Madhya Pradesh

Madhya Pradesh Receives Rs. 14,000 Crore Tax Devolution

- 19 Oct 2024

- 2 min read

Why in News?

Recently, Madhya Pradesh received a Rs. 14,000 crore boost in tax devolution from the central government ahead of Diwali, improving fiscal space for the state.

Key Points

- How Tax is Devolved in India:

- The Finance Commission determines the division of central tax revenues between the Union and states, recommending how much each state should receive.

- Articles 270-275 of Indian Constitution outline how taxes are shared, ensuring states get a share of central taxes for financial stability.

- Current Status of Tax Devolution in India:

- Financial devolution refers to the transfer of financial resources and decision-making powers from the central government to the states.

- Article 270 of the Constitution outlines the distribution of net tax proceeds between the Union government and the States.

- The Finance Commission (FC), constituted every five years, provides recommendations for the vertical distribution of funds from the central government's divisible pool of taxes (excluding cess and surcharge).

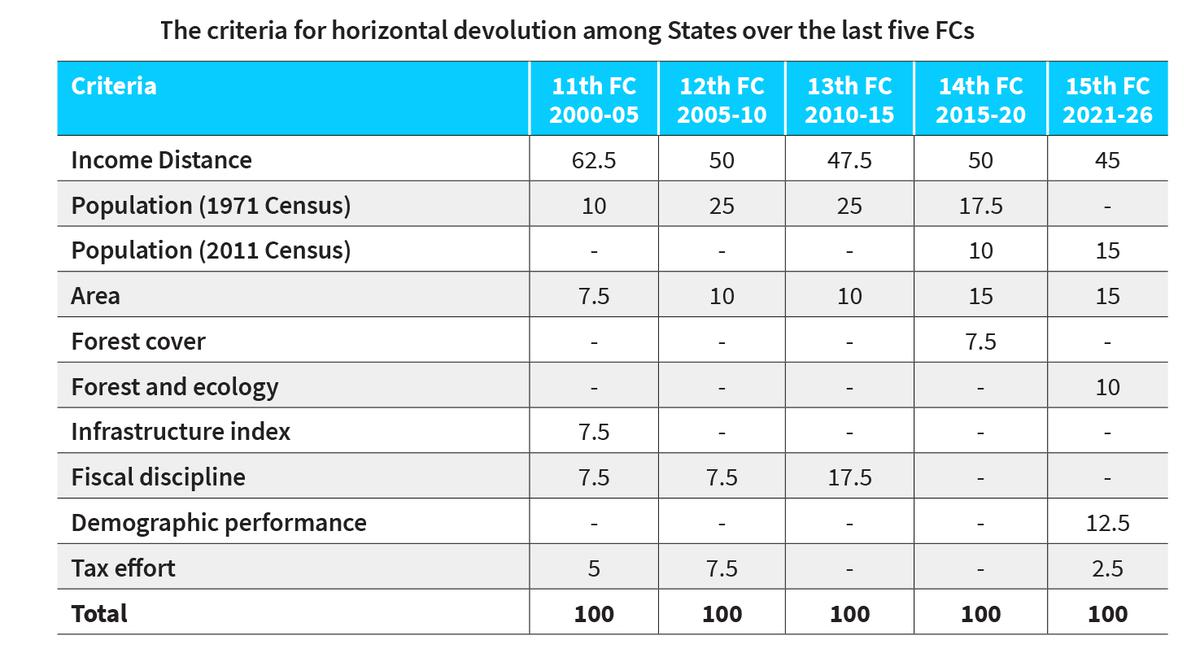

- Additionally, it offers a formula for the horizontal allocation of these funds among individual states.

- Apart from the share of taxes, States are also provided grants-in-aid as per the recommendation of the FC.

- The 16th Finance Commission, chaired by Dr Arvind Panagariya, has been tasked with making recommendations for the period 2026-31.

- Criteria for Devolution Among States: Currently, the share of States from the divisible pool (vertical devolution) stands at 41% as per the recommendation of the 15th FC.