Reforming India's Logistics Sector | 15 Apr 2025

This editorial is based on “Road map for efficiency: India must rethink its transport strategy” which was published in The Business Standard on 15/04/2025. The article brings into spotlight the need for integrated transport planning in India to reduce high logistics costs and shift freight movement from roads to more efficient modes like rail.

For Prelims: Dedicated Freight Corridors, National Logistics Policy (NLP), PM Gati Shakti, Economic Survey 2023-24, World Bank’s Logistics Performance Index, Production Linked Incentive .

For Mains: Key Growth Drivers of India's Logistical Sector, Key Issues Associated with India's Logistical Sector.

India is moving toward an integrated transport planning mechanism to break down silos between different modes of transportation. Currently, road transport dominates freight movement (70%), while railways lags behind (below 30%) due to high tariffs from cross-subsidization. Multimodal transportation initiatives like the Dedicated Freight Corridors are beginning to show promise in enhancing efficiency. Successful implementation will require both interministerial cooperation and effective coordination with states to unlock economic growth potential.

What are the Key Growth Drivers of India's Logistical Sector?

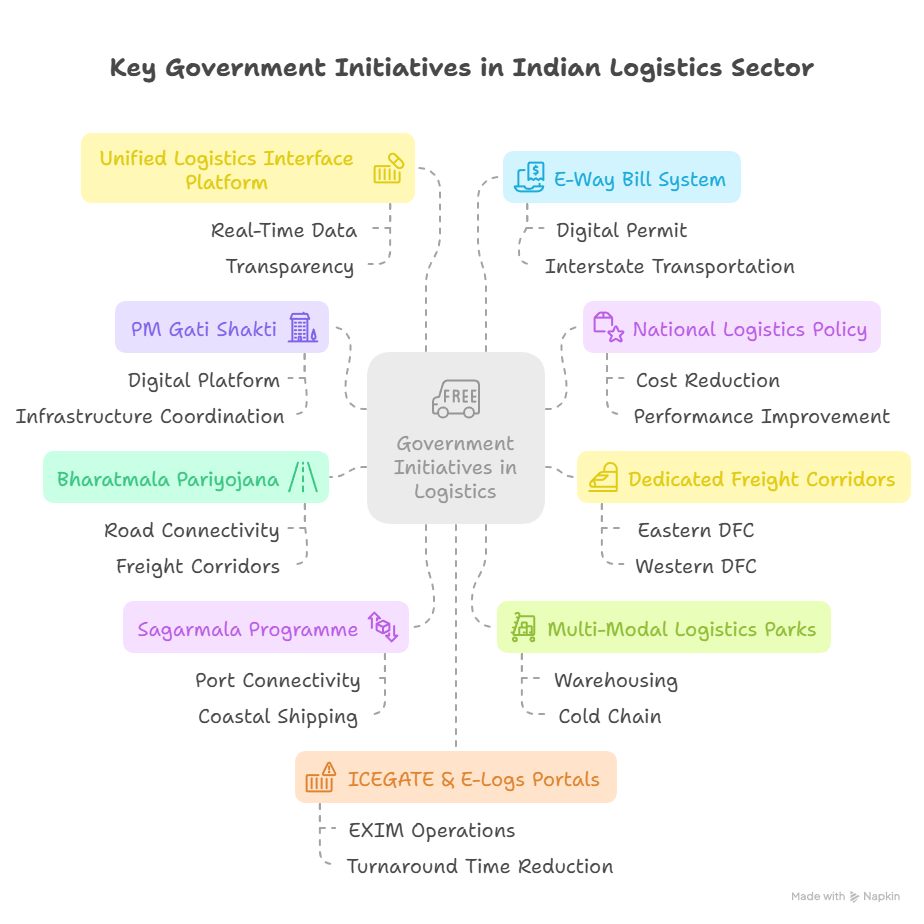

- Government-led Policy and Regulatory Reforms: The logistics sector's expansion is significantly driven by landmark policy interventions such as the National Logistics Policy (NLP) and PM Gati Shakti.

- These aim to address fragmentation in infrastructure planning and reduce logistics costs by integrating multiple transport modes.

- GST has streamlined interstate movement, eliminating bottlenecks and making India a single national market.

- According to the Economic Survey 2023-24, logistics costs dropped by 0.8–0.9% of GDP between FY14 and FY22.

- Over 614 entities have registered on ULIP (Unified Logistics Interface Platform).

- Rapid Infrastructure Expansion and Multimodal Connectivity: Massive investment in physical infrastructure is unlocking value in the logistics space through dedicated freight corridors (DFCs), multi-modal logistics parks, and port connectivity upgrades.

- These projects promote efficient movement of goods, reduce turnaround time, and lower freight costs. This is complemented by the Sagarmala, Bharatmala, and NIP (National Infrastructure Pipeline) frameworks.

- For instance, 35 multi-modal parks are being developed with an outlay of ₹50,000 crore.

- Digital Transformation and Tech Adoption: Digitisation is accelerating logistics growth by enhancing visibility, cutting delays, and automating supply chains.

- Tools like RFID, GPS tracking, blockchain, digital twins, and government portals like ICEGATE and E-Logs are transforming traditional systems.

- These innovations reduce transaction costs, improve cargo predictability, and support real-time logistics management.

- For instance, India rose 6 places to 38th in the World Bank’s Logistics Performance Index (2023).

- Manufacturing-led Demand via Make in India and PLI Schemes: India's aspiration to become a global manufacturing hub is creating new demand for modern, agile logistics networks.

- The Production Linked Incentive (PLI) schemes are drawing foreign and domestic investments, requiring seamless end-to-end supply chain services. Sectors like electronics, pharma, and textiles are particularly logistics-intensive.

- For instance, India’s manufacturing contributed 15.3% to GDP in FY22 and is projected to expand rapidly with global shifts like China+1.

- Recent data projects India’s GDP to hit $6 trillion by FY30 and $26 trillion by FY48 — logistics will be a key enabler.

- Booming E-commerce and Last-Mile Delivery Ecosystems: The exponential rise of e-commerce platforms has redefined logistics demand, particularly in Tier II and III cities.

- Fast delivery, returns logistics, and warehousing are now integral to customer satisfaction, propelling investment in hyperlocal logistics, micro-warehousing, and tech-enabled tracking.

- This is also giving rise to reverse logistics and demand for real-time supply chain responsiveness.

- For instance, The Indian e-commerce market is expected to reach $200 billion by 2026. The logistics sector is projected to grow to $591 billion by FY27, up from $435 billion in FY22 (EY).

- Fast delivery, returns logistics, and warehousing are now integral to customer satisfaction, propelling investment in hyperlocal logistics, micro-warehousing, and tech-enabled tracking.

- Skilling, Formalisation, and Employment Opportunities: A structured shift from informal to formal logistics has catalysed skilling, job creation, and better workforce productivity.

- Government-backed Employee-Linked Incentive (ELI) schemes and focus on training for logistics and warehousing jobs are transforming this traditionally unorganised sector. It also contributes to India’s demographic dividend.

- The sector currently employs 22 million people and is expected to create 10 million more jobs by 2027.

- Organised players, who hold 5.5–6% of the logistics market in FY22, are projected to grow at 32% CAGR till FY27.

- Sustainability and ESG-led Supply Chain Transition: Growing environmental consciousness and global ESG norms are reshaping Indian logistics, prompting a shift toward electric fleets, coastal shipping, energy-efficient ports, and carbon-tracked supply chains.

- India is aligning with global benchmarks like the Carbon Intensity Rating and EEXI for sustainable shipping. This also helps attract ESG-sensitive capital.

- Freight villages and coastal shipping corridors (like Sagar Sethu portal) are being expanded to cut emissions and logistics costs.

- India is aligning with global benchmarks like the Carbon Intensity Rating and EEXI for sustainable shipping. This also helps attract ESG-sensitive capital.

What are the Key Issues Associated with India's Logistical Sector?

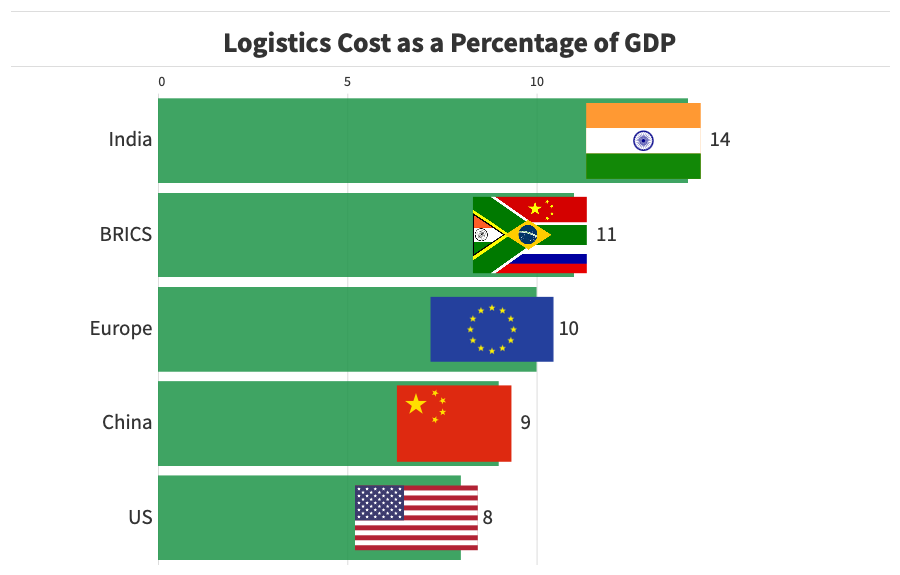

- High Logistics Cost as a Share of GDP: India’s logistics cost remains significantly higher than global benchmarks, impacting the competitiveness of exports and domestic production.

- The fragmented supply chain, over-reliance on roads, and lack of modal integration inflate costs.

- This affects MSMEs the most, reducing their margins and limiting global competitiveness.

- For instance, India's logistics cost is estimated at 14–18% of GDP (Economic Survey 2022-23) while global benchmarks stand at around 8%.

- Modal Imbalance in Freight Movement: India’s freight movement is heavily skewed toward roadways, undermining cost-efficiency and environmental sustainability.

- Multimodal logistics are still underdeveloped, with limited connectivity between rail, ports, and inland waterways. This limits economies of scale and causes congestion on highways.

- For instance, Roads handle 66% of freight, while railways contribute 31%, and shipping just 3% (EY report).

- Inland waterways, despite being 60% cheaper than road, are underutilised due to infrastructure gaps.

- Infrastructure Deficits and Project Execution Delay: Despite policy push, infrastructure development is hampered by land acquisition issues, environmental clearance delays, and bureaucratic hurdles.

- These delays cause cost overruns and limit private sector participation. Many logistics parks, DFCs, and port connectivity projects face slow execution.

- For instance, only 1,724 km of DFC completed against longer-term targets; many Multi-Modal Logistics Parks are under initial stages.

- Though the average turnaround time for the Major Ports has reduced significantly, it is still high - 48 hours (2023-24).

- Regulatory Fragmentation and Compliance Complexity: The logistics ecosystem is governed by multiple ministries and departments, resulting in regulatory overlap and inefficiencies.

- Inter-state differences in rules, permits, and taxes delay goods movement and increase transaction costs. Despite the launch of PM Gati Shakti, centre-state coordination remains patchy.

- Enterprises have to comply with several hundred acts and rules, depending on the size and geographical footprint of the business. These include the Carriage by Road Act, 2007 & Carriage by Road Rules, 2011 and the Warehousing (Development and Regulation) Act, 2007.

- Furthermore, some types of logistics companies also need to balance additional compliances contained in the Foreign Trade (Development & Regulation) Act, 1992 and Foreign Trade (Regulation) Rules, 1993.

- According to industry estimates, compliance burden contributes to 20–25% of logistics delays in India.

- Digital Divide and Low Tech Penetration: Digital transformation in logistics is advancing, but unevenly — small players lack access to or knowledge of tech tools like RFID, IoT, blockchain, and predictive analytics.

- This creates inefficiencies, especially in warehousing, cargo tracking, and delivery routing. The benefits of ULIP and E-Logs remain concentrated among organised players.

- For instance, only 5.5–6% of the logistics market was held by organised, tech-driven players as of FY22 (EY).

- Skilling and Human Resource Challenges: India’s logistics workforce lacks structured training in handling modern supply chain technologies, multimodal transport coordination, and ESG compliance.

- Over 90% of the logistics industry is unorganized, leading to low productivity, unsafe work conditions, and limited career mobility. The absence of large-scale, formal skilling programs adds to inefficiencies.

- Recent data highlight that 4.3 million additional workers will be required between 2024 and 2030 in this sector, with concentrated demand in states like West Bengal, Tamil Nadu and Maharashtra.

- Sustainability and Environmental Concerns: India’s logistics sector is predominantly carbon-intensive, dominated by diesel-based trucking, limited electrification, and inadequate green corridors.

- While ESG focus is rising, compliance remains weak, particularly among smaller operators. Coastal shipping and inland waterways — greener modes — remain underexploited.

- For instance, the transportation and logistics sector accounts for approximately 14% of India's total CO2 emissions.

- Despite policies like NLP Marine and Energy Efficiency Index adoption, the modal shift to sustainable transport is sluggish.

What Measures can India Adopt to Enhance the Efficiency of the Logistical Sector?

- Operationalising Integrated Multimodal Transport Infrastructure: India must accelerate the implementation of PM Gati Shakti in tandem with the National Logistics Policy (NLP) to break departmental silos and synchronise investments across roads, railways, ports, and air freight.

- By mapping logistics corridors through the National Master Plan, the government can enable seamless end-to-end cargo movement. Strengthening first- and last-mile connectivity will ensure full utilisation of dedicated freight and coastal corridors.

- Building upon the recommendations of the Bibek Debroy Committee, there is a need for converging multi-departmental actions into an integrated logistics policy.

- Creation of an integrated digital platform to facilitate a paperless environment across the logistics value chain and setting up a mechanism for periodic diagnostics and benchmarking of sectoral outputs.

- Promoting Cluster-Based Development of Logistics Hubs: Developing multi-modal logistics parks (MMLPs) near industrial corridors and SEZs will create efficient cargo aggregation and distribution systems.

- These hubs should provide unified services like warehousing, cold storage, and customs clearance under one roof.

- Co-locating them with freight villages and EXIM zones can generate economies of scale. The government can prioritise strategic nodes through Public-Private Partnerships (PPP).

- Strengthening Digital Logistics Infrastructure: India must push for full-scale digitisation of logistics operations through platforms like ULIP, ICEGATE, and E-Logs, ensuring universal adoption by small and medium logistics operators.

- Real-time cargo visibility, digital document exchange, and process automation should be scaled through incentives and mandatory standards.

- A unified logistics data exchange architecture can help de-risk supply chains. Enhancing cybersecurity and data privacy measures will build trust among stakeholders. This will also enable predictive analytics and AI-based logistics planning.

- Enhancing Rail and Waterway Utilisation for Long-Haul Freight: Policy incentives should be introduced to shift bulk cargo from road to railways and inland waterways, especially for sectors like cement, steel, coal, and fertilisers.

- Electrification of short rail links and expansion of inland water terminals can enhance modal share.

- Linking Sagarmala and Bharatmala schemes to logistics planning will unlock underused maritime and road infrastructure.

- Creating a National Logistics Workforce Development Mission: A dedicated skilling mission under Skill India and Logistics Sector Skill Council should be launched to build capacity in warehouse operations, multimodal handling, and digital tools.

- Modular training tied to certification and employability incentives can raise sectoral productivity.

- Special emphasis should be given to upskilling informal workers in emerging technologies and ESG compliance.

- Formalising the Unorganised Logistics Sector: India should simplify compliance procedures and create an enabling environment for small fleet operators, local warehousing agents, and truckers to register, upgrade, and formalise their operations.

- A unified logistics registration portal, low-cost finance, and simplified GST filings can ease this transition.

- Logistics providers can leverage the ONDC platform to streamline operations, optimize routes, and consolidate shipments from various sellers.

- Leveraging Geospatial Intelligence and AI for Logistics Optimisation: Integrating GIS and AI-based analytics with the Gati Shakti masterplan can enable real-time monitoring of traffic patterns, infrastructure usage, and freight flow bottlenecks.

- Such insights can inform smarter logistics network design, investment prioritisation, and congestion management.

- Predictive analytics can also help preempt supply chain disruptions. Collaboration between ISRO, NIC, and MoRTH can support deployment.

Conclusion:

India’s logistics sector is undergoing a transformative shift through integrated transport planning, digital innovation, and infrastructure modernisation. Bridging modal imbalances and ensuring centre-state coordination will be key to realising cost efficiency and global competitiveness. This aligns with SDG 9 (Industry, Innovation and Infrastructure) and SDG 11 (Sustainable Cities and Communities) by fostering resilient infrastructure and sustainable urban logistics.

|

Drishti Mains Question: “High logistics cost is a structural bottleneck in India’s path to becoming a global manufacturing hub.” Discuss and suggest measures to improve efficiency and competitiveness of the logistics sector. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. The Gati-Shakti Yojana needs meticulous coordination between the government and the private sector to achieve the goal of connectivity. Discuss. (2022)