Repo Rate Unchanged

Why in News

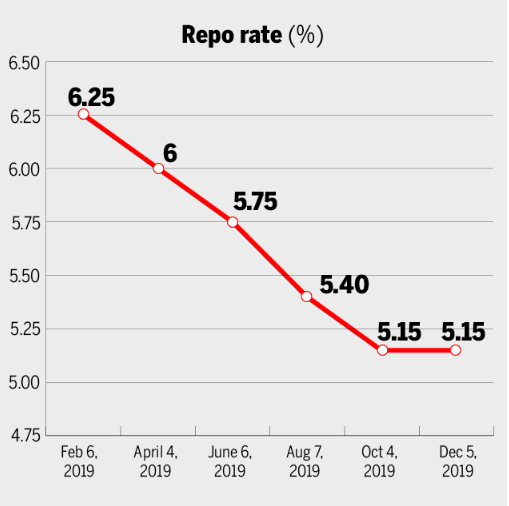

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has decided to keep the repo rate unchanged at 5.15% in the recent bimonthly policy review.

- This is the first bi-monthly monetary meeting in the year 2019 in which the repo rate has been kept unchanged. Since February 2019, the RBI has cumulatively cut rates by 135 basis points (bps).

- The market was expecting the central bank to cut the repo rate further owing to the weak economic growth rate.

- The repo rate has been kept unchanged owing to inflation pressure.

- The RBI has revised its inflation forecast for the second half of the 2019-20 to 4.7-5.1% from earlier 3.5-3.7%.

- The RBI has also slashed its GDP growth forecast for 2019-20 from 6.1% projected earlier to 5%.

Monetary Policy Committee

- The Monetary Policy Committee is a statutory and institutionalized framework under the Reserve Bank of India Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- The Governor of RBI is ex-officio Chairman of the committee.

- The MPC determines the policy interest rate (repo rate) required to achieve the inflation target (4%).

- An RBI-appointed committee led by the then deputy governor Urjit Patel in 2014 recommended the establishment of the Monetary Policy Committee.

Repo rate

- It is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds.

- It is used by monetary authorities to control inflation.

- In the event of inflation, central banks increase repo rate as this acts as a disincentive for banks to borrow from the central bank. This ultimately reduces the money supply in the economy and thus helps in arresting inflation.

- The central bank takes the contrary position in the event of a fall in inflationary pressures.

- Ideally, a low repo rate should translate into low-cost loans for the general masses. When the RBI slashes its repo rate, it expects the banks to lower their interest rates charged on loans.

Current Economic Scenario

- Headline inflation spiked above the 4% medium-term target in October, 2019.

- The food and fuel inflation form one of the components of headline inflation in India.

- The increase was largely due to increase in food prices as fuel group prices have been in deflation for four months in a row.

- Headline Inflation is different from Core Inflation. Core Inflation excludes volatile goods from the basket of commodities tracking Headline Inflation. These volatile commodities mainly comprise food and beverages (including vegetables) and fuel and light (crude oil).

- Manufacturing has seen a 1% contraction in the second quarter after almost a flat first quarter. This is clearly reflected in capacity utilisation of the industry that has dropped to 68.9% in July-September 2019 compared with 73.6% in April-June 2019.

- The output in eight core industries — which make up 40% of the Index of Industrial Production (IIP)— contracted for the second consecutive month in October 2019.

RBI’s Stand

- Several measures already initiated by the Government and the monetary easing undertaken by the Reserve Bank since February 2019 are gradually expected to further feed into the real economy.

- The focus must be on the need to maximise the impact of rate reductions.

- The Weighted Average Lending Rate (WALR) of scheduled commercial banks between December 2018 and October 2019 increased by 5 basis points bps against a cumulative policy rate cut to the tune of 135 bps. This implies that retail borrowers are yet to experience reduction in commercial lending rates of banks. For them, the cost of borrowing has yet not come down.

- Data on corporate finance and on projects sanctioned by banks and financial institutions suggest some early signs of recovery in investment activity, though its sustainability needs to be watched closely. The need at this juncture is to address impediments, which are holding back investments.

- The introduction of external benchmarks is expected to strengthen monetary transmission. In this context, there is also a need for greater flexibility in the adjustment in interest rates on small saving schemes.

- The forthcoming union budget (2020-21) will provide better insight into further measures to be undertaken by the Government and their impact on growth.