PRS Capsule

PRS Capsule - August 2022

- 13 Sep 2022

- 29 min read

Key Highlights of PRS

- Governance:

- Electricity (Amendment) Bill, 2022

- The Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Amendment Bill, 2022

- The Indian Antarctic Bill, 2022

- Pradhan Mantri Awas Yojana-Urban (PMAY-U)

- Passenger Name Record (PNR) Information Regulations, 2022

- Aeromedical Evaluation of Transgender Pilot Applicants

- Economy:

- Biodiversity & Environment:

Governance

Electricity (Amendment) Bill, 2022

The Electricity (Amendment) Bill, 2022 was introduced in Lok Sabha. The Bill amends the Electricity Act, 2003 which regulates the electricity sector in India.

- The bill also sets up the Central and State Electricity Regulatory Commissions (CERC and SERCs) to regulate inter-state and intra-state matters.

What are the Key Features of the Bill?

- Multiple Discoms:

- The Act provides for multiple distribution licensees (discoms) to operate in the same area of supply. It requires discoms to distribute electricity through their own network.

- The Bill removes this requirement and adds that a discom must provide non-discriminatory open access to its network to all other discoms operating in the same area, on payment of certain charges.

- Power Procurement & Tariff:

- Once the grant of multiple licenses for the same area is obtained, the power and associated costs as per the existing power purchase agreements (PPAs) of the existing discoms will be shared between all discoms.

- The bill adds that along with specifying the maximum ceiling for tariff, the State Electricity Regulatory Commissions (SERCs) will also specify the minimum tariff in case of multiple discoms in an area.

- Once the grant of multiple licenses for the same area is obtained, the power and associated costs as per the existing power purchase agreements (PPAs) of the existing discoms will be shared between all discoms.

- Cross-Subsidy Balance Fund:

- The Bill adds that upon grant of multiple licenses for the same area, the state government will set up a Cross subsidy Balancing Fund.

- Cross-subsidy refers to the arrangement of one consumer category subsidizing the consumption of another consumer category.

- Any surplus with a distribution licensee on account of cross-subsidy will be deposited into the fund, which will be used to finance deficits in cross-subsidy for other discoms in the same area or any other area.

- The Bill adds that upon grant of multiple licenses for the same area, the state government will set up a Cross subsidy Balancing Fund.

- Renewable Purchase Obligation:

- The Act empowers SERCs to specify renewable purchase obligations (RPO) for discoms.

- RPO refers to the mandate to procure a certain percentage of electricity from renewable sources.

- The Bill adds that RPO should not be below the minimum percentage prescribed by the central government.

- The Act empowers SERCs to specify renewable purchase obligations (RPO) for discoms.

The Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Amendment Bill, 2022

The Weapons of Mass Destruction and their Delivery Systems (Prohibition of Unlawful Activities) Amendment Bill, 2022 was passed by Parliament.

- The 2005 Act prohibits unlawful activities (such as manufacturing, transport, or transfer) related to weapons of mass destruction, and their means of delivery.

- Weapons of mass destruction are biological, chemical, or nuclear weapons.

What are the Provisions of 2022 Bill?

- The Bill bars persons from financing any prohibited activity related to weapons of mass destruction and their delivery systems.

- To prevent persons from financing such activities, the central government may freeze, seize or attach their funds, financial assets, or economic resources (whether owned, held, or controlled directly or indirectly).

- It may also prohibit persons from making finances or related services available for the benefit of other persons in relation to any activity which is prohibited.

The Indian Antarctic Bill, 2022

The Indian Antarctic Bill, 2022 was passed by Parliament.

- The Bill seeks to give effect to the Antarctic Treaty, the Convention on the Conservation of Antarctic Marine Living Resources, and the Protocol on Environmental Protection to the Antarctic Treaty.

- It also seeks to protect the Antarctic environment and regulate activities in the region.

What are the Key Features of the Bill?

- Applicability:

- The provisions of the Bill will apply to any person, vessel or aircraft that is a part of an Indian expedition to Antarctica under a permit issued under the Bill.

- Areas comprising of Antarctica include:

- The continent of Antarctica, including its ice-shelves, and all areas of the continental shelf adjacent to it.

- All islands (including their ice-shelves), seas, and air space south of 60°S latitude.

- Establishment of Central Committee:

- The central government will establish a Committee on Antarctic Governance and Environmental Protection. The functions of the committee will be:

- Granting permits for various activities.

- Implementing and ensuring compliance of relevant international laws for protection of Antarctic environment.

- Obtaining and reviewing relevant information provided by parties to the Treaty, Convention, and Protocol.

- Negotiating fees/charges with other parties for activities in Antarctica.

- The central government will establish a Committee on Antarctic Governance and Environmental Protection. The functions of the committee will be:

- Permit:

- A permit by the Committee or written authorization from another party to the Protocol (other than India) will be required for various activities such as:

- An Indian expedition to enter or remain in Antarctica.

- A person to enter or remain in an Indian station in Antarctica.

- A vessel or aircraft registered in India to enter or remain in Antarctica.

- A person or vessel to drill, dredge or excavate for mineral resources, or collect samples of mineral resources.

- Activities which may harm the native species.

- Waste disposal by a person, vessel, or aircraft in Antarctica.

- A permit by the Committee or written authorization from another party to the Protocol (other than India) will be required for various activities such as:

Pradhan Mantri Awas Yojana-Urban (PMAY-U)

The Union Cabinet approved extension of the Pradhan Mantri Awas Yojana-Urban (PMAY-U) up to December 31, 2024.

- The scheme was earlier applicable till March 31, 2022.

What do we need to know about PMAY-U?

- About:

- Pradhan Mantri Awas Yojana (PMAY) falls under the Government’s mission - Housing for All by 2022 for urban housing being implemented by the Ministry of Housing and Urban Affairs (MoHUA).

- It makes home loans affordable for the urban poor by providing a subsidy on the Interest Rate of a home loan during repayment by way of EMI (Equated Monthly Installments).

- Beneficiaries:

- The Mission addresses urban housing shortage among the Economically Weaker Section (EWS)/Low Income Group (LIG) and Middle-Income Group (MIG) categories including the slum dwellers.

- Economically Weaker Section (EWS): with a maximum annual family income of Rs. 3,00,00.

- Low Income Group (LIG): with maximum annual family income of Rs. 6,00,000) and

- Middle Income Groups (MIG I & II): with a maximum annual family income of Rs. 18,00,000)

- A beneficiary family will comprise husband, wife, unmarried sons and/or unmarried daughters.

- The Mission addresses urban housing shortage among the Economically Weaker Section (EWS)/Low Income Group (LIG) and Middle-Income Group (MIG) categories including the slum dwellers.

Passenger Name Record (PNR) Information Regulations, 2022

The Central Board of Indirect Taxes and Customs (CBIC) notified the Passenger Name Record (PNR) Information Regulations, 2022 under the Customs Act, 1962.

- According to the regulations, airlines must share details of international travellers collected in their normal course of business with the National Customs Targeting Centre – Passenger (NCTCP), an authority established by the Board to process passenger details.

- The details are collected to prevent, detect, investigate, and prosecute offences under the Customs Act, 1962.

What are the Key Features of the Regulations?

- Details to be Shared:

- Airlines must share details such as name, PNR record, date of ticket reservation, date of travel, all contact information, and baggage information with the NCTCP, at least 24 hours before the departure time.

- Information Sharing:

- NCTCP may share passenger details upon request with other law enforcement agencies or government departments if they are required in relation to a violation of a national or international law.

- Protection of Information:

- Information collected by NCTCP shall be protected, processed, and disseminated by authorised officers only.

- Revealing details such as a person’s race, religion, political opinions, trade union membership, health or sexual orientation is not permitted.

- Retention of Data:

- The details shall be retained for up to 5 years, unless they are required for an investigation, prosecution, or a court proceeding.

- The details will be anonymised after 5 years.

- Details may be ‘depersonalised’ by an authorised officer if it is required for further analysis in connection with an identifiable case, threat, or risk.

Aeromedical Evaluation of Transgender Pilot Applicants

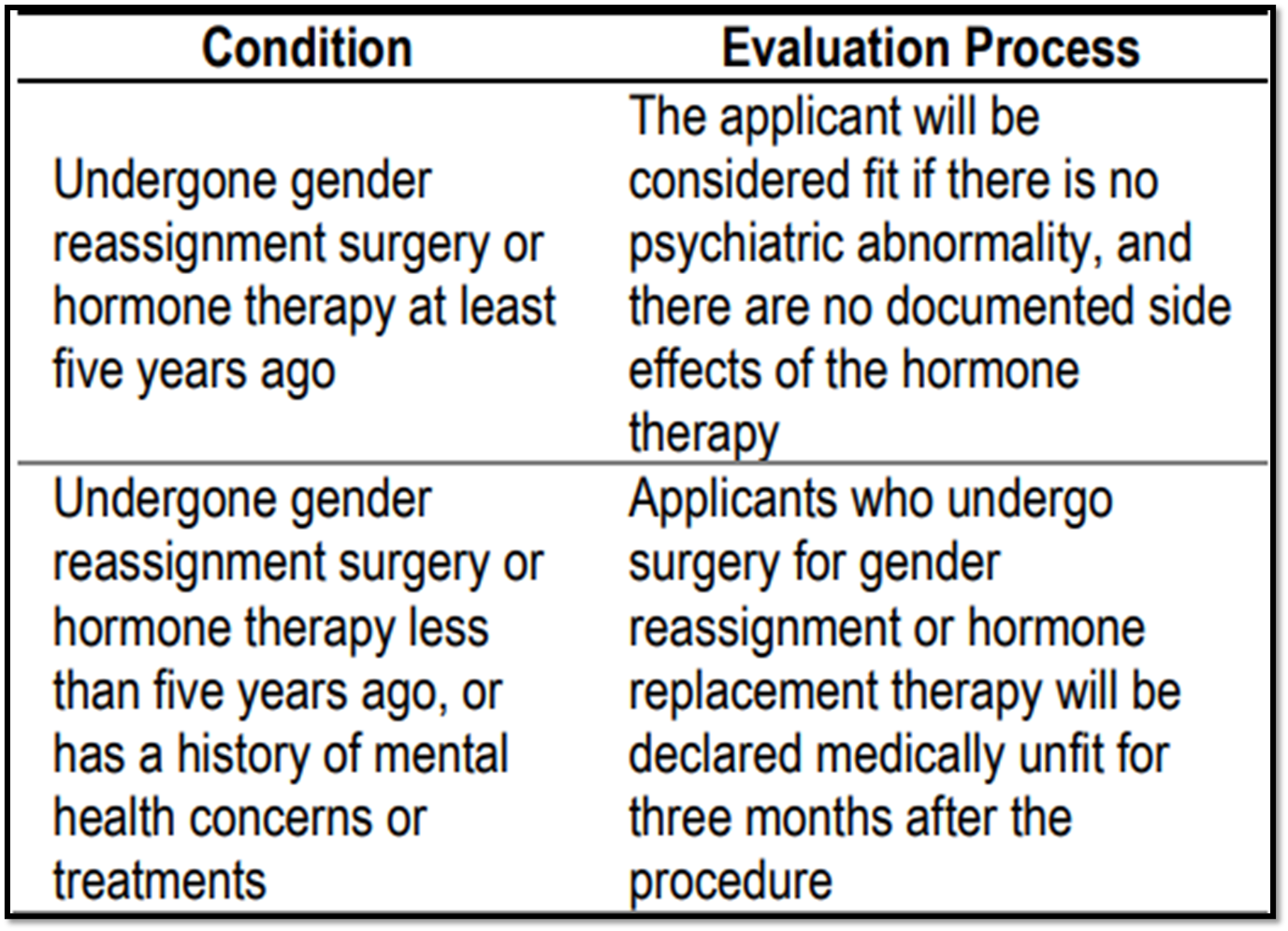

The Directorate General of Civil Aviation (DGCA) released guidelines for medical examiners to conduct aeromedical evaluation of transgender pilot applicants.

- Transgender individuals refer to those who seek to undergo social transition from their assigned gender at birth.

What are the Guidelines?

- Registration Process:

- Transgender applicants will register on the e-Governance for Civil Aviation (eGCA) portal as per the gender on their Certificate of Identity.

- Such candidates would be declared temporarily unfit by medical assessors for further review at the Institute of Aerospace Medicine (IAM) of the Indian Air Force.

- Transgender applicants will register on the e-Governance for Civil Aviation (eGCA) portal as per the gender on their Certificate of Identity.

- Evaluation:

Economy

Benami Property Transactions Act, 1988

Recently, the Supreme Court struck down certain provisions of the Prohibition of Benami Property Transactions Act, 1988.

What is the Benami Property Transactions Act, 1988?

- Benami transactions include transactions where a property is held by or transferred to a person for which the consideration was paid by another person.

- Prior to the 2016 amendment the act, it barred persons from entering into a benami transaction, provided for confiscation of benami properties, and a penalty of imprisonment of up to three years or a fine or both.

- Exemptions were provided in cases such as purchase of property by a person in the name of his wife or unmarried daughter.

- The act was amended in 2016 and was renamed as Prohibition of Benami Property Transaction Act, 1988.

- The 2016 amendment removed this exemption (purchase of property in the name of wife or unmarried daughter) and retained the penalty.

- This was deemed to have been applicable for benami transactions entered into between 1988 and 2016.

- The 2016 amendment removed this exemption (purchase of property in the name of wife or unmarried daughter) and retained the penalty.

What did the Supreme Court Rule?

- The Supreme Court made the following observations:

- Criminal Intent & Benami Transaction:

- The unamended Act (Prior to 2016) was devoid of criminal intent on the part of the person entering into benami transactions.

- However, it criminalized the act of one person paying consideration for acquisition of property for another person.

- This created a harsh provision with strict liability.

- However, it criminalized the act of one person paying consideration for acquisition of property for another person.

- The criminal provision of the unamended Act along with confiscation proceedings were overly broad and operated without adequate safeguards in place.

- Therefore, the court held the criminal provisions and confiscation proceedings under the unamended Act as unconstitutional.

- The unamended Act (Prior to 2016) was devoid of criminal intent on the part of the person entering into benami transactions.

- Criminal Intent & Benami Transaction:

- Retrospective Punishment for Benami Transactions:

- The Supreme Court held the “retrospective punishment for entering into the benami transaction between 1988 and 2016” as unconstitutional as it violated Article 20 (1) of the Constitution.

- Article 20 (1) states that no person shall be convicted for an offence if a law was not violated at the time of commission of the act.

- The Court ruled that criminal prosecution or confiscation proceedings for transactions prior to the 2016 amendment Act cannot continue and can only be applied prospectively.

- The Supreme Court held the “retrospective punishment for entering into the benami transaction between 1988 and 2016” as unconstitutional as it violated Article 20 (1) of the Constitution.

RBI’s Regulatory Framework for Digital Lending

The Reserve Bank of India (RBI) released the regulatory framework for digital lending based on the report of the Working Group on Digital Lending.

- It focuses on RBI regulated entities (such as banks) and lending service providers (LSP) engaged by such entities for credit facilitation services.

What are the Key Features of the Framework?

- Consumer Protection:

- Loan Disbursals and Repayments:

- All loan disbursals and repayments are to be executed between the bank accounts of the borrower and the regulated entity.

- Loans cannot be passed through or pooled in the account of an LSP or any other third party.

- Payment:

- Any fees or charges payable to the LSP will be paid by the regulated entity and not by the borrower.

- Loan Disclosure:

- An all-inclusive cost of digital loans is required to be disclosed to the borrower.

- An automatic increase in credit limit without the explicit consent of the borrower has been prohibited under the framework.

- An all-inclusive cost of digital loans is required to be disclosed to the borrower.

- Grievance Redressal Officer:

- Regulated entities and their LSPs should have a suitable nodal grievance redressal officer for addressing fintech/digital lending related complaints.

- Loan Disbursals and Repayments:

- Data Protection:

- Data Collection:

- Data collected by digital lending applications should be need-based, have a clear audit trail, and be done with the explicit consent of the borrower.

- Borrower’s Control:

- Borrowers may be provided with an option to accept or deny the consent for use of specific data.

- The borrower should also be provided with the options to revoke previously granted consent and delete their data.

- Data Storage:

- All data should be stored in servers located in India.

- Data Collection:

- Reporting Requirements:

- Credit Information Companies:

- All loans sourced through digital lending applications must be reported to Credit Information Companies (CICs).

- All new digital lending products extended by regulated entities over merchant platforms, which involve short-term credit or deferred payment, must be reported to CICs.

- Credit Information Companies:

What is Digital Lending?

- It consists of lending through web platforms or mobile apps, by taking advantage of technology for authentication and credit assessment.

- Banks have launched their own independent digital lending platforms to tap into the digital lending market by leveraging existing capabilities in traditional lending.

Overseas Investment Regulations

- The Reserve Bank of India (RBI) notified the Foreign Exchange Management (Overseas Investment) Regulations, 2022 under the Foreign Exchange Management Act, 1999.

- It seeks to regulate debt investment by Indian entities in foreign entities.

What are the Key Features of the Regulations?

- Financial Commitment by Indian Entities:

- An Indian entity may lend or invest in any debt instrument issued by a foreign entity, if the Indian entity:

- is eligible to make Overseas Direct Investment (ODI).

- has made ODI in the foreign entity.

- has acquired control in such foreign entity at the time of making the financial commitment.

- Loans given by the Indian entity should be backed by a loan agreement where the interest rate shall be charged on an Arm’s Length Basis.

- Arm’s length basis means a transaction between two related parties that is conducted so that there is no conflict of interest.

- An Indian entity may lend or invest in any debt instrument issued by a foreign entity, if the Indian entity:

- Guarantee Extension:

- Guarantees can be extended by the Indian entity to the foreign entity or any of its subsidiaries where the Indian entity has acquired control.

- Such guarantees include:

- Corporate or Performance Guarantee by an Indian entity.

- Corporate or Performance Guarantee by a group company of the Indian entity.

- Bank Guarantee issued by a bank in India.

- Reporting Requirements:

- An Indian resident who has made any investment or disinvestment in a foreign entity shall report certain details through designated banks which includes:

- Whether the financial commitment is reckoned towards the financial commitment limit.

- Disinvestment transaction within 30 days of receiving disinvestment proceeds.

- Restructuring within 30 days from the date of such restructuring.

- An Indian resident who has made any investment or disinvestment in a foreign entity shall report certain details through designated banks which includes:

Biodiversity & Environment

The Energy Conservation (Amendment) Bill, 2022

- The Energy Conservation (Amendment) Bill, 2022 was introduced in and passed by Lok Sabha.

- It seeks to amend the Energy Conservation Act, 2001, which promotes energy efficiency and conservation.

What are the Key Features of the Bill?

- Obligation to Use Non-Fossil Sources of Energy:

- The Act empowers the central government to specify energy consumption standards.

- The Bill adds that the government may require the designated consumers to meet a minimum share of energy consumption from non-fossil sources.

- Different consumption thresholds may be specified for different non-fossil sources and consumer categories.

- Designated consumers include:

- Industries such as mining, steel, cement, textile, chemicals, and petrochemicals.

- The transport sector including Railways.

- Commercial buildings, as specified in the schedule.

- Failure to meet the obligation for use of energy from non-fossil sources will be punishable with a penalty of up to Rs 10 lakh.

- Carbon Trading:

- The Bill empowers the central government to specify a carbon credit trading scheme.

- Carbon credit implies a tradeable permit to produce a specified amount of carbon emissions.

- The central government or any authorized agency may issue carbon credit certificates to entities registered under and compliant with the scheme.

- The entities will be entitled to purchase or sell the certificate.

- Any other person may also purchase a carbon credit certificate on a voluntary basis.

- The Bill empowers the central government to specify a carbon credit trading scheme.

- Energy Conservation Code for Buildings:

- The 2001 Act empowers the central government to specify energy conservation codes for buildings. The code prescribes energy consumption standards in terms of area.

- The Bill amends this to provide for an ‘energy conservation and sustainable building code’.

- This new code will provide norms for energy efficiency and conservation, use of renewable energy, and other requirements for green buildings.

- The 2001 Act empowers the central government to specify energy conservation codes for buildings. The code prescribes energy consumption standards in terms of area.

- Applicability to Residential Buildings:

- Under the Bill, the new energy conservation and sustainable building code will also apply to the office and residential buildings.

- The Bill also empowers the state governments to lower the load thresholds.

- Standards for Vehicles and Vessels:

- Under the Act, the energy consumption standards may be specified for equipment and appliances which consume, generate, transmit, or supply energy.

- The Bill expands the scope to include vehicles (as defined under the Motor Vehicles Act, 1988), and vessels (includes ships and boats).

- The failure to comply with standards will be punishable with a penalty of up to Rs 10 lakh.

- Under the Act, the energy consumption standards may be specified for equipment and appliances which consume, generate, transmit, or supply energy.

Battery Waste Management Rules, 2022

The Ministry of Environment, Forest and Climate Change notified the Battery Waste Management Rules, 2022, under the Environment (Protection) Act, 1986.

- These rules replace the Batteries (Management and Handling) Rules, 2001 and lay down the standards for management of various types of waste batteries.

What are the Key Features of the Bill?

- Extended Producer Responsibility (EPR):

- The bill puts the liability on the producers of batteries to ensure the collection, recycling, and refurbishment of the Waste Batteries.

- The Extended Producer Responsibility (EPR) targets are specific to the kind of battery (Lithium-ion, Lead-acid etc) within each type of battery- portable, automotive, electric, and industrial.

- EPR mandates the minimum use of domestically recycled materials in a new battery.

- The bill puts the liability on the producers of batteries to ensure the collection, recycling, and refurbishment of the Waste Batteries.

- Responsibilities of Consumers:

- The Consumers should ensure:

- Discarding waste batteries separately from other types of waste

- Disposal of waste batteries by giving it to an entity engaged in collection, refurbishment, or recycling.

- The Consumers should ensure:

- Committee for Implementation:

- The central government will constitute a Committee to recommend measures to the Ministry of Environment, Forest and Climate Change for implementation of the Rules.

- The Central Pollution Control Board (CPCB) will chair the Committee.

- Centralised Online Portal:

- The CPCB will create a centralized online portal for the registration and return filing of waste batteries.

- The portal will facilitate the generation and exchange of the EPR certificates between the producers and recyclers/refurbishers to meet the producer’s obligations.

- Environmental Compensation will be levied by CPCB on entities in violation of the Rules.

- The CPCB will create a centralized online portal for the registration and return filing of waste batteries.

Conservation of Coastal Ecosystems

The Comptroller and Auditor General of India (CAG) released its audit report on ‘Conservation of Coastal Ecosystems’.

What are the Key Findings & Observations of CAG Report?

- Institutional Framework:

- Findings:

- CAG noted that the National Coastal Zone Management Authority (NCZMA) has failed to carry out its functions due to an ad-hoc status and manpower constraints.

- The NCZMA was constituted by the Ministry of Environment, Forests and Climate Change as an ad-hoc body for protecting coastal environment.

- The role of NCZMA has also shrunk to mere deliberations or decision making on reclassification of Coastal Regulation Zone (CRZ).

- CAG noted that the National Coastal Zone Management Authority (NCZMA) has failed to carry out its functions due to an ad-hoc status and manpower constraints.

- Recommendations:

- The NCZMA and State Coastal Zone Management Authorities (SCZMAs) to be made permanent bodies with full-time members.

- Findings:

- Project Clearances:

- Findings:

- Certain projects improved despite inadequacy in Environmental Impact Assessment (EIA) reports, which includes:

- Preparation of EIA reports by nonaccredited consultants.

- Use of outdated baseline data.

- Insufficient analysis of environmental impact in EIA.

- Other issues in project approval:

- Non-verification of information provided by private consultants

- Deficiencies in public hearings (where people express their concerns about the environmental impact of the project)

- Certain projects improved despite inadequacy in Environmental Impact Assessment (EIA) reports, which includes:

- Recommendations:

- The Ministry ensures in-depth ecological evaluation of projects by project proponents before granting them clearances.

- Project proponents refer to agencies that propose to establish a project.

- The Ministry ensures in-depth ecological evaluation of projects by project proponents before granting them clearances.

- Findings:

Why did the CAG conduct this Audit?

- The CAG has a constitutional mandate to investigate and report on publicly funded programmes.

- The CAG conducted “pre-audit studies” and found that there were large-scale Coastal Regulation Zone (CRZ) violations in the coastal stretches.

- Coastal land up to 500 metres from the High Tide Line (HTL) and a stage of 100m along banks of creeks, lagoons, estuaries, backwater and rivers subject to tidal fluctuations is called Coastal Regulation Zone (CRZ).

- The media reported incidents of illegal construction activities (reducing beach space) and effluent discharged by local bodies, industries, and aquaculture farms that prompted a detailed investigation.

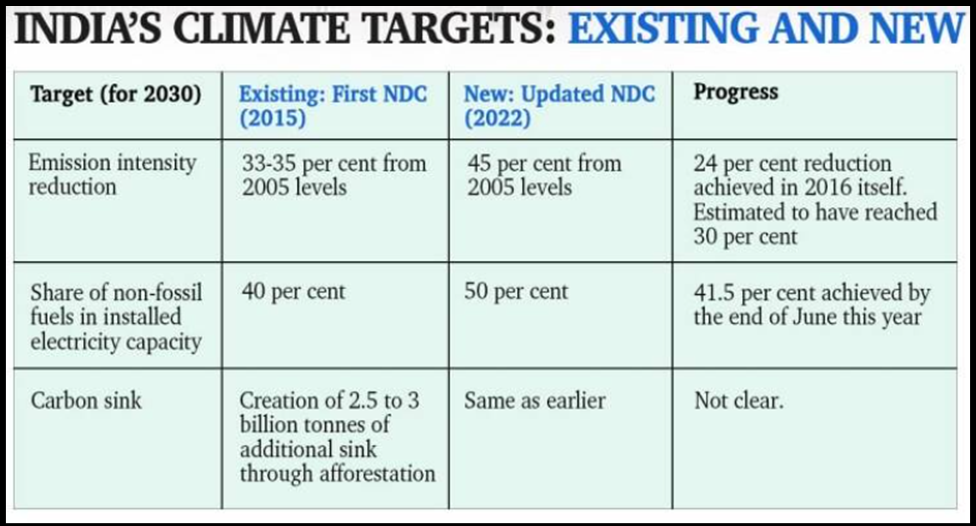

Nationally Determined Contribution

The Union Cabinet approved India’s updated Nationally Determined Contribution (NDC).

- At the UNFCCC COP 26, held at Glasgow, UK in 2021, India announced certain revised targets to be achieved by 2030.

What do we know about Nationally Determined Contributions?

- About:

- NDCs are efforts by each country to reduce national emissions and adapt to the impacts of climate change.

- The Paris Agreement requires each party to prepare, communicate and maintain successive nationally determined contributions that it intends to achieve.

- Parties shall pursue domestic mitigation measures, with the aim of achieving the objectives of such contributions.

- NDCs are submitted every five years to the UNFCCC secretariat.

- In order to enhance the ambition over time, the Paris Agreement provides that successive NDCs will represent a progression compared to the previous NDC and reflect its highest possible ambition.

- India’s Updated NDCs:

- Emission Intensity:

- At least 45% reduction in emissions intensity of Gross Domestic Product (Emissions per unit of GDP) from 2005 levels.

- The existing target was a 33% - 35% reduction.

- At least 45% reduction in emissions intensity of Gross Domestic Product (Emissions per unit of GDP) from 2005 levels.

- Electricity Generation:

- At least 50% of installed electricity generation capacity in 2030 would be based on non-fossil fuel-based sources.

- This is an increase from the existing 40% target.

- At least 50% of installed electricity generation capacity in 2030 would be based on non-fossil fuel-based sources.

- Other NDCs of India:

- Increase non-fossil energy capacity to 500 GW (gigawatts) by 2030.

- Reduce the total projected carbon emissions by 1 billion tonnes (BT) by 2030.

- Achieve net zero carbon by 2070.