Uttarakhand Switch to Hindi

Uttarakhand to Translocate Four Tigers to Rajasthan

Why in News?

Recently, the Uttarakhand government has agreed to translocate four tigers to Rajasthan following a request from the authorities.

Key Points

According to guidelines of the National Tiger Conservation Authority (NTCA),the tigers to be sent to Rajasthan will not be captured from the protected forest area but from the buffer zone.

- A similar request for the relocation of three tigers to Odisha has also been received and it is under consideration.

- The requests from the Rajasthan and the Odisha governments for the translocation of tigers were received following the successful operation of the tiger relocation project in Uttarakhand under which four big cats were translocated from the Corbett Tiger Reserve to Rajaji Tiger Reserve.

National Tiger Conservation Authority

- It is a statutory body under the Ministry of Environment, Forests and Climate Change.

- It was established in 2005 following the recommendations of the Tiger Task Force.

- It was constituted under enabling provisions of the Wildlife (Protection) Act, 1972, as amended in 2006, for strengthening tiger conservation, as per powers and functions assigned to it.

Rajaji Tiger Reserve

- It is located in Haridwar (Uttarakhand), along the foothills of the Shivalik range. It is part of Rajaji National Park.

- Rajaji National Park was established in the year 1983 after amalgamating three sanctuaries in the Uttarakhand i.e., Rajaji, Motichur and Chila.

- It was named after the famous freedom fighter C. Rajgopalachari; popularly known as “Rajaji”.

- It was declared a Tiger Reserve in 2015 as the 48th tiger reserve of the country.

Uttarakhand Switch to Hindi

Indian Railway & Uttarakhand Tourism Launches Manaskhand Express

Why in News?

The Uttarakhand Tourism Development Board, along with the Indian Railway Catering and Tourism Corporation Ltd. (IRCTC), has introduced a new tourist train called the "Manaskhand Express" to promote the hidden gems of the Kumaon Region in Uttarakhand.

Key Points

- The "MANASKHAND EXPRESS - BHARAT GAURAV TOURIST TRAIN" is a special 10 Nights/11 Days tour.

- This unique journey is designed to showcase the divine beauty and cultural richness of Uttarakhand's Devbhoomi, known for its spiritual significance and heritage sites.

- Departing on 22 April 2024, the tour offers a comprehensive exploration of various destinations across Uttarakhand.

- The train's boarding and deboarding stations include Pune, Lonavala, Panvel, Kalyan, Nashik, Jalgaon, Bhusawal, Khandwa, Itarasi, and Rani Kamlapati, ensuring accessibility for travelers from different regions.

- Some of the highlights of the tour include visits to Champawat/Lohaghat to explore Baleshwar, Tea Gardens, and Mayawati Ashram, paying homage at Nanda Devi & Kainchi Dham - Baba Neem Karoli Temple, and seeking blessings at Nanakmatta Gurudwara – Khatima & Naina Devi - Nainital.

- Additionally, participants will have the chance to discover the spiritual aura of Jageshwar Dham & Golu Devta – Chitai and visit Haat Kalika Temple & Patal Bhuvneshwar.

Bihar Switch to Hindi

India Employment Report 2024

Why in News?

According to the India Employment Report 2024, released by the Institute for Human Development and International Labour Organisation (ILO) the ‘Employment Condition Index’ of the states have improved between 2004-05 and 2021-22.

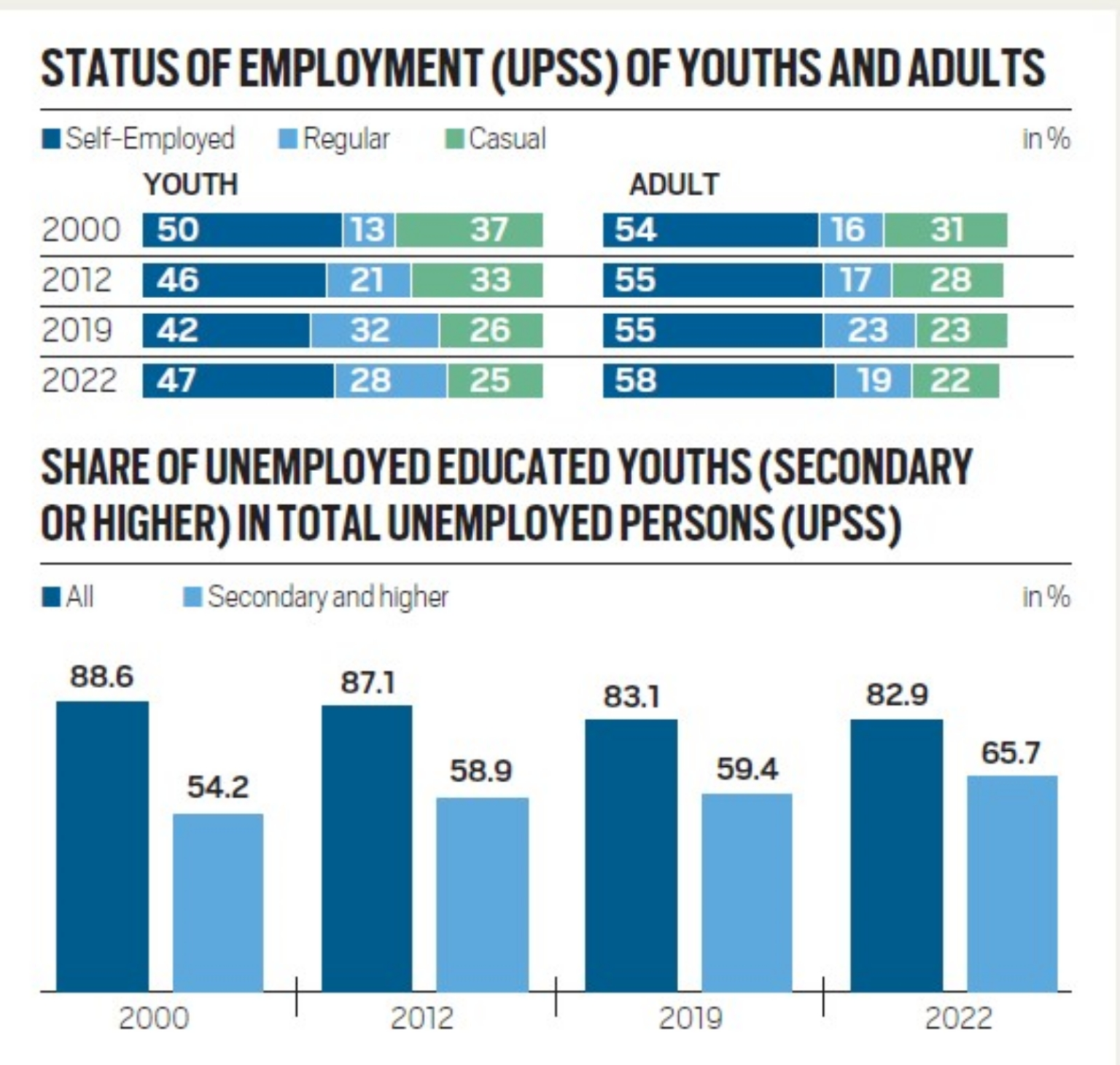

Key Points

- The "Employment Condition Index" has improved between 2004-05 and 2021-22, but some states such as Bihar, Odisha, Jharkhand, and UP have remained at the bottom throughout this period.

- While some others Delhi, Himachal Pradesh, Telangana, Uttarakhand, and Gujarat have stayed at the top.

- The index is based on seven labour market outcome indicators:

- percentage of workers employed in regular formal work;

- percentage of casual labourers;

- percentage of self-employed workers below the poverty line;

- work participation rate;

- average monthly earnings of casual labourers;

- unemployment rate of secondary and above-educated youth;

- youth not in employment and education or training.

- The report has flagged concerns about poor employment conditions: the slow transition to non-farm employment has reversed; women largely account for the increase in self-employment and unpaid family work; youth employment is of poorer quality than employment for adults; wages and earnings are stagnant or declining.

- Employment Quality: Almost 82% of the workforce is engaged in the informal sector, and nearly 90% is informally employed. Self-employment and unpaid family work has also increased, especially for women.

- Participation of Women: The female Labour Force Participation Rate (LFPR) in India remains among the world’s lowest. Female LFPR declined by 14.4% points (compared to 8.1% points for males) between 2000 and 2019.

- The trend reversed thereafter, with female LFPR rising by 8.3% points (compared to 1.7% points for male LFPR) between 2019 and 2022.

- Structural Transformation: The share of agriculture in total employment fell to around 42% in 2019 from 60% in 2000. This shift was largely absorbed by construction and services, the share of which in total employment increased to 32% in 2019 from 23% in 2000.

- Youth Employment: There has been a rise in youth employment, but the quality of work remains a concern, especially for qualified young workers. In 2022, the share of unemployed youths in the total unemployed population was 82.9%.

Haryana Switch to Hindi

GST Evasion: Fake Credit Claims Worth Rs 19,690 Crore

Why in News?

Recently, Haryana along with Delhi, stood at the top in terms of value detected in fake Input Tax Credit (ITC) claims as Goods and Services (GST) Evasion.

Key Points

- A total of 1,999 cases have been booked for fake ITC claims in India in the ongoing financial year 2023-24 (till January), involving an amount of Rs 19,690 crore.

- The amount involved in fake ITC claims in FY24 (till January) is 49% higher than Rs 13,175 crore detected in 1,940 cases in FY23.

- In terms of value detected, Haryana and Delhi stood at the top with an amount of Rs 10,851 crore,as per data. Haryana and Delhi together account for 55% of the total amount of Rs 19,690 crore detected in the fake ITC claims under GST in the current financial year.

Input Tax Credit

- It is the tax that a business pays on a purchase and that it can use to reduce its tax liability when it makes a sale.

- It means at the time of paying tax on output, one can reduce the tax that has already been paid on inputs and pay the balance amount.

- Exceptions: A business under GST composition scheme cannot avail of input tax credit. ITC cannot be claimed for personal use or for goods that are exempt.

GST Council

- Article 279A - GST Council to be formed by the President to administer & govern GST. It's Chairman is Union Finance Minister of India with ministers nominated by the state governments as its members.

- The council is devised in such a way that the centre will have 1/3rd voting power and the states have 2/3rd.

- The decisions are taken by 3/4th majority.

%20MPPCS%202025%20Desktop%20E.jpg)

%20MPPCS%202025%20Mobile%20E%20(1).jpg)

.jpg)

.png)

.png)

PCS Parikshan

PCS Parikshan