Bihar Switch to Hindi

NABARD Projects Credit Potential for Bihar

Why in News?

The National Bank for Agriculture and Rural Development (NABARD) has projected Rs 2,43,093 crore credit potential for Bihar in 2024-25.

Key Points

- The estimate has been made taking into account the Reserve Bank of India's priority sector-based guidelines, Central and state government policies and policies for sustainable agriculture and rural development.

- The State Focus Paper 2024-25 for Bihar, a compilation of the assessed credit flow for all 38 districts of the state was unveiled by the Development Commissioner at NABARD's credit seminar.

- The total credit flow under the priority sector for the year 2024-25 is estimated at Rs 2,43,093 crore.

- There is a need for credit intensification through specific planning for each of the sub-sectors under agriculture in Bihar.

- Credit plays an important role in economic development and employment generation in the state.

National Bank for Agriculture and Rural Development (NABARD)

- It is a development bank focussing primarily on the rural sector of the country. It is the apex banking institution to provide finance for Agriculture and rural development.

- Its headquarter is located in Mumbai, the country’s financial capital.

- It is responsible for the development of the small industries, cottage industries, and any other such village or rural projects.

- It is a statutory body established in 1982 under the Parliamentary act-National Bank for Agriculture and Rural Development Act, 1981.

Reserve Bank of India (RBI)

- It was established on April 1, 1935 in accordance with the provisions of the Reserve Bank of India Act, 1934.

- The Central Office of the Reserve Bank was initially established in Calcutta but was permanently moved to Mumbai in 1937. The Central Office is where the Governor sits and where policies are formulated.

- Though originally privately owned, since nationalization in 1949, the Reserve Bank is fully owned by the Government of India.

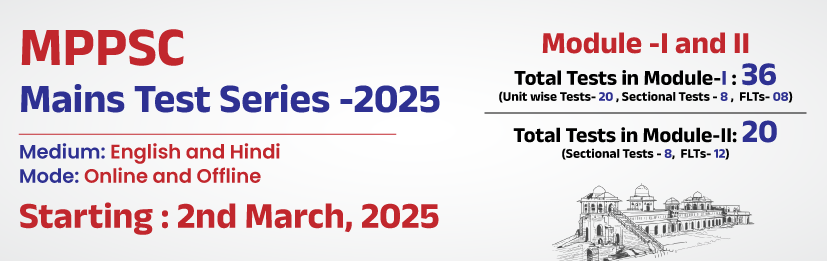

%20MPPCS%202025%20Desktop%20E.jpg)

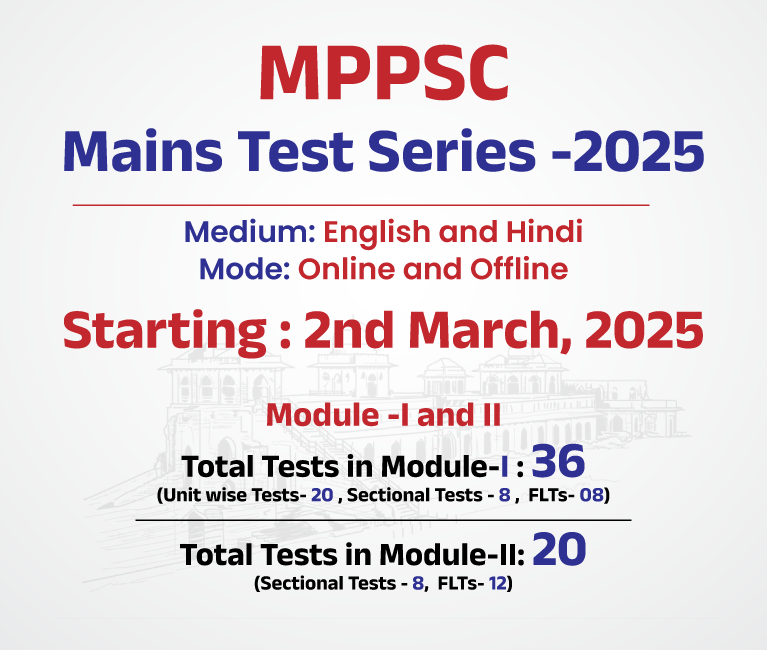

%20MPPCS%202025%20Mobile%20E%20(1).jpg)

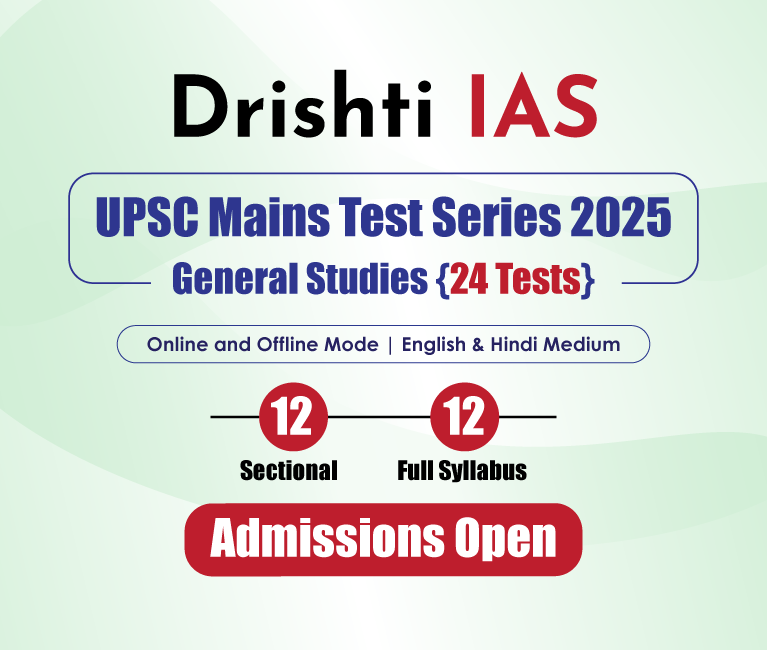

.png)

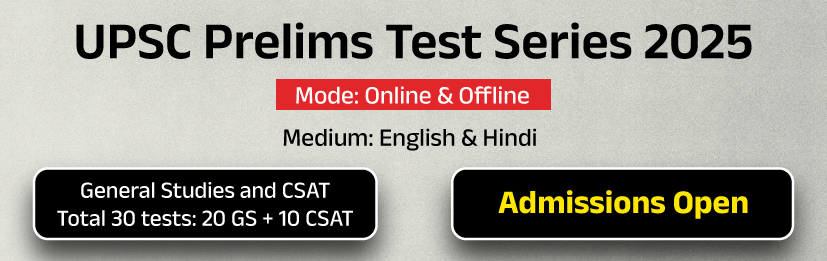

.png)

PCS Parikshan

PCS Parikshan