Biodiversity & Environment

Reducing Industrial Emissions in India

- 07 Feb 2025

- 22 min read

This editorial is based on “The saga of regulating India’s thermal power emissions” which was published in The Hindu on 07/02/2025. The article brings into picture the repeated delays in India's thermal power sector’s compliance with SO₂ emission norms, with the latest extension pushing it to 2027. This highlights governance challenges where economic priorities often overshadow environmental and public health concerns.

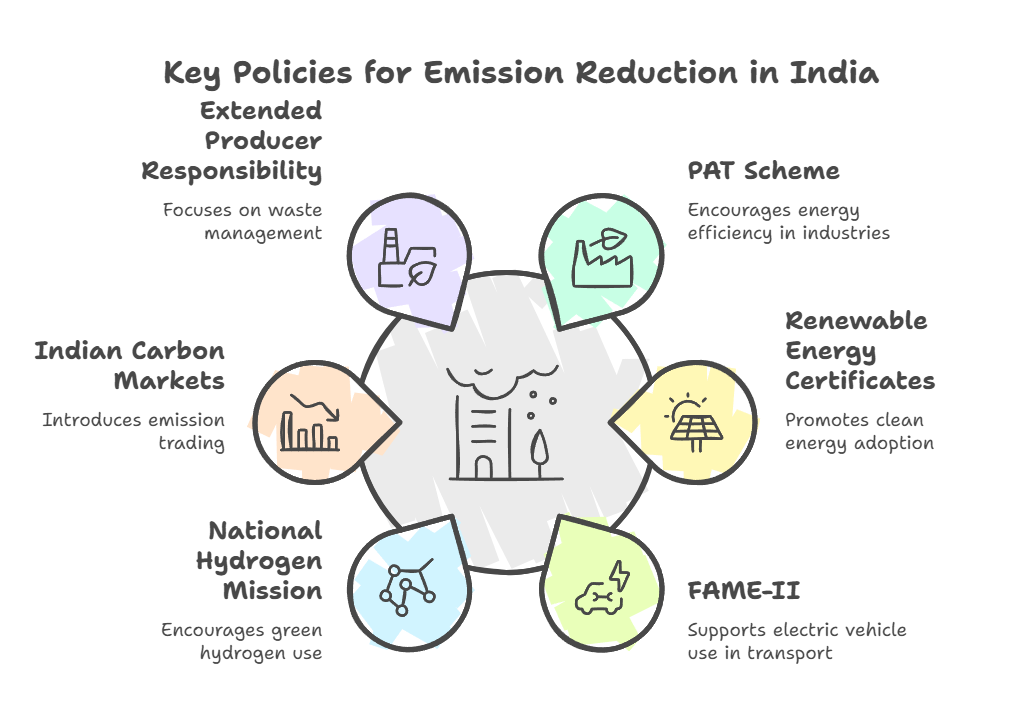

For Prelims: India's thermal power sector, Emission Gap Report, Flue Gas Desulphurisation (FGD) technology, Methane leaks, SATAT scheme, Nano-urea, Green hydrogen, PAT (Perform, Achieve, and Trade), Extended Producer Responsibility, Carbon Capture and Storage (CCS) deployment, Dedicated Freight Corridor.

For Mains: Major Emission-Intensive Industries in India, Key Barriers to Industrial Emission Reduction in India.

India's thermal power sector, a major contributor to air pollution, has long grappled with delays in enforcing emission norms, with the latest extension for SO₂ compliance pushing deadlines to December 2027. However, beyond thermal power, industries such as steel, cement, and transportation also contribute significantly to emissions, exacerbating air quality concerns and climate challenges. As India pursues economic growth, balancing industrial expansion with environmental responsibility is imperative. Strengthening regulatory enforcement, accelerating cleaner technologies, and adopting a comprehensive emissions reduction strategy across sectors will be crucial in achieving sustainable development while safeguarding public health.

What are the Major Emission-Intensive Industries in India?

- Power Generation (Thermal Power Plants): India's power sector is the largest contributor to greenhouse gas (GHG) emissions, primarily due to coal-based thermal plants, which contributes around 50% of the country's fuel-related CO2 emissions.

- Delay in implementing Flue Gas Desulphurisation (FGD) technology and frequent extensions in SO₂ emission norms further exacerbate pollution.

- Additionally, inefficiencies in old power plants and high transmission losses lead to unnecessary emissions.

- Iron and Steel Industry: The steel sector is highly energy-intensive, contributing significantly to CO₂ emissions and particulate matter pollution.

- Most Indian steel production relies on coal-based blast furnaces rather than cleaner electric arc furnaces, increasing emissions.

- The transition to green hydrogen-based steelmaking is slow due to high costs and limited hydrogen infrastructure.

- India is the second-largest crude steel producer, emitting 242 Mt CO₂ in 2022. The Steel Scrap Recycling Policy (2021) aims to reduce emissions, but significant gaps persist.

- Most Indian steel production relies on coal-based blast furnaces rather than cleaner electric arc furnaces, increasing emissions.

- Cement Industry: Cement manufacturing is a ‘hard-to-abate’ sector due to its reliance on limestone calcination, which directly emits CO₂.

- The construction sector is a major emitter due to cement and brick production, along with diesel-powered machinery

- Efforts to use blended cement (fly ash, slag) and alternative fuels have helped reduce emissions, but adoption remains limited due to economic constraints.

- Cement production is responsible for 7-8% of current global CO2 emissions, and approximately 5.8% of CO2 emissions in India (2022).

- The construction sector is a major emitter due to cement and brick production, along with diesel-powered machinery

- Oil and Gas Industry (Refineries & Petrochemicals): Refineries and petrochemical plants are major sources of methane leaks, CO₂, and volatile organic compounds (VOCs).

- India’s push for strategic petroleum reserves and increased refining capacity has amplified emissions.

- Oil demand in India is projected to register a 2x growth to reach 11 million barrels per day by 2045, further exacerbating emissions issues.

- While biofuels and compressed biogas (CBG) projects under the SATAT scheme aim to reduce dependency on crude oil, progress remains slow.

- Fertilizer Industry: The fertilizer sector is a major emitter of nitrous oxide (N₂O), a potent greenhouse gas 300 times stronger than CO₂.

- Excessive use of urea-based fertilizers not only depletes soil health but also contributes to emissions from ammonia synthesis, which relies on fossil fuels.

- Though the government has introduced nano-urea to reduce usage, large-scale adoption is slow.

- India's fertilizer sector emits approximately 0.58 tonnes of CO₂ per tonne of fertilizer produced, contributing to a total emissions footprint of around 25 million tonnes of CO₂ in 2022-23.

- Excessive use of urea-based fertilizers not only depletes soil health but also contributes to emissions from ammonia synthesis, which relies on fossil fuels.

- Aluminum and Non-Ferrous Metal Industry: Aluminum production is one of the most energy-intensive industrial processes due to its dependence on electricity and carbon anodes, leading to high CO₂ emissions.

- The Indian aluminium industry emits 20.88 tonnes of CO2 per tonne of aluminium

- India’s large bauxite reserves have fueled domestic production, but most smelters still rely on coal-based power.

- Though recycling aluminum could cut emissions, India’s scrap recycling infrastructure is underdeveloped.

- Global demand for green aluminum is rising, but Indian producers lag in adopting clean energy sources.

- Transport & Automotive Industry: The transport sector’s emissions are rapidly increasing due to the rise in vehicle ownership, freight movement, and aviation growth.

- The expansion of highways and increased SUV sales have further intensified fossil fuel dependency.

- According to NITI Aayog, the transport sector of India is the third most greenhouse gas (GHG) emitting sector and Road transport presently accounts for 12% of India's energy-related CO2 emissions and is a key contributor to urban air pollution.

What are the Key Barriers to Industrial Emission Reduction in India?

- Dependence on Coal-Based Energy: India’s industrial sector remains heavily reliant on coal for electricity and process heat, making emission reduction challenging.

- Many industries, such as steel, cement, and aluminum, require high-temperature processes where coal remains the cheapest and most accessible option.

- In November 2024, the government approved 36 new coal projects to meet rising energy demands, underscoring continued reliance on coal.

- High Cost of Clean Technologies: The adoption of carbon capture, green hydrogen, and energy-efficient processes is slow due to high capital investment.

- For instance, Green hydrogen costs ₹350-400/kg, making it unviable for large-scale industrial use.

- Many industries, especially MSMEs, find the upfront costs prohibitive despite long-term energy savings.

- Technologies such as Flue Gas Desulphurisation (FGD) in thermal power plants and electrification in steel production remain underutilized due to financial constraints.

- Also, while India has expanded its renewable energy capacity, grid integration issues, transmission bottlenecks, and lack of industrial-scale storage hinder adoption.

- Weak Regulatory Enforcement and Frequent Policy Dilutions: Emission norms for industries often face deadline extensions, dilution, or inconsistent implementation.

- Industries take advantage of the regulatory loopholes and delays in compliance checks to avoid investing in cleaner technologies.

- Pollution control boards often lack the capacity and resources to strictly monitor and penalize violations, leading to unchecked emissions.

- For instance, SO₂ emission compliance deadline extended to 2027, delaying clean air benefits.

- Lack of Financial Incentives for Decarbonization: While India has launched initiatives like PAT (Perform, Achieve, and Trade) and carbon trading markets, industries often lack sufficient financial support.

- Green financing options are limited, and banks are reluctant to lend due to uncertainty in returns from clean investments.

- Carbon credit pricing remains low, offering minimal incentive for emission reductions.

- India’s carbon credit market price is ₹300-600 per tonne, too low to drive significant change.

- Inefficiencies in Industrial Processes: Many Indian industries still operate with outdated, inefficient machinery, increasing their energy consumption and emissions.

- The majority of thermal power plants in India were set up during the late 1990s and have been facing the problems of declining efficiency.

- Retrofitting older plants is expensive, and industries often prioritize production output over efficiency improvements.

- Waste heat recovery, cogeneration, and low-carbon manufacturing techniques remain underutilized due to lack of awareness and technical expertise.

- The majority of thermal power plants in India were set up during the late 1990s and have been facing the problems of declining efficiency.

- Slow Progress in Circular Economy & Waste Management: Industrial waste recycling and reuse remain underdeveloped, increasing raw material demand and emissions.

- Many industries fail to adopt circular economy principles, leading to excessive resource extraction and waste generation.

- For instance, India generates approximately 4.43 million tons of hazardous waste annually, with only 71,833 tons classified as incinerable (suitable for disposal by burning).

- Also, Only 21% of India’s steel is made from scrap.

- Socioeconomic Trade-Offs in Industrial Decarbonization: Balancing economic growth, job creation, and emission reduction poses a significant challenge.

- Many emission-intensive industries are major employment generators, making strict regulations politically sensitive.

- Without a just transition framework, the shift to cleaner industries may face strong resistance from workers and businesses.

- In terms of jobs, the study estimates that 3.6 million people are either directly or indirectly employed in the coal mining and power sectors, making transition difficult.

What are the Global Best Practises for Emission Reduction and Sustainability?

- Renewable Energy Transition: Wind power generated nearly 60% of Denmark's electricity.

- Germany’s Energiewende policy has led to extensive adoption of solar and wind power.

- Carbon Pricing & Taxes: Switzerland and Liechtenstein currently levy the highest carbon tax rate at $130.81 per ton of carbon emissions

- Canada has implemented a federal carbon pricing system covering multiple industries.

- The European Union’s Emissions Trading System (ETS) follows a cap-and-trade model to regulate carbon emissions.

- Sustainable Transport: Norway has the highest electric vehicle penetration, with more than 80% of new cars being electric.

- China runs world's largest EV charging network, with 1.8 million public charging stations

- Energy Efficiency & Green Buildings: Japan's Top Runner Program sets efficiency standards for appliances.

- Singapore’s Green Building Masterplan aims for net-zero emissions.

- Afforestation & Carbon Sinks: Costa Rica has restored over 50% of its forest cover through a Payment for Ecosystem Services (PES) program.

- China leads the world’s largest afforestation initiative with the Great Green Wall.

What Measures can India Implement to Reduce Industrial Emissions and Accelerate Energy Transition?

- Strengthening Carbon Pricing and Emission Trading: India should implement a mandatory carbon pricing mechanism with stringent cap-and-trade regulations to make emissions reduction financially viable.

- Expanding the Carbon Credit Trading Scheme to cover more industries and integrating it with global markets will increase its effectiveness.

- Higher carbon pricing will push industries towards cleaner fuels, energy efficiency, and carbon capture adoption.

- The government must also impose strict penalties for non-compliance to deter industries from paying low fines instead of cutting emissions.

- Expanding the Carbon Credit Trading Scheme to cover more industries and integrating it with global markets will increase its effectiveness.

- Expanding Green Hydrogen and Biofuel Ecosystem: Scaling up green hydrogen production through policy incentives and public-private partnerships can help decarbonize steel, cement, and fertilizer sectors.

- Simultaneously, boosting biofuels and compressed biogas (CBG) under the SATAT scheme will reduce reliance on fossil fuels in the transport and refining sectors.

- These clean alternatives must be backed by low-cost financing to encourage industries to make the switch.

- Faster Adoption of Circular Economy in Manufacturing: India must enforce strict Extended Producer Responsibility (EPR) for industries like steel, cement, textiles, and e-waste, mandating a shift to recycled and secondary raw materials.

- Promoting industrial symbiosis—where waste from one industry serves as raw material for another—can significantly cut emissions.

- Mandatory material recovery targets should be set under sustainability frameworks like ZED (Zero Defect, Zero Effect) Certification to encourage cleaner production.

- Additionally, creating recycled material marketplaces can improve supply chain efficiency and lower raw material demand.

- Decarbonizing Thermal Power Plants through Rapid FGD and CCS Deployment: India must enforce the long-delayed Flue Gas Desulphurisation (FGD) installation in coal-fired power plants while accelerating Carbon Capture and Storage (CCS) deployment.

- Setting up carbon utilization hubs where captured CO₂ is repurposed for chemicals, synthetic fuels, and construction materials can enhance economic feasibility.

- Retrofitting old coal plants with supercritical technology will improve efficiency and reduce emissions per unit of power generated.

- In parallel, a gradual shift towards coal gasification and hybrid power models (coal + renewables) should be incentivized.

- Strengthening Industrial Energy Efficiency Standards: Expanding the Perform, Achieve, and Trade (PAT) Scheme to cover more energy-intensive industries with sector-specific efficiency benchmarks will ensure targeted improvements.

- Making Energy Conservation Building Code (ECBC) compliance mandatory for factories will promote the adoption of waste heat recovery, cogeneration, and smart grid solutions.

- MSMEs should receive subsidized access to energy-efficient machinery and digital monitoring tools under schemes like Technology Upgradation Fund (TUF) to drive emissions reduction at scale.

- Accelerating Renewable Energy Adoption in Industries: Industries must be incentivized to shift to captive solar, wind, and hybrid renewable power solutions to reduce dependence on fossil-fuel-based electricity.

- Expanding Open Access Renewable Energy Policies will allow industries to buy power directly from green energy suppliers at lower tariffs.

- Faster battery storage deployment through viability gap funding will improve renewable power reliability for industrial use.

- Developing Low-Carbon Transport and Green Logistics: To decarbonize freight transport, industries must transition to electric and hydrogen-powered trucks, supported by an EV battery swapping ecosystem.

- Enhancing the Dedicated Freight Corridor (DFC) and promoting rail-based goods movement over road transport will cut emissions significantly.

- Expanding green shipping initiatives in major ports and mandating zero-emission warehouses will further reduce supply chain emissions.

- Linking rail electrification with industrial transport policies can ensure a synchronized transition to cleaner logistics.

- Ensuring Just Transition for Coal-Dependent Industries: While moving towards low-carbon alternatives, India must implement a Just Transition framework to protect workers and communities reliant on coal mining, thermal power, and energy-intensive industries.

- A national Reskilling and Green Jobs Program can train workers in solar panel manufacturing, hydrogen fuel cell technology, and EV component production.

- Industrial zones should be repurposed into clean energy and sustainable manufacturing hubs, ensuring no region is left behind in the energy transition.

- Strengthening Waste-to-Energy and Industrial Waste Management: Scaling up waste-to-energy plants, bio-CNG production, and industrial waste valorization will significantly cut methane and CO₂ emissions.

- Implementing zero landfill policies for large industries will push sectors like textiles, chemicals, and food processing to adopt closed-loop production.

- Incentivizing biodegradable alternatives and chemical recycling in plastic-heavy industries will also contribute to lower emissions.

- Industries should be mandated to use certified green packaging to curb waste generation at the source.

Conclusion:

India's industrial sector must urgently balance economic growth with emission reduction to ensure sustainable development. Aligning with the Kyoto Protocol’s principle of common but differentiated responsibilities (CBDR), India must accelerate its transition while considering its developmental needs. Implementing these measures will also contribute to SDG 7 (Affordable and Clean Energy), SDG 9 (Industry, Innovation, and Infrastructure), and SDG 13 (Climate Action).

|

Drishti Mains Question: Examine the primary sources of emissions in India and the challenges in their mitigation. How can India achieve a balance between economic growth and environmental sustainability? |

UPSC Civil Services Examination Previous Year Question

Prelims

Q. The ‘Common Carbon Metric’, supported by UNEP, has been developed for

(a) assessing the carbon footprint of building operations around the world

(b) enabling commercial fanning entities around the world to enter carbon emission trading

(c) enabling governments to assess the overall carbon footprint caused by their countries

(d) assessing the overall carbon foot-print caused by the use of fossil fuels by the world in a unit time

Ans: (a)

Q. “Momentum for Change: Climate Neutral Now” is an initiative launched by (2018)

(a) The Intergovernmental Panel on Climate Change

(b) The UNEP Secretariat

(c) The UNFCCC Secretariat

(d) The World Meteorological Organisation

Ans: (c)

Q. With reference to an initiative called ‘The Economics of Ecosystems and Biodiversity (TEEB)’, which of the following statements is/are correct? (2016)

- It is an initiative hosted by UNEP, IMF and World Economic Forum.

- It is a global initiative that focuses on drawing attention to the economic benefits of biodiversity.

- It presents an approach that can help decision makers recognize, demonstrate and capture the value of ecosystems and biodiversity.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (c)