-

Q. Critically evaluate the effect of financial inclusion initiatives on improving access to banking services in rural and remote regions of India.(150 words)

09 Apr, 2025 GS Paper 3 EconomyApproach

- Introduce the definition of financial inclusion as ensuring access to affordable financial services for all.

- Critically evaluate the impact of financial inclusion initiatives, focusing on improvements in banking services, while addressing challenges.

- Conclude suitably

Introduction

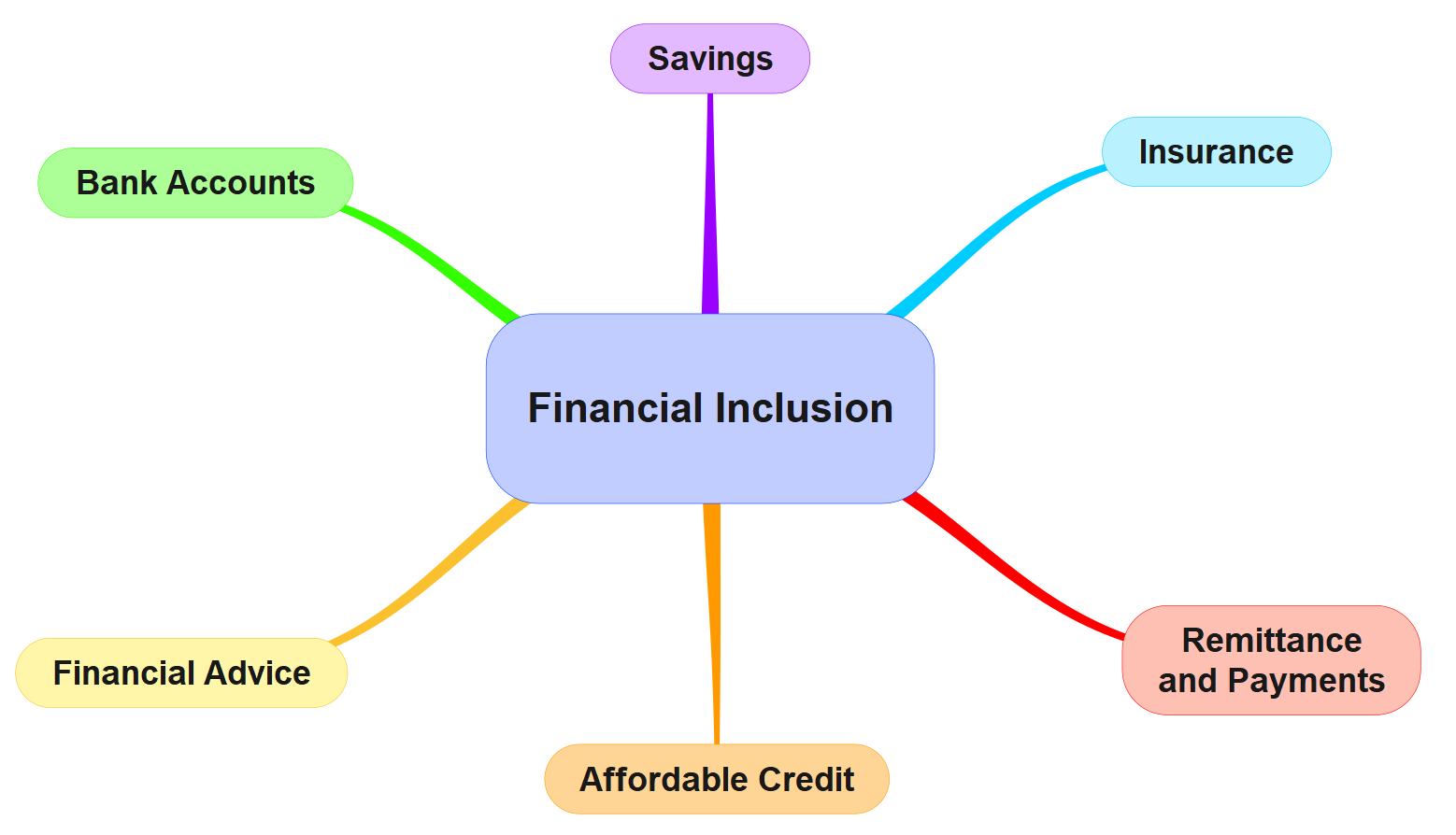

Financial inclusion is the process of providing affordable, accessible financial services like savings, credit, and insurance to all individuals, particularly vulnerable and low-income groups, in a fair and transparent manner. Initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY), banking correspondents, and mobile banking have built upon this vision, aiming to provide accessible financial services.

Body

Financial Inclusion Initiatives in India

- Increased Bank Account Ownership: PMJDY led to the opening of over 54 crore bank accounts, with a significant share in rural areas. This has expanded the basic access to banking services.

- Financial inclusion through zero-balance accounts, facilitating insurance coverage.

- Expansion of Banking Touchpoints: The Business Correspondent model has extended banking services to over 6 lakh villages, reducing the physical distance to access banks.

- Example: Gramin Bank's agents reach isolated villages, offering services like savings, micro-insurance, and remittances.

- Direct Benefit Transfers (DBT): DBT has enabled targeted transfer of government subsidies (e.g., LPG, pensions, MGNREGA wages) directly into bank accounts, reducing leakages and improving efficiency in rural areas.

- DBT to bank accounts reduce inefficiencies in subsidies, with DBT saving over ₹63,000 crore in FY 22-23.

- Growth in Digital Financial Services: The UPI ecosystem, mobile wallets, and Aadhaar-enabled Payment Systems (AePS) have enabled even rural citizens to conduct cashless transactions.

- Key Enabler for Sustainable Development Goals (SDGs): Financial inclusion supports 7 out of the 17 SDGs, including gender equality, with 55.6% of PMJDY account holders being women, promoting women’s empowerment.

Challenges Hindering Financial Inclusion Effort

- Demand Side Factors: Many poor individuals lack regular income or savings, making them ineligible for bank loans or credit cards. E.g., informal workers often fail to meet KYC or minimum balance norms.

- Limited awareness means schemes like PM Jan Dhan Yojana remain underused beyond basic transfers.

- Additionally, high charges by fintech apps like hidden fees in instant loan apps discourage regular use.

- Supply Side Challenges: Banks are often unwilling to serve low-value, non-profitable consumers with irregular income.

- E.g. Banks avoid opening branches in remote areas with limited demand. Irregular income patterns of such customers also increase the perceived credit risk.

- Digital divide: Poor internet connectivity and frequent power failures, especially in remote areas, hinder access to banking services.

- As of 2021, India's internet penetration rate was about 47%, leaving over half the population without access. Rural internet penetration is only 37% as of 2023

- Lack of Financial Literacy: Poor financial understanding leading to dormant or zero-balance accounts (e.g., 20% of PMJDY accounts are dormant).

Path to Ensure Financial Inclusion

- Promote Financial Penetration: The RBI, in collaboration with banks and educational institutions, can integrate financial literacy into the curriculum at all levels of education, from schools to universities.

- Optical Fiber Network Programme of India needs to be further streamlined to ensure access to Internet connectivity all across the country.

- Leverage Fintech Innovations: Fintech solutions, including mobile banking, digital payment systems, and alternative credit scoring models, can provide cost-effective and scalable financial services.

- For example, mobile-based apps like Paytm and PhonePe are making digital payments accessible in rural and remote areas, while platforms like Lendingkart are using data analytics to offer small loans to small businesses without traditional credit histories.

- Tailored Financial Products: Financial institutions can develop customized products that meet the specific needs of low-income groups, such as micro-insurance, affordable pension schemes, and low-interest loans.

- For instance, the PM Atal Pension Yojana provides a pension plan for workers in the unorganized sector.

Conclusion

Financial inclusion initiatives have made significant strides in improving banking access in rural India, particularly through PMJDY, digital platforms, and BC model. Strengthening digital literacy, improving internet infrastructure, and targeting financial inclusion policies towards vulnerable groups are essential for sustained growth in rural financial inclusion.

To get PDF version, Please click on "Print PDF" button.

Print PDF