-

14 Feb 2025

GS Paper 2

Polity & Governance

Day 65: The spirit of the 73rd Amendment is diluted because many states have failed to transfer the ‘three Fs’ – Functions, Functionaries, and Funds – to Panchayats. Comment.(250 words)

Approach

- Briefly introduce the 73rd Constitutional Amendment Act, 1992

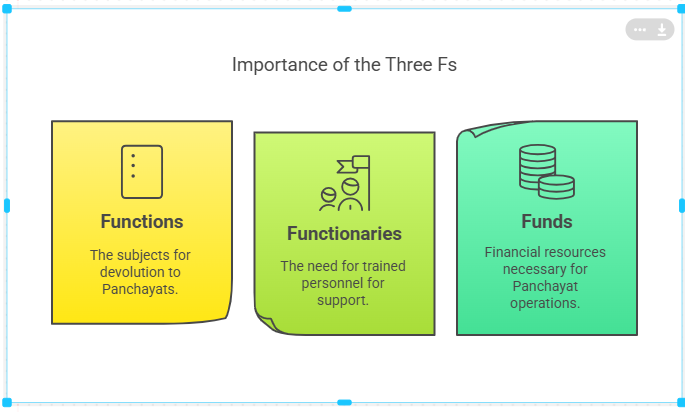

- Discuss the importance of the 'Three Fs' in Strengthening Panchayati Raj

- Explain How the Failure to Transfer the 'Three Fs' Has Weakened Panchayati Raj

- Suggest Measures to Strengthen Panchayati Raj.

- Conclude suitably.

Introduction

The 73rd Constitutional Amendment Act, 1992, aimed to institutionalize Panchayati Raj as the third tier of governance. However, its implementation remains weak due to the failure of many states to devolve the ‘Three Fs’ – Functions, Functionaries, and Funds – to Panchayats. This incomplete devolution has significantly impacted grassroots democracy and local governance in India.

Body

The Weakening of Panchayati Raj Due to the Non-Transfer of the 'Three Fs' :

- Incomplete Devolution of Functions: Despite the Eleventh Schedule listing 29 subjects under Panchayati Raj Institutions (PRIs), many states have not clearly specified the roles and responsibilities of Panchayats in key areas.

- State Control and Bureaucratic Oversight

- Many states retain excessive bureaucratic control, limiting Panchayats' authority.

- Line departments at the state level exercise control over service delivery, reducing the autonomy of Panchayats

- Example: In states like Uttar Pradesh and Tamil Nadu, Panchayats have minimal decision-making powers, as most functions remain with the state government.

- Weak Implementation of Rural Development Programs

- Panchayats struggle to provide essential services like sanitation, water supply, and public health due to a lack of functional autonomy.

- Example: The 15th Finance Commission highlighted that only a limited number of Gram Panchayats in India have control over drinking water supply systems.

- Lack of Adequate Functionaries: Panchayats often lack the required administrative staff to carry out governance functions efficiently.

- Dependence on State-Appointed Officers

- Panchayats rely on state-appointed officers who prioritize state government directives over local governance.

- Sarpanch-Bureaucracy Nexus

- In some states, the Sarpanch-Patwari nexus allows state-level officials to dominate decision-making, undermining grassroots democracy.

- Shortage of Technical Personnel

- A report by the Ministry of Panchayati Raj (2022) found that a Lack of trained officials such as engineers, accountants, and development officers affects the implementation of rural development programs.

- Dependence on State-Appointed Officers

- Financial Constraints and Dependence on States: Panchayats have limited financial autonomy, making them dependent on state governments for funds.

- Limited Revenue Generation Powers

- Many states do not allow Panchayats to effectively collect property tax, user charges, and market fees.

- Panchayats in India earn only one percent of their revenue through taxes with the rest being raised as grants from the State and the Centre,

- Specifically, 80% of the revenue was from Central government grants; only 15% was from State government grants.

- Delays in State Finance Commission (SFC) Grants

- Many states delay the transfer of SFC-recommended funds to Panchayats, further weakening their financial stability.

- States like Andhra Pradesh, Haryana, Mizoram, Punjab, and Uttarakhand have significantly lower average revenues, less than Rs 6 lakh per panchayat.

- Over-Reliance on Central Finance Commission (CFC) Grants

- Panchayats largely depend on CFC funds, reducing their fiscal independence.

- Example: The 15th Finance Commission recommended ₹4.36 lakh crore for local bodies (2021–26), but its utilization remains ineffective due to lack of financial autonomy.

Measures to Strengthen Panchayati Raj

- Clear Delegation of Functional Responsibilities

- States must fully devolve all 29 subjects listed in the Eleventh Schedule.

- Strengthening the District Planning Committees (DPCs) for better coordination.

- Example: Kerala’s decentralized planning model provides a successful framework where Panchayats have real functional authority.

- Strengthening Functionaries

- Recruitment of dedicated staff at the Panchayat level, including engineers, accountants, and development officers.

- Capacity-building programs for elected representatives to improve governance efficiency.

- Enhancing Financial Autonomy

- Allowing Panchayats to collect property tax, user fees, and market levies for independent revenue generation.

- Example: Karnataka and Maharashtra have empowered Panchayats to collect taxes on markets and water usage, strengthening local governance.

- Reforming State Finance Commissions (SFCs)

- Ensuring timely and adequate devolution of funds to Panchayats.

- Implementing real-time fund transfer mechanisms to avoid delays.

- Reducing Political and Bureaucratic Interference

- Strengthening Gram Sabhas to ensure community participation in decision-making.

- Greater transparency and accountability in fund allocation and utilization.

- Example: Rajasthan has implemented a Social Audit Mechanism for MGNREGA funds at the Panchayat level.

Conclusion

As Gandhi advocated, "Real swaraj will come not by the acquisition of authority by a few but by the acquisition of the capacity by all to resist authority when abused." True participatory democracy can only be achieved when Panchayats function as self-reliant and empowered bodies, fostering inclusive and sustainable development at the grassroots level.