Bihar Switch to Hindi

4-4 Lakh Rupees to the Dependents of Corona Dead from CM Relief Fund

Why in News

- On January 28, 2022, in the 21st meeting of the CM Relief Fund Trustee Council held under the chairmanship of Chief Minister Nitish Kumar through video conferencing, it was told that in case of death due to corona, the dependents of the deceased were given the help of four lakh rupees from the Chief Minister's Relief Fund.

Key Points

- Under this, a total of Rs 148 crore 16 lakh has been released from the fund at the rate of Rs 4 lakh each to the dependents of 3704 dead.

- Significantly, the Chief Minister's Relief Fund (CMRF) was established in the year 1971 to help the people in distress. This fund is recognized as a trust and its income is exempted for return purposes under sections 12A and 139 of the Income Tax Act, 1961.

- The Chief Minister is the chairman of CMRF and is assisted by officers/staff on an honorary basis.

- It was informed in the meeting that so far Rs 59 crore has been given for the construction of 100 flood shelters in 10 flood affected districts, out of which the construction work of 40 flood shelters has been completed and the construction of the remaining is in progress.

- At present, for complete freedom from Kala-azar disease, under 'Mukhyamantri Kala-azar Rahat Yojna', assistance of Rs.6600 is being given to each Kala-azar patient, which was started in the year 2011.

- Similarly, every child labor freed for eradication of child labor is being given assistance of Rs.25 thousand for housing.

Bihar Switch to Hindi

Tax Exemption Decision for Vehicle Scraping

Why in News

- On January 28, 2022, in the cabinet meeting held under the chairmanship of Chief Minister Nitish Kumar through video conferencing, it was decided that the state government would provide exemption in motor vehicle tax on the purchase of new vehicles instead of declaring old vehicles as junk.

Key Points

- Under this decision, 25 percent tax exemption will be given on the purchase of private vehicles and 15 percent on the purchase of commercial vehicles.

- It is to be noted that 8 percent tax is levied on vehicles up to Rs 1 lakh, 9 percent on vehicles between Rs 1 to 8 lakh, 10 percent on vehicles between Rs 8 and 15 lakh and 12 per cent on vehicles above Rs 15 lakh. In such a situation, this decision will reduce pollution in the state and increase the revenue of the state government from the purchase of new vehicles, while on the other hand, industries for scrap will be developed in the state.

- It is noteworthy that the vehicle scrapping policy was announced by the Central Government in March 2021, under which-

- Old vehicles will have to pass a fitness test before re-registration and as per the policy, government commercial vehicles older than 15 years and private vehicles, which are more than 20 years old, will be canceled.

- State governments have been advised to provide road-tax exemption of up to 25% for private vehicles and 15% for commercial vehicles to provide incentives to owners of old vehicles to scrap old and unserviceable vehicles.

- The automakers will also give a 5% discount to those who use the scrapping certificate. Also, the registration fee will be waived off on the purchase of a new vehicle.

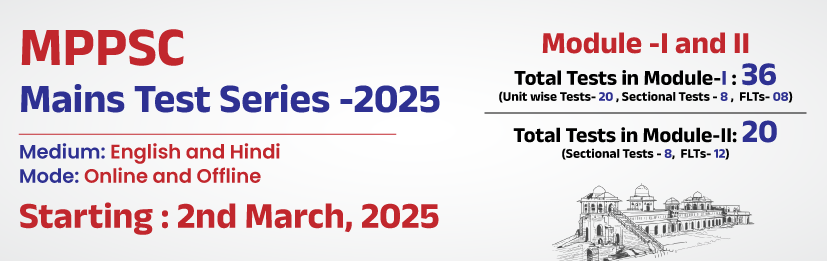

%20MPPCS%202025%20Desktop%20E.jpg)

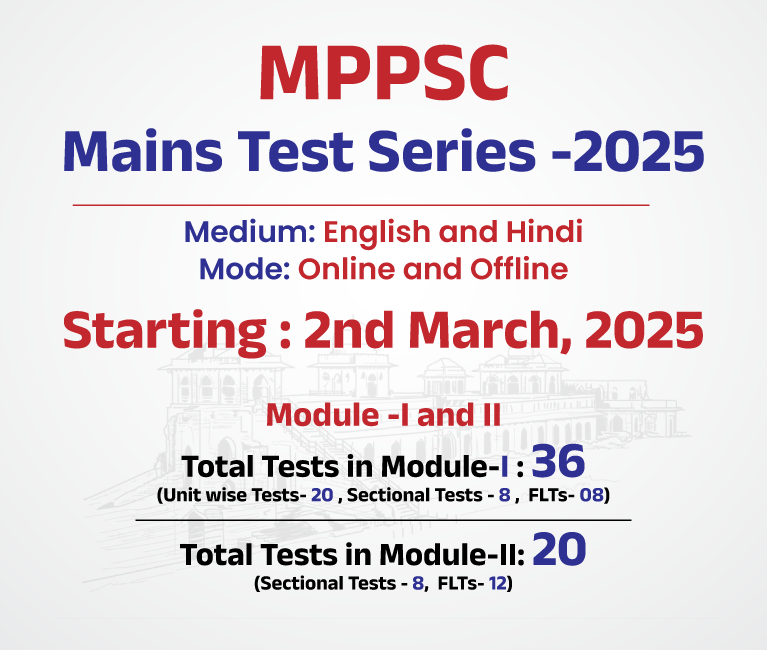

%20MPPCS%202025%20Mobile%20E%20(1).jpg)

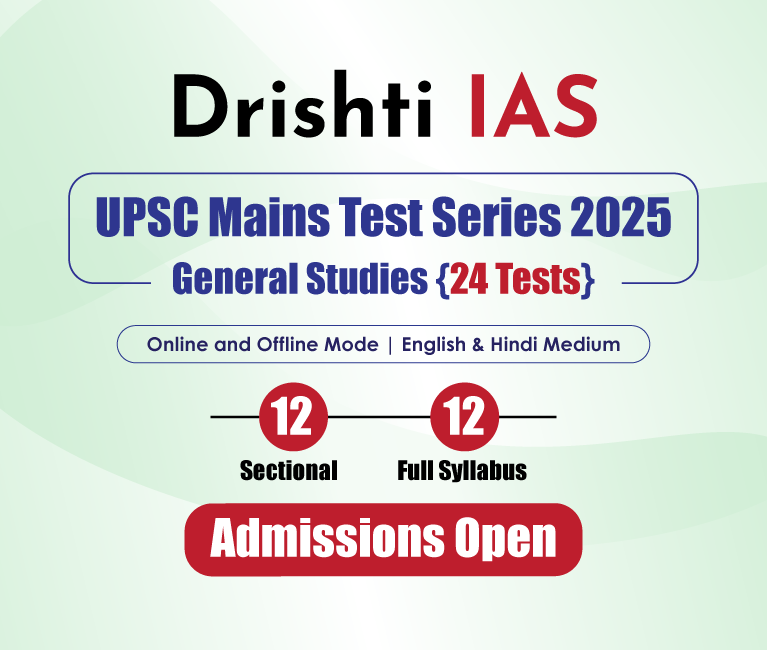

.png)

.png)

PCS Parikshan

PCS Parikshan