Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) | 15 Nov 2024

Key Points

|

About PM-KISAN

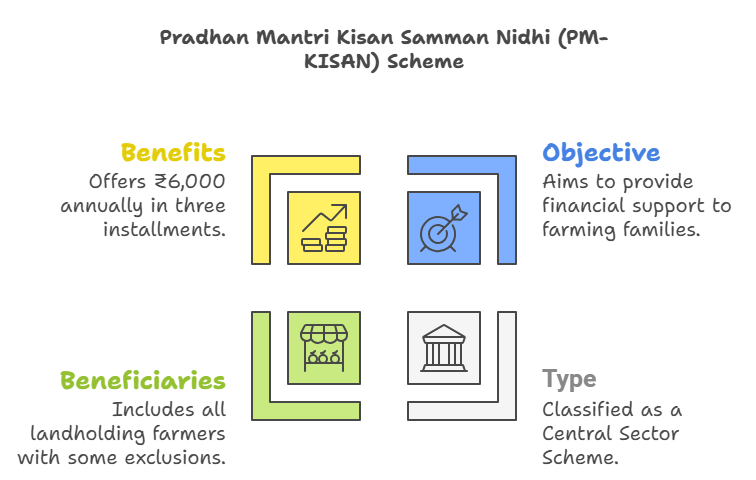

- Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) is a Central-Sector scheme (100% funded by Government of India) launched in December 2018, to provide financial assistance to all land-holding farmer families across India.

What are the Key Features of the PM-KISAN Scheme?

- Income Support: Under PM-KISAN, eligible farmer families receive income support of Rs 6,000 annually, distributed in three equal installments of Rs 2,000 each.

- Direct Benefit Transfer: The scheme ensures that funds are directly transferred to beneficiaries' bank accounts to promote transparency and reduce delays.

- Eligibility: All landholding farmers' families, which have cultivable land holding in their names are eligible to get benefit under the scheme.

- Definition of Family: For the purposes of this scheme, a farmer "family" consists of the husband, wife, and any minor children.

- Beneficiary Identification: The responsibility to identify eligible farmer families rests with State Governments and Union Territory (UT) administrations, following the scheme’s guidelines.

- Implementing Agency: The Department of Agriculture and Farmers Welfare (DA&FW) of the Ministry of Agriculture and Farmers Welfare is the implementing agency.

- The DA&FW works with the Department of Agriculture of all the states and union territories to implement the scheme.

- KCC Linkage: The government linked Kisan Credit Card with PM-KISAN to streamline farmers' access to formal credit, reduce documentation, and make loan processing faster using existing beneficiary data.

What are the Exclusion Categories of the PM-KISAN Scheme?

The PM-KISAN scheme excludes beneficiaries with higher economic status, making them ineligible for benefits.These exclusions are as follows:

- Institutional Landholders: All institutional landholders are not eligible.

- High Economic Status Farmer Families: Families where any member holds, or has held, constitutional posts.

- Former and present Ministers (Central or State), Members of Parliament (Lok Sabha/Rajya Sabha), State Legislative Assemblies/Councils, as well as former/present Mayors of Municipal Corporations and Chairpersons of District Panchayats.

- Government Employees and Pensioners: All serving or retired officers and employees of Central/State Government Ministries, Departments, and field units, including Public Sector Enterprises (PSEs) and autonomous institutions under government and regular employees of local bodies.

- Exclusion does not apply to Multi-Tasking Staff (MTS), Class IV, or Group D employees.

- All retired pensioners with a monthly pension of Rs. 10,000 or more, except MTS, Class IV, or Group D retirees.

- Income Taxpayers: Individuals who paid Income Tax in the last assessment year are excluded from the scheme.

- Professionals: Professionals such as Doctors, Engineers, Lawyers, Chartered Accountants, and Architects registered with professional bodies are also excluded.

Impact of the Scheme

- Income Support for Farmers: With the 18th installment in October 2024, total disbursements surpassed Rs 3.45 lakh crore, benefiting 11 crore farmers. It provides income support to small and marginal farmers, reducing loan dependency.

- Efficient Digital Implementation: The scheme ensures 100% Direct Benefit Transfer through Aadhaar-based verification and real-time payment tracking, minimizing leakages and ensuring transparency.

- Boost to Rural Economy: Regular financial assistance encourages spending on agricultural inputs, healthcare, and education, positively impacting the rural economy and local markets.