-

Q. "Financial inclusion is necessary but not sufficient for inclusive growth." In light of this statement, evaluate India's progress in achieving comprehensive inclusive growth. (250 words)

08 Jan, 2025 GS Paper 3 EconomyApproach

- Introduce the answer by defining Financial inclusion

- Delve into the Significance of Financial Inclusion in Inclusive Growth

- Highlight the Limitations of Financial Inclusion for Inclusive Growth

- Delve into overall Challenges in Achieving Comprehensive Inclusive Growth

- Suggest Measures to Promote Inclusive Growth

- Conclude suitably.

Introduction

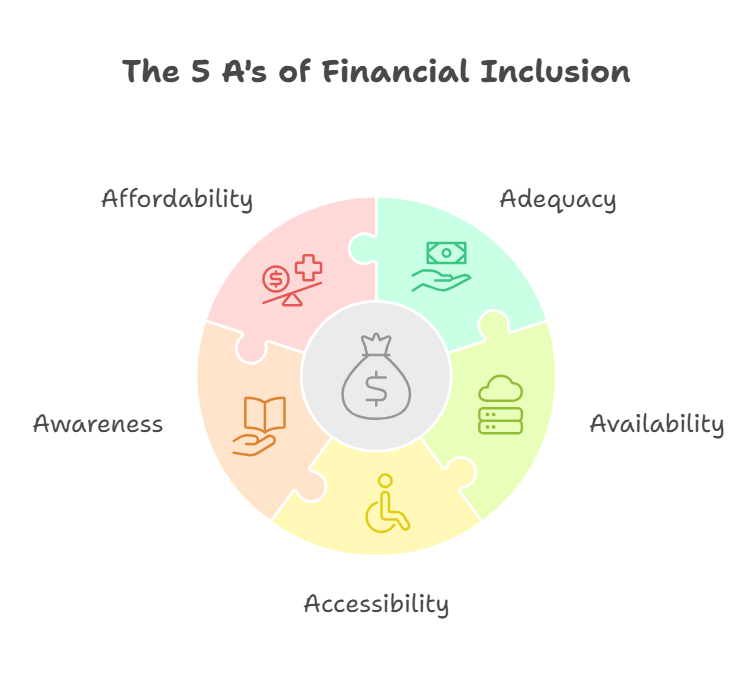

Financial inclusion refers to ensuring that individuals and businesses, especially those from disadvantaged groups, have access to affordable and essential financial services such as banking, payments, credit, insurance, and savings.

Body

Significance of Financial Inclusion in Inclusive Growth:

- Economic Empowerment: Financial inclusion boosts economic participation by enabling access to savings, credit, and insurance. It strengthens entrepreneurship, especially in rural areas.

- Over 50 crore PMJDY accounts opened as of August 2023)

- 63.6% of the total Mudra beneficiaries in the financial year 2023-24 were women entrepreneurs (gender-focused financial inclusion).

- Poverty Alleviation and Social Justice: By ensuring access to welfare benefits and financial credit, financial inclusion reduces income inequalities and uplifts marginalized communities.

- Direct Benefit Transfer of Rs 34 lakh crore from the government using PM-Jan Dhan accounts has led to savings of Rs 2.7 lakh crore.

- The IMF has hailed it as 'a logistical marvel'.

- Direct Benefit Transfer of Rs 34 lakh crore from the government using PM-Jan Dhan accounts has led to savings of Rs 2.7 lakh crore.

- Digital Financial Ecosystem: Financial inclusion has accelerated due to a robust digital infrastructure, promoting convenience and transparency in transactions.

- India tops world ranking in digital payments, records 89.5 million transactions in 2022.

Limitations of Financial Inclusion for Inclusive Growth

- Low Financial Literacy: Financial inclusion is ineffective without sufficient awareness of its benefits, as many accounts remain dormant. (Approximately 20% of PMJDY accounts were dormant as of 2022).

- Regional Disparities: While urban areas benefit, rural and tribal regions lag due to poor infrastructure and connectivity.

- For instance, physical access to banking was the weakest in the North-East, with only 19 branches per 1000 square kilometers in 2020-21.

- Limited Multidimensional Impact: Financial inclusion addresses monetary aspects but does not solve structural challenges in education, healthcare, and skill development.

- Out-of-Pocket Expenditure (OOPE) as a percentage of Total Health Expenditure remains 39.4%, despite schemes like Ayushman Bharat.

Challenges in Achieving Comprehensive Inclusive Growth

- Persistent Poverty and Inequality: The richest 1% of the Indian population owns 53% of the country's wealth, while the poorer half jostles for a mere 4.1%

- Large Informal Workforce: 90% of workers are informal, lacking social security (ILO).

- Regional Disparities: Economic imbalances between states. (Per capita GSDP in Bihar is ~1/5th of Maharashtra).

- Infrastructure Gaps: Insufficient rural roads, education, and healthcare facilities. (A quarter of Indians still do not have access to electricity

Measures to Promote Inclusive Growth:

- Expanding Social Security: Universalization of schemes like Pradhan Mantri Shram Yogi Maandhan, Ayushman Bharat.

- Targeted Subsidies and DBT: Better targeting of subsidies (food, fuel, fertilizers) like JAM trinity for direct transfers.

- Bridging Regional and Sectoral Gaps: Invest in backward regions through infrastructure and social programs.

- World Bank - 10% increase in fixed broadband penetration would increase GDP growth by 1.38% in developing economies

- Education and Health: Strengthen initiatives like Samagra Shiksha and Ayushman Bharat.

Conclusion

While financial inclusion has laid the foundation for inclusive growth by improving financial access and empowering the underserved, it remains insufficient by itself. Comprehensive growth requires simultaneous progress in education, healthcare, employment, and social equity.

To get PDF version, Please click on "Print PDF" button.

Print PDF