-

16 Aug 2024

GS Paper 3

Internal Security

Day 35: The fight against money laundering is a continuous battle, requiring constant adaptation to evolving criminal tactics.Analyze.(250 words)

Approach

- Define money laundering and its global impact.

- Discuss the continuous challenges in the fight against money laundering.

- Mention Anti-Money Laundering (AML) strategies in India.

- Conclude Suitably.

Introduction

Money laundering is a complex process used by individuals and organisations to conceal the origins of illegally obtained money. It involves making illicit funds appear legitimate through a series of transactions. According to the IMF, global money laundering is estimated between 2 to 5% of World GDP.

Body

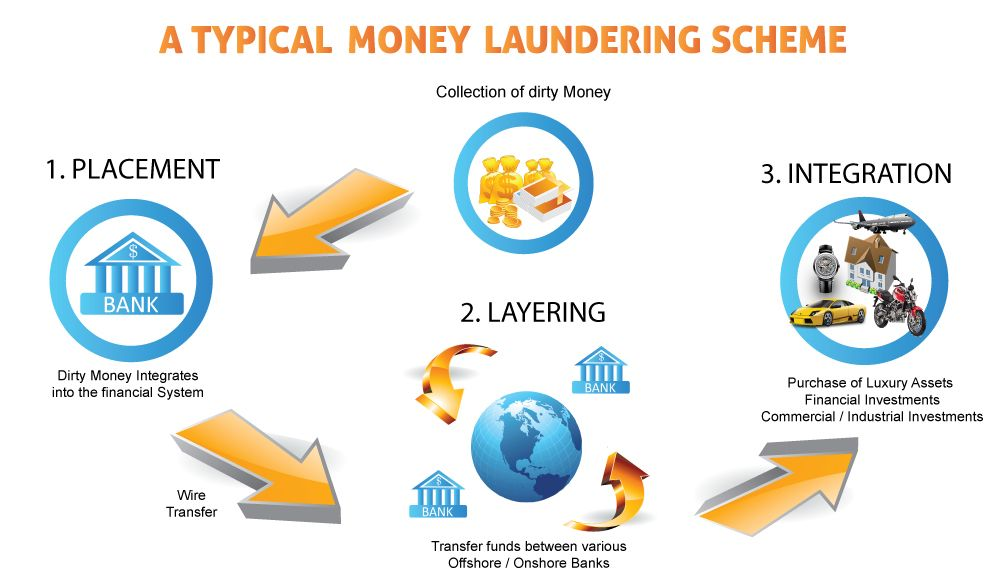

Stages of Money Laundering:

- Placement: The initial stage where illicit funds are introduced into the financial system. This can involve deposits into bank accounts, currency exchanges, or purchases of valuable assets.

- Layering: The process of separating the illicit funds from their source through a series of complex financial transactions. This often involves transferring funds between accounts or across borders to obscure their origin.

- Integration: The final stage where the laundered funds are reintroduced into the economy as legitimate funds. This can involve investing in businesses, purchasing real estate, or other means of legitimising the funds.

Evolving Challenges in the Fight Against Money Laundering :

- Cryptocurrencies and Digital Assets: The rise of cryptocurrencies like Bitcoin and Ethereum has provided new avenues for money laundering. The decentralized and often anonymous nature of these digital currencies makes it challenging to trace transactions and identify the individuals behind them.

- Emergence of Decentralized Finance (DeFi): DeFi platforms, which allow for peer-to-peer financial transactions without intermediaries, have become popular among money launderers.

- Complex Layering Techniques: Criminals often use complex financial structures, such as shell companies, trusts, and offshore accounts, to create multiple layers of transactions. This layering process makes it difficult for authorities to trace the flow of funds back to their original source.

- Regulatory Arbitrage: Money launderers exploit differences in regulatory standards across countries. They may route funds through countries with weaker AML controls, creating challenges for regulators in jurisdictions with stricter laws.

- International Coordination Issues: Money laundering is a transnational crime, and effective enforcement requires cooperation between countries. However, differences in legal frameworks, enforcement capabilities, and political will can hinder international collaboration. Criminals often exploit these differences to move funds across borders, making it difficult for any single country to address the issue comprehensively.

- Lack of Uniformity in anti-money laundering (AML) Regulations: The lack of consistent AML regulations across jurisdictions creates opportunities for criminals to launder money in countries with weaker enforcement. This inconsistency makes it challenging for global financial institutions to implement a uniform AML strategy, as they must navigate varying regulatory environments.

- Limited Resources for Enforcement: Many countries, especially those with smaller economies, may lack the resources to enforce AML regulations effectively. This includes insufficient funding for regulatory bodies, limited access to advanced technologies, and a shortage of trained personnel to detect and investigate money laundering activities.

- Data Sharing and Security: Effective AML efforts often require sharing information across institutions and borders. However, ensuring the security of this data and protecting it from breaches is a significant challenge.

Anti-Money Laundering (AML) Measures in India :

- Prevention of Money Laundering Act (PMLA), 2002: The primary anti-money laundering legislation in India aimed at preventing money laundering and confiscating property derived from laundered money.

- Financial Intelligence Unit-India (FIU-IND) : A government agency responsible for receiving, analyzing, and disseminating information related to suspicious financial transactions.

- The Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976: It covers penalty of illegally acquired properties of smugglers and foreign exchange manipulators and for matters connected therewith and incidental thereto.

- Narcotic Drugs and Psychotropic Substances Act, 1985: It provides for the penalty of property derived from, or used in illegal traffic in narcotic drugs.

- Know Your Customer (KYC) Norms: Guidelines issued by the Reserve Bank of India (RBI) to prevent money laundering by ensuring that financial institutions verify the identity of their customers.

- Enforcement Directorate (ED): A law enforcement agency under the Ministry of Finance tasked with investigating economic crimes, including money laundering.

- India’s Relationship with Financial Action Task Force (FATF): FATF is the global money laundering and terrorist financing watchdog set up in 1989 out of a G-7 meeting of developed nations in Paris.

- India joined with ‘observer’ status in 2006 and became a full member of FATF in 2010.

Conclusion

The fight against money laundering is a continuous and evolving challenge. As criminals develop new techniques and exploit emerging technologies, regulators and financial institutions must constantly adapt their strategies to stay ahead. The complexity of global financial systems, coupled with the transnational nature of money laundering, requires a coordinated and innovative approach. While significant progress has been made, the dynamic nature of this threat means that the battle against money laundering is far from over, necessitating ongoing vigilance and adaptation.