Haryana Switch to Hindi

Bills Passed in Haryana Assembly

Why in News?

Recently, Haryana Assembly has passed various bills including Haryana lease of agricultural land Bill 2024, Bharatiya Nagarik Suraksha Sanhita (Haryana amendment) Bill 2024, Haryana Appropriation (number 3) Bill 2024, Haryana Goods and Services Tax (Amendment) Bill 2024.

Key Points

- Haryana Lease of Agricultural Land Bill 2024:

- Objective: Establishes a framework for legalizing agricultural land leases to protect landowners' rights and optimize land use.

- Issues:

- Landowners avoid written lease agreements due to fears of lessees demanding occupancy rights.

- Non-written leases prevent lessees from accessing relief during natural calamities or securing crop loans.

- Expected Impact:

- Encourages formal lease agreements to benefit both landowners and lessees.

- Aims to boost agricultural productivity by reducing barren land.

- Bharatiya Nagarik Suraksha Sanhita (Haryana Amendment) Bill 2024:

- Amendments to Section 23:

- Section 23 of the Bharatiya Nagarik Suraksha Sanhita (BNSS), 2023 outlines the sentencing authority of different magistrates.

- It specifies the types and limits of sentences that can be imposed by first-class, second-class, and Chief Judicial Magistrates.

- Increased maximum fine for first-class magistrates from Rs 50,000 to Rs 5 lakh under Section 23(2).

- Raised fine limit under Section 23(3) from Rs 10,000 to Rs 1 lakh.

- Section 23 of the Bharatiya Nagarik Suraksha Sanhita (BNSS), 2023 outlines the sentencing authority of different magistrates.

- Higher fines align with cases under Acts like the Negotiable Instruments Act 1881 where cheque amounts exceed previous limits.

- Enhanced penalties are consistent with revised traffic fines under the Motor Vehicles Act, 1988.

- Objective: Strengthens deterrence and aligns fine limits with current economic realities.

- Amendments to Section 23:

- Haryana Appropriation (Number 3) Bill 2024:

- Purpose: Authorizes additional payment and appropriation from the state’s consolidated fund for services in the financial year ending 31st March 2025.

- Haryana Goods and Services Tax (Amendment) Bill 2024:

- Basis: Reflects recommendations of the GST Council and amendments to the Central GST Act, 2017 under the Finance Act, 2024.

- Objective: Ensures uniformity and alignment with national GST regulations to enhance tax governance

Haryana Switch to Hindi

Gurugram AQI Recorded 402

Why in News?

According to the Central Pollution Control Board (CPCB), the Air Quality Index (AQI) in Gurugram district reached the 'severe' category registering 402.

Key Points

- Other places like Sonepat (390), Dharuhera (377), Jind (358), Charkhi Dadri (351), Bahadurgarh (347), Manesar (345), Faridabad (320), Hisar (317), Narnaul (310), Sirsa (309) and Panipat (303) were in the ‘very poor’ category.

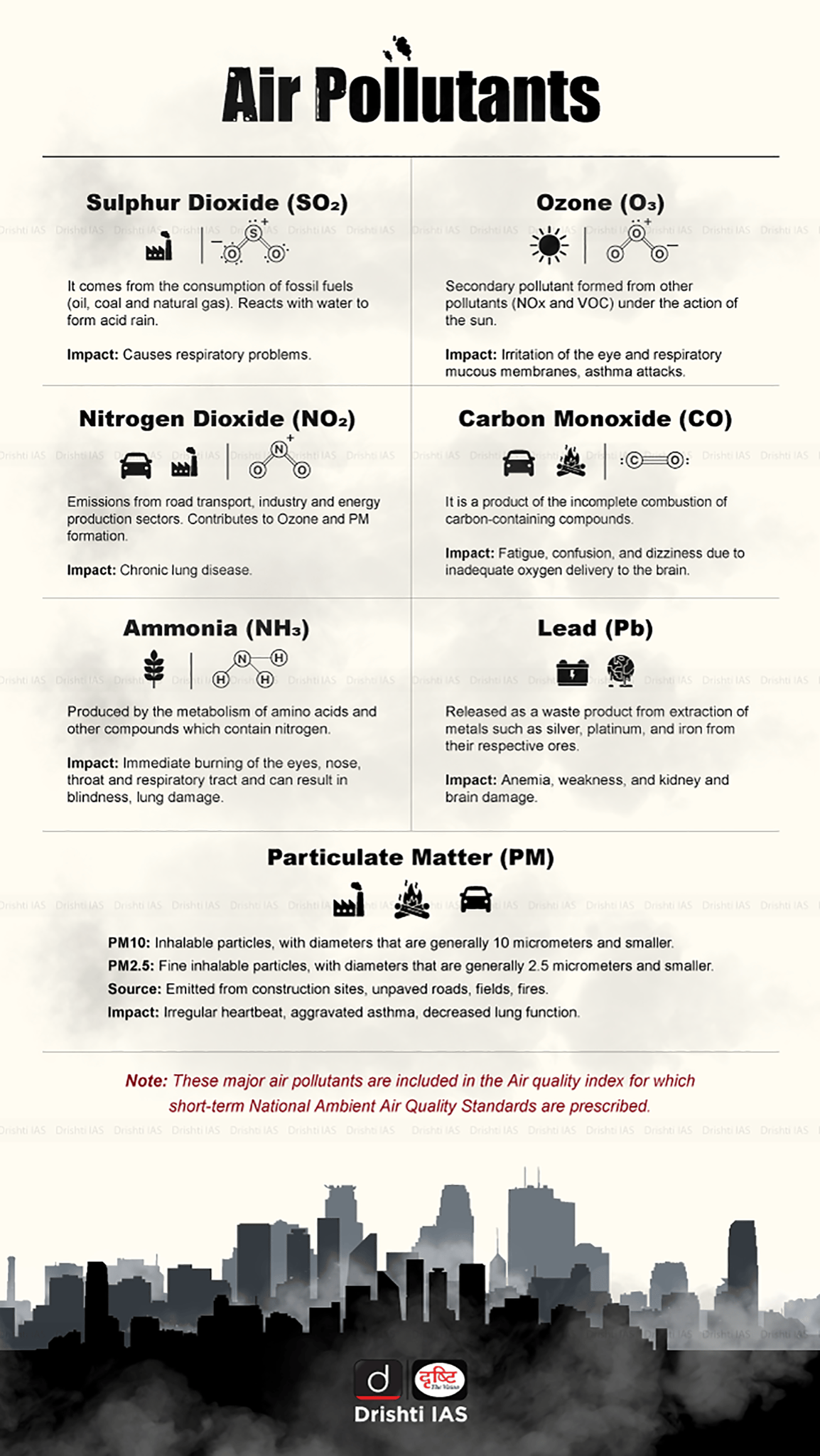

- Air Quality Index:

- AQI is a tool for effective communication of air quality status to people in terms, which are easy to understand.

- Graded Response Action Plan for Delhi and NCR has been prepared for implementation under different AQI categories.

- AQI has been developed for eight pollutants viz. PM2.5, PM10, Ammonia, Lead, nitrogen oxides, sulfur dioxide, ozone, and carbon monoxide.

- AQI is a tool for effective communication of air quality status to people in terms, which are easy to understand.

Central Pollution Control Board (CPCB)

- It was constituted in 1974 under the Water (Prevention and Control of Pollution) Act, 1974.

- CPCB was also entrusted with the powers and functions under the Air (Prevention and Control of Pollution) Act, 1981.

- It serves as a field formation and also provides technical services to the Ministry of Environment and Forests and Climate change of the provisions of the Environment (Protection) Act, 1986

Switch to Hindi

%20(1).png)

%20(1).png)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.jpg)

PCS Parikshan

PCS Parikshan