Pathways & Strategy for Accelerating Growth in Edible Oil Towards Goal of Atmanirbharta | 20 Sep 2024

For Prelims: Oilseeds Sector, NITI Aayog, Edible oil, Crops, MSP, Seed quality, Trade policy, National Mission on Edible Oils

For Mains: Scenario of Edible Oil Sector in India, Challenges in the Edible Oil Sector in India, Recommendations of NITI Aayog

Why in News?

Recently, a report titled “Pathways and Strategies for Accelerating Growth in Edible Oils towards Goal of Atmanirbharta” was released by NITI Aayog.

- The report analyses the current edible oil sector outlines its future potential, and provides a detailed roadmap to address challenges, aiming to close the demand-supply gap and achieve self-sufficiency.

What are the Key Highlights of the Report?

- Global Perspective:

- The global economy for edible vegetable oils has seen steady expansion over time, with forecasts for 2024-25 predicting a 2% rise in production, reaching 228 MT.

- Global oilseed production has increased nearly tenfold since 1961. Although the cultivated area for oilseeds has expanded, production has grown much faster.

- The 1.5% growth in the world population has led to an increase in global oilseed consumption.

- The growth rate of vegetable oils has been surpassing that of oilseeds over the past three decades due to the inclusion of palm oil, olive oil, coconut oil, and cottonseed oil, which are not traditionally classified under oilseeds and led to vegetable oils outpacing oilseeds in growth.

- From 2017-18 to 2022-23, soybeans dominated global oilseed production, covering the most area and accounting for 60% of total output, with other major crops like rapeseed, sunflower, and groundnuts trailing behind in both yield and production.

- Palm oil currently leads global vegetable oil consumption, followed by soybean oil, rapeseed oil (canola oil), and sunflower oil.

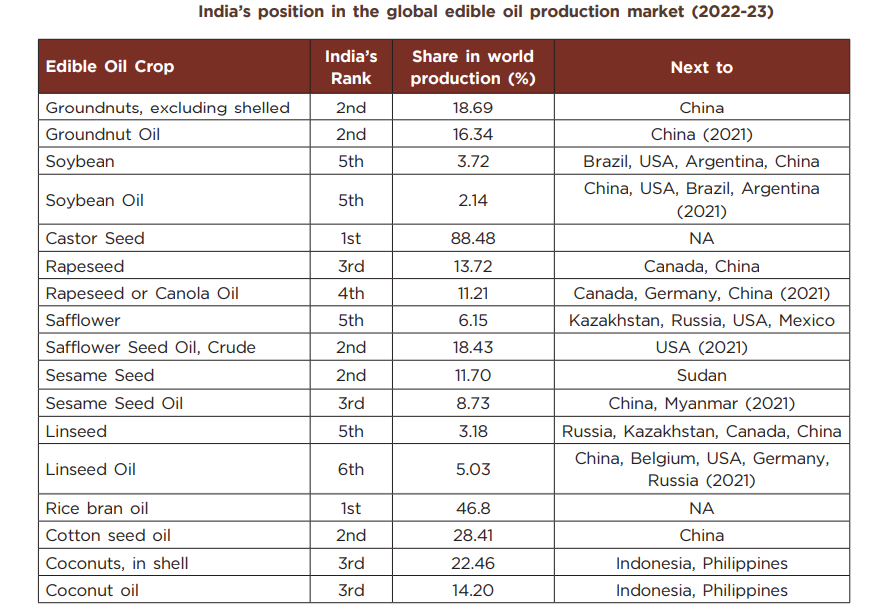

- India’s Position:

- India, the 5th largest economy globally, is a significant player in the global edible vegetable oil sector, ranking fourth behind the USA, China, and Brazil.

- It contributes a substantial global share, accounting for roughly 15-20% of the global oilseed area, 6-7% of vegetable oil production, and 9-10% of total consumption.

- India is at the top in rice bran oil production (46.8% of global market share) and demonstrates clear dominance. Similarly, India is a leader in castor seed production with an impressive 88.48% global share.

- The country is second in cottonseed oil production (28.41% share), following China. For groundnut seeds and oil, India ranks second with shares of 18.69% and 16.34%, respectively, trailing China and the USA.

- The country ranks third in coconut (in shells) and coconut (oil) production behind Indonesia and the Philippines and for sesame seed oil production behind China and Myanmar, contributing 22.46%, 14.2%, and 8.73% of the global market share, respectively.

- In rapeseed production, India has the third position (13.72% of the global share, behind Canada and China).

- India is the world's fifth largest producer of soybean and soybean oil (behind Brazil, USA, Argentina, and China), contributing 3.72% and 2.14% of the global market share, respectively.

- Further, India ranks fifth in linseed production (3.18% share, behind Russia, Kazakhstan, Canada, and China) and sixth in linseed oil production (5.03% share), with established players like China, Belgium, USA, Germany, and Russia posing challenges in this segment.

- India, the 5th largest economy globally, is a significant player in the global edible vegetable oil sector, ranking fourth behind the USA, China, and Brazil.

What is the Overview of India’s Edible Oil Sector?

- Within Indian agriculture, oilseeds hold the second-highest position in the area, and production is surpassed only by food grains.

- India's diverse agro ecological conditions enable the cultivation of nine annual oilseed crops, including groundnut, rapeseed-mustard, soybean, sunflower, sesame, safflower, nigerseed, castor, and linseed.

- Nine major oilseeds account for 14.3% of the gross cropped area in India, contribute about 12-13% to dietary energy, and account for about 8% of agricultural exports.

| Crop | Area (Mha) |

| Soybean | 11.74 |

| Rapeseed and Mustard | 7.08 |

| Groundnut | 5.12 |

| Sesame | 1.58 |

| Castor Seed | 0.89 |

| Sunflower | 0.65 |

| Linseed | 0.42 |

| Nigerseed | 0.38 |

| Safflower | 0.07 |

- Among nine major oilseeds, soybean leads with 34% of the total oilseed production, followed by rapeseed & mustard (31%) and groundnut (27%), contributing to more than 92% of total oilseed production.

- This underlines the dominance of soybean, rapeseed-mustard, and groundnut in India's oilseed production.

- The major contribution to domestic edible oil production comes from rapeseed mustard oil (45%), groundnut oil (25%), and soybean oil (25%).

- The minor edible oilseeds (sesame, sunflower, safflower, and nigerseed) contribute about 5% of the total domestic oil production.

- Rajasthan and Madhya Pradesh have the highest production of oilseeds, about 21.42% each of the national production, followed by Gujarat (17.24%) and Maharashtra (15.83%).

- Together, these four states contribute to 75.63% of the total production in the country.

- In secondary oil crops, significant contributions to palm oil production come from Andhra Pradesh (87.3%), Telangana (9.8%), Kerala, and Karnataka.

- Gujarat leads in cotton production with a 24.4% share, followed by Maharashtra, Telangana, Rajasthan, and Karnataka, collectively contributing 77.3%.

- Coconut production is dominated by Kerala, followed by Tamil Nadu and Karnataka, contributing 84% of the total production in the country.

- Tree-borne oilseeds (TBOs) like wild Apricot, cheura, kokum, olive, simarouba, mahua, sal seed, mango kernel, dhupa, and tamarind seed offer oils with diverse uses.

What are the Growth Trends and Instability in Edible Oil Crops?

- Growth Trends:

- The area, production, and yield of oilseeds experienced trend growth rates of 0.90%, 2.84%, and 1.91%, respectively, during 1980-81 to 2022-23.

- In the most recent decade, production and yield displayed growth rates of 2.12 % and 1.53 %, respectively.

- The total area under oilseeds showed a positive growth trend in all decades except during 1991-2000.

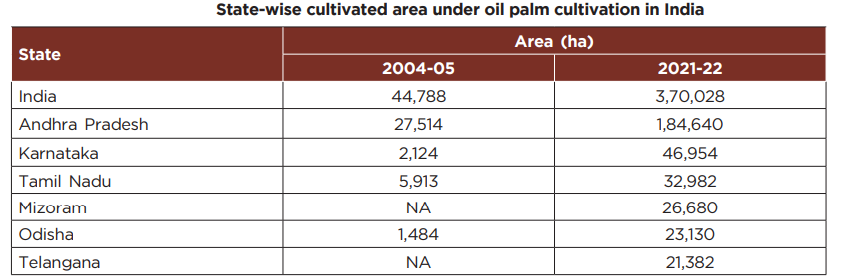

- The total palm oil production in India for 2021-22 has reached 0.36 MT from 0.079 MT in 2010-11.

- Instability in Edible Oil Crops:

- The instability analysis suggests that when a longer period is considered, reflecting the widespread adoption of improved technology across large areas, the notion of increased instability due to new technology adoption is refuted.

- In the last decade, only sunflower and safflower experienced fluctuating areas, highlighting challenges in maintaining consistent cultivation patterns for these crops.

- Edible Oil Trade Dynamics:

- Edible vegetable oils stand out among agricultural commodities due to their exceptionally high trade volume.

- Import dependence on edible oils decreased from 63.2% in 2015-16 to 54.9% in 2021-22.

- This translates to increased self-sufficiency from 36.8% to 45.1%. However, this progress is overshadowed by the stark rise in overall consumption.

- Palm oil dominates imports, accounting for 59%, followed by soybean (23%) and sunflower (16%).

- Groundnut, sesame, soybean, and rapeseed are the main exported oilseeds, with groundnut being the largest exported crop for the last three consecutive years.

- In terms of edible vegetable oil exports, castor oil stands out as the front-runner, followed by groundnut oil and other oils. Soybean and rice bran are the main exported oil meals.

- Initiatives Taken:

- Open General Licenses (OGLs) are a crucial facilitator, enabling essential imports to bridge the demand-supply gap for edible oils in India.

- Import duty structures are strategically reviewed to balance the interests of various stakeholders.

- The government extended the free import policy for refined palm oils until further notice.

- To encourage domestic production, the government annually announces MSPs for 22 mandated crops, including seven key oilseeds, namely groundnut, sunflower, soybean, sesame, nigerseed, rapeseed & mustard, and safflower.

- Demand-Supply Gap:

- The ongoing trend of urbanization in developing countries, including India, is expected to alter dietary habits and traditional meals particularly.

- This shift will likely favour processed foods, generally high in edible oil content.

- OECD-FAO Agricultural Outlook (2023-2032) highlighted that India, the world’s biggest vegetable oil importer, is projected to maintain its high import growth to satisfy growing domestic demand.

- The report further emphasized that the consumption of vegetable oils for food purposes is expected to account for 57% of the total globally, driven by a growing population and rising per capita consumption in lower and middle-income countries due to higher incomes and in emerging markets, the consumption of vegetable oil for food is set to reach levels comparable to those of wealthier economies.

- The ICAR-Indian Institute of Oilseeds Research survey revealed distinct regional preferences in edible oil consumption across India.

- These variations likely reflect traditional culinary practices and locally available oilseeds.

- The ongoing trend of urbanization in developing countries, including India, is expected to alter dietary habits and traditional meals particularly.

What are the Strategies for Accelerating Growth in Edible Oil Sector?

- The rationale for Atmanirbharta in Edible Oil:

- “Atmanirbharta” the Hindi term for self-reliance or self-sufficiency, has become a guiding principle for Indian government policies, aiming to minimize dependence on imports and empower the nation to meet its domestic needs.

- This pursuit of self-sufficiency holds Pathways and Strategy for Accelerating Growth in 27 Edible Oil toward the Goal of Atmanirbharta's immense strategic value for economic advancement, food security, and cultural heritage preservation.

- Achieving Atmanirbharta in edible oil, a critical sector within agriculture promises a multifaceted benefit. It strengthens the national infrastructure, fosters domestic production and innovation, and bolsters the production capacity to meet future demands, ultimately contributing to a sustained rise in living standards.

- Pursuing Atmanirbharta in edible oil is not merely an economic goal but a strategic imperative for a self-reliant and prosperous India.

- Achieving self-reliance (Atmanirbharta) in the edible oil sector holds immense strategic importance for India, encompassing several critical aspects:

- Minimizing Import Dependency: The path of self-reliance minimizes risks caused by external factors along with unnecessary economic and political dependence on other nations.

- Achieving Nutritional Security: Ensuring sufficient and consistent access to safe and nutritious edible oils becomes paramount for guaranteeing nutrition security for the Indian population.

- Enhancing Economic Development: Given the multifaceted benefits of Atmanirbharta in the edible oil sector, it is imperative to address existing challenges and identify effective strategies for growth.

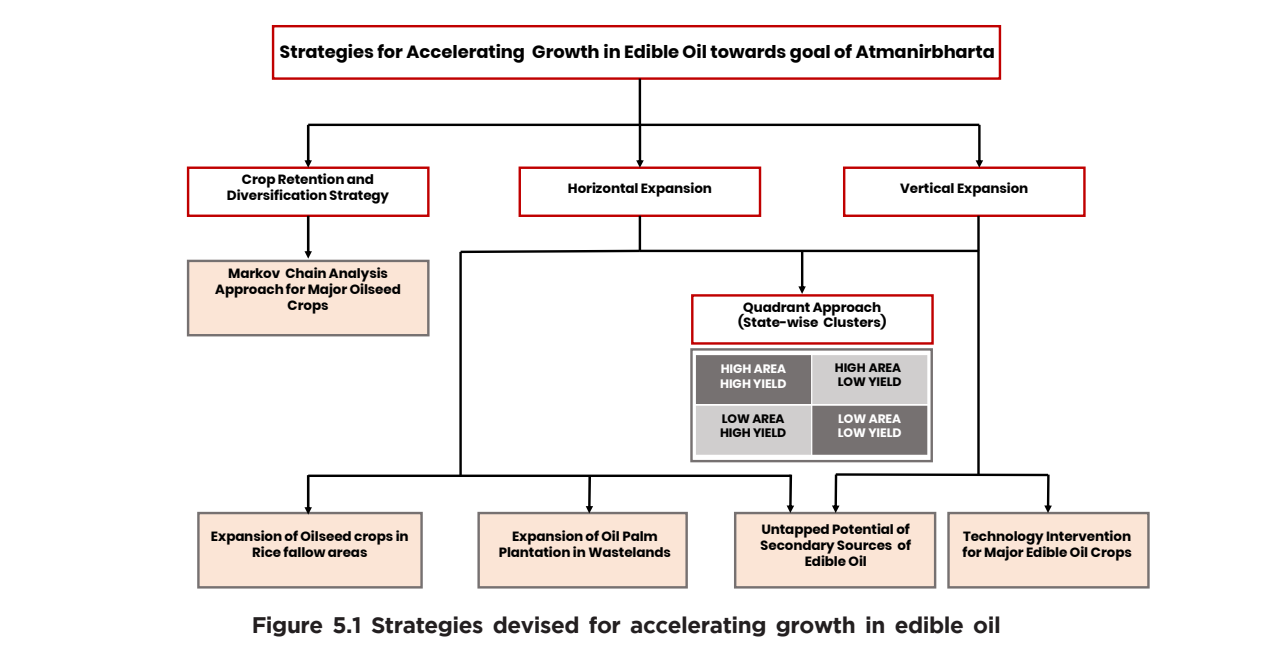

- Achieving self-reliance in the edible oil sector requires a comprehensive strategy built around three key pillars, as outlined in the report.

- Crop Retention and Diversification: Retaining and diversifying oilseed crops could increase production by 20% adding 7.36 MT and cutting imports by 2.1 MT.

- This strategy leverages the Markov Chain Analysis Approach, a statistical method that predicts future states based on current trends.

- Horizontal Expansion: Horizontal Expansion Strategy aims to strategically increase the area dedicated to cultivating edible oil crops. This strategy seeks to bring more land under cultivation for specific oilseeds.

- Potential avenues for achieving this include rice fallow lands and highly suitable wastelands for transformation through palm cultivation and promoting crop retention and diversification in regions that currently focus on other agricultural crops.

- Vertical Expansion: Vertical Expansion Strategy focuses on enhancing the yield of existing oilseed cultivation areas.

- This can be achieved through improved farming practices, better-quality seeds, and advanced production technologies.

- Crop Retention and Diversification: Retaining and diversifying oilseed crops could increase production by 20% adding 7.36 MT and cutting imports by 2.1 MT.

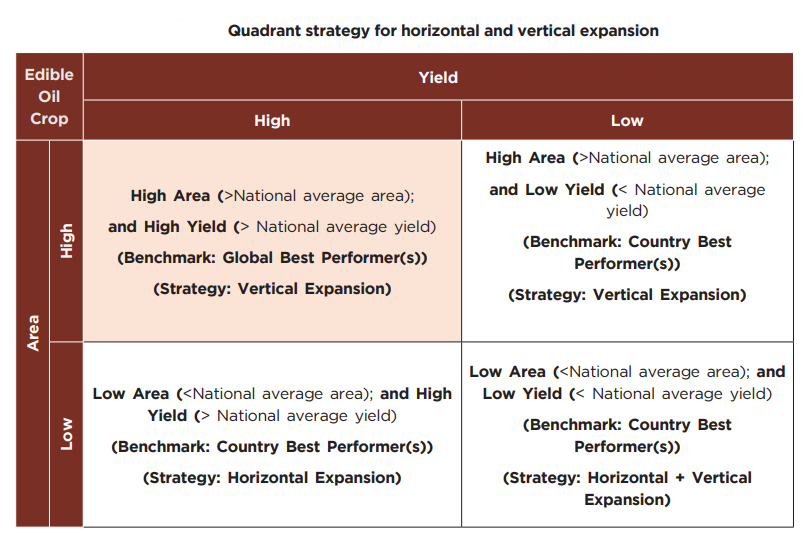

- The state-wise quadrant approach offers a valuable tool for achieving “Atmanirbharta” in edible oils. Identifying state clusters using four quadrants for the edible oil crops cultivated in India.

- High Area-High Yield (HA-HY): Focus on efficiency and adopting global best practices.

- High Area-Low Yield (HA-LY): Implement vertical expansion to boost yields.

- Low Area-High Yield (LAHY): Prioritise horizontal expansion to increase cultivation.

- Low Area-Low Yield (LA-LY): Address both horizontal and vertical expansion to enhance area and yield.

- Boosting Oilseed Production: Focus on keeping oilseed crops and shift some land from cereal crops in nine states. This could increase oilseed production by 20%, adding 7.36 million tonnes (MT) and cutting our reliance on imports by 14.2% (2.1 MT).

- Utilizing Rice Fallow Areas: Use a portion of rice fallow areas in ten states to grow oilseeds. This could add 3.12 MT to our production and lower import dependence by 7.1% (1.03 MT of edible oil).

- Improving Yields with Technology: Close the yield gap in oilseed crops by adopting better technologies and management practices. This could boost domestic oilseed production by 46% (17.4 MT) and reduce imports by 25.7%.

- Optimizing Seeds and Processing: Use high-quality seeds and improve processing methods. High-quality seeds alone can increase production by 15-20%, and better management can push this up to 45%. Modernizing mills will also help cut waste and improve efficiency.

- Expanding Oil Palm Cultivation: Increase oil palm cultivation by using the 2.43 million hectares (Mha) of land identified as suitable. Target planting 0.34 Mha annually over the next 18 years in suitable wastelands.

- Inclusive Partnerships: Work with farmer organizations and local groups to manage wastelands effectively and expand cultivation.

- Focusing on Sunflower and Palm Oil: Prioritize growing sunflower and palm oil to boost domestic production and reduce dependence on imports, aiming to enhance India’s global position in the edible oil market.

What are the Challenges in the Edible Oil Sector in India?

- Low Yields Compared to Global Producers: While India ranks among the largest producers, yields of most edible oil crops (except castor) have lagged behind other countries, largely due to the limited use of genetically modified (GM) herbicide-tolerant varieties.

- Rainfed Dependency: Around 76% of India's oilseed cultivation relies on rainfed systems, vulnerable to erratic weather. Irrigation coverage has only grown by 4% over the past decade.

- Heavy Import Reliance: India produces only 40-45% of its edible oil needs domestically, relying on imports for 55-60% of its requirements, making it the world's largest vegetable oil importer.

- Solvent Extraction Industry: Despite its growth, this industry operates at just 30% capacity due to uneven plant distribution and outdated technologies.

- Soybean, Cotton, and Coconut Challenges: Soybean yields remain low despite increased cultivation, and yields of cotton and coconut have slightly declined in recent years.

- Pests and Diseases: Effective pest and disease management is needed, as limited resistant crop varieties make oilseeds vulnerable to major pests and diseases.

- Rising Demand Due to Socio-Economic Factors: Increasing population and rising living standards are driving higher demand for edible oils, further straining India's ability to meet this demand domestically.

- Inconsistent Cultivation of Sunflower and Safflower: Over the past decade, the cultivation area for sunflower and safflower has fluctuated, making it difficult to maintain stable production levels for these crops.

Way Forward

- Adoption of Improved and Advanced Production Technologies: Crop improvement strategies should prioritize maximizing genetic potential by integrating conventional breeding techniques with modern biotechnological tools.

- Cluster-Based Seed Village: Establishment of cluster-based seed hubs at block levels “One Block-One Seed Village” to supply high-quality seeds for oilseeds aiming to enhance seed replacement rate (SRR) and varietal replacement rate (VRR).

- Data-Driven Transformation and Research Investment: Investing in research and development is crucial for transforming the edible oil sector, offering higher returns than input subsidies.

- A Dynamic Trade Policy for Balanced Growth: Aligning support prices with the import duty structure will support farmers, processors, and consumers alike.

- Enhancing Oilseed Development in Bundelkhand and the Indo-Gangetic Plain: Revitalizing the Bundelkhand region in Madhya Pradesh and Uttar Pradesh, suitable for oilseed cultivation, is crucial.

- Prioritizing Wasteland Utilization for Oil Palm Horizontal Expansion: Prioritizing a strategic approach to horizontal expansion of oil palm cultivation, leveraging highly suitable underutilized wastelands is recommended.

- Optimizing Storage Strategies and Price Incentives: Implementing fair pricing structures ensures adequate margins for storage costs, interest, and stakeholder returns, promoting market stability while incentivizing off-season sales.

- Enhancing Marketing Infrastructure: To improve the realizable income of oilseed farmers, ensuring procurement at the Minimum Support Price (MSP) through NAFED (National Agricultural Cooperative Marketing Federation of India) and state-owned oilseeds federations is essential.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. Consider the following statements: (2018)

- The quantity of imported edible oils is more than the domestic production of edible oils in the last five years.

- The Government does not impose any customs duty on all the imported edible oils as a special case.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)