-

Q. To what extent has India's federal fiscal architecture been able to address regional economic disparities? Analyze with reference to recent reforms in center-state financial relations. (250 words)

29 Jan, 2025 GS Paper 3 EconomyApproach

- Introduce the answer by briefing India's federal fiscal structure

- Delve into how Fiscal Federalism has addressed Regional Economic Disparities

- Highlight the gaps that still remain

- Suggest a Way Forward

- Conclude by stressing upon to what extent it has been addressed regional economic disparities and way ahead.

Introduction

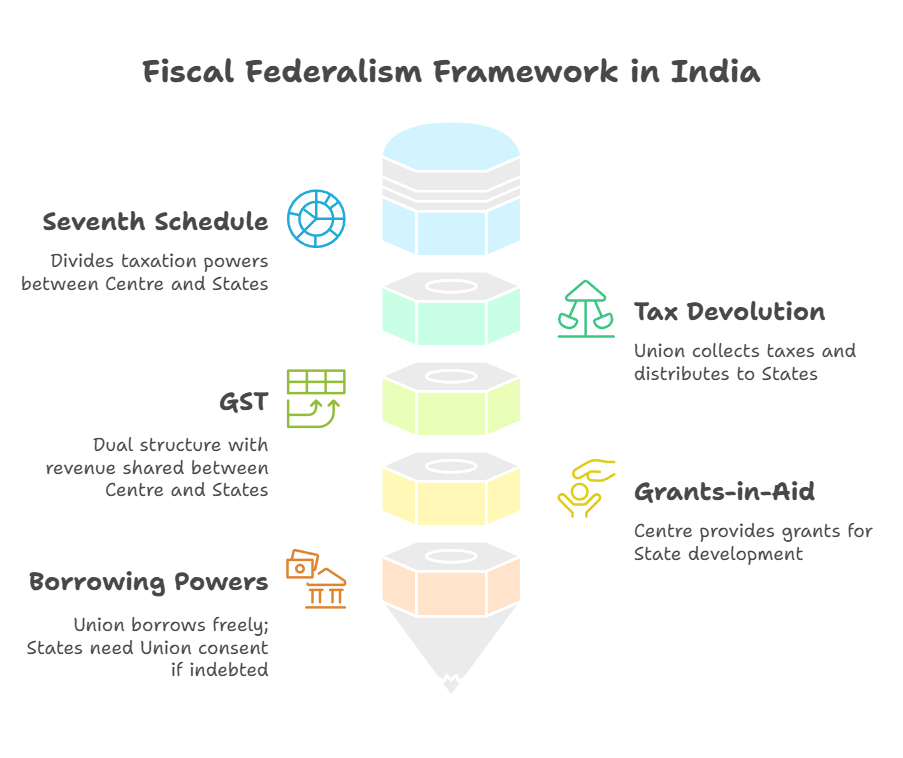

India’s federal fiscal structure, as outlined in the Constitution, aims to balance financial resources between the Centre and States to promote equitable economic growth.

- However, despite mechanisms such as tax devolution (Article 270), grants-in-aid (Article 275), and Finance Commission recommendations (Article 280), regional economic disparities persist.

Body

Fiscal Federalism Addressing Regional Economic Disparities :

- Increased Tax Devolution: Post 14th FC (2015-20), states' share in central taxes rose from 32% to 42% (later revised to 41%).

- Greater fiscal autonomy for states in prioritizing expenditures.

- Goods and Services Tax (GST) Implementation (2017): Unified tax structure, reducing cascading effects.

- GST Council (Article 279A) ensures cooperative federalism in taxation.

- Grants & Centrally Sponsored Schemes (CSS): Specific grants for disaster relief, health, and rural development.

- Shift from Plan and Non-Plan Expenditure to sectoral funding.

- Borrowing & Fiscal Responsibility: Fiscal Responsibility and Budget Management (FRBM) Act limits deficits but allows flexibility in crises (e.g., COVID-19).

- States allowed additional borrowing (up to 5% of GSDP) under Atmanirbhar Bharat Package.

However, significant gaps still exist including:

- Vertical Fiscal Imbalance and Erosion of State Tax Autonomy: The Centre retains taxation power over high-revenue sources (income tax, CGST, foreign transactions), while States primarily rely on SGST and minor local taxes.

- Post-GST, States have limited autonomy in setting tax rates, making them dependent on Union transfers, which are often delayed (e.g., pending GST compensation dues flagged by States).

- Changing Trends in Finance Commission Transfers: The 15th Finance Commission's formula allocates tax transfers based on population (15%), area (15%), income distance (45%), demographic transition (12.5%), forest cover (10%), and tax effort (2.5%).

- The income distance criterion disadvantages economically progressing States like Tamil Nadu and Maharashtra, while favoring historically poorer States.

- This method definitely helps less developed States but creates resentment among high-growth States regarding their fiscal share.

- Decline in Grants-in-Aid and Rise in Cess & Surcharges

- Grants-in-aid have fallen from ₹1.95 lakh crore (2015-16) to ₹1.65 lakh crore (2023-24), reducing discretionary funding for States.

- Cess and surcharge collections increased by 133% (2017-18 to 2022-23), but are not shared with States.

- This has disproportionately impacted poorer States, which rely more on central grants for development projects.

Way Forward

- Greater Fiscal Autonomy for States: Allow States greater flexibility in taxation under GST to cater to regional economic needs. Ensure timely release of GST compensation dues.

- Reforms in Finance Commission Allocations Balance income distance criteria with incentives for high-growth States to maintain inter-State equity.

- Increase untied grants to allow greater State-level fiscal planning.

- Rationalization of Centrally Sponsored Schemes: Rationalise the number of Central Sponsored Schemes (NK Singh Committee) or reduce State co-financing obligations to support financially weaker States.

- Allow State governments greater say in scheme design to ensure region-specific development.

- Revisiting Cess and Surcharge Sharing Mechanism: Institutionalize a framework to share a portion of cess and surcharge revenue with States to reduce fiscal imbalance.

- Enhancing Borrowing Flexibility for Developmental Expenditure: Allow higher borrowing limits for States with responsible fiscal management to finance infrastructure and welfare schemes.

Conclusion

While decent progress has been made in ensuring fiscal transfers, significant gaps remain like increased centralization of revenues, decline in State grants, and borrowing restrictions disproportionately impact less developed States, exacerbating existing inequalities. To achieve equitable growth, reforms should focus on empowering States with greater financial autonomy, fairer revenue-sharing mechanisms, and flexibility in expenditure planning.

To get PDF version, Please click on "Print PDF" button.

Print PDF