Haryana Switch to Hindi

GST Bhawan in Haryana

Why in News?

Recently, the Chairman of the Central Board of Indirect Taxes and Customs (CBIC), inaugurated the Goods and Services Tax (GST) Bhawan, an official complex of Central Goods & Services Tax (CGST) at Rohtak, Haryana.

Key Points

- Located at one of the most preferred locations in Rohtak, the project sits at the hub of connectivity to major districts of Haryana and has easy and quick access to facilitate GST Taxpayers.

- The inauguration of project in Amrit Kaal showcases the strength of New India.

- CBIC is a part of the Department of Revenue under the Ministry of Finance.

- The Central Board of Excise and Customs (CBEC) was renamed as the CBIC in 2018 after the roll out of the GST.

- It deals with the tasks of formulation of policy concerning levy and collection of Customs, Central Excise duties, Central Goods & Services Tax and IGST, prevention of smuggling and administration of matters relating to Customs, Central Excise, Central Goods & Services Tax (CGST), Integrated GST and Narcotics to the extent under CBIC's purview.

Goods & Services Tax (GST)

- About: ST is a value-added tax system that is levied on the supply of goods and services in India.

- It is a comprehensive indirect tax that was introduced in India on 1st July 2017, through the 101st Constitution Amendment Act, 2016, with the slogan of ‘One Nation One Tax’.

- GST Council: It is a constitutional body responsible for making recommendations on issues related to the implementation of the GST in India.

- As per Article 279A (1) of the amended Constitution, the GST Council was constituted by the President.

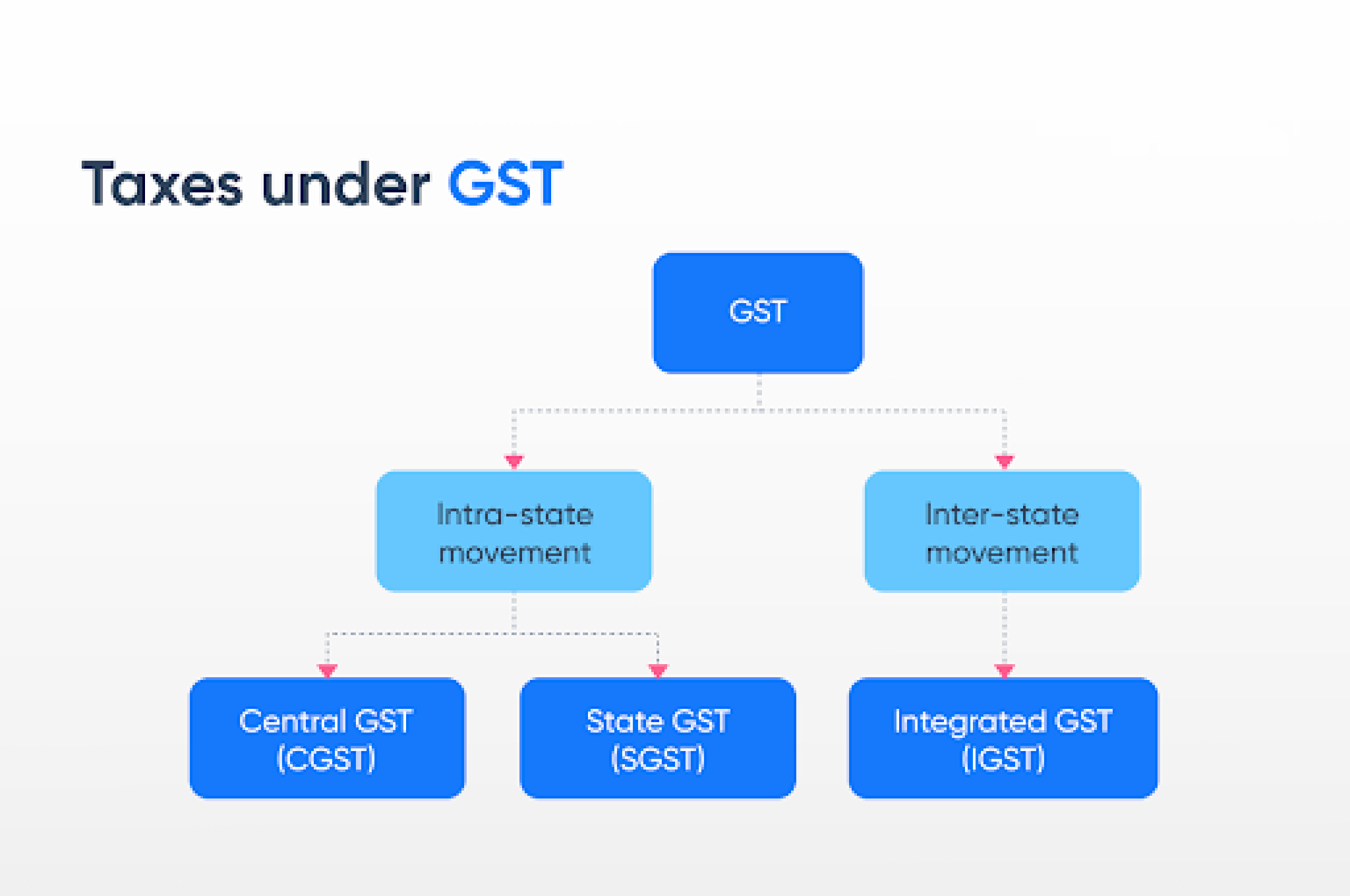

- CGST: Under GST, CGST is a tax levied on intrastate supplies of both goods and services by the Central Government and collected by the Central Government and contributes to its funds.

- IGST: It is a tax levied on all interstate supplies of goods and/or services or across two or more states/Union Territories.

- SGST: An equivalent amount of SGST is a tax levied on intrastate supplies of both goods and services by the particular state government where the product sold is consumed.

%20MPPCS%202025%20Desktop%20E.jpg)

%20MPPCS%202025%20Mobile%20E%20(1).jpg)

.png)

.png)

PCS Parikshan

PCS Parikshan

-min.jpg)