-

20 Feb 2024

GS Paper 3

Economy

Day 80: Critically examine the causes and implications of increasing public debt in India. (250 words)

- Start the answer by introducing the Public Debt.

- Examine the causes of increasing public debt in India.

- Mention the implications of increasing public debt in India.

- Conclude as per the requirement of keywords.

Introduction

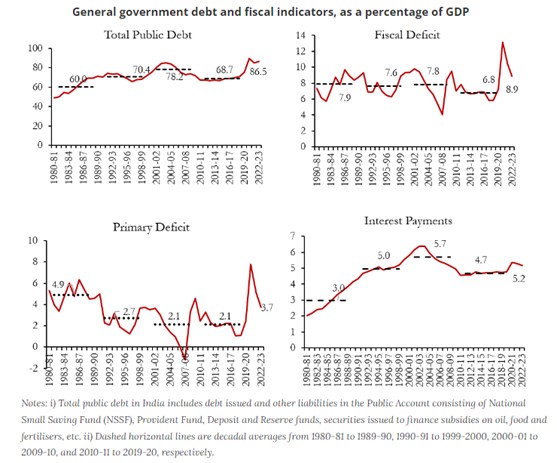

Public debt refers to the borrowings of the government to finance its expenditure when revenue falls short. The Union government’s debt was Rs 155.6 trillion, or 57.1% of GDP, at the end of March 2023, with state governments adding about 28% of GDP to the overall debt burden.

Body

Causes of Increasing Public Debt in India:

- Fiscal Deficit: One of the primary reasons for the increasing public debt is the persistent fiscal deficit. The government spends more than it earns, leading to borrowing to finance the deficit.

- The fiscal deficit in 2024-25 is estimated to be 5.1%of GDP.

- Revenue Shortfall: Insufficient revenue generation, especially in relation to expenditure commitments, leads to borrowing to bridge the gap.

- Expenditure Pressure: Rising expenditure on subsidies, interest payments, and administrative costs contributes to the need for more borrowing.

- India spends roughly 10% of revenue expenditure on major subsidies.

- Economic Slowdown: Periods of economic slowdown or recession can reduce government revenue, leading to higher borrowing to maintain spending levels.

- India has witnessed a decline in GDP growth rate which was further aggravated by the Covid pandemic-induced lockdowns.

- Infrastructure Development: Large-scale infrastructure projects require significant funding, often leading to increased borrowing.

- In the past few years, the government has significantly increased its capex to boost infrastructure creation. The 2024-25 budget has raised the capex target by 11.1%.

- Interest Payments: Interest payments in India, amounting to more than 5% of the GDP and 25% of revenue receipts on average, exceed government spending on vital areas such as education and healthcare.

- External Factors: Global economic conditions, such as changes in interest rates or exchange rates, fed tapering etc. can impact the cost of borrowing and the overall debt level.

Implications of Increasing Public Debt:

- Higher Interest Payments: As the debt increases, a larger portion of government revenue is allocated to servicing the debt, limiting funds available for other essential expenditures.

- Crowding Out Effect: High levels of public debt can lead to a crowding out effect, where government borrowing reduces the availability of credit for private investment, potentially hampering economic growth.

- Credit Rating Impact: Excessive public debt can lead to a downgrade in the country's credit rating, making it more expensive to borrow in the future.

- Inflationary Pressures: To finance debt, governments may resort to printing more money, leading to inflation.

- Reduced Fiscal Space: High debt levels constrain the government's ability to respond to economic shocks or undertake necessary reforms.

- Inter-generational Equity: Excessive borrowing can transfer the burden of debt repayment to future generations, compromising their economic prospects.

- Economic Instability: High public debt levels can increase the vulnerability of the economy to external shocks and financial crises and impact policymaking.

Mitigating Measures:

- PPP Model in Social Schemes: The government may think of a public-private partnership (PPP) model in social schemes like Deen Dayal Upadhyay Grameen Kaushalya Yojna (DDU-GKY). This may help in reducing public debt.

- Introduce Green Debt Swaps: In a green debt swap, a debtor nation and its creditors negotiate to exchange or restructure existing debt in a way that aligns with environmentally friendly and sustainable projects.

- Expenditure Rationalization: Prioritize spending to reduce wasteful expenditures and focus on essential areas like healthcare, education, and infrastructure.

- Enhance Tax Collection and Compliance: Improve tax administration and compliance to increase government revenue. Utilising technology for cross-matching of GST and income-tax returns can enhance tax collection efficiency and curb tax evasion.

- Leveraging the Public Financial Management System (PFMS): Leveraging the PFMS to its fullest potential is integral to effective fiscal deficit management, ensuring heightened transparency and accountability in government expenditures.

Conclusion

Addressing the causes and implications of increasing public debt in India requires a comprehensive approach that includes fiscal discipline, revenue enhancement, and prudent debt management. Failure to manage public debt effectively can have serious consequences for the economy, affecting growth, stability, and inter-generational equity.