Governance

Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM)

- 13 Dec 2024

- 4 min read

Key Points

|

About PM-SYM Scheme

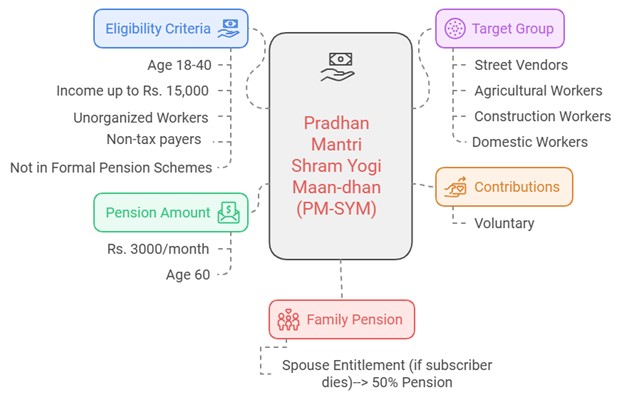

- Eligibility Criteria: Workers must be between 18-40 years of age and have a monthly income of up to Rs. 15,000.

- They should not be tax payers, engaged in Organised Sector or part of any formal pension schemes like New Pension Scheme (NPS), Employees’ State Insurance Corporation (ESIC) scheme or Employees’ Provident Fund Organisation (EPFO).

- Pension Amount: The scheme offers an assured pension of Rs. 3000/month once the subscriber reaches 60 years of age.

- Voluntary and Contributory: It is a voluntary and contributory pension scheme where both the subscriber and the government contribute equally to the pension fund.

- Target Group: The scheme targets unorganised workers engaged in occupations like street vendors, agricultural workers, construction workers, domestic workers, and more, who are earning less than Rs. 15,000 a month.

- Family Pension: If the subscriber dies during the receipt of pension, the spouse is entitled to a family pension of 50% of the subscriber's pension.

- Grievance Redressal: A 24/7 customer care helpline and an online portal/app are available for registering complaints or grievances.

What are the Other Key Details of the PM-SYM Scheme?

- Equal Contribution Model: The scheme works on a 50:50 contribution model, where the subscriber and the government each contribute an equal amount towards the pension fund.

- Enrollment Process: Eligible workers can register at Common Services Centres (CSCs) with their Aadhaar, mobile number, and bank details.

- Contributions are made via auto-debit from the bank account.

- Pension Pay Out: Once the beneficiary joins the scheme at the entry age of 18-40 years, the beneficiary has to contribute till 60 years of age.

- On attaining the age of 60 years, the subscriber will receive by DBT the assured monthly pension of Rs.3000/- with benefit of family pension, as the case may be.

- Exit and Withdrawal Flexibility: Workers can exit the scheme before 60 and receive their contributions with interest, depending on the duration of participation.

- In case of death or permanent disability, the spouse can continue the scheme or withdraw the funds.

- Grievance Redressal Mechanism: A 24/7 customer care helpline and a web portal/app provide a platform for registering complaints or grievances.

- Pension Fund Management: The scheme is administered by the Ministry of Labour and Employment and implemented through Life Insurance Corporation of India (LIC) and CSC eGovernance Services India Limited (CSC SPV).

Latest Update

|