and unpredictable regulatory changes create uncertainty for global semiconductor players, limiting their willingness to invest in India.

- Talent Shortage: The industry faces a significant talent gap, with over 1 million skilled professionals needed by 2025. Talent development and retention are critical priorities.

- Although India has a strong base in semiconductor design, it lacks a sufficient pool of skilled workers who can operate on the manufacturing floors of fabrication plants.

- Limited Access to Advanced Technology: The global semiconductor ecosystem is dominated by a few countries like Taiwan and South Korea, which have exclusive access to critical technologies. This limits India's ability to quickly scale its semiconductor capabilities.

- Environmental Concerns: Semiconductor manufacturing involves hazardous chemicals and high energy consumption, raising environmental issues.

- Weak R&D Ecosystem: India currently lags in original research and development in semiconductor design, where the future of chip technology is decided, hampering innovation.

- Regulatory Compliance: Navigating international and domestic regulations, including export controls and Intellectual Property (IP) rights, adds complexity to operations.

How is India Addressing Challenges in Semiconductor Manufacturing?

- High Costs for Setup: India’s relatively high land and power costs in major cities have been a deterrent for investors. However, government incentives and subsidies are aimed at mitigating these issues.

- India is leveraging both domestic and international investments. For instance, the Indian government’s Semiconductor Fab Scheme offers fiscal support of 50% of the project cost to attract investment in semiconductor fabs.

- Skilled Workforce: India boasts a large pool of Science, Technology, Engineering and Mathematics (STEM) graduates and semiconductor design engineers, constituting around 20% of the global semiconductor design workforce. Various initiatives like Skill India and Industrial Training Institutes (ITIs) are underway to produce more skilled workers who can operate on the manufacturing floors.

- Talent Development: Initiatives by All India Council for Technical Education (AICTE) and industry collaborations are enhancing semiconductor education and training in India.

- Global Supply Chain Diversification: With disruptions in traditional supply chains, India is becoming a preferred location for back-end assembly and testing, and potentially for front-end manufacturing in the future.

- India is forming strategic partnerships with other countries and international organisations to strengthen and stabilise its semiconductor supply chains. Recent MOUs with the European Commission and Singapore are examples of such efforts.

- Competitiveness in the Global Market: India offers a cost advantage in semiconductor manufacturing due to lower labour and operational costs.

- This is being leveraged to attract global semiconductor companies to set up production and research facilities in India.

How are Semiconductors Shaping Global Geopolitics?

- US-China Rivalry: The US has imposed export controls and sanctions to restrict China’s access to advanced semiconductor technologies, aiming to curb its rise in critical sectors like AI, 5G, and military applications.

- This has escalated tensions between the two nations, with semiconductors becoming a focal point in the broader US-China trade and tech war.

- The US aims to regain dominance in semiconductor manufacturing, which has largely shifted to Asia, particularly Taiwan and South Korea.

- Taiwan’s Strategic Importance: Taiwan's TSMC (Taiwan Semiconductor Manufacturing Company) is the world's leading producer of advanced semiconductors.

- The Taiwan geopolitical position is highly sensitive, with China considering Taiwan part of its territory and the US viewing it as a critical partner for technology and defence.

- Any disruption in Taiwan’s semiconductor production due to geopolitical conflict could have catastrophic effects on global tech industries.

- South Korea and Japan’s Role: South Korea along with Japan’s semiconductor firms, are major players in the global supply chain.

- South Korea faces pressure from both the US and China to align with their respective tech policies, while Japan has strengthened cooperation with the US to secure critical semiconductor materials.

- Europe’s Strategic Autonomy: The European Union is seeking to reduce its dependence on Asia for semiconductors by boosting local production through its "Digital Compass" initiative.

- Europe is also looking to develop strategic partnerships with the US to strengthen supply chain resilience.

- China’s Semiconductor Ambitions: China has made self-reliance in semiconductors a top national priority as part of its "Made in China 2025" strategy. It has significantly increased investment in domestic semiconductor production and chip design to reduce dependence on US technologies.

What are India’s Strategic Options in the Semiconductor Geopolitics?

- Strengthening Domestic Manufacturing: India’s India Semiconductor Mission (ISM) offers 50% capital support for companies investing in chip manufacturing, assembly, and testing.

- Major international players like Micron and Tata Electronics have already committed to setting up facilities in India, positioning the country as a reliable alternative in the global supply chain.

- India’s Role: India is positioning itself as a key partner in the semiconductor ecosystem, particularly to diversify the global supply chain away from China. Its "India Semiconductor Mission" aims to attract investments in semiconductor manufacturing and design.

- India, along with Southeast Asian countries like Malaysia, Thailand, and Vietnam, is now a preferred destination for back-end assembly and testing operations.

- India is part of the broader geopolitical trend of "friend-shoring," where countries are encouraged to rely on trusted allies for critical technology supplies. This reflects India’s growing role in the US-led bloc in the semiconductor sector.

- Geopolitical Neutrality: India’s geopolitical position allows it to act as a neutral ground for semiconductor investments, attracting companies from both Western nations and countries like China looking to diversify production bases.

- By maintaining strategic neutrality, India can attract investments from countries seeking to de-risk their supply chains amidst rising U.S.-China tensions.

- Leveraging Global Alliances: India can strengthen its partnerships with semiconductor-heavy nations like the US, Japan, South Korea, and Taiwan to access cutting-edge technology.

- Membership in multilateral forums like QUAD could also provide strategic opportunities to collaborate on semiconductor R&D and supply chain security.

- Fostering Innovation and R&D: India’s focus on RISC-V architecture through its Digital India RISC-V program promotes innovation in open-source chip design, reducing dependency on costly, proprietary designs like Advanced RISC Machine.

- The Design Linked Incentive (DLI) scheme helps fabless startups access Electronic design automation (EDA) tools (software solutions used to design electronic systems in three key steps: simulation, design, and verification), fostering a talent pool of skilled engineers in semiconductor design.

How Will the Semiconductor Industry Shape the Future of India?

- Growth Potential: India’s semiconductor market, valued at approximately USD 15 billion, is projected to grow to USD 55 billion by 2026.

- The industry is set to generate over one million job opportunities in the next five years.

- Strategic Positioning: India’s efforts to enhance its semiconductor capabilities align with global trends of diversifying supply chains away from traditional hubs.

- The country is positioning itself as a key player in the global semiconductor industry. No single country can dominate all aspects of semiconductor production. The US leads in chip design but relies on Taiwan and South Korea for manufacturing, and Japan for materials and equipment.

- Technological Advancements:The future of semiconductors lies in the development of smaller and faster chips, 3D stacked architectures, and sustainable technologies like energy-efficient chip designs.

- Sustainability Focus: As climate change concerns grow, the industry may focus on sustainable innovations, such as compound semiconductors that enhance energy efficiency and reduce carbon footprints.

Conclusion

The semiconductor industry is crucial to modern technology, but faces supply chain and geopolitical challenges. India's strategic initiatives position it as a key player in this evolving landscape. As global demand grows, collaboration and innovation will be crucial in addressing industry challenges and ensuring a resilient future for semiconductor manufacturing.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Which one of the following laser types is used in a laser printer? (2008)

(a) Dye laser

(b) Gas laser

(c) Semiconductor laser

(d) Excimer laser

Ans: (c)

Q. With reference to solar power production in India, consider the following statements: (2018)

- India is the third largest in the world in the manufacture of silicon wafers used in photovoltaic units.

- The solar power tariffs are determined by the Solar Energy Corporation of India.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Mains

Q. How is science interwoven deeply with our lives? What are the striking changes in agriculture triggered off by the science-based technologies? (2020)

Q. What do you understand by nanotechnology and how is it helping in health sector? (2020)