Biodiversity & Environment

Stocktaking Climate Finance

- 01 Nov 2023

- 18 min read

This editorial is based on “Stocktaking climate finance — a case of circles in red ink” which was published in The Hindu on 01/11/2023. It talks about the challenges and complexities surrounding climate finance and the urgency of addressing these issues to fulfill commitments and combat climate change effectively.

For Prelims: United Nations Framework Convention on Climate Change (UNFCCC), NDCs, GCF, SCCF, LDCF, UN-REDD Programme, Multilateral Development Banks (MDBs), National Adaptation Fund, Greenwashing, National Clean Energy Fund, Carbon Tax, Global Stocktakes,Clean Development Mechanism.

For Mains: About Climate Finance, Purpose of Climate Finance, Major Sources of Climate Finance, Target for Climate Finance, Main Challenges for Climate Finance, Indian Initiatives for Financing Climate Action ,Next Steps for Climate Finance.

Climate finance is crucial for maintaining trust between developed and developing countries in climate change negotiations. Climate finance is expected to be a prominent issue in the upcoming Conference of the Parties (COP 28) meeting of the United Nations Framework Convention on Climate Change (UNFCCC) in Dubai.

What is Climate Finance ?

- According to the United Nations Framework Convention on Climate Change (UNFCCC), climate finance is local, national or transnational funding from public, private and alternative sources that seek to support climate change mitigation and adaptation actions.

- Essential Components :

- Funding Sources: Climate finance can come from various sources, including public sources such as government funding and international aid and private sources such as investments from the financial and corporate sectors.

- Financial Instruments: Many financial instruments can be used to channel climate finance, including grants, loans, equity investments, and financial instruments such as carbon credits.

- Recipients: Climate finance can be provided to various recipients, including governments, businesses, and civil society organizations.

- Projects and Activities: Climate finance can support various projects and activities contributing to climate change mitigation and adaptation. These may include renewable energy projects, energy efficiency measures, and projects that help build resilience to climate change's impacts.

- Governance and Oversight: Several initiatives and mechanisms have been established to facilitate the flow of climate finance and ensure effective governance and oversight, such as the Green Climate Fund and the Clean Development Mechanism.

What are the Primary Purposes of Climate Finance?

- Mitigation: To fund projects and initiatives that reduce greenhouse gas emissions and mitigate the impacts of climate change. This includes investments in renewable energy, energy efficiency, sustainable agriculture, and other activities that help combat climate change.

- Adaptation: To support measures that help communities and nations adapt to the adverse effects of climate change. This may include investments in infrastructure, disaster resilience, water resource management, and other strategies to reduce vulnerability to climate-related risks.

- Technology Transfer: To facilitate the transfer of environmentally friendly and sustainable technologies from developed to developing countries, enabling the latter to transition to low-carbon, climate-resilient development pathways.

- Capacity Building: To build the capacity of nations and communities to better understand and address climate change, develop and implement climate policies and strategies, and access and manage climate finance effectively.

How much Climate Finance is Needed ?

- Adaptation Financing Gap: The global adaptation financing gap is substantial and growing. Adaptation costs in developing countries are projected to increase to around USD 340 billion per year by 2030 and up to USD 565 billion by 2050.

- Mitigation Financing Gap: The gap for mitigation efforts is even larger, estimated at USD 850 billion per year by 2030.

- The Trillion-Dollar Climate Finance Challenge: The Glasgow Financial Alliance for Net Zero estimates a requirement of at least USD 125 trillion in investments by 2050, approximately USD 5 trillion per year, to achieve net-zero emissions.

- Climate Finance for Developing Countries: The financial needs projected by developing countries in their NDCs, especially in the Global South, are substantial, potentially reaching close to USD 6 trillion until 2030.

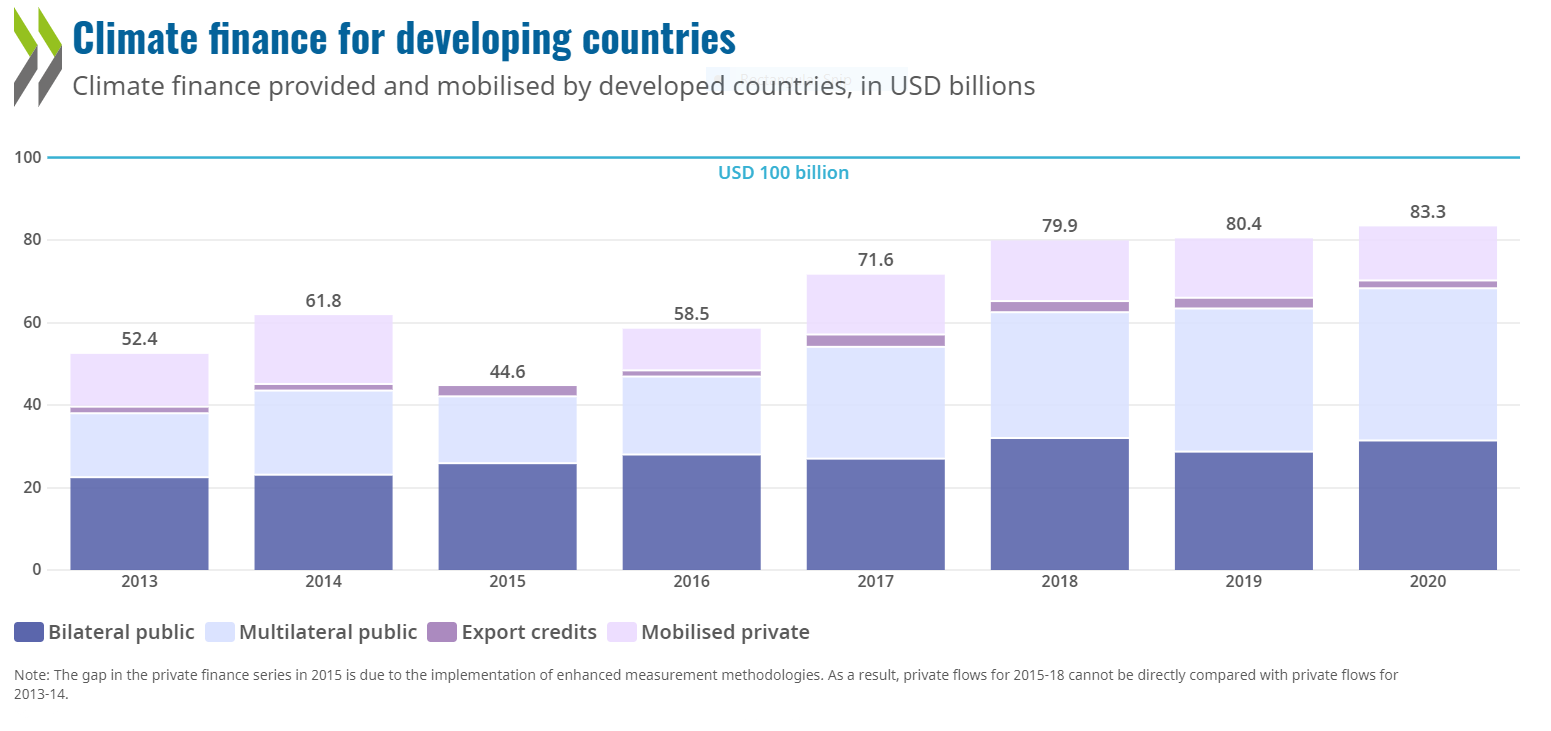

- USD 100 Billion Annual Target: In 2009, at the UNFCCC COP15, developed countries jointly set a target to provide at least USD 100 billion annually to support mitigation and adaptation efforts to address the climate crisis effectively.

What are the Main Sources for Climate Finance ?

Types of Instruments:

- Green bonds : Green Bonds are a kind of debt issued by a public or private institution to use the funds for environmental purposes.

- Debt swaps :These entail the sale of foreign currency debt by the creditor country to an investor which can then swap the debt with the debtor country for the development of mitigation and adaptation projects.

- Guarantees : These are commitments whereby a guarantor promises to fulfill the obligations undertaken by a borrower to a lender in the context of climate change activities.

- Concessional loans : These are loans for climate change mitigation and adaptation activities that differ from traditional loans in that they have longer repayment periods and lower interest rates, among other preferential conditions.

- Grants and donations : These are amounts granted to projects related to the fight against the climate emergency, which do not need to be repaid.

Major Climate Finance Funds :

- Green Climate Fund (GCF): GCF was set up by the UNFCCC in 2010. It is the world's largest fund devoted to helping developing countries reduce their GHG emissions and adapt to the impact of climate change, paying particular attention to the needs of the most vulnerable countries. The GCF plays an essential role in compliance with the Paris Agreement, channeling climate finance to developing countries.

- Special Climate Change Fund (SCCF): Administered by the Global Environment Facility (GEF), it offers four different finance services: adaptation to climate change; technology transfer; energy, transport, industry, agriculture, forestry and waste management; and economic diversification for countries dependent on fossil fuels.

- Least Developed Countries Fund (LDCF) :Administered by the Global Environment Facility (GEF), its purpose is to support the almost 50 countries classified as least developed by the United Nations to tackle their high vulnerability to climate change and implement their national adaptation plans.

- UN-REDD Programme : Created in 2008, also as part of the UN, its objective is to reduce the emissions caused by deforestation and forest degradation in developing countries, helping governments to prepare and implement national REDD+ strategies.

- Bilateral climate finance funds: It includes institutions such as the United States Agency for International Development (USAID), the European Union's Global Climate Change Alliance+ (GCCA+), and the Japan International Cooperation Agency (JICA), etc.

What are the Main Challenges to Climate Financing?

- Funding Shortages:

- The primary challenge in climate financing is the inadequate availability of funds for climate projects, especially in low-income countries.

- Developed countries fell short of the USD 100 billion annual target, having mobilized only USD 79.6 billion at the 26th UN Climate Change conference in Glasgow in 2021.

- Lack in Institutional Capacity:

- Many impoverished countries lack the financial infrastructure necessary to effectively manage and allocate substantial foreign investments into climate projects, potentially causing concerns among investors and destabilizing fragile economies.

- Some experts raise concerns about the capacity of Multilateral Development Banks (MDBs) to meet the world's climate finance needs, particularly their limited expertise in climate-related matters.

- MDBs are criticized for primarily concentrating their financing on climate mitigation, with less focus on assisting businesses and communities in adapting to climate risks.

- Accountability Mechanisms:

- There is currently no established mechanism to hold governments and institutions accountable for fulfilling their climate financing commitments.

- Wealthier nations have been known to either overstate their investment estimates or fail to meet their financial responsibilities.

- "Green funds," which allow private investors to participate in Environmental, Social, and Governance (ESG) investing, do not mandate the disclosure of their investments' carbon footprints or emissions, leading to the problem of greenwashing.

- Greenwashing is when an organization spends more time and money on marketing itself as environmentally friendly than on actually minimizing its environmental impact.

- Measuring Climate Finance:

- Data on climate finance flows are compiled using various methodologies and have varying interpretations.

- Double counting of climate finance can occur when the same funds are reported by multiple parties, leading to an overestimation of the actual financial flows.

- Missing Urgency:

- Unlike the rapid response to the global financial crisis in 2009-10, climate finance transfers currently lack the strong political will, perceived urgency, and global cooperation seen in the financial crisis response.

What are Indian Initiatives for Financing Climate Action ?

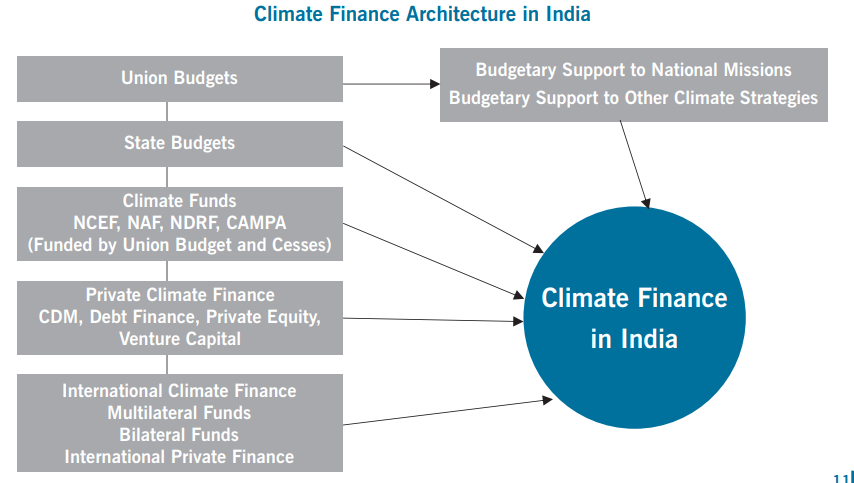

- National Adaptation Fund:

- The fund was established in 2014 with a corpus of Rs. 100 crores with the aim of bridging the gap between the need and the available funds.

- The fund is operated under the Ministry of Environment, Forests, and Climate Change (MoEF&CC).

- National Clean Energy and Environment Fund (NCEEF):

- The NCEEF was established to promote clean energy and environmental projects in India.

- It funds initiatives that help reduce greenhouse gas emissions and improve environmental quality.

- The fund is supported by a cess on coal production and usage.

- Green Climate Fund (GCF) and Adaptation Fund (AF):

- India is eligible to access financial resources from international climate funds like the GCF and AF.

- These funds support climate mitigation and adaptation projects in the country.

- Renewable Energy Financing:

- India has actively promoted renewable energy projects, including solar and wind energy.

- The government offers financial incentives and subsidies to encourage investment in these sectors.

- National Clean Energy Fund (NCEF):

- NCEF was created to support clean energy initiatives and research.

- It provides resources for innovative projects that contribute to low-carbon development.

- Emission Trading System (ETS):

- India has explored the possibility of setting up an ETS to promote carbon trading and incentivize emissions reductions.

- Carbon Tax:

- There have been discussions about the introduction of a carbon tax in India, which could provide additional revenue for climate initiatives.

- Bilateral and Multilateral Agreements:

- India engages in bilateral agreements with countries for climate finance, and it participates in multilateral negotiations to secure funding for climate projects.

What are the Next Steps for Climate Finance ?

- Commit to Climate Finance Targets :

- All bilateral donors must live up to their climate finance commitments and set more ambitious targets.

- The need for integrating climate finance into national development plans and policies is even greater than before

- Enhancing International Cooperation:

- Strengthening collaboration among nations and international organizations is crucial.

- All countries will need to unlock opportunities for low carbon climate resilient infrastructure and other climate-related investments to support recovery and transformation.

- Accountability in MDBs :

- Multilateral Development Banks must better leverage their balance sheets, improve their private sector multipliers and work better as a system.

- Multilateral Development Banks need to accelerate the alignment of their financial support and activities with the Paris Agreement, building on the common framework set out at COP25.

- Supporting Vulnerable Communities:

- Tackling debt distress and excessive debt overhang, especially in poor and climate vulnerable countries, is crucial.

- Targeted efforts should be made to channel finance to the most vulnerable communities and countries, especially those at risk from the adverse impacts of climate change.

- Innovative Financing Mechanisms:

- Exploring innovative financing mechanisms, such as green bonds, carbon pricing, and public-private partnerships, can attract additional funding for climate projects.

- Private capital is not flowing fast enough to finance the low-carbon and climate-resilient transition and is often not aligned to Paris Agreement targets. Moreover, most of the current stock of private sector climate investment is in advanced economies.

- Transparency and Accountability:

- Establishing transparent reporting mechanisms and holding nations accountable for their financial commitments is vital to ensuring the effective use of climate finance.

- Promoting Sustainable Practices:

- Encouraging sustainable practices and the transition to green economies is part of the long-term strategy in climate finance.

- Global Stocktakes:

- Continuously assessing and enhancing climate finance efforts through global stocktakes, as outlined in the Paris Agreement, is essential to ensure alignment with climate goals.

Conclusion

Fostering increased cooperation in global climate finance is not just a necessity, it is an imperative for addressing the urgent challenges posed by climate change. The complexity of climate issues, coupled with the substantial financial requirements, calls for a united and collaborative effort among nations, organizations, and private sectors.

|

Drishti Mains Question: What are the key challenges in mobilizing, measuring and monitoring climate finance? Suggest measures to ensure accurate and transparent financial contributions for climate mitigation and adaptation projects on a global scale. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q.With reference to the Agreement at the UNFCCC Meeting in Paris in 2015, which of the following statements is/are correct? (2016)’

- The Agreement was signed by all the member countries of the UN, and it will go into effect in 2017.

- The Agreement aims to limit the greenhouse gas emissions so that the rise in average global temperature by the end of this century does not exceed 2ºC or even 1.5ºC above pre-industrial levels.

- Developed countries acknowledged their historical responsibility in global warming and committed to donate $ 1000 billion a year from 2020 to help developing countries to cope with climate change.

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: B

Mains

Q. Describe the major outcomes of the 26th session of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC). What are the commitments made by India in this conference? (2021)